Michigan Agreement Pledge of Stock and Collateral for Loan

Description

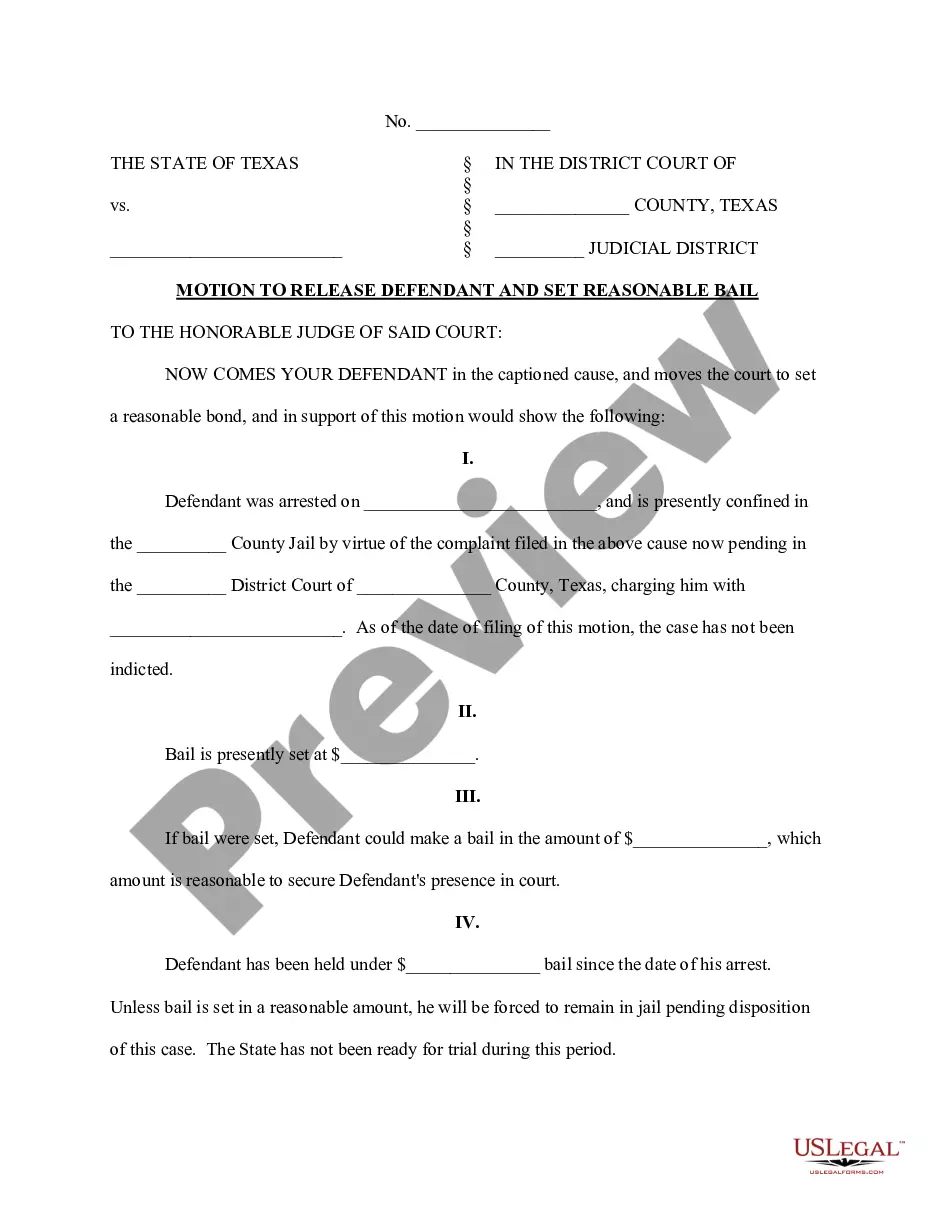

How to fill out Agreement Pledge Of Stock And Collateral For Loan?

Choosing the right legitimate file format might be a have difficulties. Obviously, there are a lot of web templates available on the Internet, but how do you get the legitimate kind you require? Use the US Legal Forms internet site. The support delivers thousands of web templates, such as the Michigan Agreement Pledge of Stock and Collateral for Loan, that you can use for business and personal demands. Every one of the varieties are checked by pros and fulfill federal and state requirements.

When you are presently signed up, log in for your accounts and then click the Down load option to find the Michigan Agreement Pledge of Stock and Collateral for Loan. Make use of your accounts to appear with the legitimate varieties you have purchased earlier. Proceed to the My Forms tab of your respective accounts and acquire an additional version from the file you require.

When you are a new customer of US Legal Forms, here are basic directions that you can adhere to:

- Initially, ensure you have chosen the correct kind for your metropolis/county. You may check out the form using the Preview option and browse the form outline to ensure it is the right one for you.

- In the event the kind does not fulfill your requirements, make use of the Seach field to get the proper kind.

- Once you are certain that the form is suitable, go through the Get now option to find the kind.

- Select the pricing strategy you would like and type in the essential information. Build your accounts and pay for your order making use of your PayPal accounts or bank card.

- Choose the submit formatting and download the legitimate file format for your gadget.

- Comprehensive, change and print out and signal the acquired Michigan Agreement Pledge of Stock and Collateral for Loan.

US Legal Forms is the most significant local library of legitimate varieties in which you can discover numerous file web templates. Use the company to download skillfully-created files that adhere to express requirements.

Form popularity

FAQ

To pledge shares on Console, follow these steps: Click on Portfolio and then on Holdings. Click on Options. Click on Pledge for margin. Agree to the terms of service for pledging. Enter the Quantity to be pledged. Click on Submit.

In simple words, a pledge is a promise to repay a loan, and collateral is what you lose if you don't keep your promise. For example, I can take a loan from a friend, pledge to return it within 30 days, and offer my bike as collateral. As long as I return the loan within 30 days, the bike is safe.

The pledging of shares is similar to a loan. Banks or financial institutions offer loans on taking the promoter's shares as collateral. The value of the pledged shares is decided by the lender and promoter as per the market value of the shares. ing to that, they pen down an agreement.

To pledge shares on Console, follow these steps: Click on Portfolio and then on Holdings. Click on Options. Click on Pledge for margin. Agree to the terms of service for pledging. Enter the Quantity to be pledged. Click on Submit.

The grantors typically enter into the pledge agreement with a collateral agent, which is acting on behalf of lenders under a syndicated loan agreement. This form can also be used for one lender. This Standard Document has integrated notes with important explanations and drafting and negotiating tips.

Pledged Collateral Definition The borrower pledges assets or property to the lender to guarantee or secure the loan. Pledging assets, also referred to as hypothecation, does not transfer ownership of the property to the creditor, but gives the creditor a non-possessory interest in the property.

You may be able to borrow against the value of your stock portfolio to get a loan. Lenders may loan you up to 50% of your portfolio's value and hold your stock as collateral. But if you can't make your monthly payments, the lender can sell your collateral to recover what it is owed.

One disadvantage of pledging shares is the risk associated with it. If a borrower fails to repay a loan that was secured using shares as collateral, the lender can sell the shares in the market to recover the amount owed.