Michigan Sample Letter for Judgment Confirming Tax Title

Description

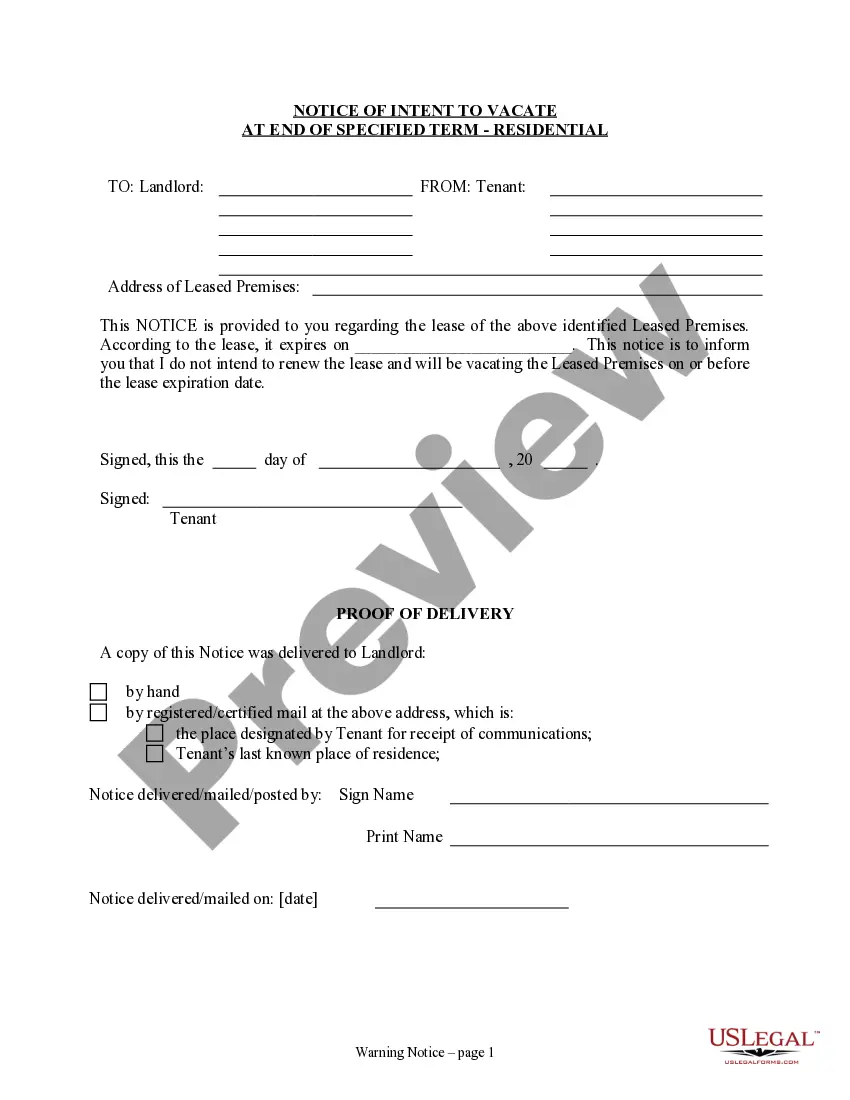

How to fill out Sample Letter For Judgment Confirming Tax Title?

US Legal Forms - one of the biggest libraries of lawful varieties in America - delivers an array of lawful file themes you may obtain or print out. Utilizing the site, you can get a large number of varieties for company and individual reasons, sorted by groups, says, or keywords and phrases.You will discover the most up-to-date versions of varieties such as the Michigan Sample Letter for Judgment Confirming Tax Title within minutes.

If you already have a monthly subscription, log in and obtain Michigan Sample Letter for Judgment Confirming Tax Title through the US Legal Forms library. The Down load option will show up on every single develop you perspective. You gain access to all formerly downloaded varieties in the My Forms tab of your own bank account.

If you would like use US Legal Forms the first time, listed here are simple instructions to help you get began:

- Make sure you have chosen the proper develop for the area/state. Click on the Preview option to examine the form`s content. Read the develop explanation to actually have chosen the right develop.

- In the event the develop doesn`t suit your specifications, take advantage of the Search industry near the top of the screen to get the one which does.

- Should you be pleased with the form, validate your choice by clicking on the Acquire now option. Then, choose the costs strategy you want and supply your accreditations to sign up on an bank account.

- Procedure the deal. Use your Visa or Mastercard or PayPal bank account to complete the deal.

- Pick the structure and obtain the form on your own system.

- Make changes. Fill out, modify and print out and indicator the downloaded Michigan Sample Letter for Judgment Confirming Tax Title.

Every single format you included in your money does not have an expiration particular date and it is the one you have forever. So, in order to obtain or print out an additional backup, just proceed to the My Forms section and click in the develop you will need.

Get access to the Michigan Sample Letter for Judgment Confirming Tax Title with US Legal Forms, by far the most considerable library of lawful file themes. Use a large number of specialist and state-particular themes that satisfy your business or individual requirements and specifications.

Form popularity

FAQ

The most common Michigan income tax form is the MI-1040. This form is used by Michigan residents who file an individual income tax return.

In addition, current year commonly used forms will continue to be available at Michigan Department of Treasury offices, most public libraries, Northern Michigan post offices, and Michigan Department of Health and Human Services (MDHHS) county offices.

Michigan Net Operating Loss Deduction (Form 5674) is used to compute the current year Michigan NOL deduction. Form 5674 is required to claim an NOL deduction on Schedule 1. Michigan Net Operating Loss Carryforward deduction is claimed on Michigan Schedule 1.

As per federal law, employers have to withhold 4.25% of the gross salary of all the employees working under them in Michigan.

A Notice of State Tax Lien is an instrument that gives the Michigan Department of Treasury a legal right or interest in a debtor's property, lasting usually until a debt that it secures is satisfied. A Notice of State Tax Lien may attach to real and/or personal property wherever located in Michigan.

We will send a letter/notice if: You are due a larger or smaller refund. We have a question about your tax return.

Most Commonly Used Forms & Instructions Form NumberForm NameMI-1040Individual Income Tax ReturnMI-1040CRHomestead Property Tax Credit ClaimMI-1040CR-2Homestead Property Tax Credit Claim for Veterans and Blind PeopleMI-1040CR-7Home Heating Credit Claim11 more rows

If you owe money to a federal agency and you did not pay it on time, you have a delinquent debt. You will receive a letter first from the agency to whom you owe the debt. If you do not pay the agency, the debt then goes to Treasury and we send you a letter about that debt.