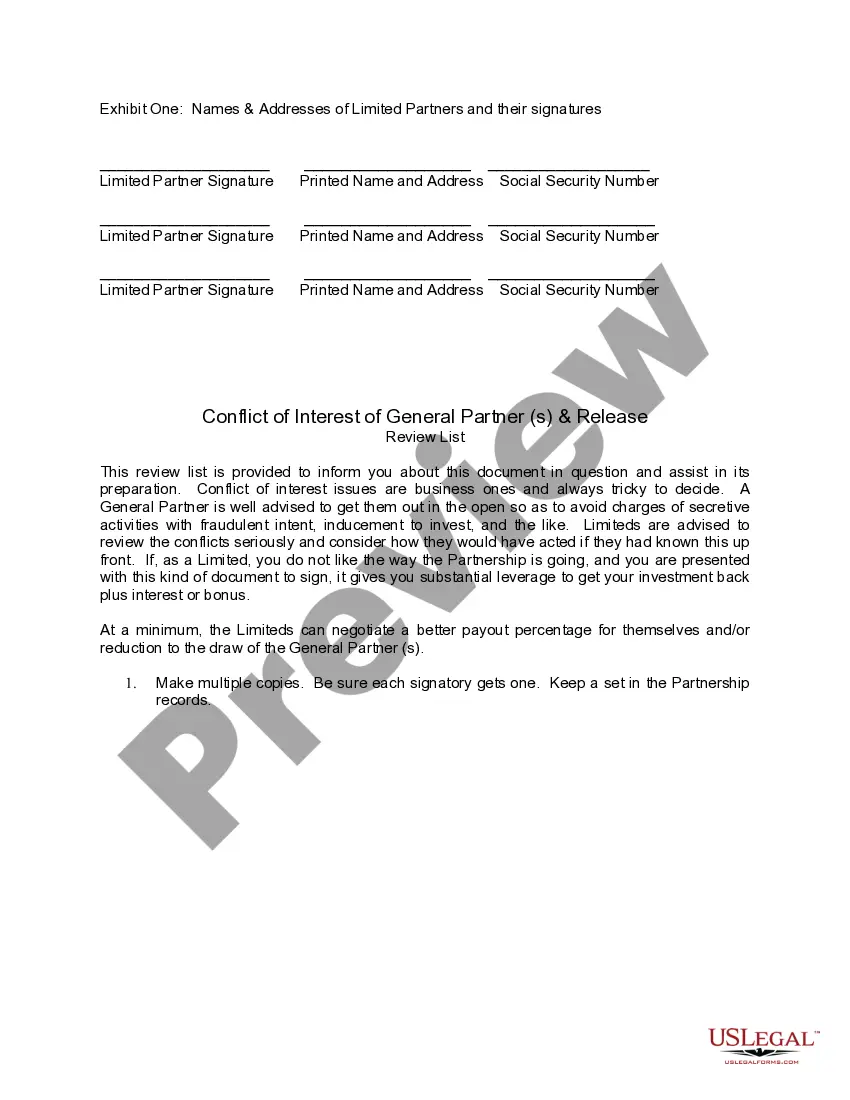

Michigan Conflict of Interest of General Partner and Release

Description

How to fill out Conflict Of Interest Of General Partner And Release?

Selecting the optimal legal document format can be a challenge.

Clearly, there are numerous templates accessible online, but how do you locate the legal form you require.

Utilize the US Legal Forms website. The service offers a vast array of templates, including the Michigan Conflict of Interest of General Partner and Release, which you can apply for both business and personal purposes.

If the form does not meet your requirements, use the Search field to find the appropriate form. Once you are sure the form is suitable, click the Get now button to obtain the form. Choose your desired pricing plan and enter the required information. Create your profile and pay for the order using your PayPal account or credit card. Select the document format and download the legal document to your device. Complete, edit, and print and sign the acquired Michigan Conflict of Interest of General Partner and Release. US Legal Forms is the largest repository of legal templates where you can find a variety of document templates. Take advantage of the service to download professionally crafted documents that comply with state regulations.

- All of the documents are reviewed by experts and comply with federal and state regulations.

- If you are already registered, sign in to your account and click the Obtain button to download the Michigan Conflict of Interest of General Partner and Release.

- Use your account to browse the legal documents you have previously acquired.

- Navigate to the My documents tab in your account and retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, ensure you have chosen the correct form for your city/state. You can examine the form using the Preview feature and read the form description to confirm it is the right one for you.

Form popularity

FAQ

When one partner wants to leave the partnership, the partnership generally dissolves. Dissolution means the partners must fulfill any remaining business obligations, pay off all debts, and divide any assets and profits among themselves.

A limited partner shall not become liable as a general partner unless, in addition to the exercise of his rights and powers as a limited partner, he takes part in the control of the business.

General Partners In a General Partnership, all partners are financially obligated to any debts incurred by the partnership. When a partner leaves, the partnership dissolves and the partners equally split debts and assets.

Legally, UpCounsel says, one partner leaving may dissolve the partnership but not in the sense that it ends the business. If A, B and C buy out D, or D sells their interest to E, the action dissolves the original partnership and launches a new one. The partnership's business, however, remains operational.

These, according to , are the five steps to take when dissolving your partnership:Review Your Partnership Agreement.Discuss the Decision to Dissolve With Your Partner(s).File a Dissolution Form.Notify Others.Settle and close out all accounts.11-Mar-2020

They do not require registration or a lot of paperwork. But all partnerships benefit from having a partnership agreement in place. In a general partnership, partners are all personally liable for the business's obligations. So, your personal assets could be at risk if someone sues your general partnership.

Each general partner is 100% liable for the business debt and lawsuits. The creditor can choose to sue only one partner, whether or not that partner authorized the deal. Partnerships are difficult especially if there is a disagreement.

A general partnership is an unincorporated business with two or more owners who share business responsibilities. Each general partner has unlimited personal liability for the debts and obligations of the business. Each partner reports their share of business profits and losses on their personal tax return.

General partners are responsible for the daily management of the limited partnership and are liable for the company's financial obligations, including debts and litigation.

Partners are 'jointly and severally liable' for the firm's debts. This means that the firm's creditors can take action against any partner. Also, they can take action against more than one partner at the same time. This applies even if there is a partnership agreement that says otherwise.