This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Michigan Complaint to Compel Mortgagee to Execute and Record Satisfaction and Discharge of Mortgage

Description

How to fill out Complaint To Compel Mortgagee To Execute And Record Satisfaction And Discharge Of Mortgage?

Choosing the right legal record web template could be a have difficulties. Needless to say, there are plenty of web templates accessible on the Internet, but how do you get the legal form you want? Use the US Legal Forms internet site. The support delivers a huge number of web templates, like the Michigan Complaint to Compel Mortgagee to Execute and Record Satisfaction and Discharge of Mortgage, which you can use for business and private requires. Each of the varieties are inspected by specialists and satisfy state and federal specifications.

Should you be presently signed up, log in in your accounts and click on the Down load key to obtain the Michigan Complaint to Compel Mortgagee to Execute and Record Satisfaction and Discharge of Mortgage. Make use of your accounts to search with the legal varieties you might have ordered earlier. Visit the My Forms tab of your respective accounts and acquire yet another backup in the record you want.

Should you be a whole new customer of US Legal Forms, listed here are basic directions that you can adhere to:

- Very first, be sure you have selected the proper form to your town/region. You may check out the form utilizing the Preview key and browse the form description to ensure it will be the best for you.

- When the form will not satisfy your expectations, use the Seach discipline to find the proper form.

- When you are positive that the form is proper, go through the Purchase now key to obtain the form.

- Select the costs program you need and enter the necessary information. Create your accounts and buy the order using your PayPal accounts or credit card.

- Choose the file formatting and download the legal record web template in your system.

- Comprehensive, change and printing and indication the acquired Michigan Complaint to Compel Mortgagee to Execute and Record Satisfaction and Discharge of Mortgage.

US Legal Forms is definitely the largest library of legal varieties in which you can see various record web templates. Use the company to download skillfully-produced documents that adhere to status specifications.

Form popularity

FAQ

If the satisfaction isn't recorded within a minimum of 60 days, they may incur penalties and be held liable for damages and attorney's fees.

No person shall bring or maintain any action or proceeding to foreclose a mortgage on real estate unless he commences the action or proceeding within 15 years after the mortgage becomes due or within 15 years after the last payment was made on the mortgage.

Suppose a mortgage lender fails to record a Satisfaction of Mortgage document within 60 days from the final payment date. In that case, you can file a lawsuit against the mortgagee. Contact a local law firm to speak with an intake specialist about your legal options.

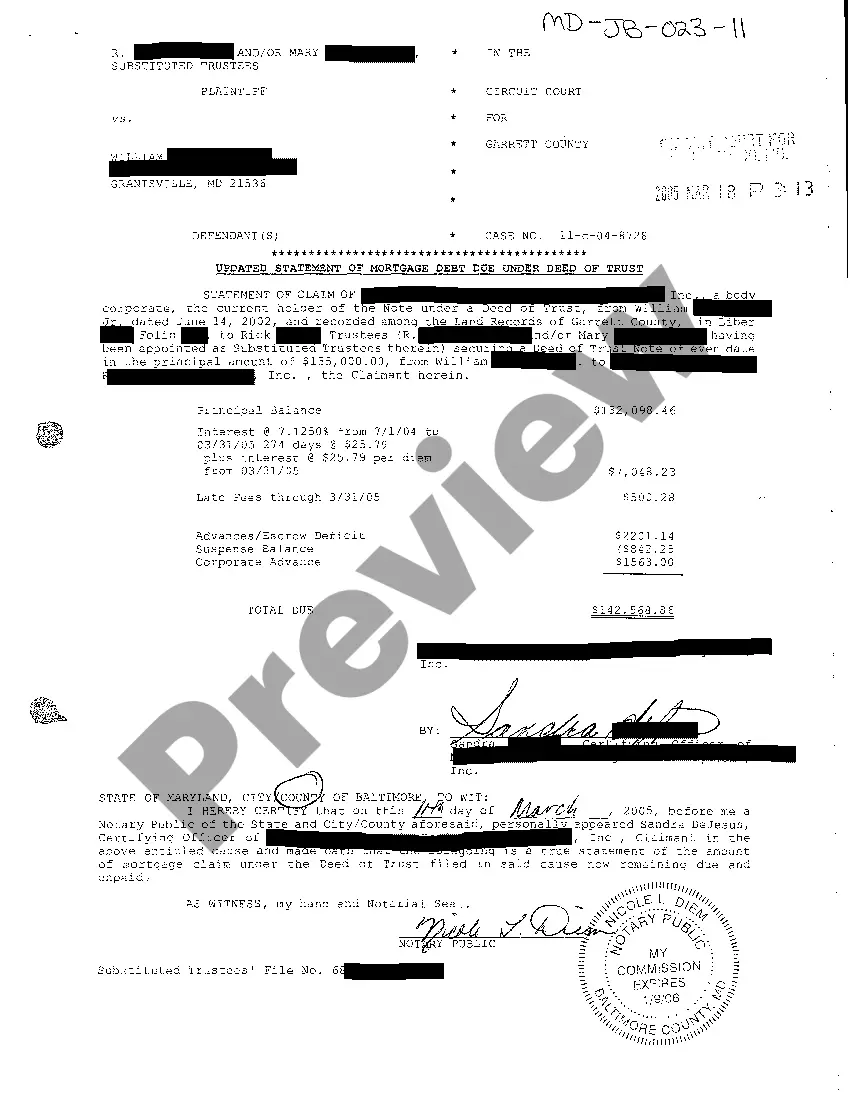

A satisfaction of mortgage, also known as release, cancellation or discharge of mortgage, is a type of legal document that proves you paid your mortgage in full. As a result, it also certifies that the property's title is clear of any liens.

If Mortgagee fails to satisfy of record, he is liable for damages, including attorney fees, if 20 days written notice is given by Mortgagor prior to suit. Acknowledgment: An assignment or satisfaction must contain a proper New Jersey acknowledgment, or other acknowledgment approved by Statute.

Suppose a mortgage lender fails to record a Satisfaction of Mortgage document within 60 days from the final payment date. In that case, you can file a lawsuit against the mortgagee. Contact a local law firm to speak with an intake specialist about your legal options.

(3) If the mortgage lender does not satisfy the net worth requirements within 120 days, the license of the mortgage lender shall be deemed to be relinquished and canceled and all servicing contracts shall be disposed of in a timely manner by the mortgage lender.