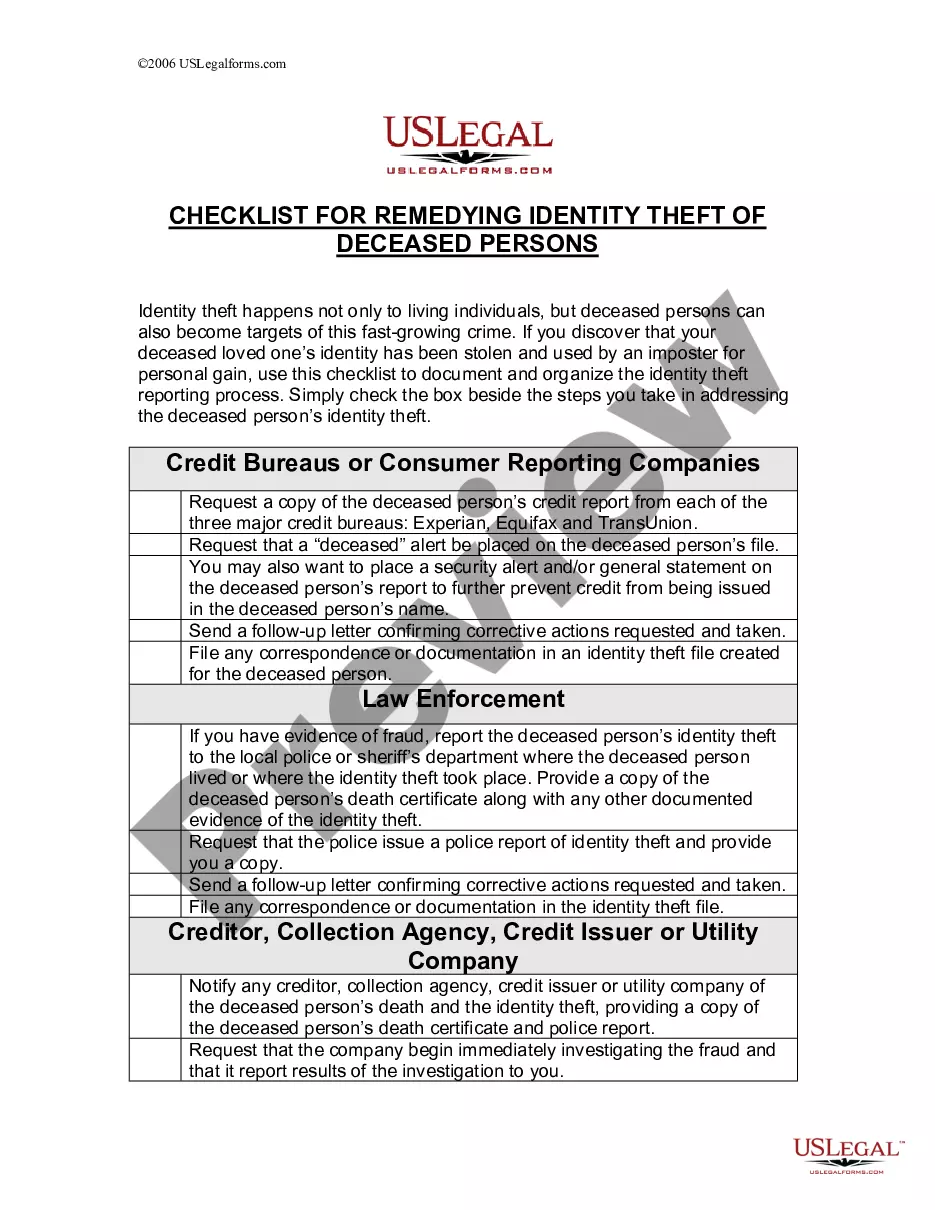

Michigan Checklist for Remedying Identity Theft of Deceased Persons

Description

How to fill out Checklist For Remedying Identity Theft Of Deceased Persons?

Are you currently in a circumstance that you need to have documentation for various organizational or personal reasons almost every day.

There are numerous legal document templates available online, but finding ones you can rely on is challenging.

US Legal Forms offers thousands of form templates, including the Michigan Checklist for Remedying Identity Theft of Deceased Persons, which are crafted to meet federal and state requirements.

Select the pricing plan you prefer, fill in the required information to create your account, and complete a purchase using your PayPal or credit card.

Choose a convenient file format and download your copy. Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Michigan Checklist for Remedying Identity Theft of Deceased Persons at any time, if needed. Simply click the required form to download or print the document template. Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors. The service provides professionally crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already acquainted with the US Legal Forms website and have an account, just Log In.

- Then, you can download the Michigan Checklist for Remedying Identity Theft of Deceased Persons template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your correct city/county.

