Michigan Sample Letter of Credit

Description

How to fill out Sample Letter Of Credit?

You are able to invest hours on-line trying to find the lawful record design that meets the federal and state requirements you require. US Legal Forms provides a huge number of lawful types that happen to be examined by professionals. It is simple to down load or produce the Michigan Sample Letter of Credit from my support.

If you currently have a US Legal Forms account, it is possible to log in and then click the Acquire key. Following that, it is possible to full, modify, produce, or sign the Michigan Sample Letter of Credit. Every lawful record design you purchase is your own permanently. To have yet another copy of the acquired type, proceed to the My Forms tab and then click the corresponding key.

If you are using the US Legal Forms internet site for the first time, follow the straightforward directions listed below:

- First, make certain you have chosen the best record design for the state/town of your liking. Browse the type outline to make sure you have picked the proper type. If available, take advantage of the Review key to check through the record design at the same time.

- In order to locate yet another version of your type, take advantage of the Search field to find the design that suits you and requirements.

- After you have located the design you want, simply click Acquire now to move forward.

- Select the pricing strategy you want, type in your references, and register for a free account on US Legal Forms.

- Comprehensive the purchase. You should use your Visa or Mastercard or PayPal account to purchase the lawful type.

- Select the format of your record and down load it for your product.

- Make alterations for your record if possible. You are able to full, modify and sign and produce Michigan Sample Letter of Credit.

Acquire and produce a huge number of record web templates while using US Legal Forms website, that provides the largest selection of lawful types. Use professional and status-specific web templates to take on your small business or personal needs.

