If you need to complete, down load, or printing authorized record layouts, use US Legal Forms, the biggest collection of authorized forms, that can be found online. Utilize the site`s easy and practical lookup to get the paperwork you require. A variety of layouts for enterprise and individual reasons are categorized by types and states, or keywords and phrases. Use US Legal Forms to get the Michigan Motion for Default Judgment against Garnishee with a couple of click throughs.

Should you be currently a US Legal Forms buyer, log in to your accounts and then click the Obtain key to have the Michigan Motion for Default Judgment against Garnishee. Also you can gain access to forms you formerly downloaded in the My Forms tab of your own accounts.

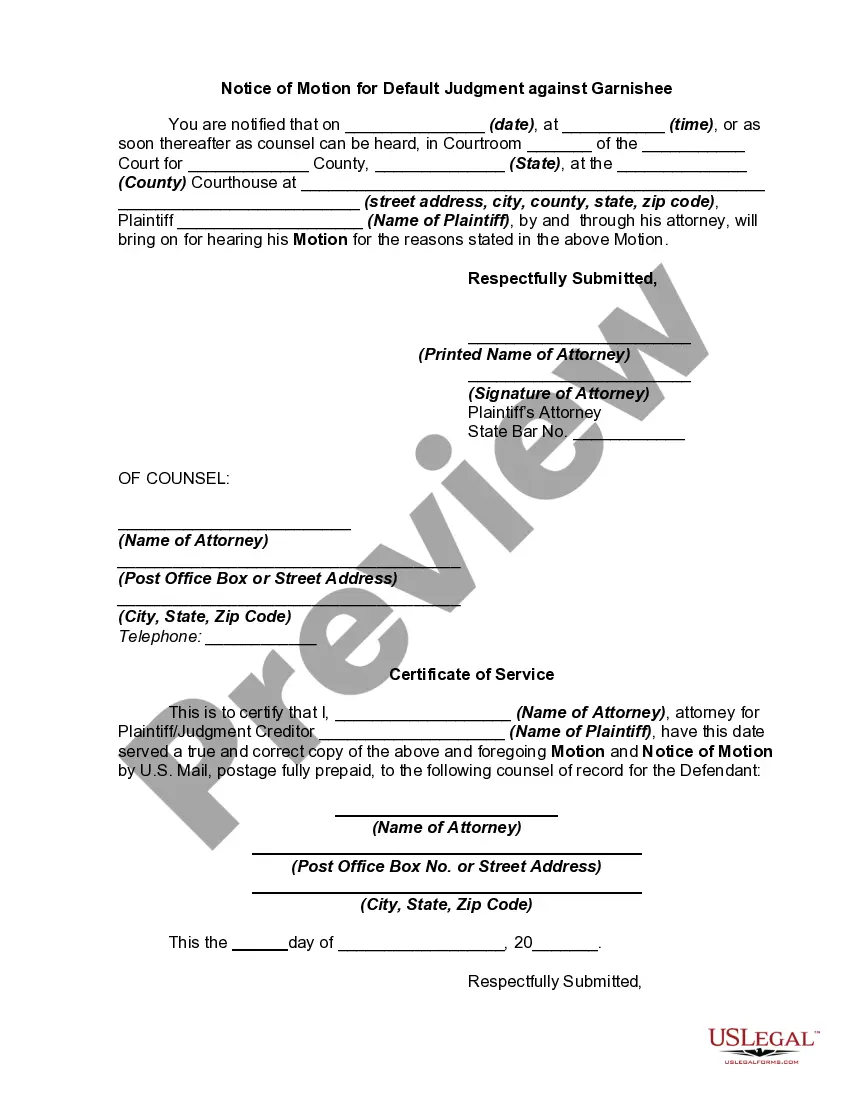

If you use US Legal Forms the first time, refer to the instructions under:

- Step 1. Be sure you have selected the form to the correct area/region.

- Step 2. Take advantage of the Preview option to check out the form`s information. Do not overlook to read through the outline.

- Step 3. Should you be not happy with all the type, take advantage of the Search field on top of the display to find other versions from the authorized type design.

- Step 4. After you have found the form you require, select the Get now key. Pick the pricing strategy you prefer and include your accreditations to sign up for an accounts.

- Step 5. Approach the purchase. You can use your bank card or PayPal accounts to accomplish the purchase.

- Step 6. Pick the format from the authorized type and down load it on the system.

- Step 7. Full, edit and printing or sign the Michigan Motion for Default Judgment against Garnishee.

Every single authorized record design you buy is your own for a long time. You might have acces to each and every type you downloaded in your acccount. Click on the My Forms section and choose a type to printing or down load yet again.

Remain competitive and down load, and printing the Michigan Motion for Default Judgment against Garnishee with US Legal Forms. There are millions of professional and status-distinct forms you may use to your enterprise or individual requirements.