Michigan Officers Bonus in form of Stock Issuance - Resolution Form

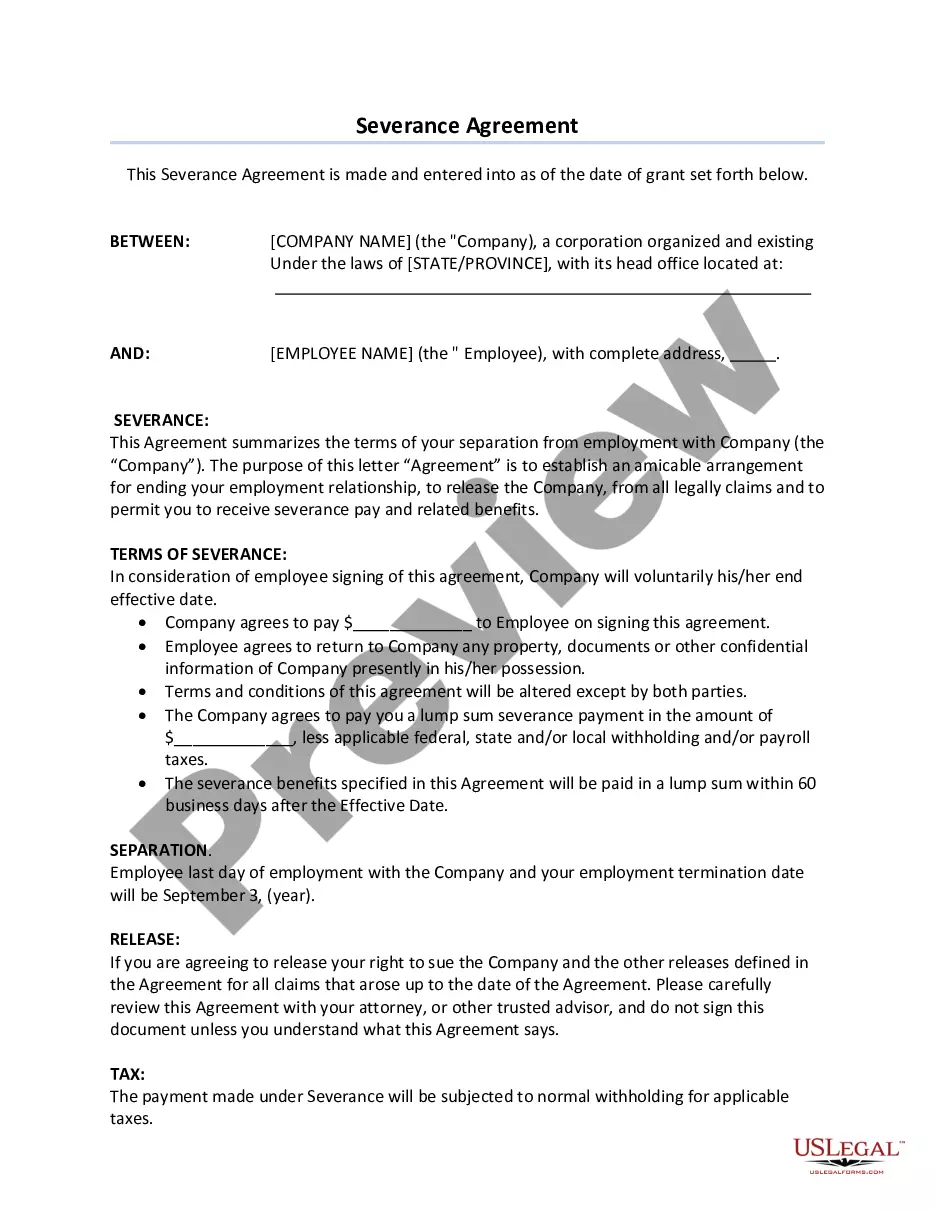

