The Fair Credit Reporting Act (FCRA) is designed to help ensure that credit bureaus furnish correct and complete information to businesses to use when evaluating your application. Your rights include:

The right to receive a copy of your credit report. The copy of your report must contain all of the information in your file at the time of your request.

The right to know the name of anyone who received your credit report in the last year for most purposes or in the last two years for employment purposes.

Any company that denies your application must supply the name and address of the credit bureau they contacted, provided the denial was based on information given by the credit bureau.

The right to a free copy of your credit report when your application is denied because of information supplied by the credit bureau. Your request must be made within 60 days of receiving your denial notice.

If you contest the completeness or accuracy of information in your report, you should file a dispute with the credit bureau and with the company that furnished the information to the bureau. Both the credit bureau and the furnisher of information are legally obligated to investigate your dispute.

A right to add a summary explanation to your credit report if your dispute is not resolved to your satisfaction.

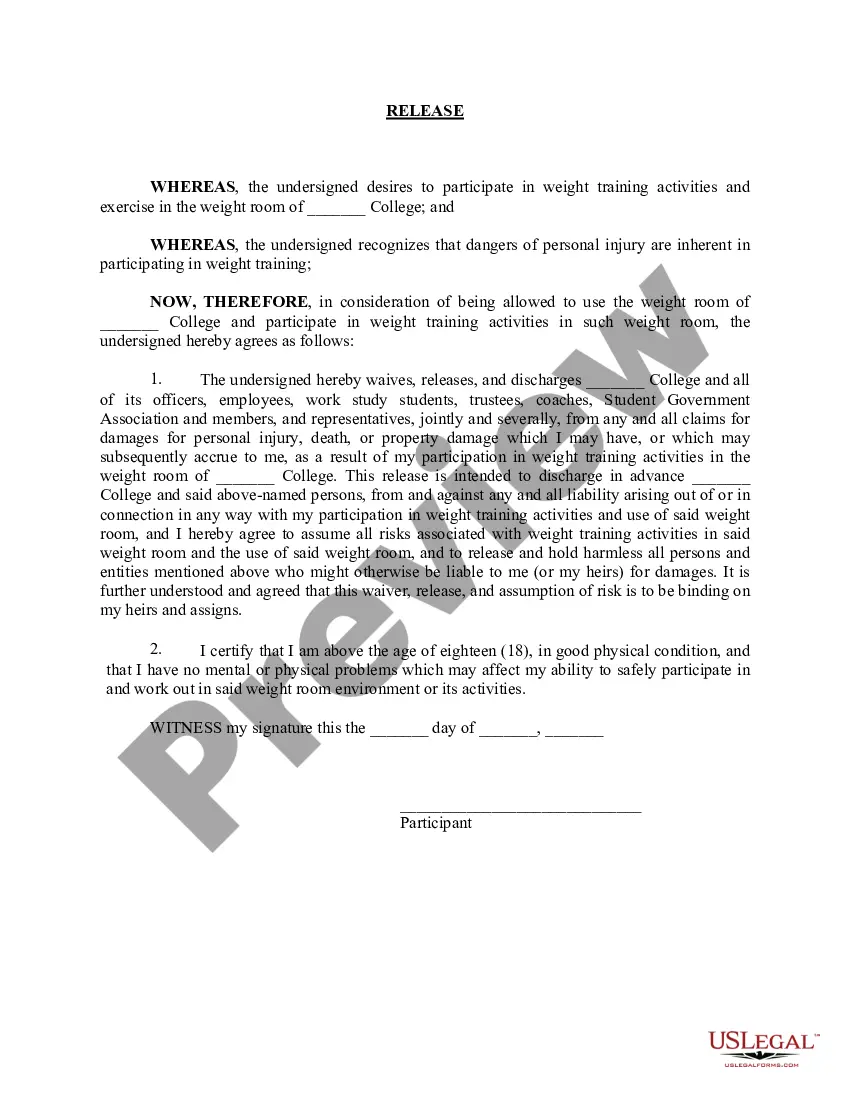

Michigan Request for Disclosure of Reasons for Increasing Charge for Credit Regarding Credit Application Where Action Was Based on Information Not Obtained by Reporting Agency

