Michigan Transfer of Title and Assignment of Equipment from Nonprofit Foundation including a Waiver and Release of Liability

Description

How to fill out Transfer Of Title And Assignment Of Equipment From Nonprofit Foundation Including A Waiver And Release Of Liability?

If you require to compile, retrieve, or create legal document templates, utilize US Legal Forms, the finest collection of legal forms, available online.

Take advantage of the site’s user-friendly and straightforward search to find the documents you need.

Various templates for corporate and personal purposes are categorized by sections and states, or keywords.

Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

Step 6. Choose the format of the legal form and download it to your device.

- Utilize US Legal Forms to acquire the Michigan Transfer of Title and Assignment of Equipment from Nonprofit Foundation, including a Waiver and Release of Liability in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and press the Acquire button to obtain the Michigan Transfer of Title and Assignment of Equipment from Nonprofit Foundation, including a Waiver and Release of Liability.

- You can also access forms you previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

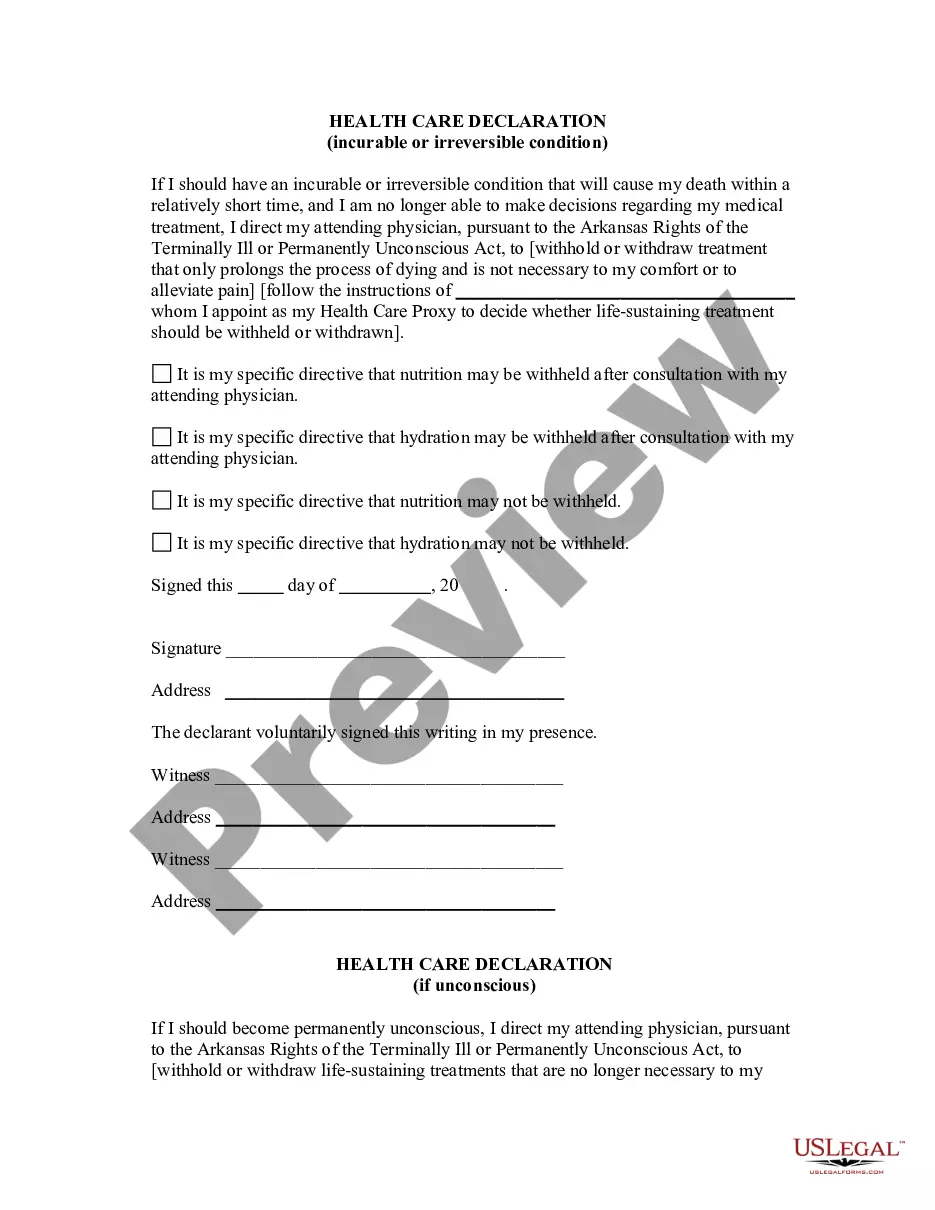

- Step 2. Use the Preview option to review the content of the form. Don't forget to read the details.

- Step 3. If you are not satisfied with the form, utilize the Search bar at the top of the page to find alternative versions of the legal form template.

- Step 4. Once you have found the form you require, click the Acquire now button. Choose the pricing plan that suits you and fill in your details to register for the account.

Form popularity

FAQ

What Do I Need To Transfer A Car Title?Completed Title Transfer Application Form, signed by you and possibly notarized.Proof of Car Insurance Coverage.Insurance Policy Documents with Name and Date.All Vehicle Documents from Seller, Like the title and possibly a Bill of Sale.Driver's License or Government Issued ID.

Title Transfer When Buying A Car Bring that, or both, into the SOS office, fill out a form and pay the title transfer fees. Michigan is a little unique in that it requires you to prove you have insurance when you get the title, instead of during the registration process.

To receive a vehicle title in Michigan, you are required to visit an SOS office location and present the vehicle's current title certificate and payment for all applicable vehicle title fees.

Attention: Most states require proof of car insurance when transferring a title....Gather the Necessary DocumentationCertificate of the vehicle title.Order from Probate Court to transfer the vehicle.Death certificate.Odometer disclosure statement.Transfer fee.

You need to transfer the title within 15 days of purchasing the vehicle. A $15 late fee is charged if you don't transfer the title in time. If possible, the seller should join you at a Secretary of State office to complete the title transfer.

If you are buying or selling a car, you have 15 days from the sale date to get the title transferred. If you are moving from another state, you have 30 days to transfer your title to Michigan.

The Michigan Secretary of State Title Application requires the driver's license title in your name, as the seller transfers the title to you, the buyer.(11)2026 In addition to the title, the recipient must bring her identification and proof of auto insurance. This must be Michigan no-fault insurance; no out-of-state (12)2026

In Washington state the title transfer fees are $12, but you must transfer your title within 15 days. If you don't there is a $50 penalty with a $2 per day fee of up to $125. In the case of needing a duplicate title you need to pay $31 for a replacement Washington title along with the $12 title transfer fee.

Transfer your Title online!You can now transfer a title online. Learn more about the steps and get started.

The title must be assigned to the purchaser BEFORE coming into the License Plate Agency. The purchaser will then pay $56 to transfer the title, and plate fee which starts at $38.75. Property tax, and 3% of the vehicles computer generated value in Highway Use Tax (some exceptions may apply) is also due at this time.