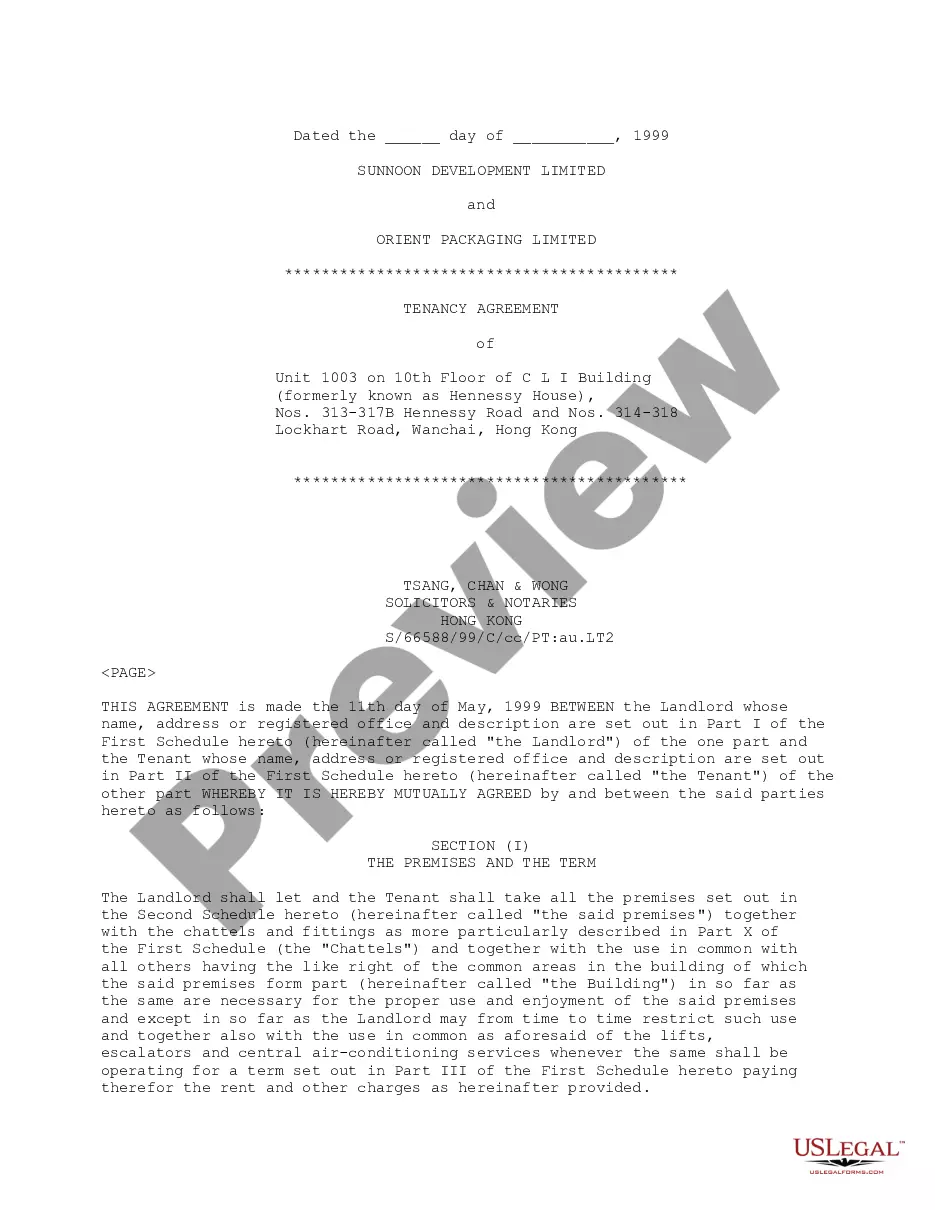

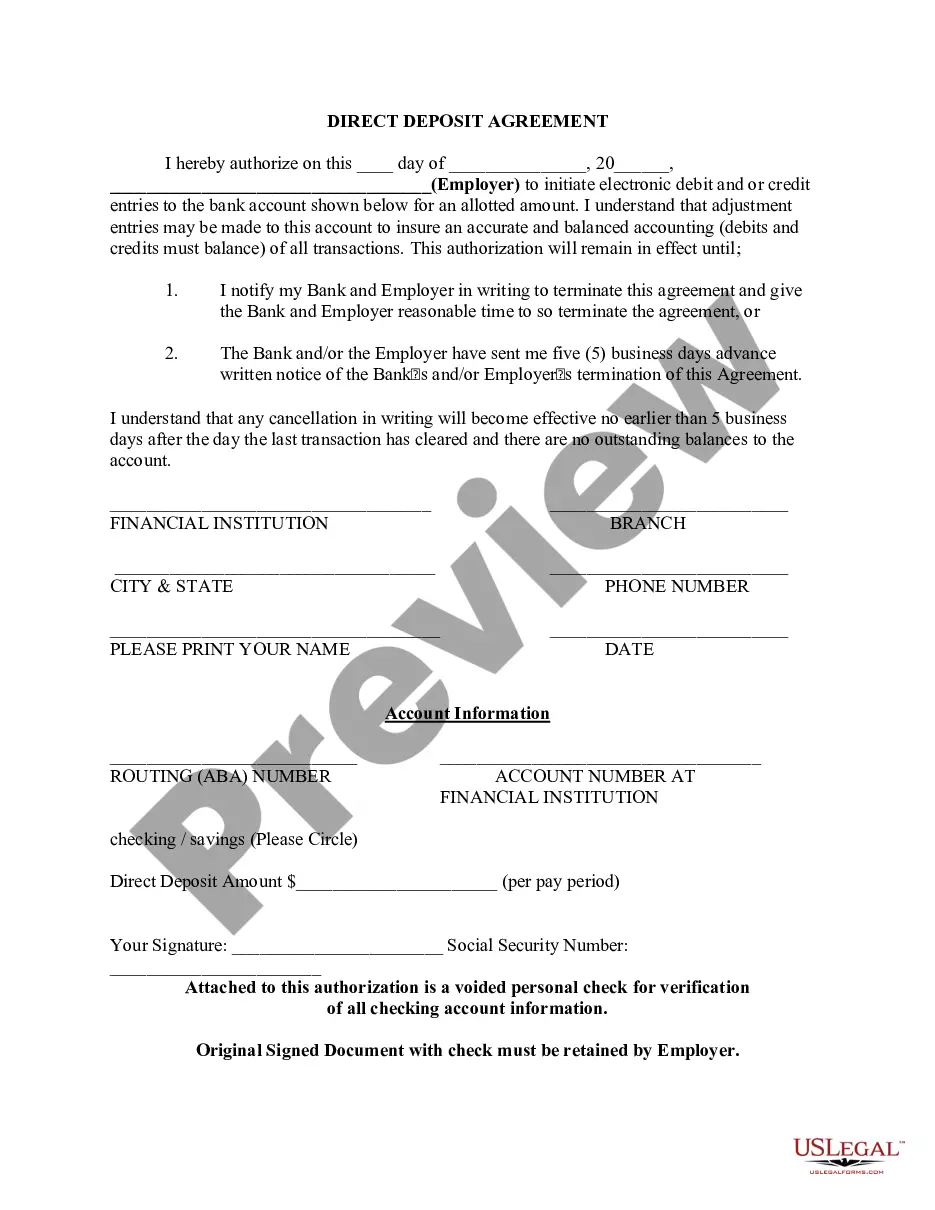

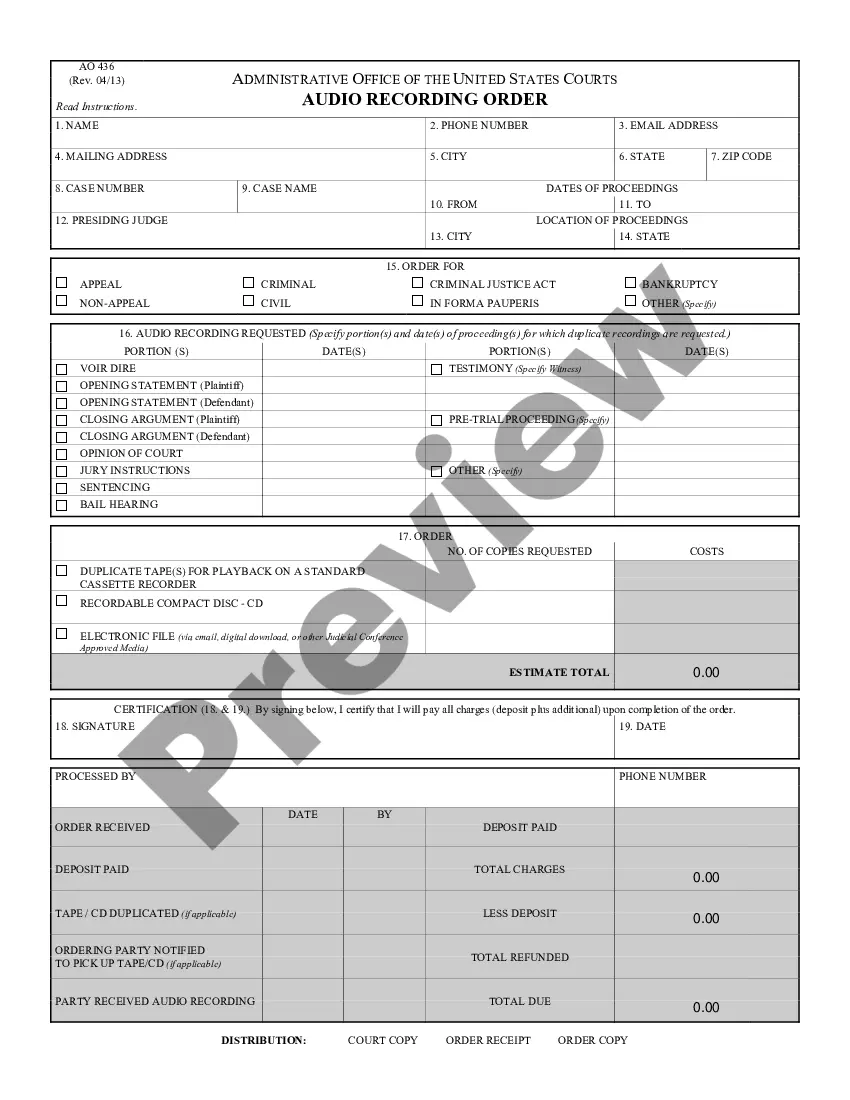

Description