Description

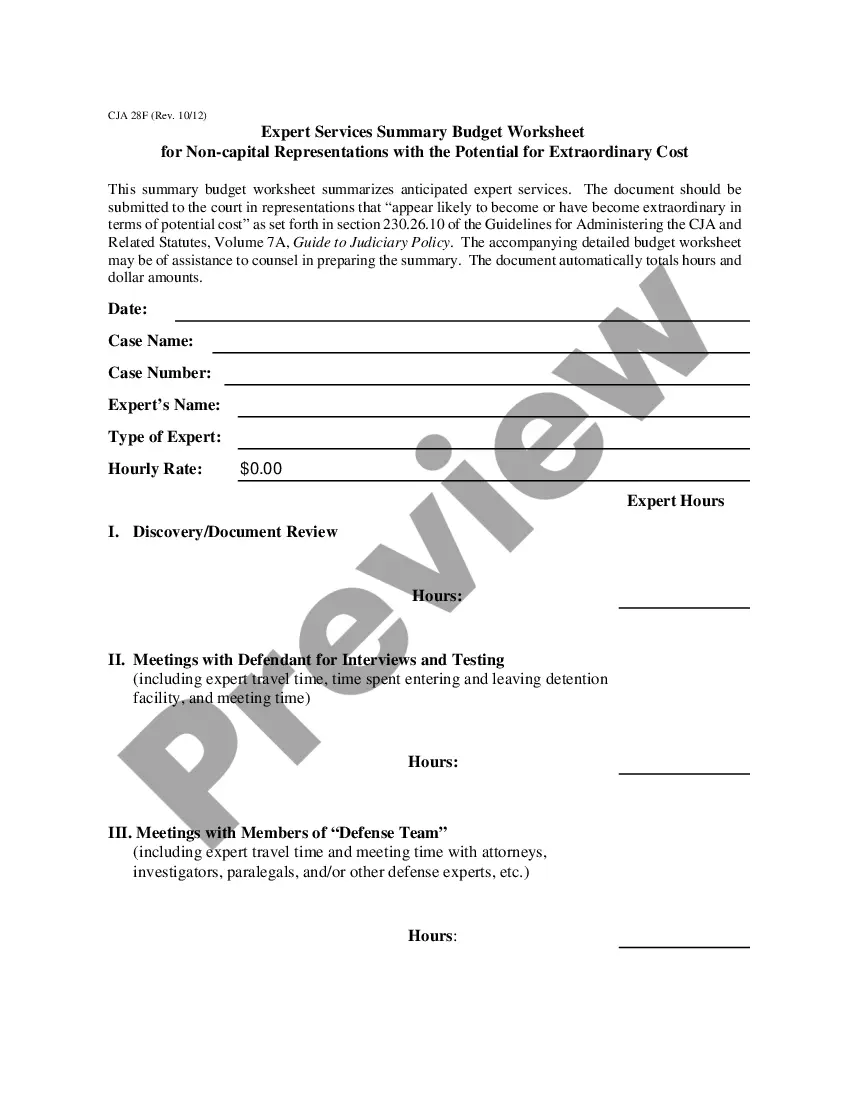

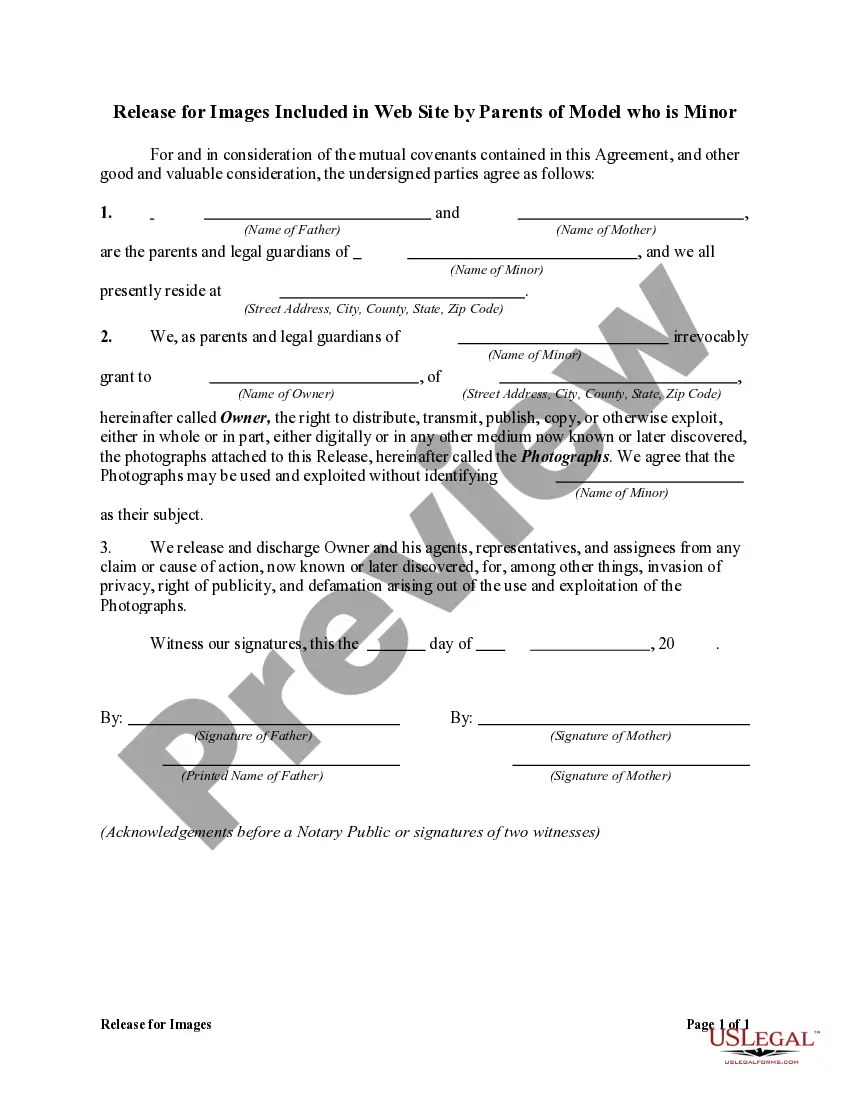

How to fill out Request For Disclosure Of Reasons For Increasing Charge For Credit Regarding Credit Application Where Action Was Based On Information Not Obtained By Reporting Agency?

If you want to comprehensive, download, or print lawful papers templates, use US Legal Forms, the greatest selection of lawful varieties, that can be found on the web. Utilize the site`s easy and convenient research to obtain the papers you require. A variety of templates for enterprise and individual reasons are categorized by groups and says, or search phrases. Use US Legal Forms to obtain the Michigan Request for Disclosure of Reasons for Increasing Charge for Credit Regarding Credit Application Where Action Was Based on Information Not Obtained by Reporting Agency in just a couple of mouse clicks.

Should you be already a US Legal Forms buyer, log in for your accounts and click on the Acquire button to find the Michigan Request for Disclosure of Reasons for Increasing Charge for Credit Regarding Credit Application Where Action Was Based on Information Not Obtained by Reporting Agency. You can even accessibility varieties you in the past saved inside the My Forms tab of your own accounts.

If you work with US Legal Forms the very first time, refer to the instructions below:

- Step 1. Make sure you have selected the form for that correct area/nation.

