Michigan Sample Letter for Claim Settlement Against Decedent's Estate

Description

How to fill out Sample Letter For Claim Settlement Against Decedent's Estate?

US Legal Forms - one of the largest repositories of legal documents in the United States - offers a variety of legal document templates that you can download or print. By utilizing the website, you can discover thousands of forms for business and personal use, organized by categories, states, or keywords. You can obtain the latest versions of forms such as the Michigan Sample Letter for Claim Settlement Against Decedent's Estate in just a few minutes.

If you already have a subscription, Log In to download the Michigan Sample Letter for Claim Settlement Against Decedent's Estate from the US Legal Forms collection. The Download option will appear on every document you view. You can access all previously downloaded forms in the My documents section of your account.

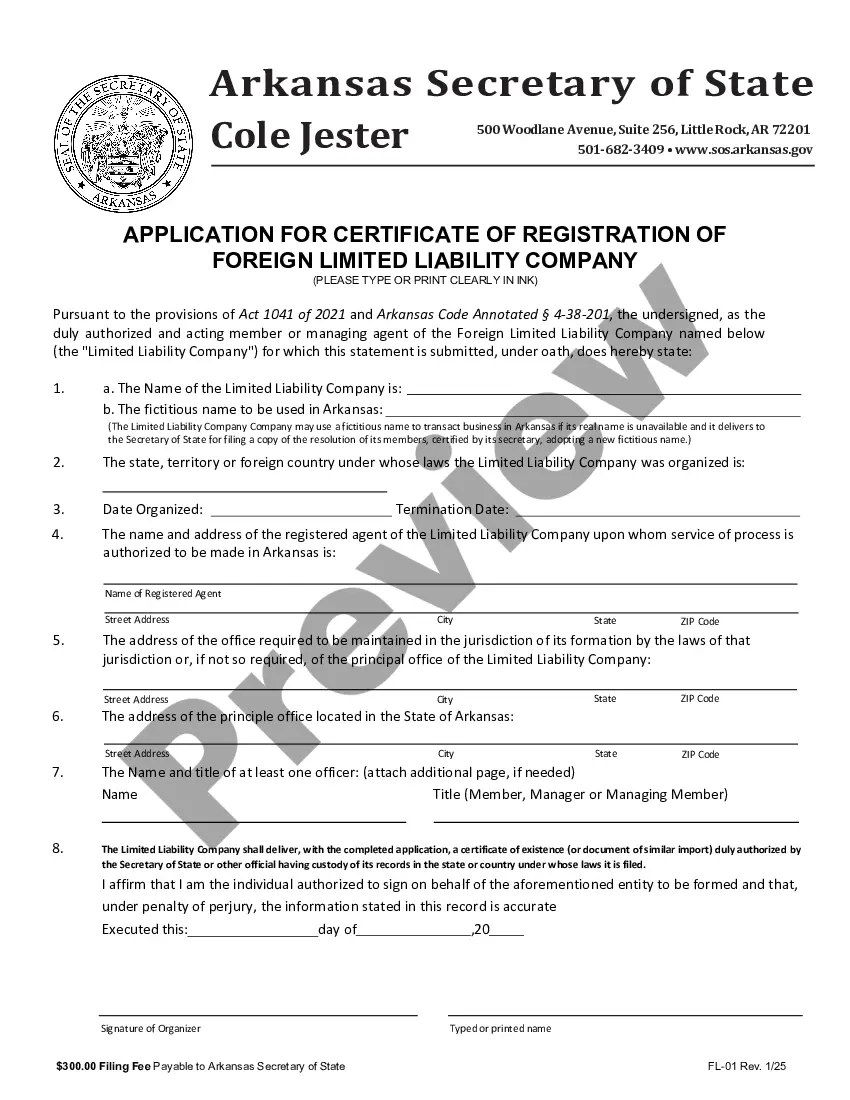

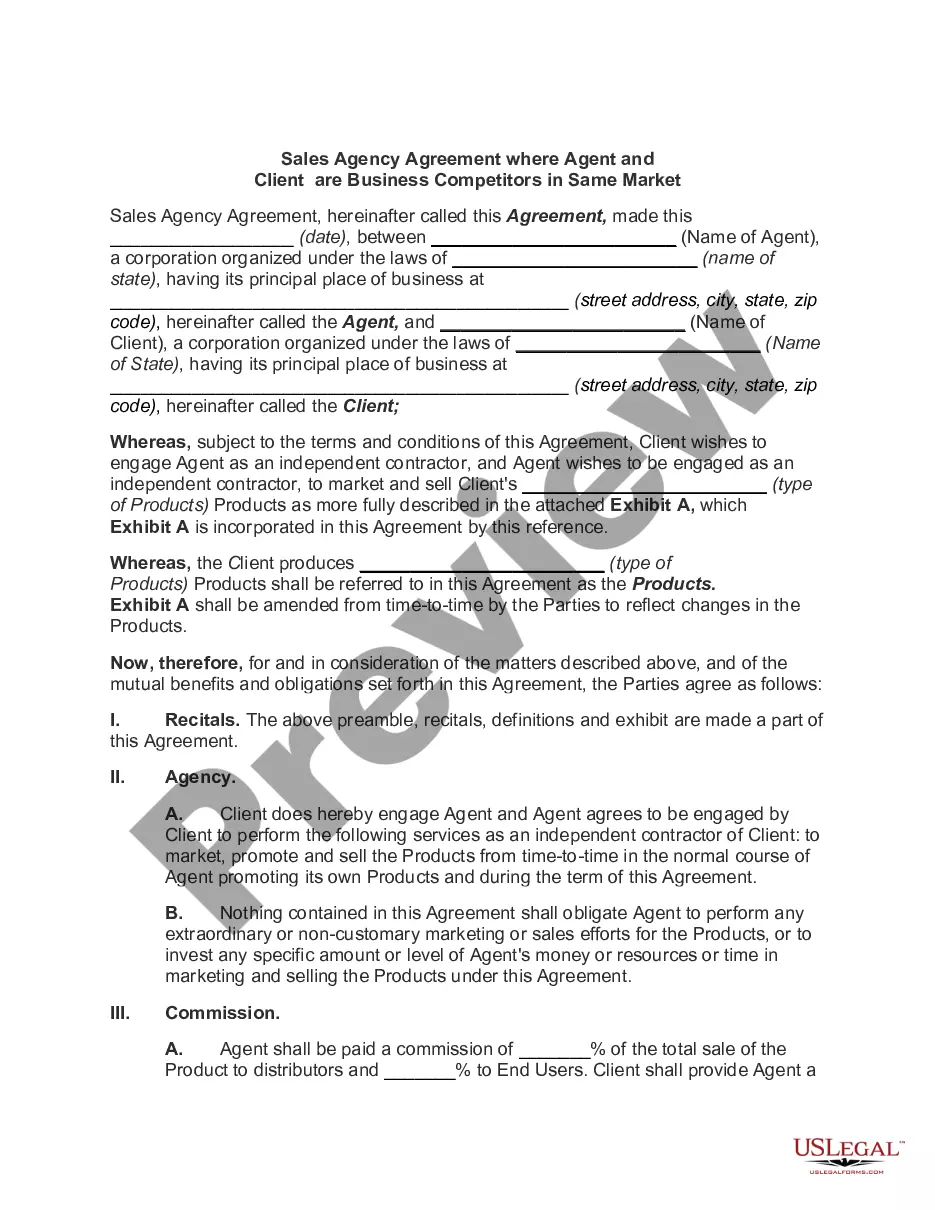

If you are using US Legal Forms for the first time, here are straightforward instructions to help you begin: Make sure you have selected the correct form for the area/county. Click on the Preview option to review the form's details. Examine the form summary to confirm that you have chosen the correct document. If the form does not meet your needs, utilize the Search field at the top of the screen to find one that does.

Access the Michigan Sample Letter for Claim Settlement Against Decedent's Estate with US Legal Forms, the most extensive collection of legal document templates. Utilize a multitude of professional and state-specific templates that satisfy your business or personal requirements and specifications.

- Once you are satisfied with the form, confirm your selection by clicking the Get now button.

- Then, select your preferred pricing plan and provide your information to sign up for an account.

- Process the payment. Use your Visa or Mastercard or PayPal account to complete the transaction.

- Choose the format and download the form to your device.

- Edit. Fill out, modify, print, and sign the downloaded Michigan Sample Letter for Claim Settlement Against Decedent's Estate.

