Michigan Qualified Domestic Trust Agreement

Description

How to fill out Qualified Domestic Trust Agreement?

If you wish to accumulate, retrieve, or reproduce legal document templates, utilize US Legal Forms, the largest selection of legal documents available online.

Employ the site’s straightforward and user-friendly search to find the documents you require.

Various templates for corporate and personal applications are organized by categories and jurisdictions, or by keywords.

Every legal document template you purchase belongs to you permanently. You have access to every form you have downloaded in your account. Click the My documents section and select a form to print or download again.

Be proactive and download, and print the Michigan Qualified Domestic Trust Agreement with US Legal Forms. There are millions of professional and state-specific forms you can utilize for your business or personal requirements.

- Utilize US Legal Forms to acquire the Michigan Qualified Domestic Trust Agreement in just a few clicks.

- If you are already a US Legal Forms member, Log In to your account and click on the Obtain button to locate the Michigan Qualified Domestic Trust Agreement.

- You can also access forms you previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the guidelines below.

- Step 1. Ensure you have selected the form for the correct municipality/state.

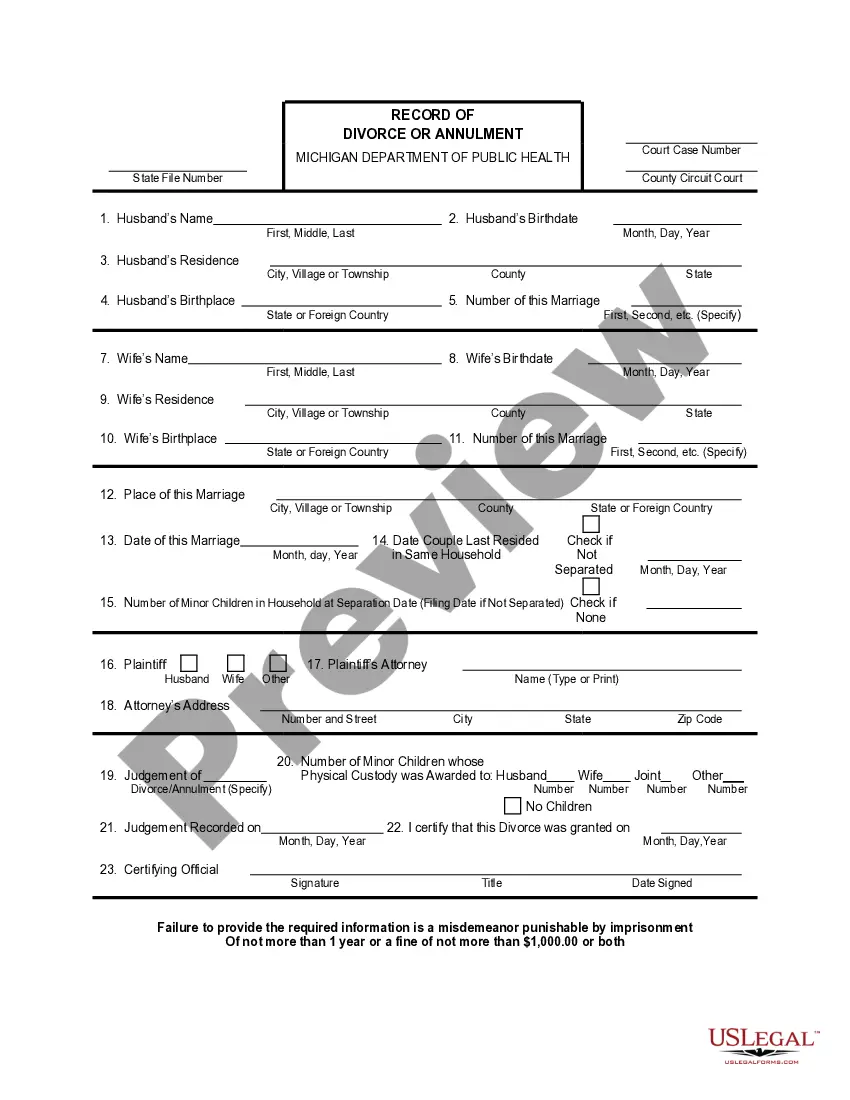

- Step 2. Use the Preview option to review the form’s details. Be sure to read the description.

- Step 3. If you are not satisfied with the form, use the Lookup field at the top of the screen to find alternative versions of the legal form template.

- Step 4. After you have located the form you require, select the Acquire now button. Choose the payment plan you prefer and enter your details to create an account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the payment.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Michigan Qualified Domestic Trust Agreement.

Form popularity

FAQ

The CF-1040 is a Michigan city common form for the cities of Albion, Grayling, Lansing, Portland,Battle Creek, Hamtramck, Lapeer, Saginaw, Big Rapids, Highland Park, Muskegon, Springfield, Flint, Ionia, Muskegon Heights, Walker,Grand Rapids Jackson and Pontiac.

Yes. You must file a Michigan Individual Income Tax Return MI-1040 and pay tax on income you earned, received, or accrued while living in Michigan.

Use Form 2210 to see if you owe a penalty for underpaying your estimated tax and, if you do, to figure the amount of the penalty.

Use the form Michigan Underpayment of Estimated Income Tax Form MI-2210 to compute penalty and interest. If you do not file an MI-2210, Treasury will compute your penalty and interest and send you a bill. If you annualize your income, you must complete and include an MI-2210.

You must file a Michigan Individual Income Tax return to claim a refund of Michigan tax withheld. Required forms include (not limited to): MI-1040, Schedule 1, Schedule NR, and Schedule W. You were a non-resident of Michigan who lived in a reciprocal state.

Use Form 2210 to see if you owe a penalty for underpaying your estimated tax. The IRS will generally figure your penalty for you and you should not file Form 2210. You can, however, use Form 2210 to figure your penalty if you wish and include the penalty on your return.

If you are a single person and are age 65 or older and your income is greater than $1,200, you must file a return. If you are married filing jointly with your spouse and both you and your spouse are age 65 or older and your income is greater than $2,400, you must file a return.

For 2021 the following Michigan cities levy an income tax of 1% on residents and 0.5% on nonresidents. Albion, Battle Creek, Benton Harbor, Big Rapids, East Lansing, Flint, Grayling, Hamtramck, Hudson, Ionia, Jackson, Lansing, Lapeer, Muskegon, Muskegon Heights, Pontiac, Port Huron, Portland, Springfield and Walker.

You must file a Michigan Fiduciary Income Tax Return (Form MI-1041) and pay the tax due if you are the fiduciary for an estate or trust that was required to file a U.S. Form 1041 or 990-T or that had income taxable to Michigan that was not taxable on the U.S. Form 1041.

Michigan Cities Imposing an Income TaxAlbion. Effective Date of Ordinance.Battle Creek. Effective Date of Ordinance.Big Rapids. Effective Date of Ordinance.Detroit. Effective Date of Ordinance.Flint. Effective Date of Ordinance.Grand Rapids. Effective Date of Ordinance.Grayling. Effective Date of Ordinance.Hamtramck.More items...