Form popularity

FAQ

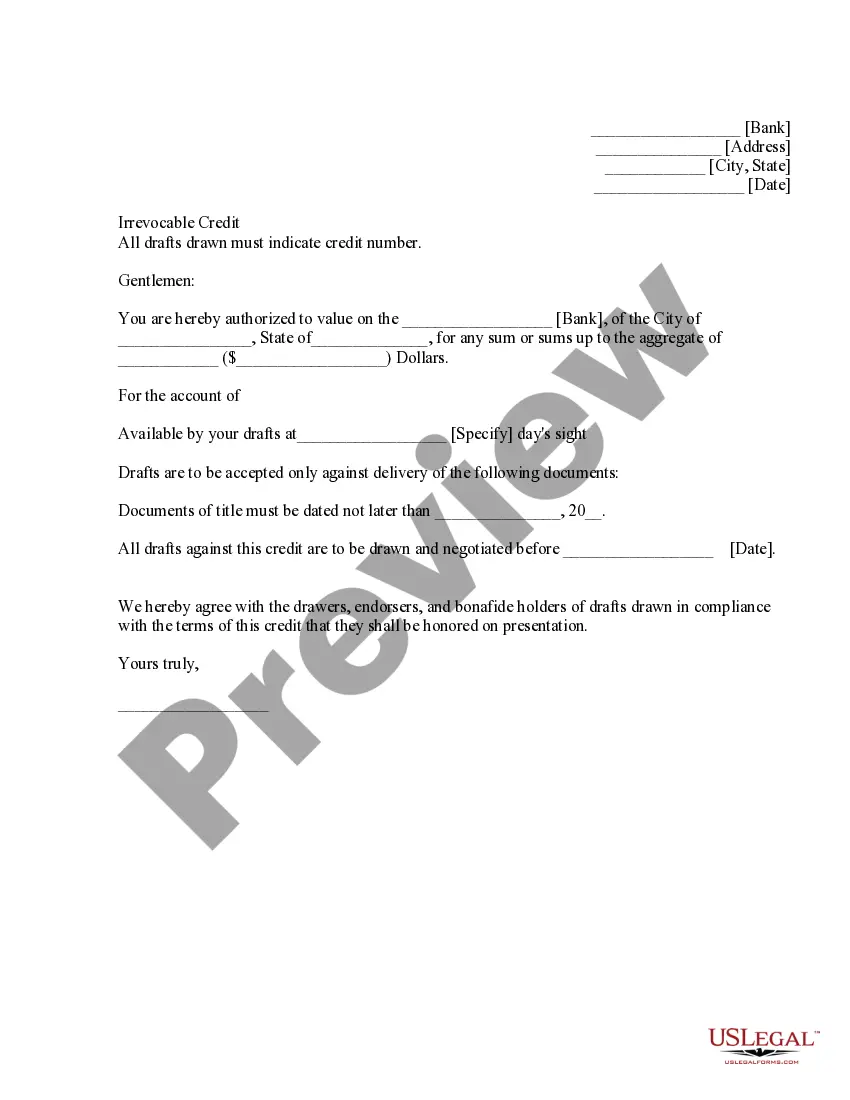

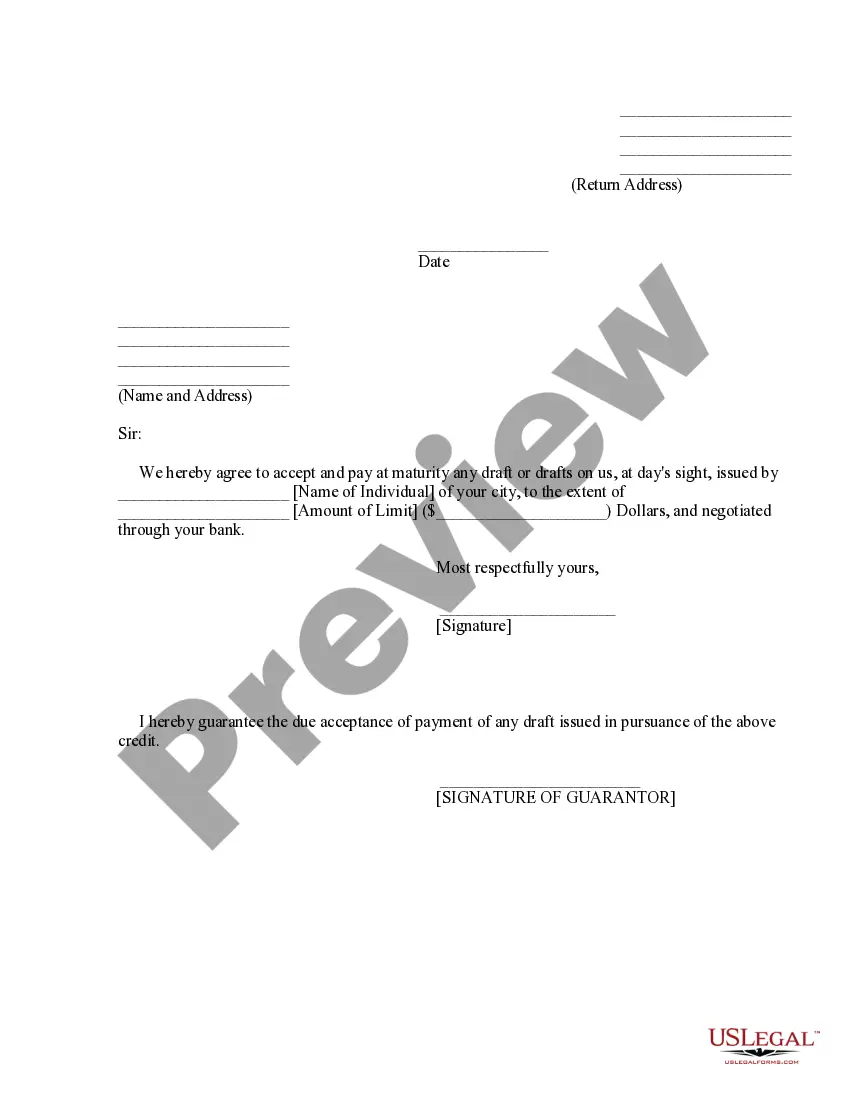

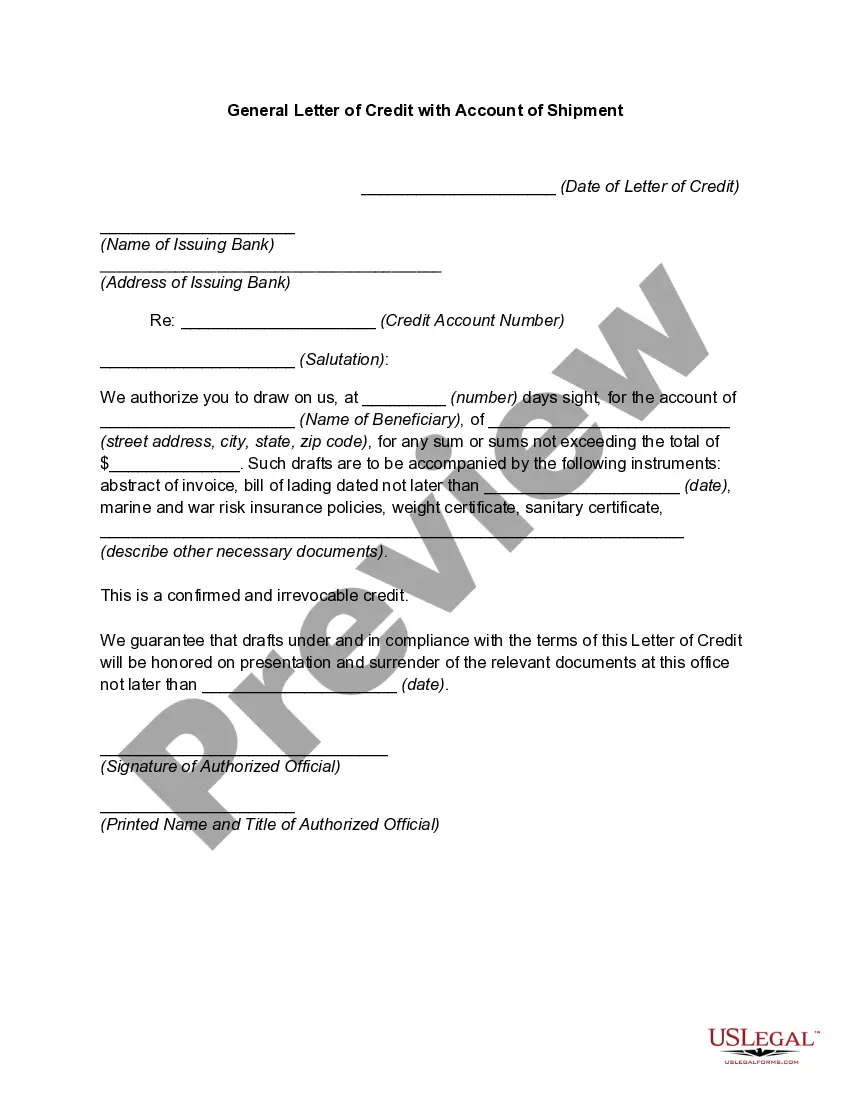

A letter of credit is an instrument issued by a financial institution, usually a bank, which authorizes the bearer to demand payment from the institution. A letter of credit can be general, if it is not addressed to any specific person, or special, if it is addressed to a specific person or entity.

Types of letters of credit include commercial letters of credit, standby letters of credit, and revocable letters of credit. Other types of letters of credit are irrevocable letters of credit, revolving letters of credit, and red clause letters of credit.

Types of letters of credit include commercial letters of credit, standby letters of credit, and revocable letters of credit.

An acceptance credit is a type of letter of credit that is paid by a time draft authorizing payment on or after a specific date, if the terms of the letter of credit have been complied with. The bank "accepts" bills of exchange drawn on the bank by the debtor, discounts them and agrees to pay for them when they mature.

A letter of credit, or a credit letter, is a letter from a bank guaranteeing that a buyer's payment to a seller will be received on time and for the correct amount. If the buyer is unable to make a payment on the purchase, the bank will be required to cover the full or remaining amount of the purchase.

An acceptance credit is a type of letter of credit that is paid by a time draft authorizing payment on or after a specific date, if the terms of the letter of credit have been complied with. The bank "accepts" bills of exchange drawn on the bank by the debtor, discounts them and agrees to pay for them when they mature.

A Letter of Credit is an arrangement whereby Bank acting at the request of a customer (Importer / Buyer), undertakes to pay for the goods / services, to a third party (Exporter / Beneficiary) by a given date, on documents being presented in compliance with the conditions laid down.

A Standby Letter of Credit is different from a Letter of Credit. An SBLC is paid when called on after conditions have not been fulfilled. However, a Letter of Credit is the guarantee of payment when certain specifications are met and documents received from the selling party.