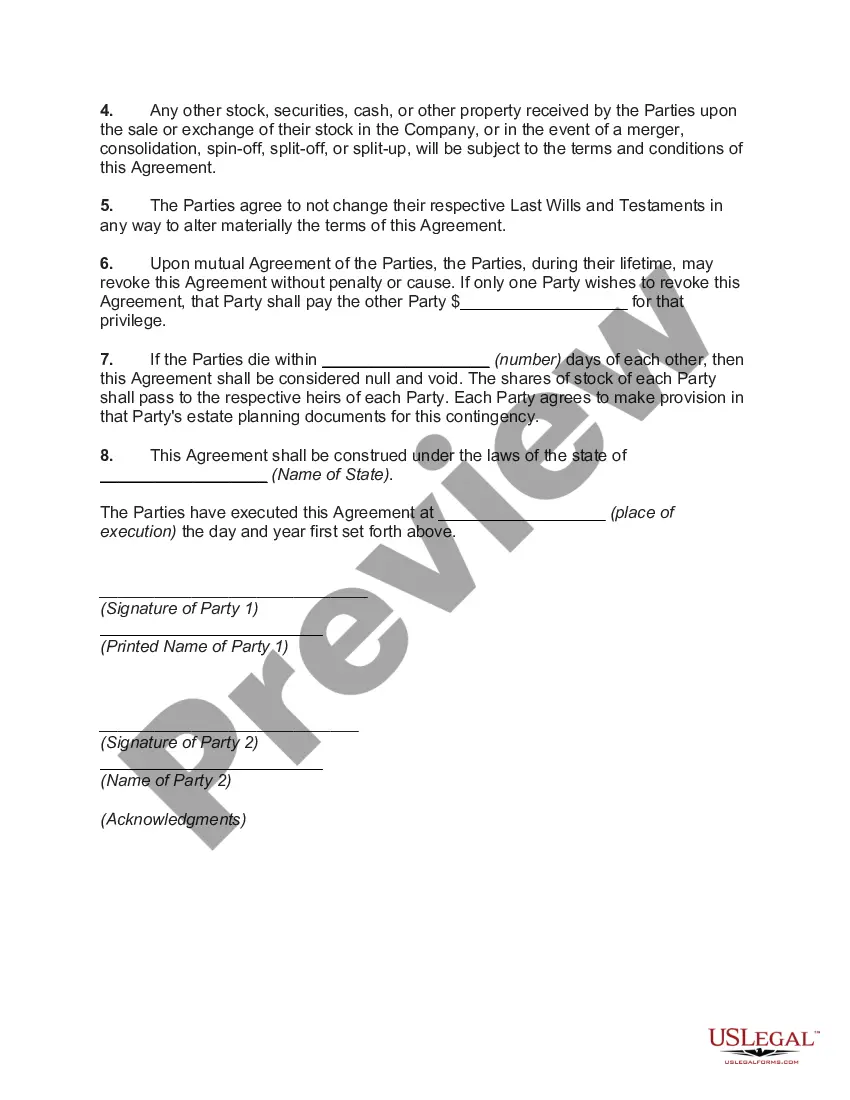

Michigan Agreement to Devise or Bequeath Property of a Business Transferred to Business Partner

Description

How to fill out Agreement To Devise Or Bequeath Property Of A Business Transferred To Business Partner?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a vast selection of legal document templates that you can download or create.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You will find the latest forms such as the Michigan Agreement to Devise or Bequeath Property of a Business Transferred to Business Partner in just moments.

If you already hold a subscription, Log In and obtain the Michigan Agreement to Devise or Bequeath Property of a Business Transferred to Business Partner from the US Legal Forms library. The Download button will be visible on each form you view. You have access to all previously saved forms in the My documents tab of your account.

Next, select the pricing plan you prefer and provide your details to register for an account.

Complete the transaction. Use your credit card or PayPal account to finalize the payment. Choose the format and download the form to your device. Make edits. Fill out, modify, print, and sign the saved Michigan Agreement to Devise or Bequeath Property of a Business Transferred to Business Partner. Each template you add to your account has no expiration and is yours indefinitely. If you wish to download or produce another copy, simply visit the My documents section and click on the form you need. Gain access to the Michigan Agreement to Devise or Bequeath Property of a Business Transferred to Business Partner with US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal requirements.

- If you are using US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the appropriate form for your city/county.

- Click the Review button to review the form’s details.

- Read the form information to ensure you have selected the right form.

- If the form does not meet your needs, use the Search bar at the top of the page to find one that does.

- Once satisfied with your choice, confirm your selection by clicking the Download now button.

Form popularity

FAQ

Generally, an owner can transfer his property unless there is a legal restriction barring such transfer. Under the law, any person who owns a property and is competent to contract can transfer it in favour of another.

State Transfer Tax Rate $3.75 for every $500 of value transferred. County Transfer Tax Rate $0.55 for every $500 of value transferred.

Gifting property to family members with deed of giftThe owner should be of sound mind and acting of their own free will.Independent legal advice should be sought before commencing with a deed of gift.The property in question should have no outstanding debts secured against it.More items...

In some states, the payment of property taxes by a person claiming adverse possession can be used to establish legal title. However, there is no such statutory requirement in Michigan. Paying taxes is not, of itself, sufficient to constitute adverse possession.

5 Ways to Transfer Property in IndiaSale Deed. The most common way of property transfer is through a sale deed.Gift Deed. Another popular way of transferring property ownership is by 'gifting' the property using a gift deed.Relinquishment Deed.Will.Partition Deed.

Here are eight steps on how to transfer property title to an LLC:Contact Your Lender.Form an LLC.Obtain a Tax ID Number and Open an LLC Bank Account.Obtain a Form for a Deed.Fill out the Warranty or Quitclaim Deed Form.Sign the Deed to Transfer Property to the LLC.Record the Deed.Change Your Lease.

Fill out and file a probate petition with the Michigan probate court in your area. If the deceased left property in her will, the probate court will use a fiduciary deed signed by the executor of the estate to transfer the property to the beneficiary.

How to Transfer Michigan Real EstateFind the most recent deed to the property. It is helpful to begin by locating the most recent deed to the property (the deed that transferred the property to the current grantor).Create the new deed.Sign and notarize the deed.File the deed in the county land records.

Although the word 'transfer' is often used to describe this type of transaction, you can't actually 'transfer' a property to the LLC, since this is legally distinct from you as an individual. Instead, you have to sell the property to the LLC.