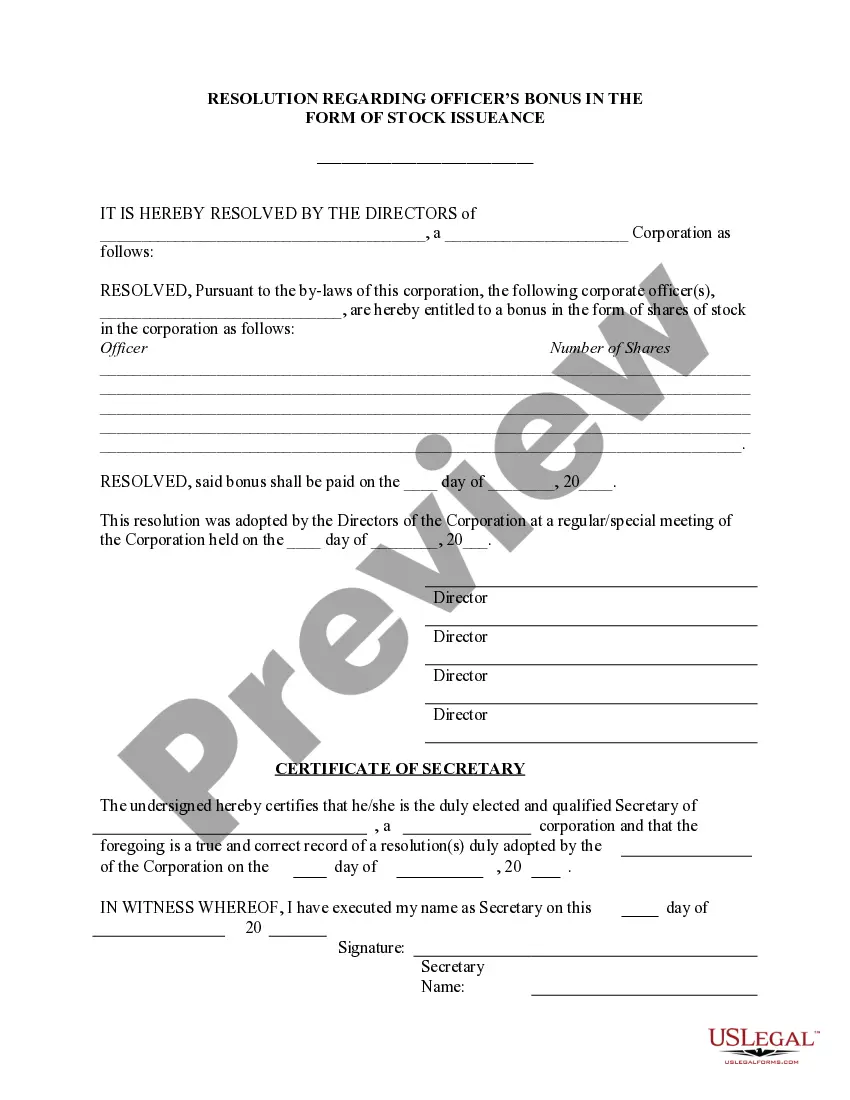

How to fill out Officers Bonus In Form Of Stock Issuance - Resolution Form?

