Michigan Telecommuting Worksheet

Description

How to fill out Telecommuting Worksheet?

You can spend hours online trying to locate the authentic document template that fulfills the state and federal standards you need.

US Legal Forms offers thousands of authentic forms that are reviewed by professionals.

You can easily download or print the Michigan Telecommuting Worksheet from the service.

To get another version of the form, use the Search field to find the template that meets your needs and preferences.

- If you already possess a US Legal Forms account, you can Log In and click the Download button.

- Subsequently, you can complete, modify, print, or sign the Michigan Telecommuting Worksheet.

- Every legal document template you acquire is yours permanently.

- To obtain an additional copy of any purchased form, navigate to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure that you have selected the correct document template for the county/town of your choice.

- Check the form description to make sure you've chosen the right type.

Form popularity

FAQ

To file Michigan flow-through entity tax, you need to collect the required financial information for your business entity. Using the Michigan Telecommuting Worksheet can help you establish how remote work impacts your tax situation. Once you have this information, complete the necessary forms associated with the flow-through entity tax and submit them to the state. Consulting a tax professional may also enhance your understanding and ensure accuracy.

You can obtain the Michigan tax booklet from the Michigan Department of Treasury's website or by visiting local offices. The booklet provides essential information, including guidance on using the Michigan Telecommuting Worksheet. If you prefer a digital format, the state often provides these documents online for easier access. Be sure to check for the most current edition to stay informed.

If you're having trouble getting started with your telecommuting policy, here's a list of things to include:Define which positions are eligible to work from home.Be specific about the policy.Create an effective power structure.Outline which tools your employees should use.Be open.

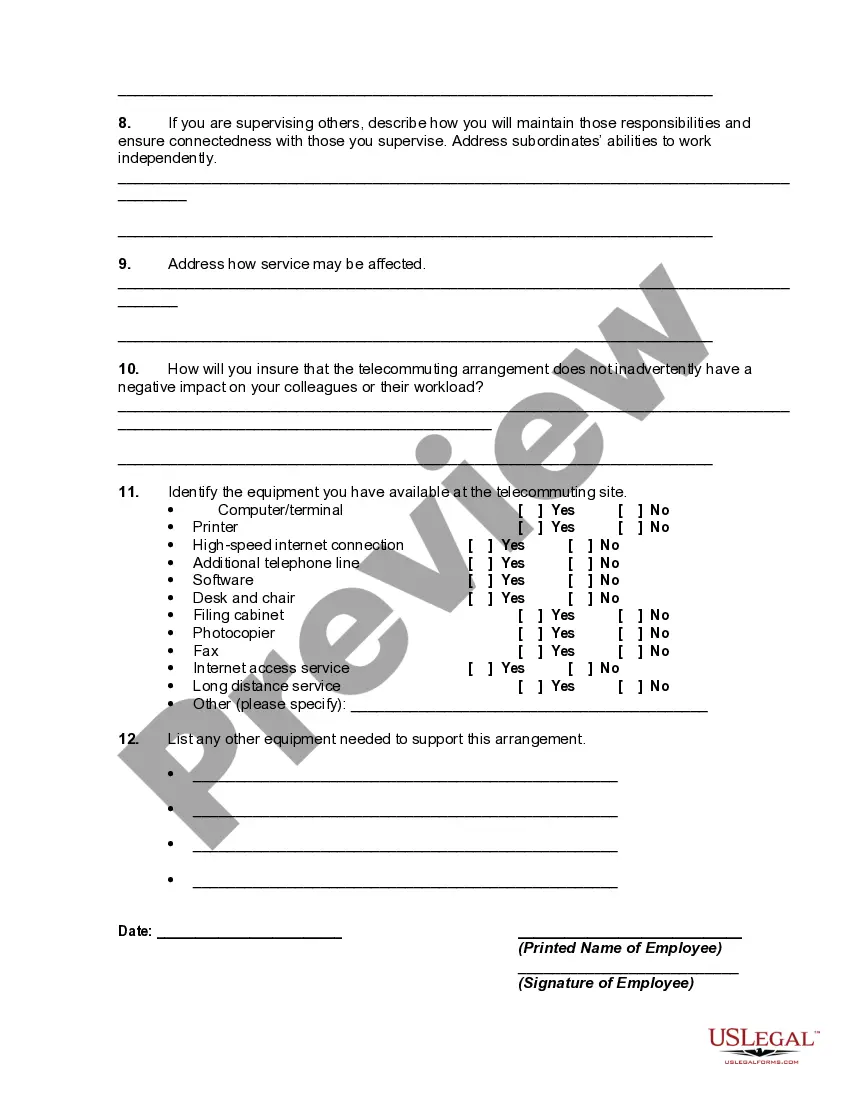

It should include:Days and hours the employee is expected to be working in the department.Hours the employee is expected to be working and reachable at the telecommuting site.Methods of contact (such as dedicated phone line, voice mail, email, videoconference, etc.)Times and frequency of contact (in both directions)More items...

5 Key Characteristics of Successful TelecommutersFocus.Collaborative attitude.Adaptabilty.While you may have established a routine that works well for your day-to-day work, it's vital that those working from home are flexible.Trust.Self-starter.

For example, teleworking employees must be able to take telephone calls and participate in online video meetings with minimal distraction and while maintaining appropriate confidentiality.

What happens next? HMRC will increase the amount you can earn tax-free for this tax year to include tax relief on your costs for working from home. They do this by changing your tax code, which decides how much tax you pay. This change will also include any tax relief from last tax year (6 April 2020 to 5 April 2021).

In most states, a remote employee must pay taxes wherever they reside. However, some states follow a convenience of the employer rule that treats days worked at home as days worked at the employer's location if the employee is working remotely for their own convenience and not the employer's necessity.

The self-employed do not qualify as telecommuters because they lack employee status.

Teleworking staff must adhere to all departmental and institutional policies including, but not limited to policies regarding confidentiality of information, work schedules, work hours, use of equipment, ethics, performance, leave use and tracking of work hours.