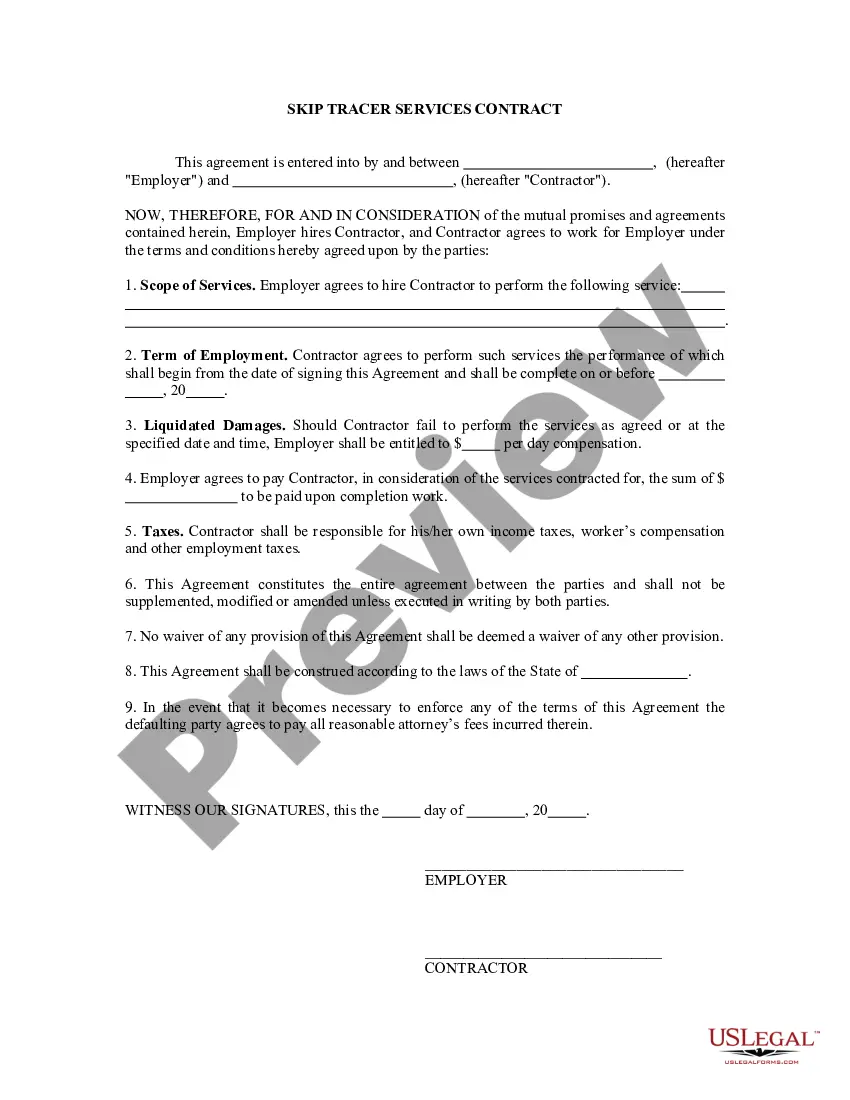

- Use the Preview button to review the form.

- Read the description to confirm you have selected the right form.

- If the form is not what you are looking for, use the Search box to find the form that meets your needs and criteria.

- When you find the appropriate form, click Buy now.