You can spend numerous hours online attempting to locate the legal document template that complies with the state and federal regulations you require.

US Legal Forms offers thousands of legal forms reviewed by specialists.

It's easy to obtain or print the Michigan Officers Bonus in the form of Stock Issuance - Resolution Form from my support.

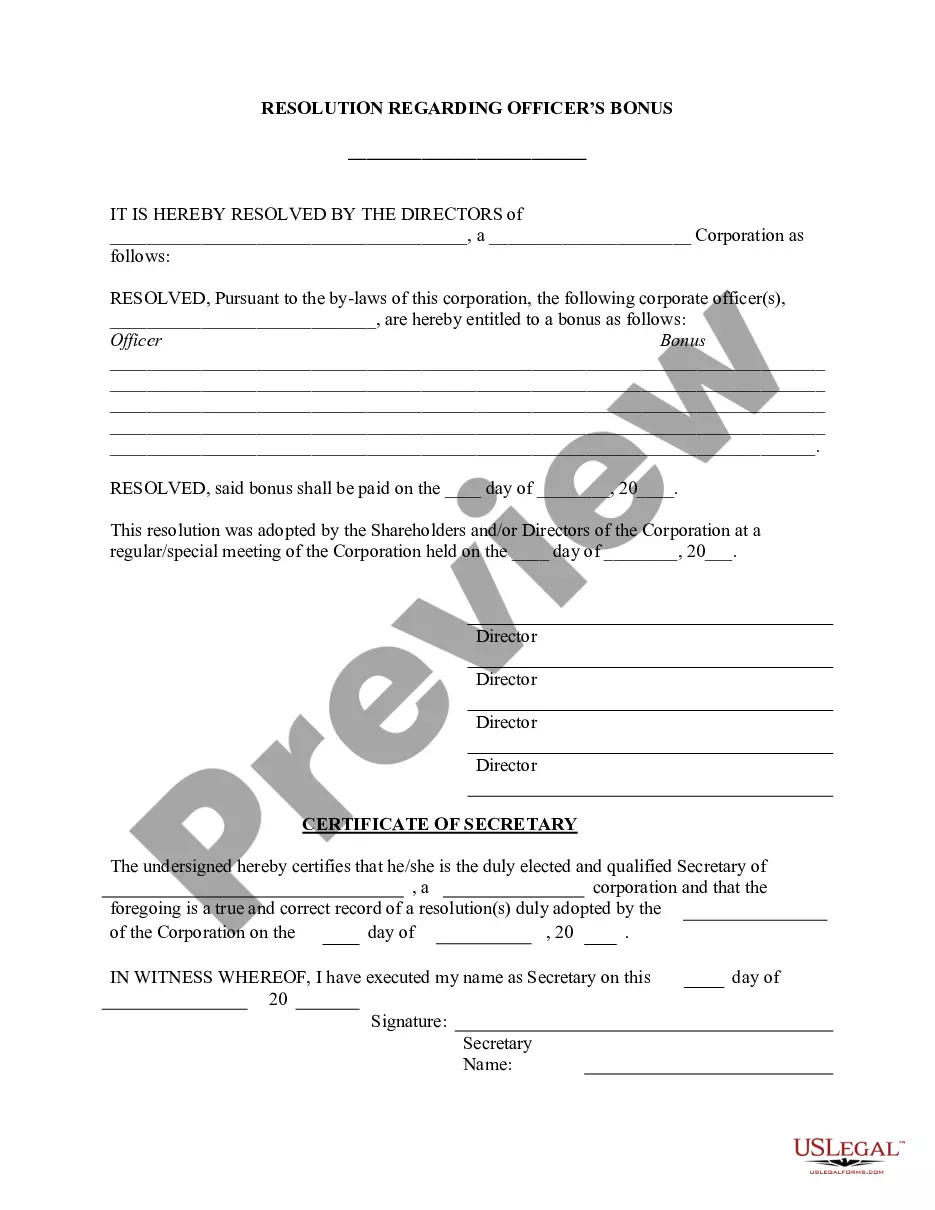

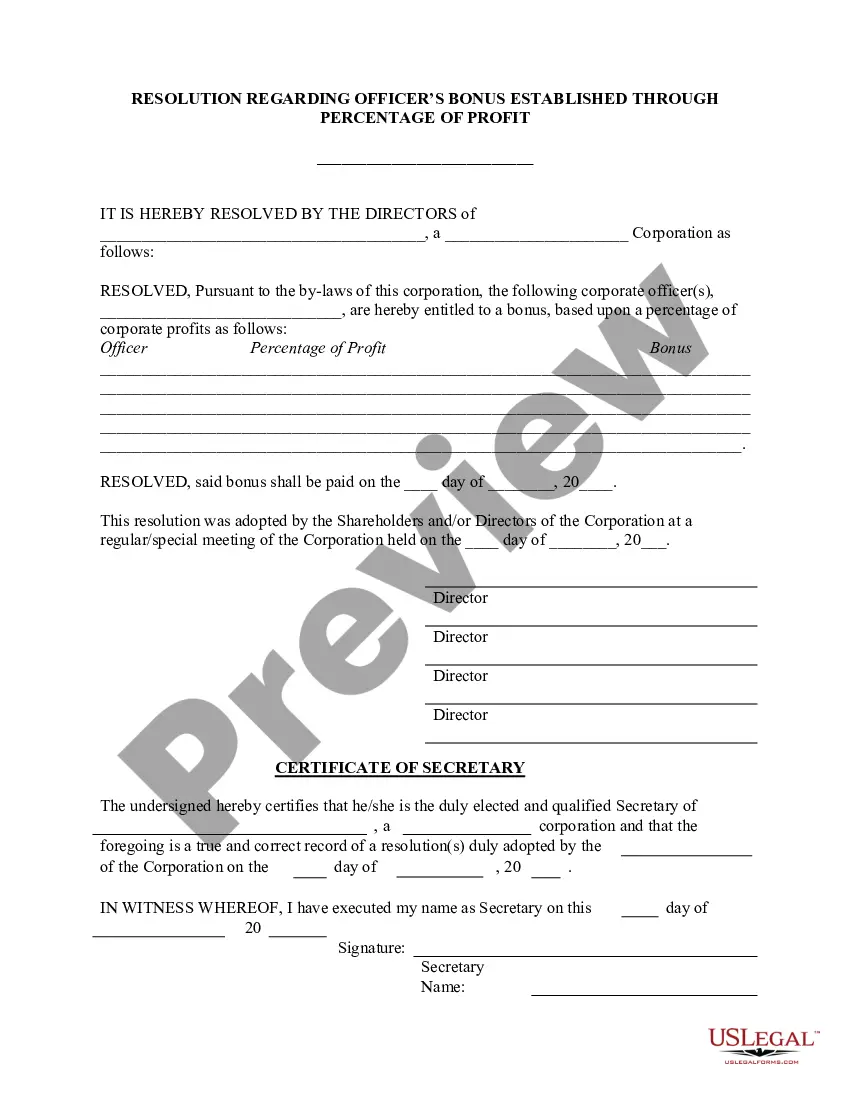

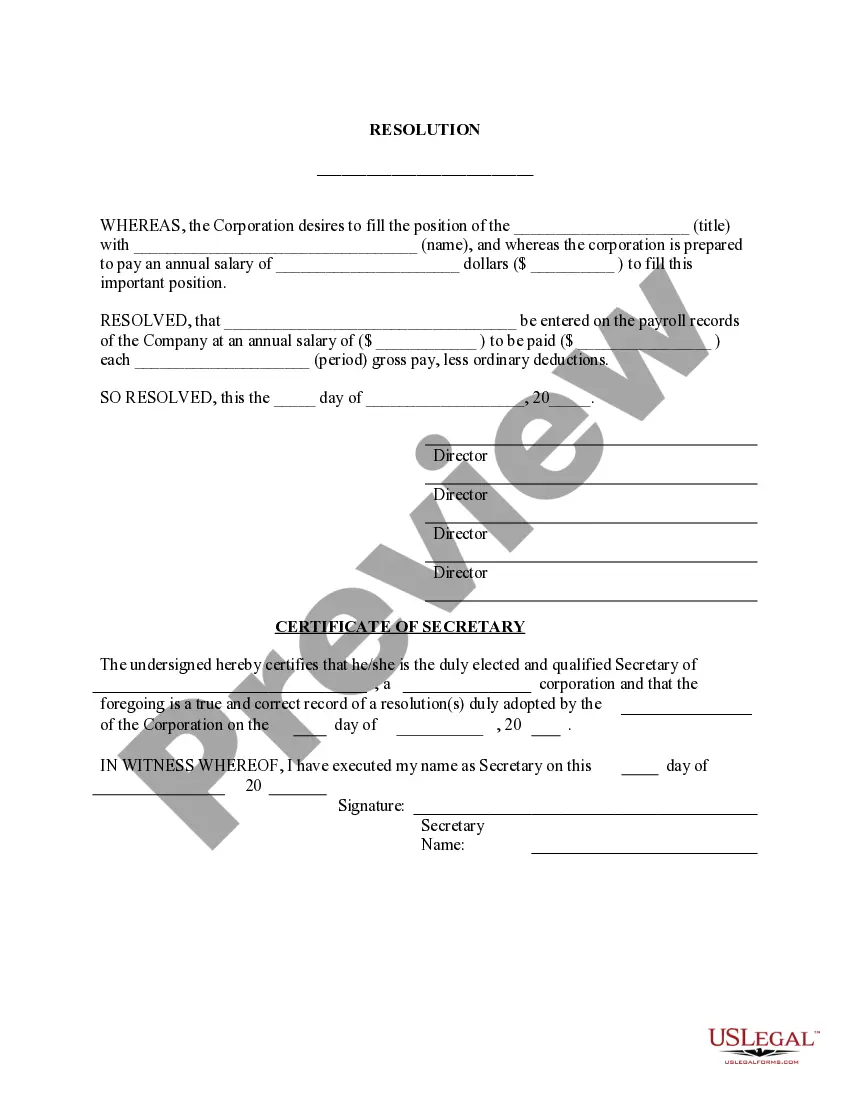

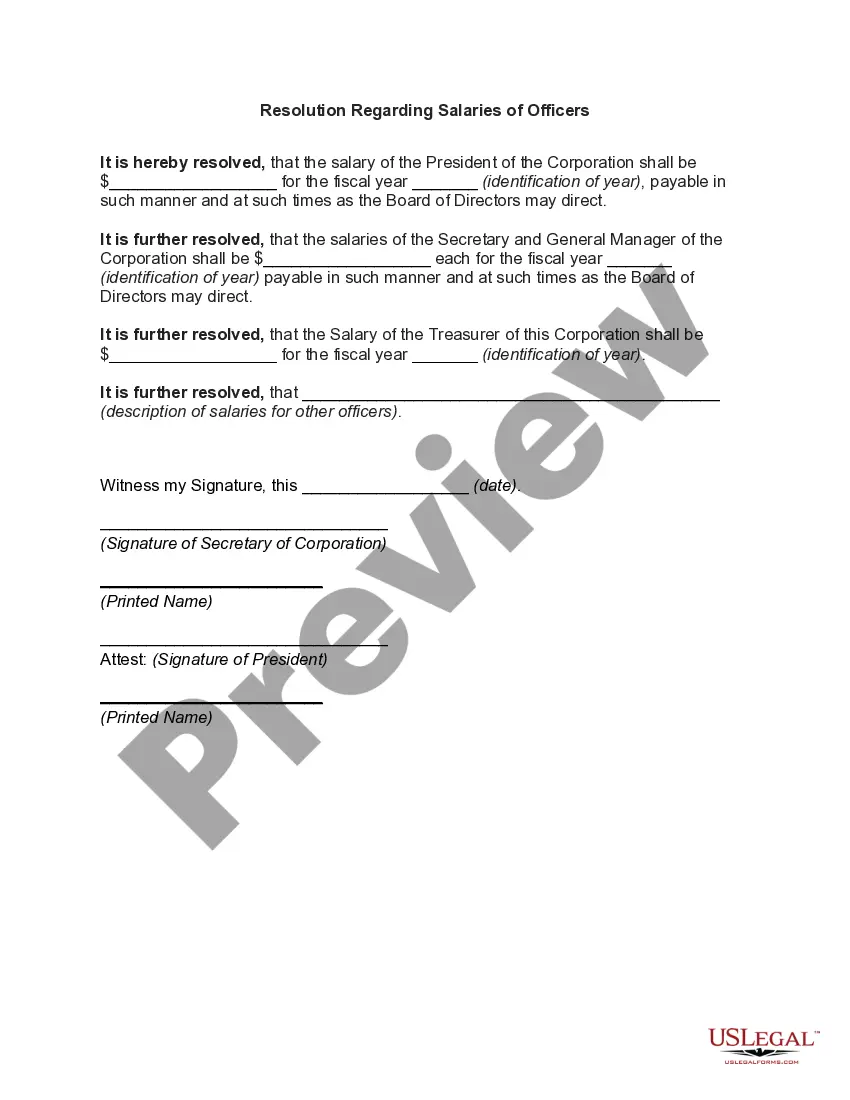

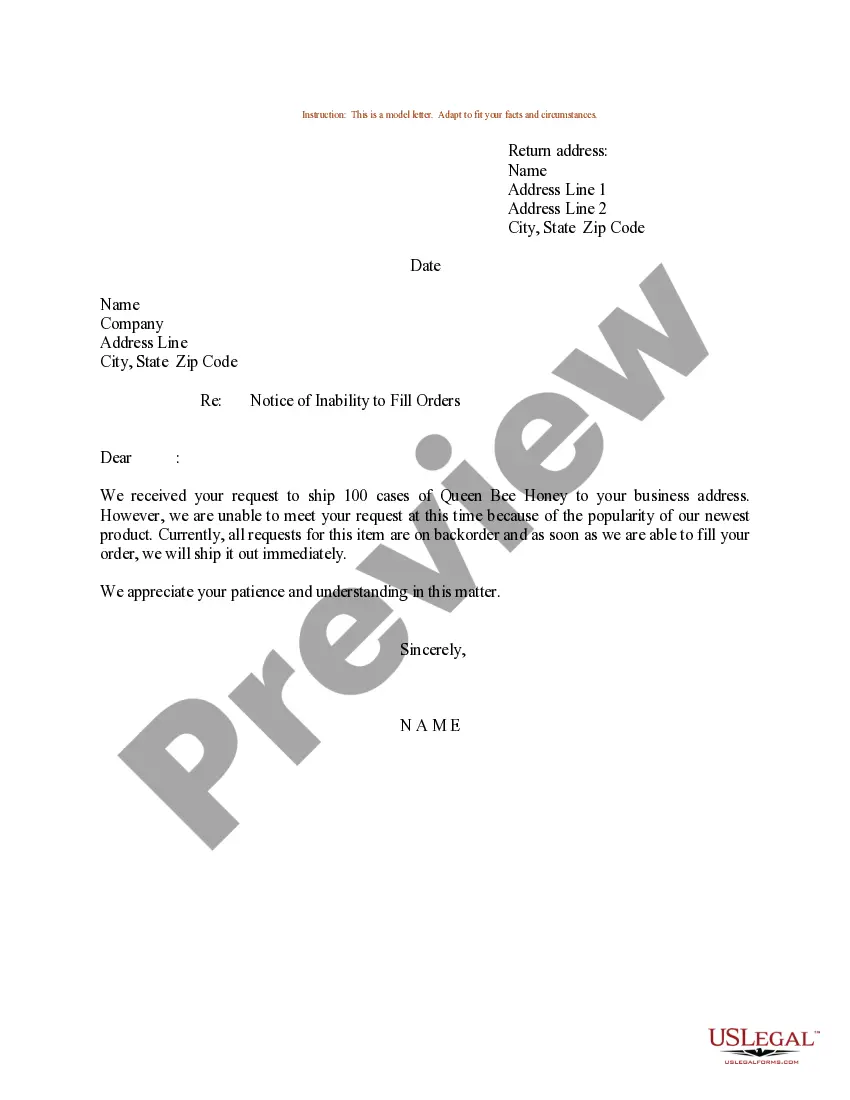

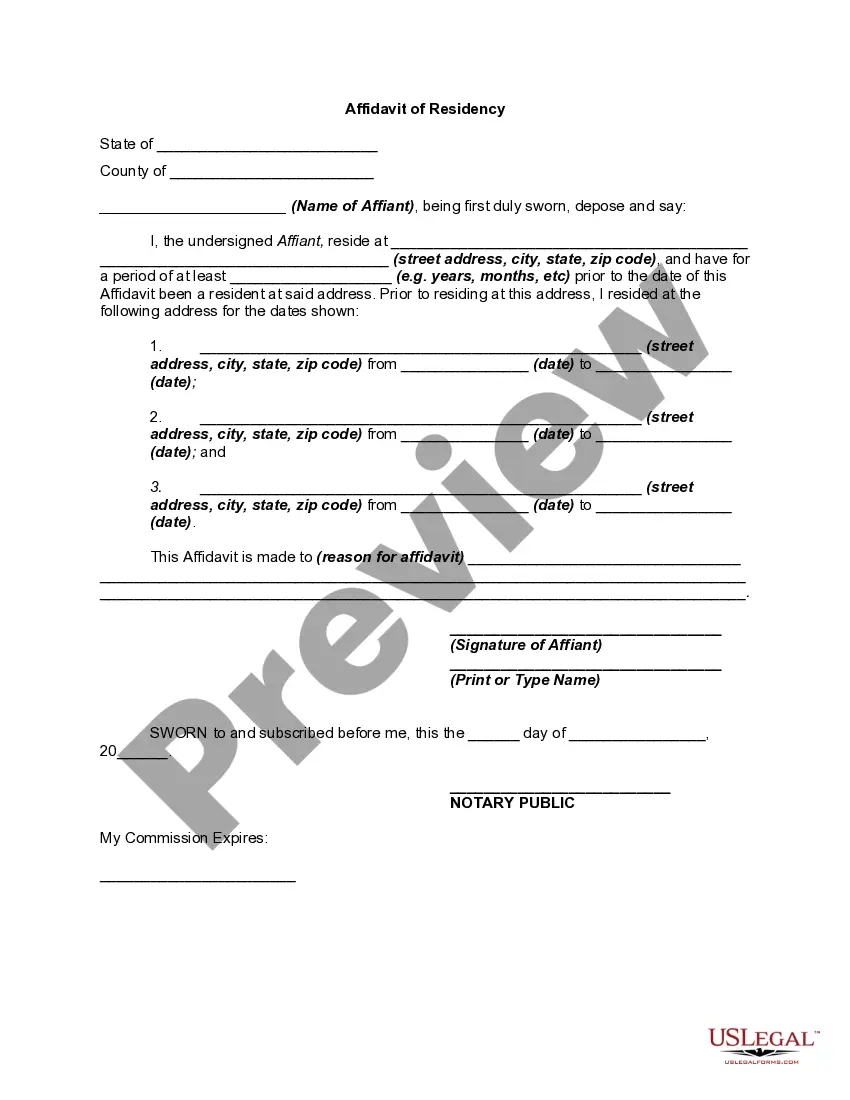

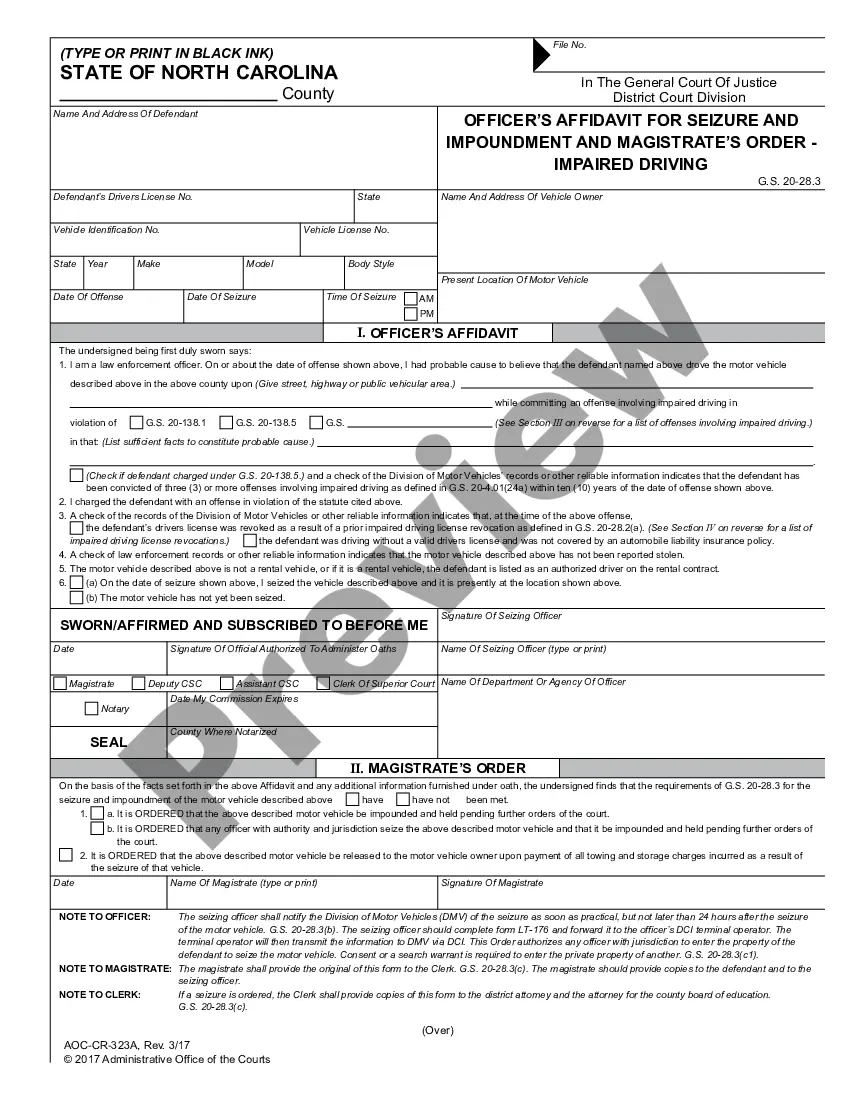

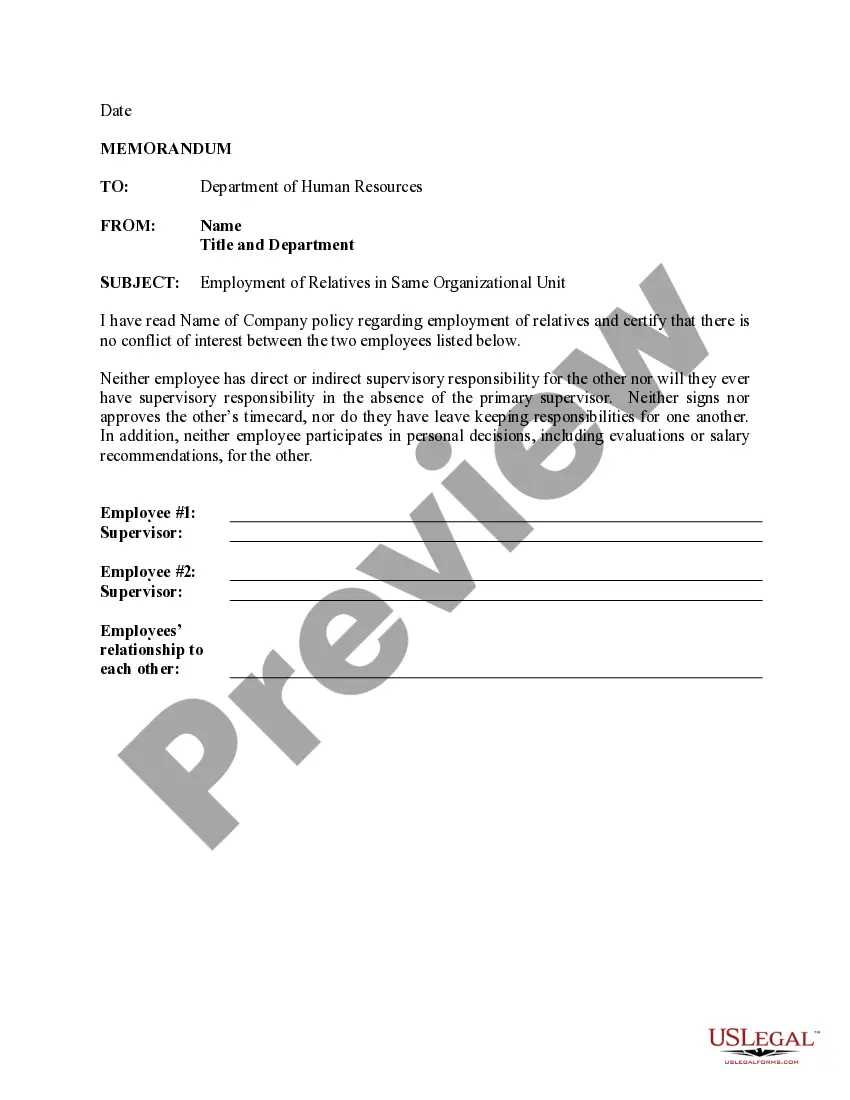

First, ensure that you have selected the correct document template for the state/city of your preference. Review the form details to confirm you have chosen the correct one. If available, utilize the Preview button to view the document template as well.