- Step 2. Make use of the Review choice to look over the form`s content. Don`t neglect to see the information.

- Step 3. Should you be unsatisfied with all the form, utilize the Search area on top of the monitor to get other types of your lawful form web template.

- Step 4. After you have identified the form you require, select the Buy now button. Select the prices plan you prefer and put your qualifications to register to have an accounts.

- Step 5. Process the deal. You can use your bank card or PayPal accounts to perform the deal.

- Step 6. Pick the file format of your lawful form and download it on the gadget.

- Step 7. Complete, change and print or sign the Michigan Request for Disclosure of Reasons for Increasing Charge for Credit Regarding Credit Application Where Action Was Based on Information Not Obtained by Reporting Agency.

Each and every lawful papers web template you get is yours eternally. You might have acces to every form you saved within your acccount. Select the My Forms portion and decide on a form to print or download again.

Contend and download, and print the Michigan Request for Disclosure of Reasons for Increasing Charge for Credit Regarding Credit Application Where Action Was Based on Information Not Obtained by Reporting Agency with US Legal Forms. There are thousands of specialist and state-certain varieties you can utilize for the enterprise or individual demands.

Form popularity

FAQ

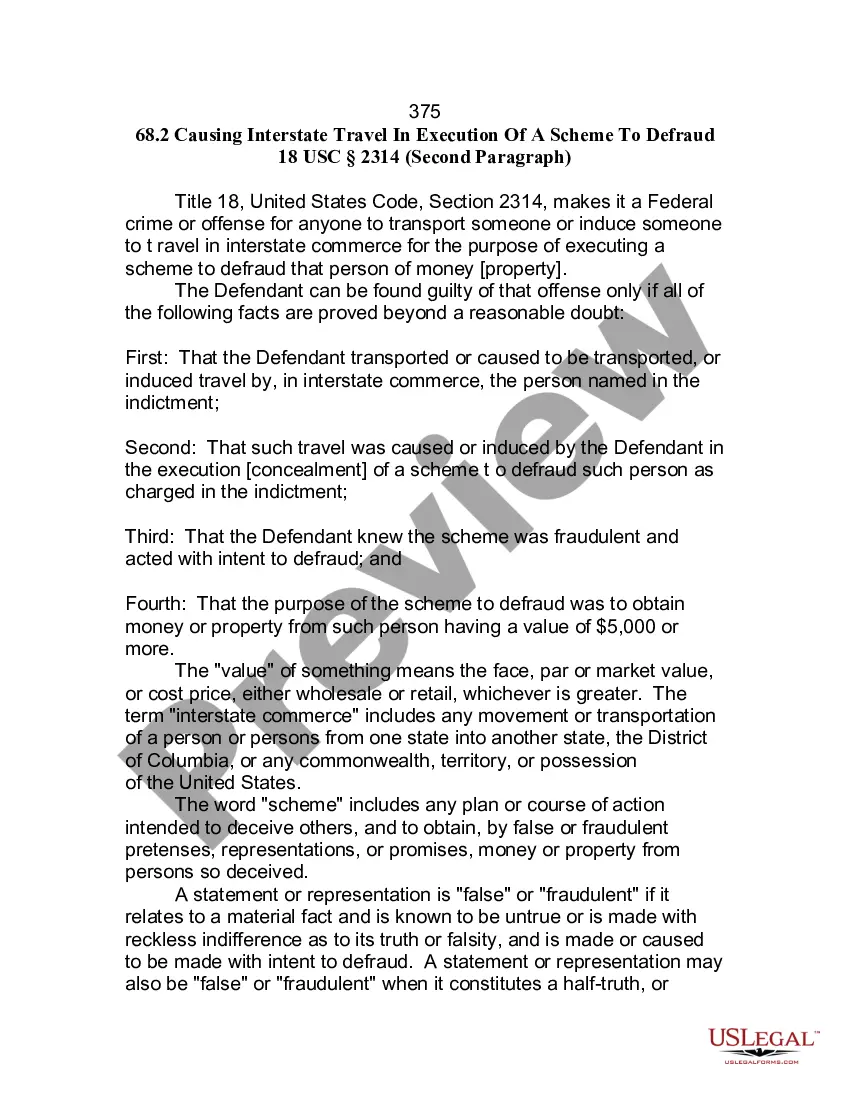

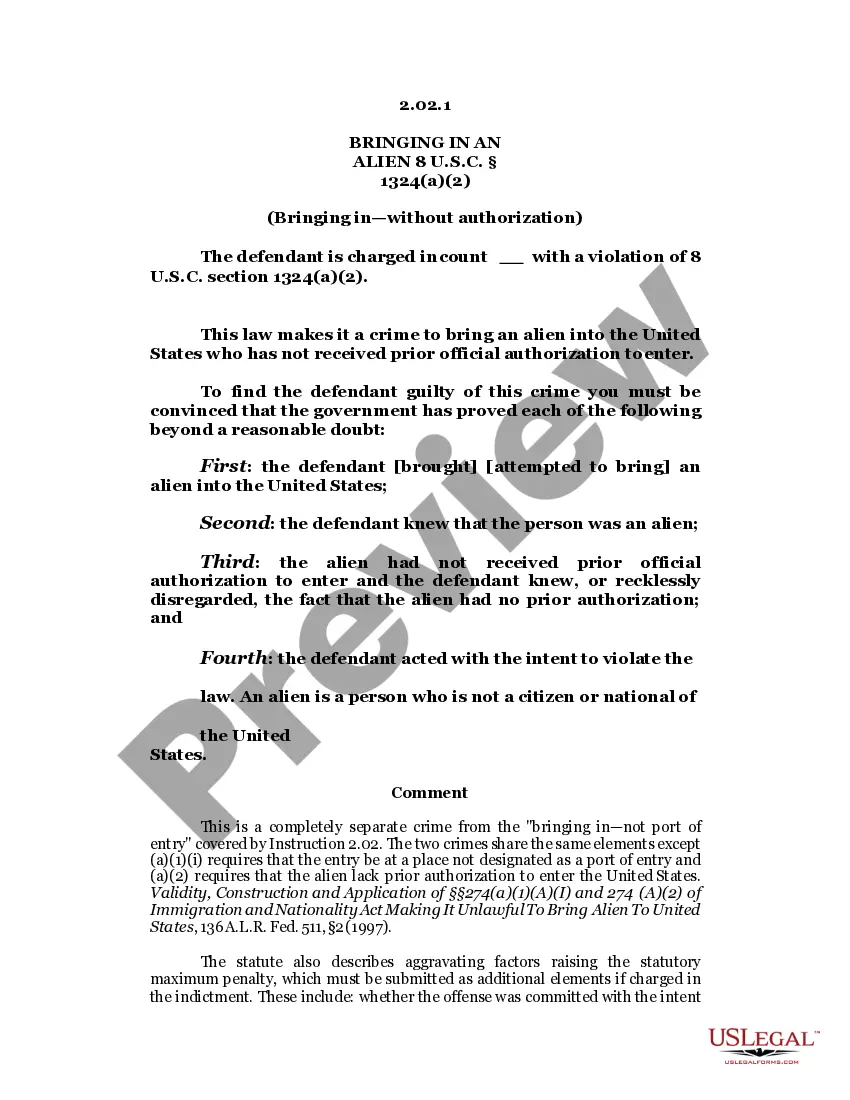

Once notified by a CRA of a consumer dispute, the furnisher of the disputed information must do its own reasonable investigation. A reasonable investigation under FCRA § 1681s-2(b) requires the furnisher to examine sufficient evidence to determine whether the disputed information is accurate.

