The Truth-in-Lending Act (TILA) is part of the Federal Consumer Credit Protection Act. The purpose of the TILA is to make full disclosure to debtors of what they are being charged for the credit they are receiving. TILA applies only to consumer credit transactions. Consumer credit is credit for personal or household use and not commercial use. This form was designed to cover an situation where the Seller is not a creditor as defined by the TILA.

Michigan Installment Sale not covered by Federal Consumer Credit Protection Act with Security Agreement

Description

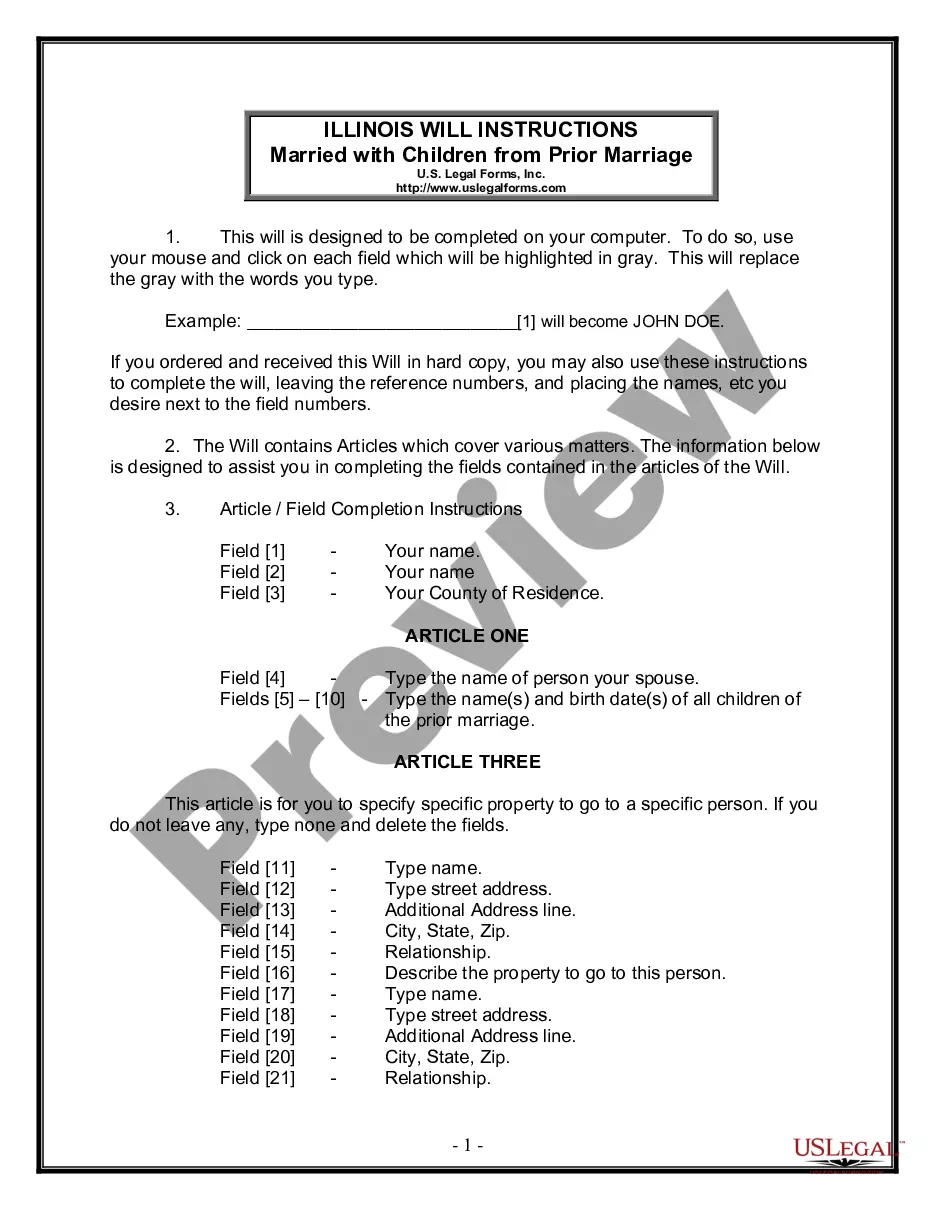

How to fill out Installment Sale Not Covered By Federal Consumer Credit Protection Act With Security Agreement?

US Legal Forms - one of the largest collections of legal documents in the USA - provides a variety of legal document templates that you can download or create.

