Michigan Notice of Meeting to Pass on Resolution to Incorporate Non-Profit Association

Description

How to fill out Notice Of Meeting To Pass On Resolution To Incorporate Non-Profit Association?

You might spend hours online searching for the legal document template that satisfies the federal and state standards you need.

US Legal Forms provides thousands of legal documents that are reviewed by experts.

You can obtain or print the Michigan Notice of Meeting to Pass on Resolution to Incorporate Non-Profit Association through our service.

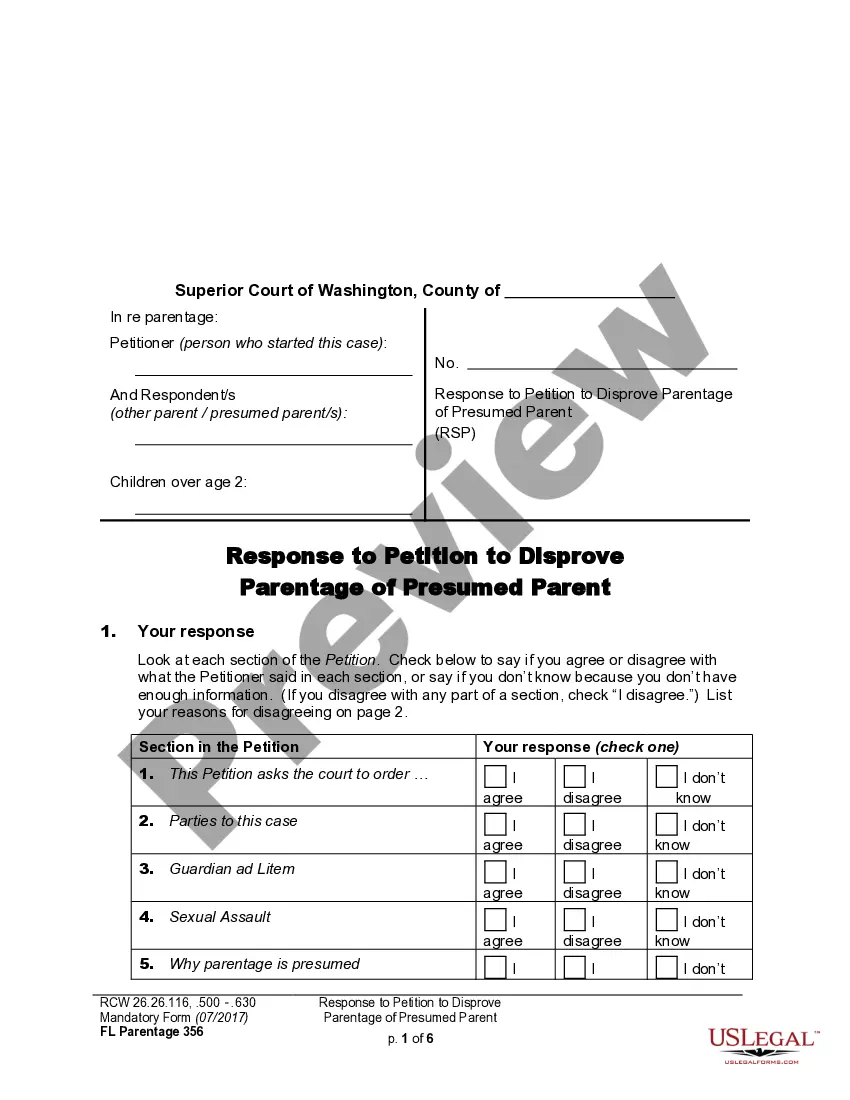

If available, utilize the Preview button to browse through the document template as well. If you wish to find another version of the form, take advantage of the Search field to identify the template that suits your needs and requirements.

- If you already have a US Legal Forms account, you can Log In and click the Obtain button.

- Subsequently, you can complete, edit, print, or sign the Michigan Notice of Meeting to Pass on Resolution to Incorporate Non-Profit Association.

- Every legal document template you receive is yours indefinitely.

- To obtain another copy of the acquired form, visit the My documents section and click the relevant button.

- If you are using the US Legal Forms website for the first time, follow these straightforward instructions.

- First, ensure you have chosen the correct document template for your area/town of preference.

- Review the form description to confirm you have selected the right form.

Form popularity

FAQ

The president cannot be a treasurer and president at the same time.

In Michigan, your nonprofit corporation must have at least three directors. The initial board of directors will play a key role in determining the purpose and goals for the organization.

The IRS generally requires a minimum of three board members for every nonprofit, but does not dictate board term length.

What to include in nonprofit bylawsGeneral information. This section should outline some basic information about your nonprofit, including your nonprofit's name and your location.Statements of purpose.Leadership.Membership.Meeting and voting procedures.Conflict of interest policy.Committees.The dissolution process.More items...?

The simple answer is that most authors agree that a typical nonprofit board of directors should comprise not less than 8-9 members and not more than 11-14 members. Some authors focusing on healthcare organizations indicate a board size up to 19 members is acceptable, though not optimal.

For many nonprofit corporations, the officers are also all directors. And sometimes, these individual are only elected as officers and wrongly assumed to have been also elected as directors.

Nonprofit corporations often deal with government agencies on issues of public concern, which may involve applying for grants, loans or other governmental approvals. In many situations, the government agency requires a corporate resolution to verify the board's approval for making the government application.

Elected by the board. Two or more offices may be held by the same individual, except the president may not also serve as secretary or treasurer.

In Michigan, a nonprofit is required to have at least three directors. The directors do not need to live in the state. The director's term of service on the board, as well as the procedure for his appointment and removal, is not outlined in state law and is instead determined by the nonprofit's corporate bylaws.