Michigan Minimum Checking Account Balance - Corporate Resolutions Form

Description

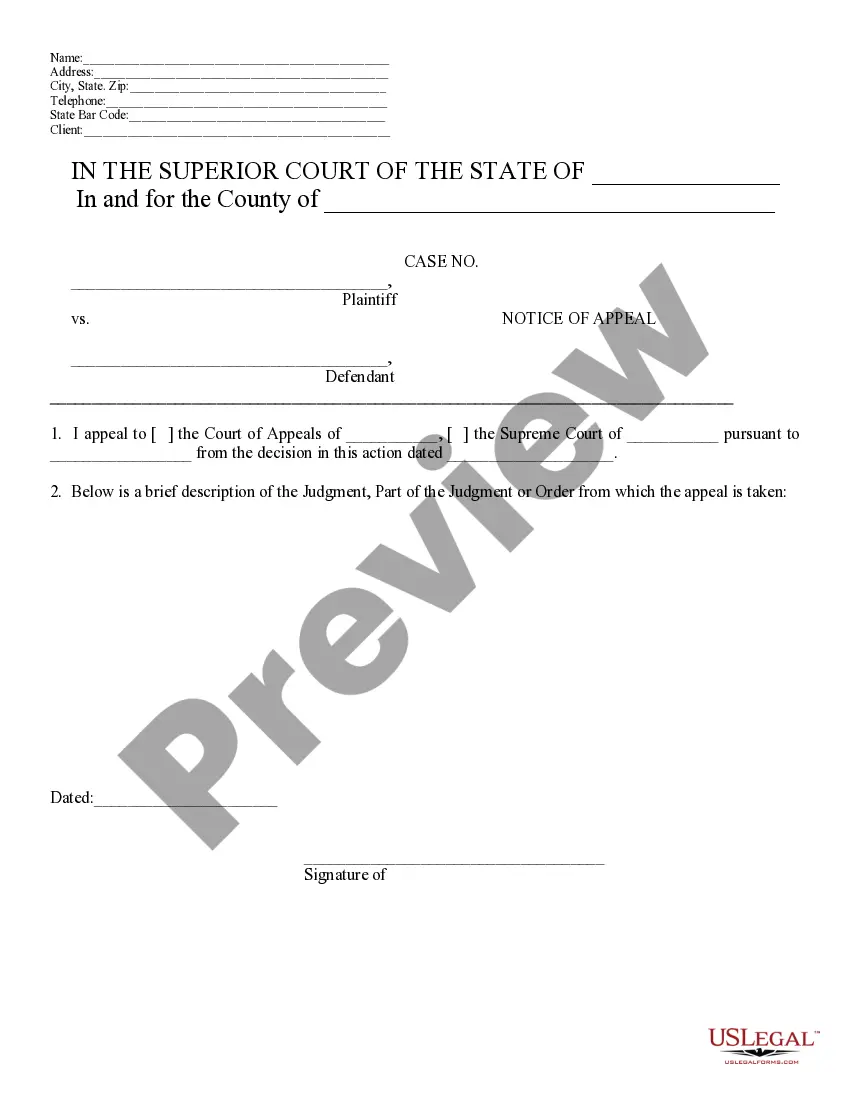

How to fill out Minimum Checking Account Balance - Corporate Resolutions Form?

If you wish to finalize, acquire, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site’s simple and convenient search feature to locate the documents you require.

A range of templates for commercial and personal purposes are organized by categories and jurisdictions, or keywords.

Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other types within the legal document format.

Step 4. Once you have found the desired form, click the Get Now button. Choose the pricing plan you prefer and enter your details to register for an account.

- Utilize US Legal Forms to quickly find the Michigan Minimum Checking Account Balance - Corporate Resolutions Form.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Michigan Minimum Checking Account Balance - Corporate Resolutions Form.

- You can also access forms you previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, check the instructions provided below.

- Step 1. Ensure that you have selected the form for the correct city/state.

- Step 2. Utilize the Preview option to review the form’s content. Be sure to read the description.

Form popularity

FAQ

The Corporate Income Tax (CIT) and the Michigan Business Tax (MBT) are two different tax structures in the state. The CIT is a tax on business income, while the MBT used to be a tax based on both gross receipts and business profits before it was phased out. Understanding which tax applies to your business is crucial for compliance and effective financial planning. Utilizing forms like the Michigan Minimum Checking Account Balance - Corporate Resolutions Form can assist in navigating these requirements.

Any business that is considered a legal entity in Michigan, including S corporations, C corporations, and partnerships, is required to file a state tax return. This includes businesses with employees or those generating any form of income. Understanding your responsibilities is crucial, and utilizing resources like the Michigan Minimum Checking Account Balance - Corporate Resolutions Form can simplify this process and keep your business compliant.

Yes, Michigan does require businesses to file a tax return, specifically the Corporate Income Tax (CIT). All corporations engaged in business activities within the state must fulfill this obligation. To ensure compliance and proper reporting, it's beneficial to gather all relevant forms and documentation, including the Michigan Minimum Checking Account Balance - Corporate Resolutions Form, before submitting your return.

Businesses that claim a credit for the Michigan Business Taxes must file Form 4891. This form is crucial for ensuring that all tax credits are accurately reported and applied. If your business meets the criteria for this credit, make sure to gather necessary documents like the Michigan Minimum Checking Account Balance - Corporate Resolutions Form to support your filing and maximize your benefits.

Yes, S corporations must file a Michigan tax return to report their income, even though the income is typically passed through to individual shareholders. This process helps ensure compliance with both state and federal regulations. It's essential to gather your financial documentation, such as the Michigan Minimum Checking Account Balance - Corporate Resolutions Form, to streamline this requirement.

Yes, if your corporation operates in Michigan, filing a corporate tax return is necessary, even if your income is low or you are not currently profitable. Failing to file can lead to penalties and complications with the state tax authority. Ensure you also have the appropriate documentation, including the Michigan Minimum Checking Account Balance - Corporate Resolutions Form, to support your tax filing process.

In Michigan, all corporations that do business in the state must file a corporate tax return, regardless of their income. This requirement applies to S corporations, C corporations, and nonprofit corporations. Filing a corporate tax return not only aids in regulatory compliance but also supports your business’s financial health. Utilizing resources like the Michigan Minimum Checking Account Balance - Corporate Resolutions Form can guide you through this process efficiently.

In Michigan, any corporation that conducts business or is registered to do business is required to file Form 4567. This includes corporations that have employees or generate income in the state. It’s vital for maintaining compliance and ensuring a clear record of your business’s financial practices. Moreover, understanding how the Michigan Minimum Checking Account Balance - Corporate Resolutions Form interacts with this requirement can help streamline your process.

The tax ID number for Central Michigan University serves as a unique identifier for tax purposes, allowing the institution to manage its finances efficiently. This number is essential for various functions, such as reporting and compliance. To find this number, you can contact their administration office or visit their financial website. We recommend utilizing the Michigan Minimum Checking Account Balance - Corporate Resolutions Form to stay compliant with all relevant regulations.

A board resolution for a corporate account is a formal document that records decisions made by the company's board of directors. It authorizes specific actions, such as opening a bank account or designating signers. This documentation supports accountability and transparency in financial operations. By utilizing the Michigan Minimum Checking Account Balance - Corporate Resolutions Form, companies can streamline their banking processes.