A disclaimer is a denial or renunciation of something. A disclaimer may be the act of a party by which be refuses to accept an estate which has been conveyed to him. In this instrument, the beneficiary of a trust is disclaiming any rights he has in the trust.

Michigan Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee

Description

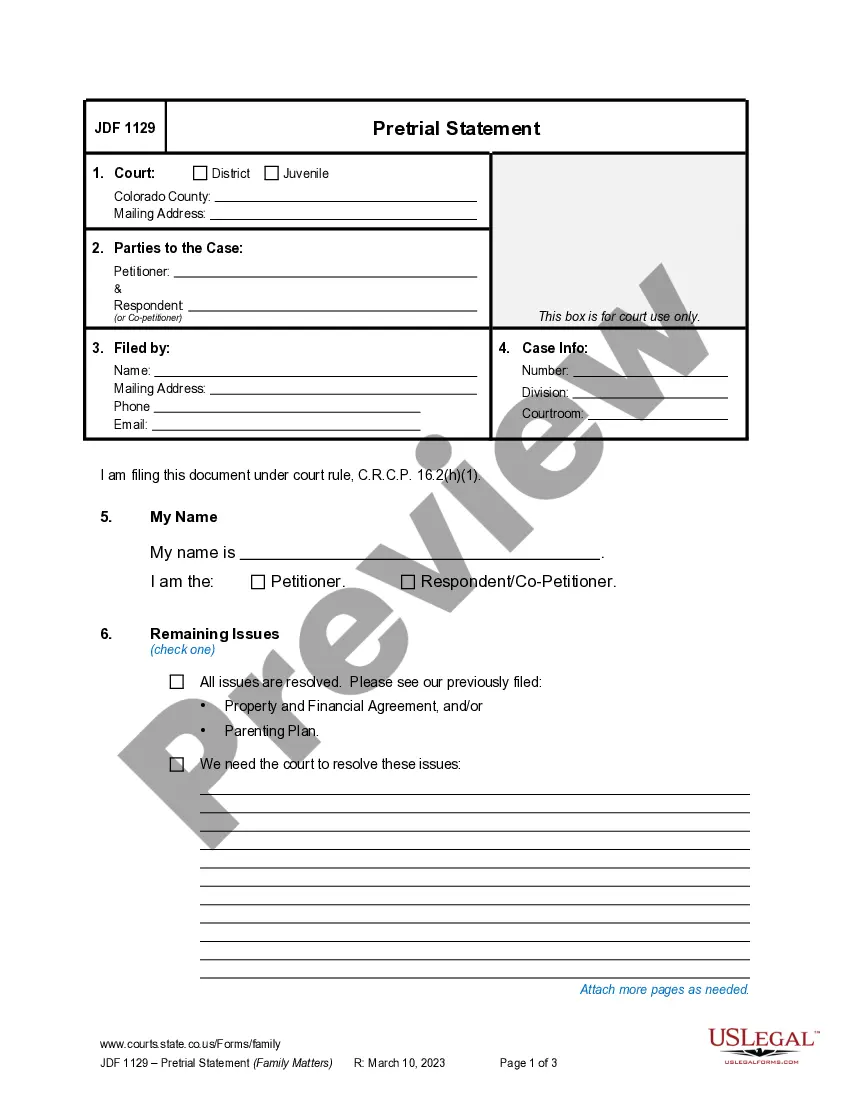

How to fill out Disclaimer By Beneficiary Of All Rights Under Trust And Acceptance Of Disclaimer By Trustee?

Selecting the appropriate official document template can be quite challenging.

Of course, there are numerous templates accessible on the internet, but how do you find the official form you need.

Utilize the US Legal Forms website. The service offers a vast array of templates, such as the Michigan Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee, which you can utilize for business and personal purposes.

First, make sure you have selected the correct form for your specific region/state. You can review the form using the Review button and read the form description to confirm it is indeed the right one for you.

- All the forms are reviewed by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to retrieve the Michigan Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee.

- Use your account to access the legal forms you have purchased before.

- Visit the My documents section of your account and download another copy of the documents you need.

- If you are a new user of US Legal Forms, here are some straightforward instructions for you to follow.

Form popularity

FAQ

A disclaimer of interest in probate in Michigan allows an individual to refuse a share of an estate. This decision must be made formally and submitted to the relevant probate court. By recognizing the significance of the Michigan Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee, you can effectively navigate the probate process and make informed decisions.

Yes, a trustee has a legal obligation to communicate with beneficiaries regarding the trust's management and its assets. Effective communication helps ensure transparency and fosters trust among the parties involved. Understanding the nuances of the Michigan Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee can further empower beneficiaries to engage meaningfully with their trustee.

The process to disclaim an inheritance typically includes writing a clear disclaimer document and submitting it to the executor or trustee. It's essential to act within the legally prescribed time limits. Engaging with platforms like uslegalforms can offer you comprehensive support regarding the Michigan Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee.

A disclaimer by beneficiary of a trust allows an individual to refuse their share of the trust assets. This action must be formalized in writing and submitted to the trustee. By utilizing the Michigan Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee, beneficiaries can manage their inheritance in a way that reflects their intentions.

Disclaiming an inheritance in Michigan involves submitting a written disclaimer to the appropriate trustee or personal representative. This disclaimer must be done within a specific timeframe and must meet certain legal requirements to be valid. Understanding the Michigan Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee can be beneficial, and resources like uslegalforms can guide you through these steps.

To politely decline an inheritance, you can communicate your decision clearly to the executor or trustee. Make sure to express your gratitude for the inheritance and state that it does not align with your personal values or circumstances. You may also want to submit a formal written statement, as this can assist with the Michigan Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee process.

A disclaimer of inheritance rights occurs when an heir decides not to accept their share of an estate. For example, if a child chooses to disclaim their inheritance from a parent’s estate, this can trigger a Michigan Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee. This legal approach can help others, such as siblings, to inherit that share without complications, streamlining the distribution process according to the decedent's wishes.

A disclaimer trust allows a beneficiary to refuse an inheritance from a trust, thereby redirecting the assets to other beneficiaries. For instance, if a beneficiary inherits a property but doesn't want it, they can create a Michigan Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee. This action can help in reducing tax benefits for the beneficiary while ensuring the trust's assets follow the intended path dictated by the grantor.

A Michigan Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee does not always require notarization, but it is highly recommended. Notarization adds a layer of authenticity and can prevent disputes later on. By using a properly notarized disclaimer, you ensure that all parties acknowledge the document’s legitimacy. If you are unsure about the process, consider using the USLegalForms platform for guidance and to access templates that clarify the requirements.

Filing a disclaimer involves a few specific steps that must be followed carefully. You should prepare a written disclaimer that details your refusal of the trust assets, and then properly execute it according to the laws in Michigan. Consulting resources like uslegalforms can simplify this process by providing the necessary templates and guidance on how to comply with the Michigan Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee.