For use in all states except AK,FL,ME,NY,PR,VT,VA,WV,WI

Michigan Multistate Promissory Note - Unsecured - Signature Loan

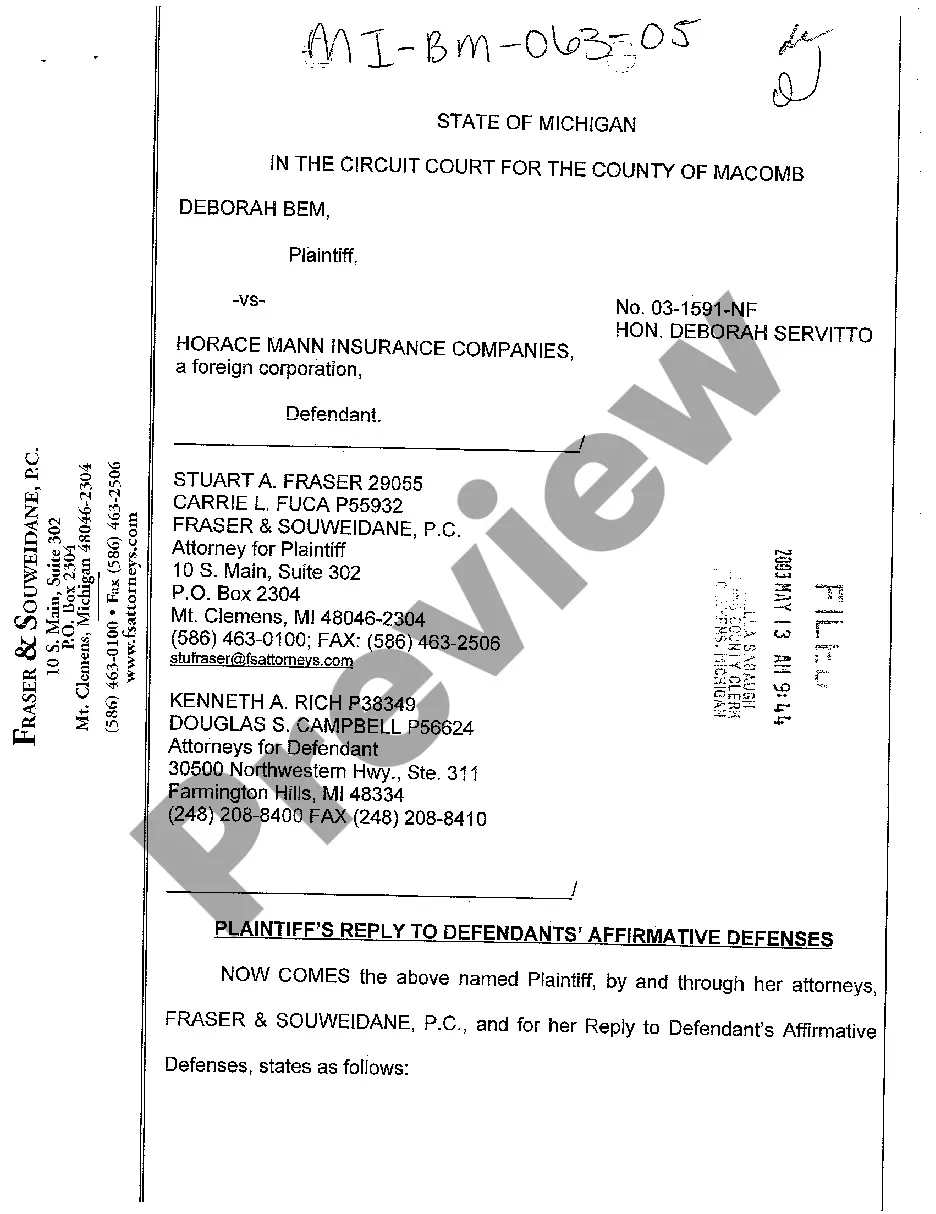

Description

How to fill out Multistate Promissory Note - Unsecured - Signature Loan?

It is feasible to spend hours online searching for the legal document template that meets the state and federal regulations you require.

US Legal Forms offers thousands of legal documents that are reviewed by professionals.

You can easily download or print the Michigan Multistate Promissory Note - Unsecured - Signature Loan from the service.

If available, utilize the Preview button to view the document template simultaneously.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- Then, you can complete, modify, print, or sign the Michigan Multistate Promissory Note - Unsecured - Signature Loan.

- Each legal document template you acquire is yours permanently.

- To obtain another copy of the purchased form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your area or city of choice.

- Review the form description to confirm you have chosen the right one.

Form popularity

FAQ

An unsecured promissory note is a legally binding contract between two parties where one party agrees to pay the other a certain amount of money at a specific time in the future. The reason it is called 'unsecured' is because the borrower does not want to pledge any assets as collateral for the loan.

An unsecured promissory note is an obligation for payment without any property securing the payment. If the payor fails to pay, the payee must file a lawsuit and hope that the payor has sufficient assets that can be seized to satisfy the loan.

In order for the promissory note to be valid, the borrower needs to sign it. The lender may require the borrower to sign this document in front of a notary to guarantee the signature.

Generally, as long as the promissory note contains legally acceptable interest rates, the signatures of the two contracted parties, and are within the applicable Statute of Limitations, they can be upheld in a court of law.

There is no legal requirement for most promissory notes to be witnessed or notarized in Michigan (a promissory note for a home loan, however, may need to be notarized). Still, the parties may decide to have the document certified by a notary public for protection in the event of a lawsuit.

Generally, promissory notes do not need to be notarized. Typically, legally enforceable promissory notes must be signed by individuals and contain unconditional promises to pay specific amounts of money. Generally, they also state due dates for payment and an agreed-upon interest rate.

In order for a promissory note to be valid and legally binding, it needs to include specific information. "A promissory note should include details including the amount loaned, the repayment schedule and whether it is secured or unsecured," says Wheeler.

Promissory notes are legally binding whether the note is secured by collateral or based only on the promise of repayment. If you lend money to someone who defaults on a promissory note and does not repay, you can legally possess any property that individual promised as collateral.

Unsecured Promissory NotesAn unsecured promissory note is an obligation for payment without any property securing the payment. If the payor fails to pay, the payee must file a lawsuit and hope that the payor has sufficient assets that can be seized to satisfy the loan.

Generally, promissory notes do not need to be notarized. Typically, legally enforceable promissory notes must be signed by individuals and contain unconditional promises to pay specific amounts of money.