- If you already have a US Legal Forms account, you can Log In and then click the Download button.

- Subsequently, you can complete, edit, print, or sign the Michigan Officers Bonus in the form of Stock Issuance - Resolution Form.

- Every legal document template you acquire is yours permanently.

- To obtain another copy of the downloaded form, visit the My documents section and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

Form popularity

FAQ

Michigan Form 4567 is the annual return for corporations that owe or may owe the Corporate Income Tax. This form collects essential information regarding a corporation’s finances, including income, deductions, and credits. Filing correctly is vital, especially if your corporation issues bonuses documented by the Michigan Officers Bonus in form of Stock Issuance - Resolution Form. The US Legal Forms platform provides templates and information to help navigate this requirement.

Michigan Form 4567, also known as the Corporate Income Tax Annual Return, must be filed by most corporations operating in Michigan subject to the CIT. This includes corporations that choose to issue bonuses documented by the Michigan Officers Bonus in form of Stock Issuance - Resolution Form. Accurate filing ensures compliance with Michigan’s tax laws. Resources for assistance in preparing these forms can be found on the US Legal Forms platform.

The Corporate Income Tax (CIT) replaced the Michigan Business Tax (MBT) to simplify and streamline corporate taxation. The CIT is based on gross receipts without the complex deductions that characterized the