Michigan Leaseback Provision in Sales Agreement

Description

How to fill out Leaseback Provision In Sales Agreement?

Locating the appropriate legal document template can be challenging. Clearly, there are countless templates accessible online, but how can you find the legal format you require.

Utilize the US Legal Forms website. This service offers thousands of templates, including the Michigan Leaseback Provision in Sales Agreement, which can be utilized for both business and personal needs.

All documents are verified by professionals and comply with federal and state regulations.

Once you are convinced that the form is suitable, click the Purchase now button to acquire the document. Choose the pricing plan you prefer and provide the necessary information. Create your account and complete your order using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, edit, print, and sign the acquired Michigan Leaseback Provision in Sales Agreement. US Legal Forms is the largest collection of legal documents where you can find a variety of record templates. Make use of the service to access professionally created documents that adhere to state requirements.

- If you're already a member, sign in to your account and click on the Download button to get the Michigan Leaseback Provision in Sales Agreement.

- Use your account to access the legal documents you’ve acquired earlier.

- Navigate to the My documents section of your account to download another copy of the document you need.

- If you’re a first-time user of US Legal Forms, here are simple steps you should follow.

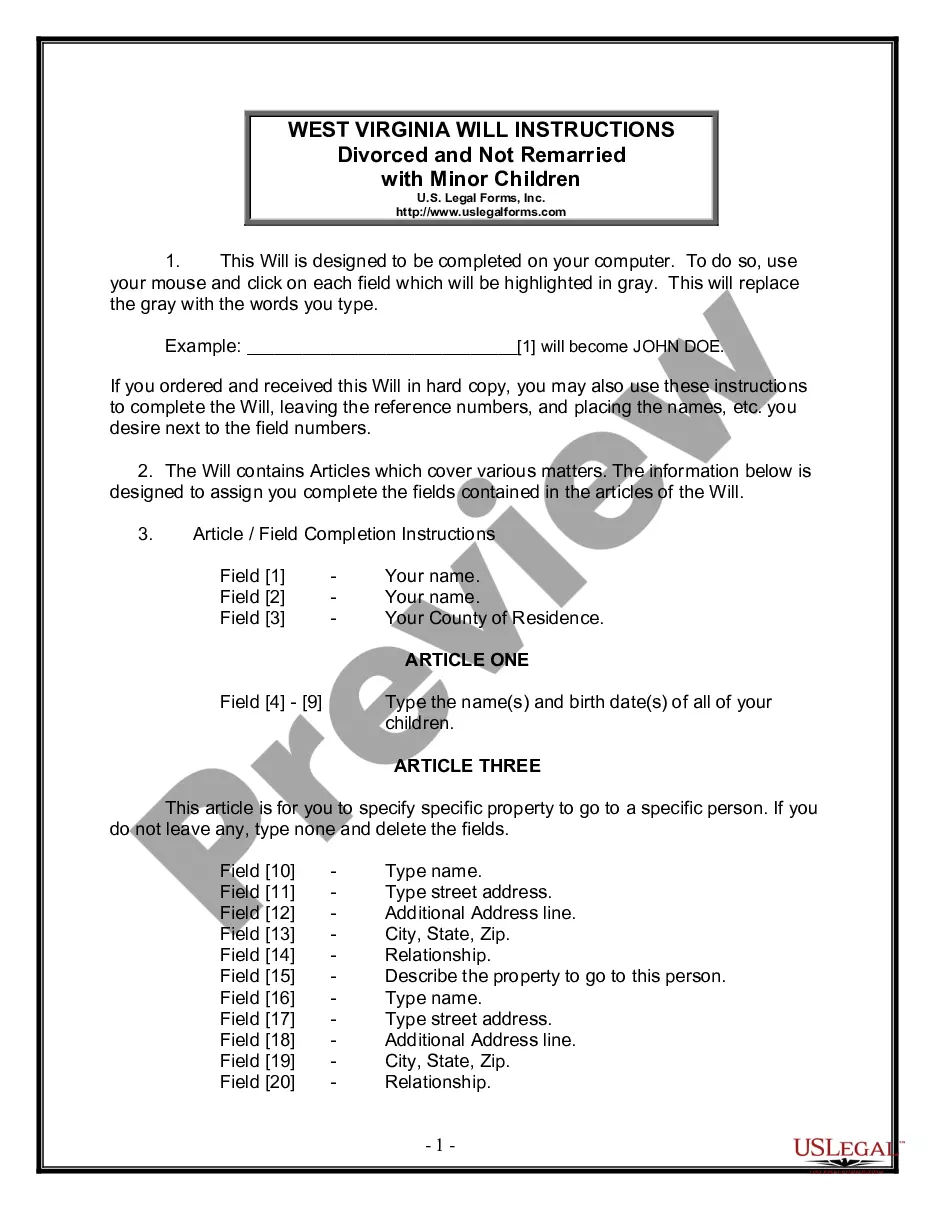

- First, ensure that you've selected the correct document for your specific area/region. You can examine the form using the Preview button and review the document summary to confirm it’s the appropriate one for you.

- If the document does not suit your needs, utilize the Search box to locate the correct document.

Form popularity

FAQ

The downsides of a sale/leaseback include potential financial strain due to fixed lease obligations and the risk of losing asset control. Moreover, market conditions may change, impacting lease terms unfavorably. Considering the Michigan Leaseback Provision in Sales Agreement can help mitigate some of these risks.

An example of a sale and leaseback is a brewery selling its facility to an investor while signing a long-term lease to continue operations. This arrangement provides the brewery with capital for expansion while guaranteeing operational continuity. Understanding the Michigan Leaseback Provision in Sales Agreement is crucial for both parties in such arrangements.