- Each template you added to your account does not have an expiration date and belongs to you permanently. So, if you wish to download or print another copy, simply go to the My documents section and click on the form you need.

Form popularity

FAQ

In Michigan, creditors have up to 3 years from the date of death to present claims to the estate. However, if you have followed the Task: Publish Notice of Death correctly, creditors will have only 4 months from the date of the first publication of notice to creditors.

If the estate is not settled within a year of the first personal representative's appointment, file a Notice of Continued Administration with the court stating why the estate must remain open. A copy of this notice must be given to all interested persons.

In the State of Michigan, probate is necessary when someone passes away while owning property or assets that are listed under their name alone. If the deceased individual has joint ownership over certain property, it's possible the assets may be transferred to the other owner with little to no court involvement.

(1) If the applicable estate property is insufficient to pay all claims and allowances in full, the personal representative shall make payment in the following order of priority: (a) Costs and expenses of administration. (b) Reasonable funeral and burial expenses. (c) Homestead allowance.

A creditor has 4 months from the date of publication or 1 month from the date they receive actual notice, whichever is later, to present their written claim or it will be barred. The written statement must indicate the basis of the claim, the claimant's name and address and the amount of the claim.

If the estate is not settled within a year of the first personal representative's appointment, file a Notice of Continued Administration with the court stating why the estate must remain open.

Appointing a Personal Representative The order from highest to lowest priority is: The person named as personal representative in decedent's will. The decedent's surviving spouse if the spouse is a devisee. Other devisees of the decedent.

You may use the Statement and Proof of Claim (form PC 579) to submit your claim. The written claim must be timely delivered or mailed to the fiduciary listed below. You may also send it to the probate court for filing along with a filing fee of $20.00. You may also commence a suit against the estate in a court.