Form popularity

FAQ

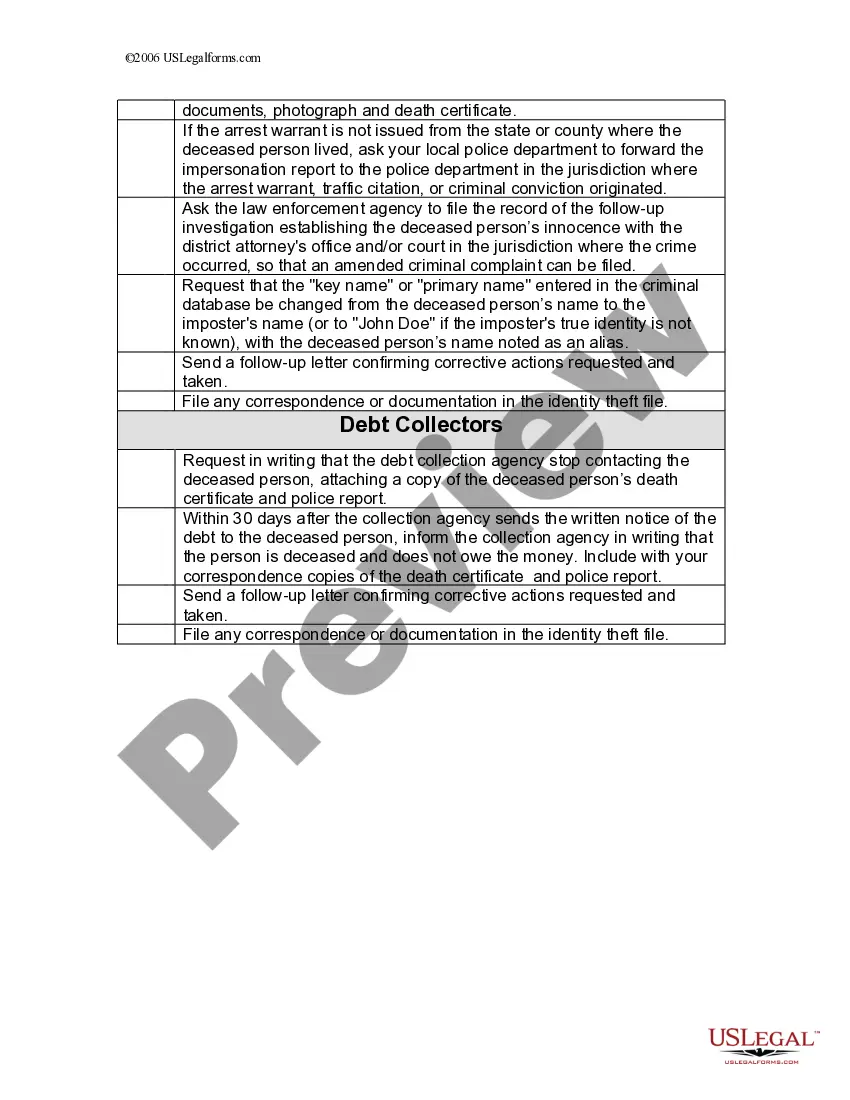

Inform your bank, building society and credit card company of any unusual transactions on your statement. Request a copy of your credit file to check for any suspicious credit applications. Report the theft of personal documents and suspicious credit applications to the police and ask for a crime reference number.

How Should You Respond to the Theft of Your Identity? Contact your identity theft protection service or other insurance provider. ... Freeze your credit report with all three bureaus. ... File an official report with the Federal Trade Commission (FTC) ... Get a free copy of your credit report and look for suspicious activity.

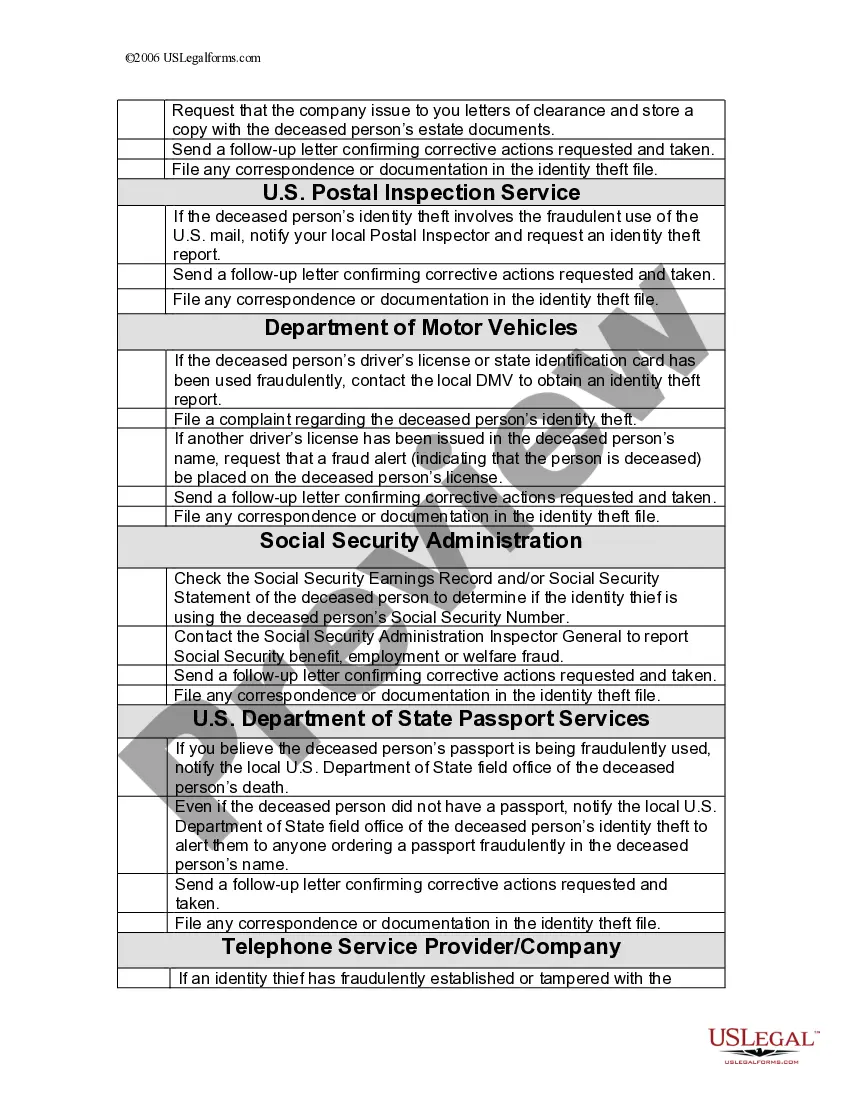

Follow these tips to reduce the risk of a deceased person from having their identity stolen: Send copies of the death certificate to each credit reporting bureau, asking them to put a ?deceased alert? on the credit reports. Review the deceased taxpayer's credit report for questionable credit card activity.

