This form is a sample of a release given by the trustee of a trust agreement transferring all property held by the trustee pursuant to the trust agreement to the beneficiary and releasing all claims to the said property. This form assumes that the trust has ended and that the beneficiary has requested release of the property to him/her. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Michigan Release by Trustee to Beneficiary and Receipt from Beneficiary

Description

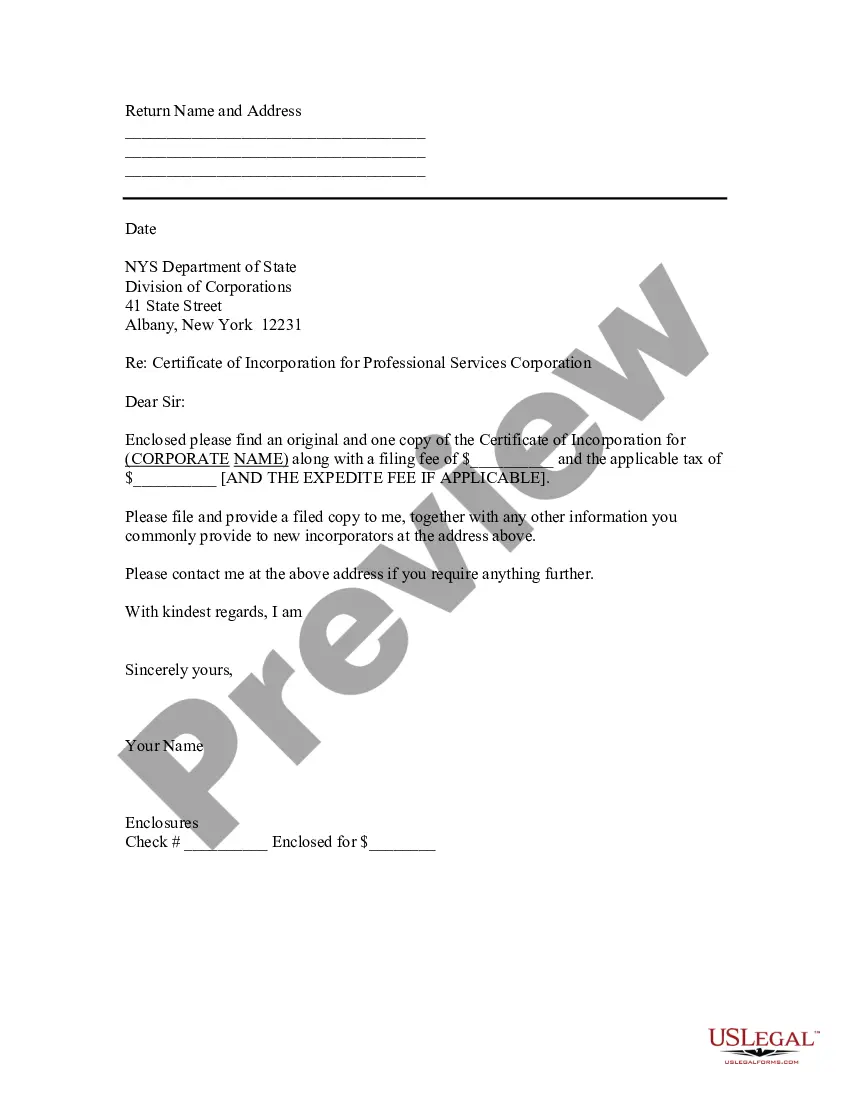

How to fill out Release By Trustee To Beneficiary And Receipt From Beneficiary?

If you need to complete, retrieve, or generate official document templates, utilize US Legal Forms, the largest selection of legal documents available online.

Use the website's straightforward and convenient search feature to find the paperwork you require. A collection of templates for business and personal use is categorized by types and states, or keywords.

Employ US Legal Forms to acquire the Michigan Release by Trustee to Beneficiary and Receipt from Beneficiary in just a few clicks.

Every legal document template you purchase is yours forever. You will have access to every form you downloaded from your account. Click on the My documents section and select a form to print or download again.

Be proactive and download, print the Michigan Release by Trustee to Beneficiary and Receipt from Beneficiary with US Legal Forms. There are millions of professional and state-specific forms you can use for your business or personal needs.

- If you are currently a US Legal Forms customer, Log In to your account and click the Download button to acquire the Michigan Release by Trustee to Beneficiary and Receipt from Beneficiary.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the guidelines below.