At the end of a sale-leaseback agreement, the tenant has options such as renewing the lease, purchasing the property back, or vacating the premises. This flexibility can be beneficial for businesses planning for future growth. During this phase, it's wise to consult the Michigan Leaseback Provision in Sales Agreement to understand your options.

A sale and leaseback transaction involves an owner selling their property to an investor while simultaneously entering into a lease agreement. The seller becomes the tenant and continues to use the property while paying rent. Familiarity with the Michigan Leaseback Provision in Sales Agreement is essential for structuring this arrangement effectively.

A failed sale/leaseback occurs when the transaction does not generate the intended financial benefits for either party. This may happen usually due to inadequate assessment of property value or market conditions. Understanding the nuances of the Michigan Leaseback Provision in Sales Agreement can help prevent such failures.

The two main types of sale and leaseback leases are operating leases and capital leases. Operating leases tend to be shorter and are more flexible, often involving financing for a specific period. In contrast, capital leases resemble ownership, with longer terms and potential tax benefits linked to the Michigan Leaseback Provision in Sales Agreement.

leaseback can limit your control over the property since you are no longer the owner. Additionally, it may lead to longterm lease obligations that could involve higher payments than anticipated. Finally, the Michigan Leaseback Provision in Sales Agreement can complicate future real estate transactions.

The difference between 842 and 840 sale leaseback primarily relates to how leases are classified under accounting standards. FASB 842 introduces more stringent criteria for lease classification, affecting how leases appear on financial statements. Understanding these differences is essential for any business considering the Michigan Leaseback Provision in Sales Agreement, as it ensures compliance with the latest accounting practices.

For tax purposes, a sale/leaseback is generally treated as separate transactions. The seller may be able to deduct lease payments as business expenses, which can reduce their taxable income. However, capital gains tax applies to the sale portion, impacting the overall tax strategy. Consulting a tax professional familiar with the Michigan Leaseback Provision in Sales Agreement can provide tailored advice.

A leaseback provision is a contractual agreement in which the seller agrees to lease the property back from the buyer after the sale is completed. This provision details the terms of the lease, including duration and rental rates. By including a leaseback provision in your Michigan Leaseback Provision in Sales Agreement, both parties can ensure clarity and alignment on occupancy and financial obligations.