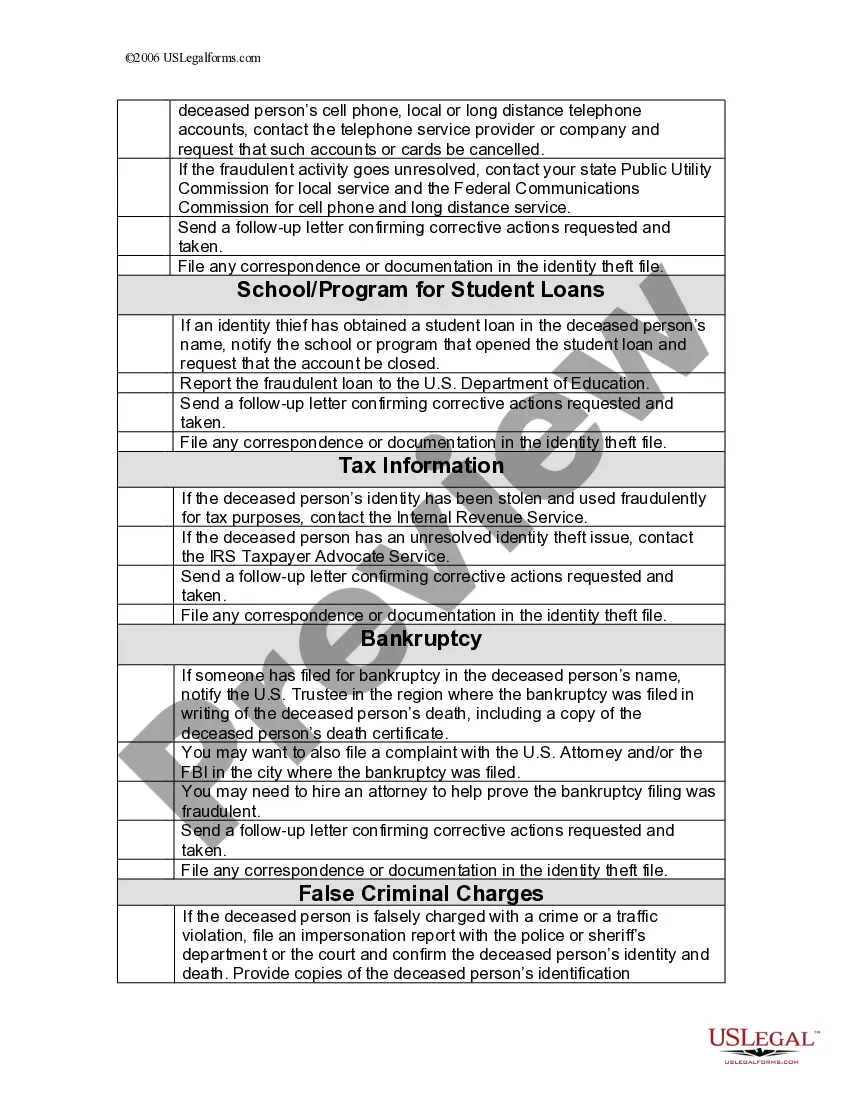

Identity theft can victimize the dead. An identity thief's use of a deceased person's Social Security number may create problems for family members. This type of identity theft also victimizes merchants, banks, and other businesses that provide goods and services to the thief.

(1) A person shall not do any of the following: (a) With intent to defraud or violate the law, use or attempt to use the personal identifying information of another person to do either of the following: (i) Obtain credit, goods, services, money, property, a vital record, a confidential telephone record, medical records ...

Identity theft has profound consequences for its victims. They can have their bank accounts wiped out, credit histories ruined, and jobs and valuable possessions taken away. Some victims have even been arrested for crimes they did not commit.

To report identity theft, contact: The Federal Trade Commission (FTC) online at IdentityTheft.gov or call 1-877-438-4338. The three major credit reporting agencies. Ask them to place fraud alerts and a credit freeze on your accounts.

Explain that someone stole your identity and ask them to close or freeze the compromised account. Contact any of the three credit reporting agencies and ask that a free fraud alert be placed on your credit report. Also ask for a free credit report.