By using the site, you can find thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can obtain the latest versions of documents like the Michigan Installment Sale not regulated by the Federal Consumer Credit Protection Act with Security Agreement within minutes.

If you already have an account, Log In and download the Michigan Installment Sale not covered by Federal Consumer Credit Protection Act with Security Agreement from the US Legal Forms library. The Download button will appear on every template you view. You have access to all previously acquired forms in the My documents tab of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the payment.

Select the format and download the form to your device.

- Make sure to select the correct document for your city/state.

- Click the Preview button to review the form’s content.

- Check the form details to confirm that you have chosen the right document.

- If the form does not meet your needs, use the Search field at the top of the page to find one that does.

- If you are satisfied with the form, finalize your choice by clicking the Download now button.

- Then, choose your pricing plan and provide your credentials to register for an account.

Form popularity

FAQ

The Home Improvement Finance Act in Michigan aims to protect consumers by regulating home improvement contracts and financing options. This law establishes guidelines that lenders and contractors must follow when offering home improvement financing, which may include Michigan Installment Sale not covered by the Federal Consumer Credit Protection Act with Security Agreement. Understanding this act is vital for safeguarding your interests and ensuring compliance. For guidance on navigating these rules, platforms like uslegalforms can provide valuable resources.

A retail installment contract can be considered a security under specific conditions, particularly when it involves a sale of a future right to payments. However, in the context of a Michigan Installment Sale not covered by the Federal Consumer Credit Protection Act with Security Agreement, these contracts may not typically meet the criteria. If you are considering this option, it is essential to understand the regulatory framework and implications. Consulting with knowledgeable professionals can help clarify your obligations and options.

An installment sales contract is a type of sales agreement where the buyer makes payments over time, often while the seller retains a security interest. A standard sales contract typically involves an immediate transfer of ownership upon full payment. Recognizing these differences is crucial, especially in scenarios involving Michigan Installment Sale not covered by Federal Consumer Credit Protection Act with Security Agreement.

A retail installment contract involves a buyer purchasing a product while making periodic payments, ultimately granting ownership. In contrast, a lease allows a person to use a product for a set period without obtaining ownership. Understanding this distinction helps clarify terms, particularly for Michigan Installment Sale not covered by Federal Consumer Credit Protection Act with Security Agreement, ensuring buyers and sellers know their rights.

In an installment sales contract, the seller maintains a security interest in the property until the buyer fulfills all payment obligations. This means that if the buyer defaults, the seller has the right to reclaim the property. Such setups are common in Michigan Installment Sale not covered by Federal Consumer Credit Protection Act with Security Agreement, where sellers can protect their interests effectively.

No, a retail installment contract is not the title of the item being purchased; rather, it is a financing agreement. In a Michigan Installment Sale not covered by Federal Consumer Credit Protection Act with Security Agreement, the title remains with the seller until the buyer completes all payment obligations. This means the buyer has the right to use the item, but legal ownership is retained by the seller until the contract is fulfilled. Understanding this distinction is essential to avoid confusion during the payment process.

A retail installment contract is not a title but rather an agreement outlining the terms of sale and payment. This contract can secure a security interest in the item being sold, often requiring the seller to hold the title until full payment is received. Understanding the distinction is crucial in managing the rights associated with the contract. If you're looking for clarity and proper agreements, USLegalForms offers templates that can ensure your contracts are legally sound.

If the buyer cannot make payments under a Michigan Installment Sale not covered by Federal Consumer Credit Protection Act with Security Agreement, the seller may pursue specific remedies outlined in the contract. This could include repossession of the item sold or seeking legal recourse for the unpaid balance. Communication between both parties is vital to explore alternative solutions, like restructuring payment plans. Utilizing the resources on USLegalForms can help both parties navigate these challenges effectively.

The Retail Installment Sales Act in Michigan governs the terms and conditions for installment sales. It outlines consumer protections, ensuring that buyers understand the costs involved in the Michigan Installment Sale not covered by Federal Consumer Credit Protection Act with Security Agreement. This law helps maintain fairness in retail transactions by requiring clear disclosures from sellers. Familiarizing yourself with this Act can enhance your knowledge of your rights and obligations.

You may elect out of an installment sale, but it depends on the specific terms in your contract. If both parties agree, you can cancel the agreement and settle any outstanding obligations. However, navigating this can involve legal intricacies, especially under Michigan laws. Consider consulting with experts on platforms like USLegalForms to ensure you follow proper procedures.