Michigan Assignment and Bill of Sale to Corporation

Description

How to fill out Assignment And Bill Of Sale To Corporation?

It is feasible to spend hours online trying to locate the legal document template that complies with the federal and state requirements you require.

US Legal Forms provides thousands of legal forms that are reviewed by professionals.

You can conveniently download or print the Michigan Assignment and Bill of Sale to Corporation from our service.

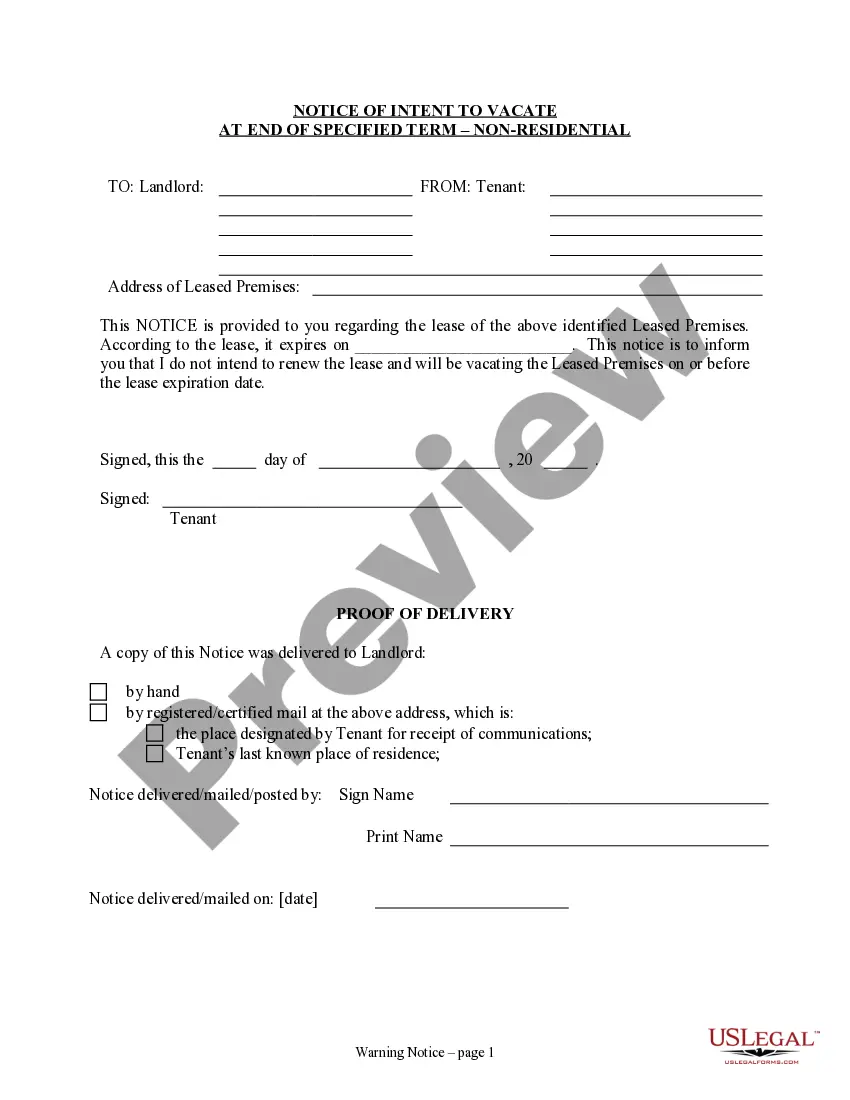

If available, use the Preview option to browse through the document template as well.

- If you already have a US Legal Forms account, you can Log In and click the Obtain option.

- After that, you may complete, alter, print, or sign the Michigan Assignment and Bill of Sale to Corporation.

- Every legal document template you purchase is yours for a long time.

- To get another copy of a purchased form, go to the My documents tab and click the relevant option.

- If you are using the US Legal Forms website for the first time, follow the basic guidelines below.

- First, ensure you have selected the appropriate document template for your state/city of choice.

- Review the form description to ensure you have chosen the correct type.

Form popularity

FAQ

State Transfer Tax Rate $3.75 for every $500 of value transferred. County Transfer Tax Rate $0.55 for every $500 of value transferred.

The Michigan residential purchase and sale agreement is a document through which a seller of residential property agrees to transfer ownership to a buyer. The form can be used by the prospective buyer to make an initial offer to the seller, and if accepted, close the deal and transfer the property title.

3-1.2 Requirement. A vehicle may not be sold, displayed, or offered for sale in Michigan unless the dealership has a properly assigned title or other ownership document (MCO/MSO) in its immediate possession.

How to Transfer Michigan Real EstateFind the most recent deed to the property. It is helpful to begin by locating the most recent deed to the property (the deed that transferred the property to the current grantor).Create the new deed.Sign and notarize the deed.File the deed in the county land records.

Some contracts may contain a clause prohibiting assignment; other contracts may require the other party to consent to the assignment. Here's an example of a basic assignment of a contract: Tom contracts with a dairy to deliver a bottle of half-and-half to Tom's house every day.

Primary tabs. Assignment is a legal term whereby an individual, the assignor, transfers rights, property, or other benefits to another known as the assignee. This concept is used in both contract and property law. The term can refer to either the act of transfer or the rights/property/benefits being transferred.

A purchase contract assignment is between a holder (assignor) that transfers their interest in buying real estate to someone else (assignee). Before the closing, it is common to assign a purchase contract to a business entity or the person whom the loan or mortgage will be under.

5 Ways to Transfer Property in IndiaSale Deed. The most common way of property transfer is through a sale deed.Gift Deed. Another popular way of transferring property ownership is by 'gifting' the property using a gift deed.Relinquishment Deed.Will.Partition Deed.

Gifting property to family members with deed of giftThe owner should be of sound mind and acting of their own free will.Independent legal advice should be sought before commencing with a deed of gift.The property in question should have no outstanding debts secured against it.More items...

Generally, an owner can transfer his property unless there is a legal restriction barring such transfer. Under the law, any person who owns a property and is competent to contract can transfer it in favour of another.