Michigan Executive Employee Stock Incentive Plan

Description

How to fill out Executive Employee Stock Incentive Plan?

If you want to be thorough, obtain, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms that are accessible online.

Employ the site's straightforward and user-friendly search to find the documents you require.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have identified the form you need, click the Download now button. Choose the pricing plan you prefer and enter your information to register for an account.

Step 5. Complete the transaction. You can use your Visa, MasterCard, or PayPal account to finalize the purchase. Step 6. Select the format of the legal form and download it to your device. Step 7. Complete, modify, and print or sign the Michigan Executive Employee Stock Incentive Plan.

- Use US Legal Forms to find the Michigan Executive Employee Stock Incentive Plan with just a couple of clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to access the Michigan Executive Employee Stock Incentive Plan.

- You can also access forms you previously downloaded from the My documents tab in your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

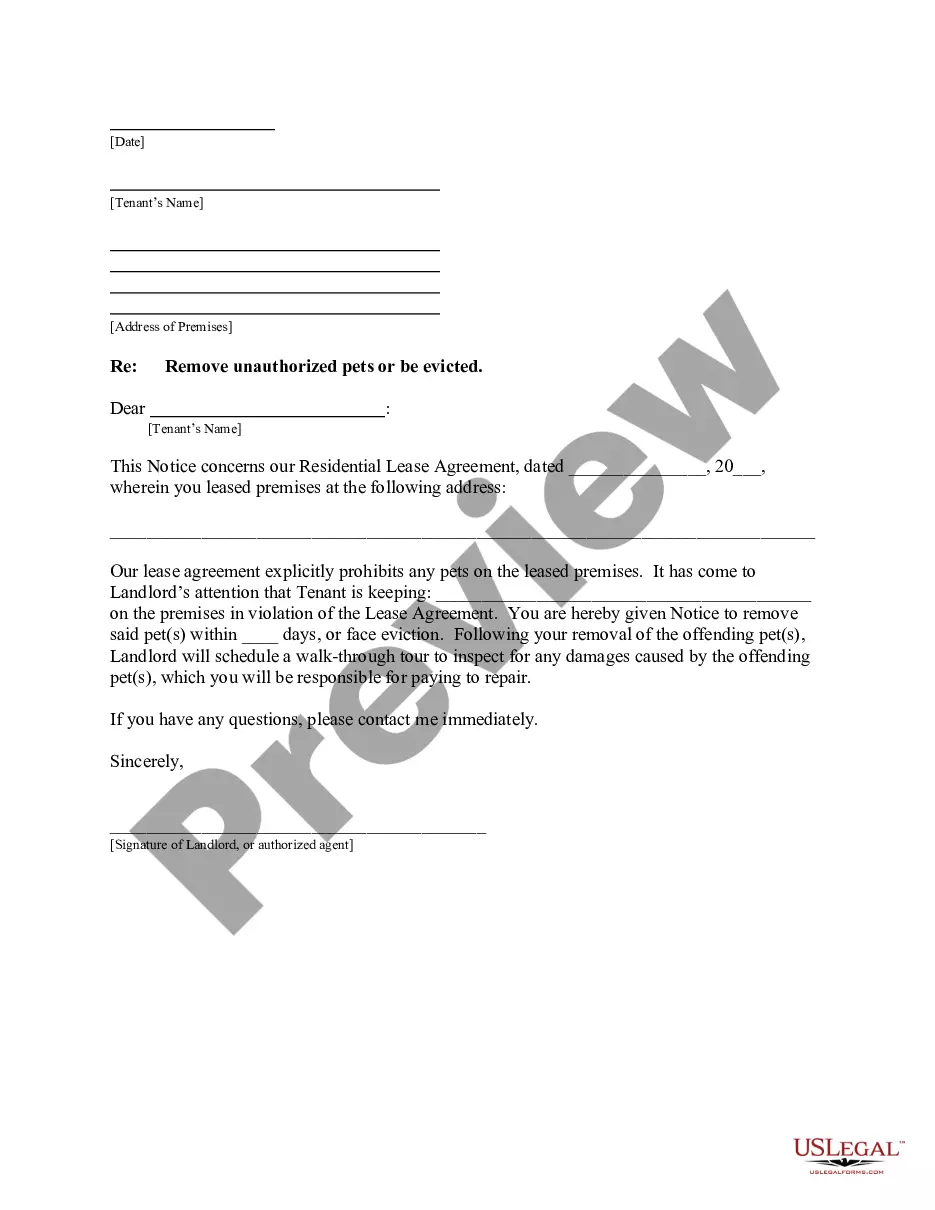

- Step 2. Use the Preview option to review the form's information. Don't forget to read the details.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

An Employee Stock Ownership Plan (ESOP) is a retirement plan that gives employees ownership in the company through shares, while an incentive plan primarily focuses on rewarding employees for performance. While both can contribute to employee motivation, the Michigan Executive Employee Stock Incentive Plan emphasizes immediate incentives linked to company performance. Understanding these distinctions helps businesses create effective ownership strategies.

Incentive stock options can have some drawbacks, including restrictions on eligibility and tax implications. If employees do not meet the necessary holding period, they may face unfavorable tax treatment. It's essential to weigh these factors when considering the Michigan Executive Employee Stock Incentive Plan, and a comprehensive understanding can help you navigate these concerns effectively.

The employee stock benefit is a program that allows employees to acquire ownership shares in the company they work for. It aligns their interests with the success of the business and can motivate them to perform at their best. In the context of the Michigan Executive Employee Stock Incentive Plan, this benefit enhances employee commitment and encourages long-term investment in the company.

Non-qualified stock options (NSOs) differ from ISOs in terms of tax treatment; NSOs typically incur taxes upon exercise. The advantages include more flexibility and no holding period requirements. However, the downsides are potentially higher tax liabilities compared to the Michigan Executive Employee Stock Incentive Plan, which provides more favorable terms for both employees and employers.

When you exercise incentive stock options, the income from that exercise may appear on your W-2 if you don't meet the holding period requirements. In contrast, ISOs generally do not show on your W-2 if you hold the stock long enough for capital gains treatment under the Michigan Executive Employee Stock Incentive Plan. Always verify this with your employer.

To report incentive stock options on your taxes, you must keep detailed records of your stock transactions. Report sales of shares on Schedule D and Form 8949, and include any income generated during the sales. Taking advantage of the Michigan Executive Employee Stock Incentive Plan can streamline your tax management.

Stock options are not typically reported on a 1099 form unless they are sold. When you exercise ISOs, the income may not appear on a 1099 unless you sell the shares in the same year. Always check your brokerage information and confirm accuracy to ensure compliance with your Michigan Executive Employee Stock Incentive Plan.

When reporting incentive stock options on your tax return, you typically need to include the income from the sale of the shares. You should use Schedule D and Form 8949 to report capital gains. Ensure you capture the sale prices and the dates you bought and sold the shares related to the Michigan Executive Employee Stock Incentive Plan.

Yes, Michigan does tax Employee Stock Ownership Plans (ESOPs), but the specifics can vary depending on individual situations. Generally, distributions from an ESOP may be subject to state income tax. Therefore, it's beneficial to consult with a tax professional familiar with the Michigan Executive Employee Stock Incentive Plan to get guidance on potential tax implications and benefits.

The requirements for an incentive stock option under the Michigan Executive Employee Stock Incentive Plan include that they must be granted only to employees, not independent contractors. Additionally, the option must be exercised within a specific time frame after leaving the company. Organizations must also establish the plan's terms and ensure they align with IRS regulations.