- Step 1. Ensure you have chosen the form for the correct jurisdiction/state.

- Step 2. Utilize the Preview option to review the form’s details. Don’t forget to read the description.

- Step 3. If you are not satisfied with the document, use the Search area at the top of the screen to find other types in the legal document format.

- Step 4. Once you have found the form you need, select the Buy now option. Choose the pricing plan you prefer and provide your details to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Choose the format of the legal document and download it to your device.

- Step 7. Fill out, edit and print or sign the Michigan Release by Trustee to Beneficiary and Receipt from Beneficiary.

Form popularity

FAQ

A release from beneficiaries is a legal document that confirms a beneficiary has received their share of an estate. This release often accompanies the Michigan Release by Trustee to Beneficiary and Receipt from Beneficiary process. By signing this document, beneficiaries relinquish any future claims regarding the distribution of the estate. Utilizing USLegalForms can streamline this process and ensure all legal requirements are met.

When a beneficiary passes away, the Michigan Release by Trustee to Beneficiary and Receipt from Beneficiary process may need to be adjusted. The remaining beneficiaries or heirs are usually required to address the deceased beneficiary's share of the estate. It is essential to consult a legal professional to understand the ramifications, as this can affect inheritance and distribution. USLegalForms offers resources to help you navigate these complex situations.

To distribute funds from a trust to beneficiaries, the trustee must follow the terms outlined in the trust agreement. Upon deciding how to allocate the funds, the trustee should prepare a Michigan Release by Trustee to Beneficiary and Receipt from Beneficiary to document the process. This not only provides a record of the distribution but also protects the trustee from potential disputes. For guidance, US Legal Forms offers resources to help execute these transactions smoothly.

Distributions from a trust can be taxable, but the specifics depend on various factors, including the type of trust. Generally, beneficiaries may need to report certain distributions as income when filing taxes. However, the use of a Michigan Release by Trustee to Beneficiary and Receipt from Beneficiary can clarify the distribution and its tax implications. If you're unsure, consulting a tax professional might be beneficial.

To transfer assets from a trust to a beneficiary, the trustee must create a Michigan Release by Trustee to Beneficiary and Receipt from Beneficiary. This document serves as a formal acknowledgment that the beneficiary has received their share of the trust assets. Once the trustee signs and the beneficiary acknowledges receipt, the transfer is legally binding. For efficiency, consider using US Legal Forms to access templates that simplify this process.

Yes, beneficiaries in Michigan generally have the right to see the trust document, especially if they are receiving distributions. This right enables beneficiaries to understand their interests and the terms guiding the trust. Transparency is essential in trust management, and beneficiaries should communicate their needs to the trustee. Tools like USLegalForms can assist you in obtaining the necessary documents related to the Michigan Release by Trustee to Beneficiary and Receipt from Beneficiary.

In Michigan, a trust can remain open indefinitely after the death of the grantor, as long as the terms of the trust allow for it. However, the trust must typically be settled within a reasonable timeframe to ensure beneficiaries receive their entitled distributions. The timeframe varies based on the complexity of the trust and the assets involved. For clarity and assistance in managing a trust, including understanding the Michigan Release by Trustee to Beneficiary and Receipt from Beneficiary, consider resources available at USLegalForms.

A beneficiary release form is a legal document that allows a beneficiary to acknowledge their receipt of distributions from a trust. This form confirms that the beneficiary accepts their share of the trust assets and releases the trustee from further claims. By utilizing a beneficiary release form, you can streamline the process of transferring assets, especially in the context of a Michigan Release by Trustee to Beneficiary and Receipt from Beneficiary. For guidance, consider using services like USLegalForms to create this document properly.

A notice to beneficiaries of a trust in Michigan is a document that informs beneficiaries about the existence of the trust and their rights under it. This notice outlines the key terms of the trust and what beneficiaries can expect, particularly after the creator's death. Understanding this notice is crucial for beneficiaries to navigate the trust process effectively. Using resources like USLegalForms can help ensure you understand the implications of a Michigan Release by Trustee to Beneficiary and Receipt from Beneficiary.

A receipt and release of trustee is a combined document that serves as both acknowledgment of receipt of trust assets and a waiver of claims against the trustee. This legal tool protects the trustee while providing assurance to beneficiaries about their distributions. It is an essential step in the Michigan Release by Trustee to Beneficiary and Receipt from Beneficiary.