Michigan Community Property Disclaimer

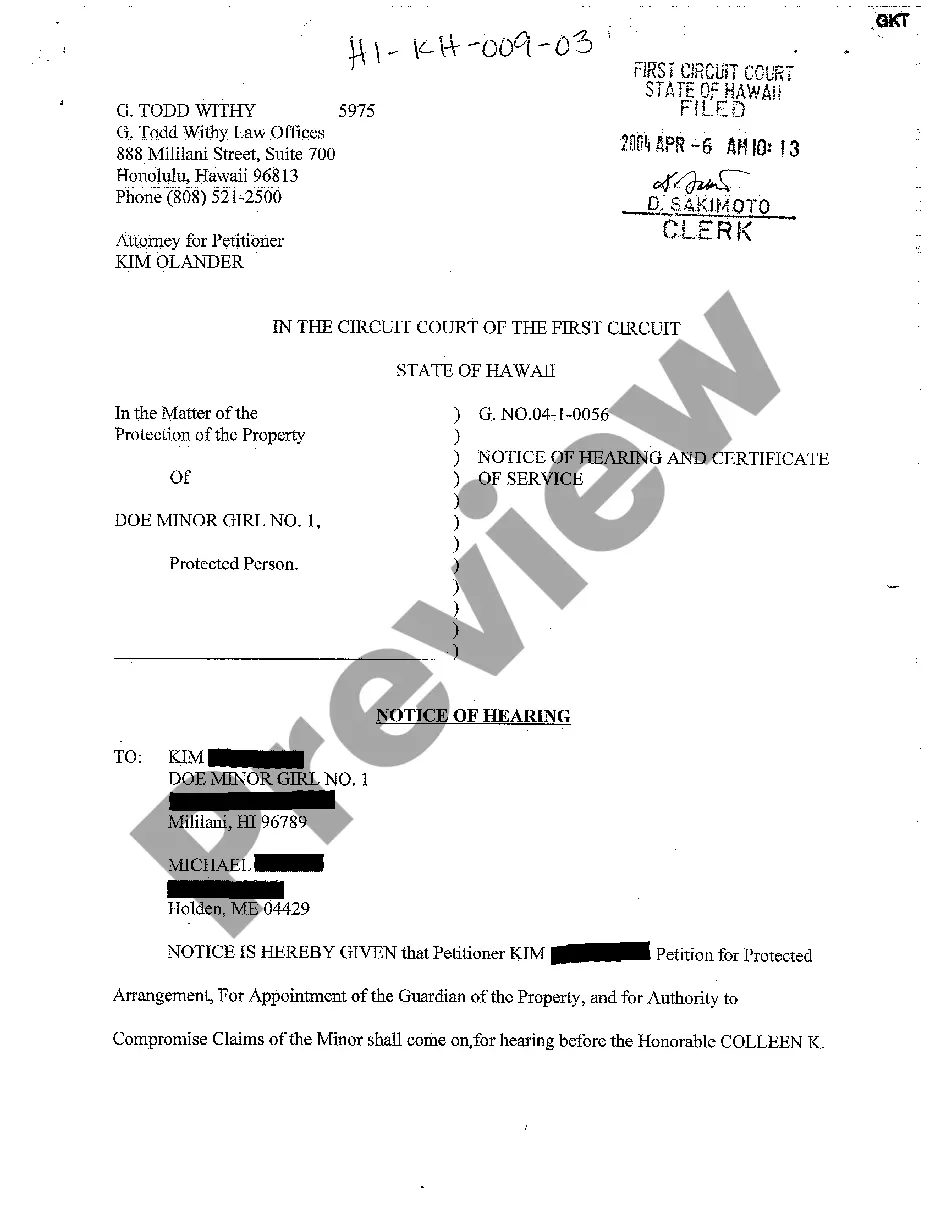

Description

How to fill out Community Property Disclaimer?

Are you currently in a situation where you need documents for either business or personal reasons almost every day.

There is a wide range of legal document templates available online, but finding ones you can trust is not easy.

US Legal Forms provides a vast assortment of template forms, such as the Michigan Community Property Disclaimer, which are designed to comply with state and federal regulations.

Once you find the appropriate form, click Get now.

Choose the pricing plan you prefer, fill in the required information to create your account, and pay for the transaction using your PayPal or credit card. Select a suitable document format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Michigan Community Property Disclaimer template.

- If you do not have an account and need to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it matches the correct city/region.

- Utilize the Preview button to examine the form.

- Review the description to ensure that you have selected the accurate form.

- If the form is not what you need, use the Search section to find the form that satisfies your needs and criteria.

Form popularity

FAQ

Yes, it is possible to disclaim jointly owned property, but the process can be intricate. Disclaiming such property requires a clear understanding of both your rights and obligations under state law. The Michigan Community Property Disclaimer may influence your ability and reasons for disclaiming ownership. Utilizing platforms like USLegalForms can ensure that you take the right steps.

Michigan does not follow community property law; instead, it operates under equitable distribution principles. This means that property is divided fairly during a divorce, not necessarily equally. Understanding how these concepts interact with a Michigan Community Property Disclaimer can guide your property rights. USLegalForms can assist you in navigating these complex laws.

A qualified disclaimer is a legal document that allows an individual to refuse property without it being counted as taxable income. This process must meet specific criteria, including being in writing and made within a certain period. Exploring the Michigan Community Property Disclaimer can provide insight into your eligibility for such disclaimers. USLegalForms offers resources to help you draft valid disclaimers.

Yes, jointly owned property can be seized under certain circumstances, such as legal judgments or debts. The ownership status can affect how much of the property is reachable by creditors. Knowing the effects of the Michigan Community Property Disclaimer can help you protect your assets. Consulting legal forms can clarify your options.

Yes, you can disclaim a joint account, but the rules vary based on state laws. When you disclaim a joint account, it means you are refusing your rights to the account's funds or property. Understanding the implications of your actions is crucial, especially regarding the Michigan Community Property Disclaimer. It is wise to seek advice to ensure you proceed correctly.

In Texas, a disclaimer allows a person to refuse an interest in property. The rules require that the disclaimer be in writing, signed, and filed appropriately. Many people consider disclaimers under laws related to community property, making it important to understand how the Michigan Community Property Disclaimer can differ. Consider using USLegalForms to navigate these rules efficiently.

To make a qualified disclaimer in Michigan, you need to follow certain steps laid out by state law and IRS guidelines. First, submit a written disclaimer to the appropriate parties, ensuring it clearly states your refusal of the inheritance. The disclaimer must be made within the nine-month filing period and cannot benefit you in any form. Platforms like US Legal Forms can provide templates and resources to help you create a compliant disclaimer.

When it comes to jointly held property in Michigan, you typically cannot disclaim your interest without the consent of the other owner. This situation means that both parties must agree on any changes to the ownership arrangement or disclaiming options. A Michigan Community Property Disclaimer does not usually apply in these cases, as joint property laws dictate the distribution. Consult legal guidance to explore your options.

In Michigan, the time limit for filing a disclaimer for inheritance is generally nine months from the date of the decedent's death. However, this can vary based on specific circumstances or estate planning documents. It’s essential to act within this timeframe to ensure the disclaimer is valid. If you face challenges, consider seeking assistance from platforms like US Legal Forms to navigate the process smoothly.

A spouse may choose to disclaim assets for various reasons, such as financial strategy or tax implications. By using a Michigan Community Property Disclaimer, they can avoid unwanted obligations or ensure beneficiaries maintain the desired inheritance. Disclaiming helps maintain family harmony, especially when complicated estate dynamics are involved. Ultimately, it allows individuals to make tailored financial decisions.