Willful FCRA violations: Legally speaking, a willful FCRA violation must have been committed knowingly and recklessly. Plaintiffs in these cases may receive actual or statutory damages ranging from $100 to $1,000 per violation, in addition to punitive damages determined by the courts.

The FCRA Protects You From Credit Report Errors You have the right to sue for damages ? the FCRA also gives consumers the right to sue credit reporting agencies for damages, that have violated the FCRA. In some cases you may also be able to sue the person/agency that used the incorrect credit report against you.

It may also include employment information, present and previous addresses, whether they have ever filed for bankruptcy or owe child support, and any arrest record. In some, but not all, instances, consumers must have initiated a transaction or agreed in writing before the credit bureau can release their report.

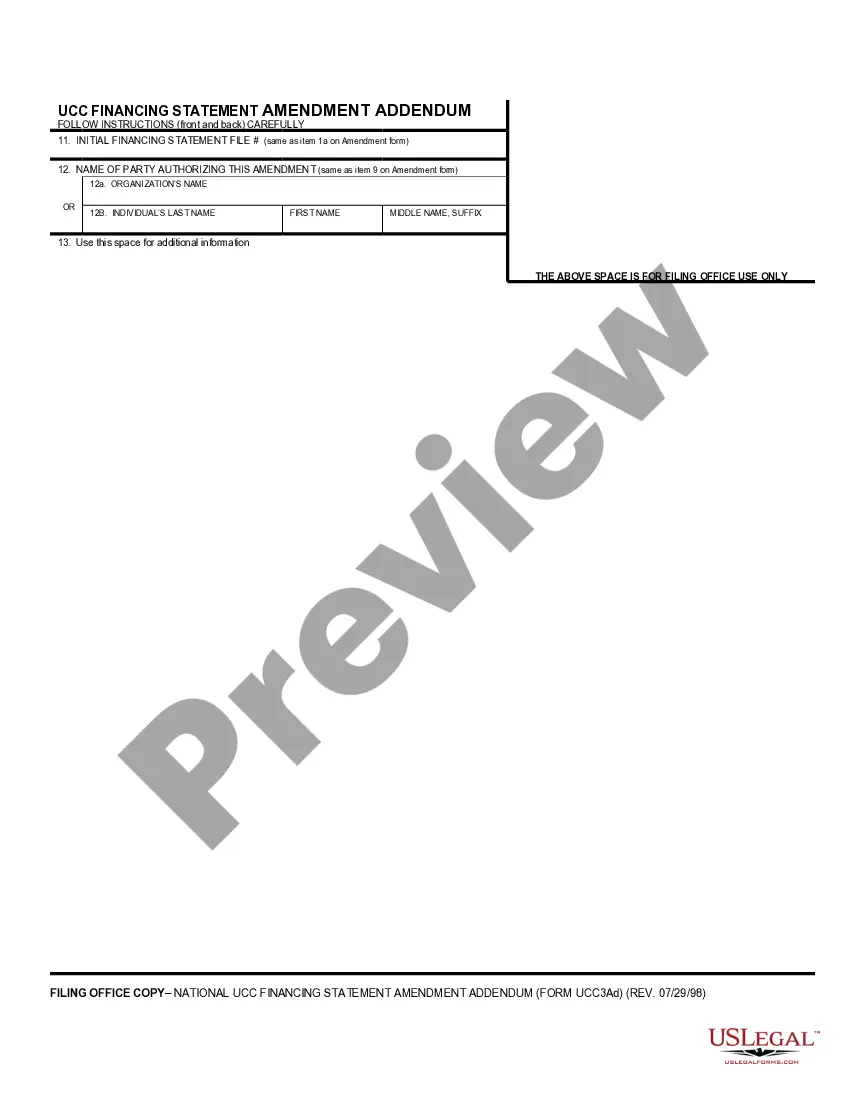

You must provide the notice either before you furnish the negative information or within 30 days of furnishing it. You may include the notice with a notice of default, a billing statement, or another item sent to the consumer, but you cannot send it with a Truth In Lending Act notification.