MBT. Understanding this difference is crucial when determining the tax impact of a Michigan Officers Bonus in form of Stock Issuance - Resolution Form. For more detailed information and forms, you may consult the US Legal Forms platform.

In Michigan, an S corporation typically files Form 1120S for federal purposes and may need to file Michigan Corporate Income Tax forms. These filings ensure the S corporation complies with both state and federal laws. For matters related to compensation or bonuses like the Michigan Officers Bonus in form of Stock Issuance - Resolution Form, consider how these forms interact. The US Legal Forms platform offers various forms and resources that can simplify this process.

For S corporations, Form 1120S is used to report income, deductions, and credits. This form helps S corps declare their earnings and pass them through to shareholders, avoiding double taxation. When issuing bonuses to officers, including the Michigan Officers Bonus in form of Stock Issuance - Resolution Form, make sure you follow all necessary guidelines on Form 1120S. You can find templates and resources to help you comply on the US Legal Forms platform.

The Corporate Income Tax (CIT) in Michigan is a tax imposed on Corporation's gross receipts that exceed a designated threshold. This tax applies to most corporations, including C corporations and certain types of S corporations. It's essential to understand how the CIT tax interacts with the Michigan Officers Bonus in form of Stock Issuance - Resolution Form, as your business structure can influence tax implications. For guidance and more details, you may explore resources available on the US Legal Forms platform.