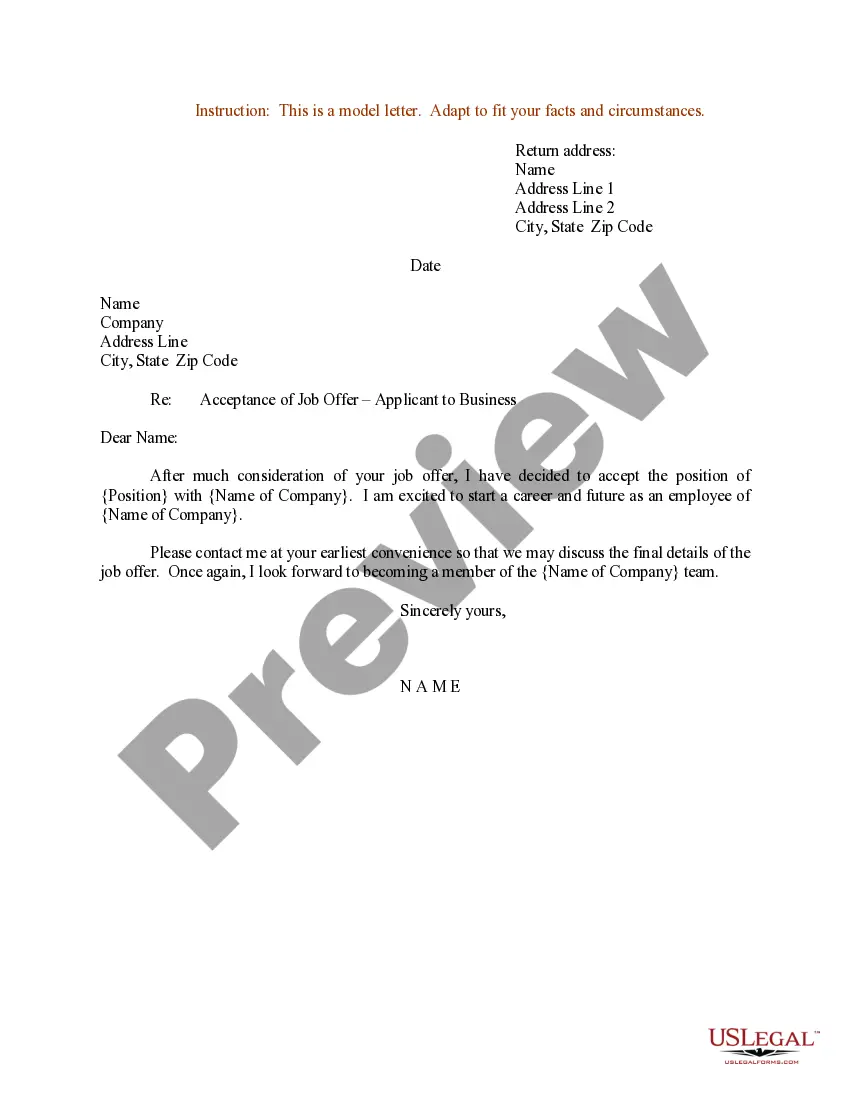

For example, employers can request a job applicant's credit report, but only with the applicant's permission. The Fair Credit Reporting Act (FCRA) mandates that when a business pulls a credit report on someone, they must specify the reason, such as: In conjunction with a loan request. For employment purposes.

A CRA may be found guilty of either willfully or negligently violating the Fair Credit Reporting Act. If you can prove that the CRA or other entity failed to exercise care in the handling of your financial information which resulted in harm to you, you may have a case for negligent violation of your FCRA rights.

Common violations of the FCRA include: Creditors give reporting agencies inaccurate financial information about you. Reporting agencies mixing up one person's information with another's because of similar (or same) name or social security number.