Michigan Assumption Agreement of Loan Payments

Description

How to fill out Assumption Agreement Of Loan Payments?

Are you in the place that you need documents for either organization or individual uses almost every day time? There are plenty of authorized record web templates available online, but discovering kinds you can rely is not easy. US Legal Forms gives thousands of form web templates, like the Michigan Assumption Agreement of Loan Payments, that happen to be composed to fulfill state and federal requirements.

In case you are already acquainted with US Legal Forms web site and possess your account, merely log in. Afterward, you are able to down load the Michigan Assumption Agreement of Loan Payments design.

Unless you have an profile and need to begin to use US Legal Forms, adopt these measures:

- Discover the form you require and make sure it is for the appropriate metropolis/county.

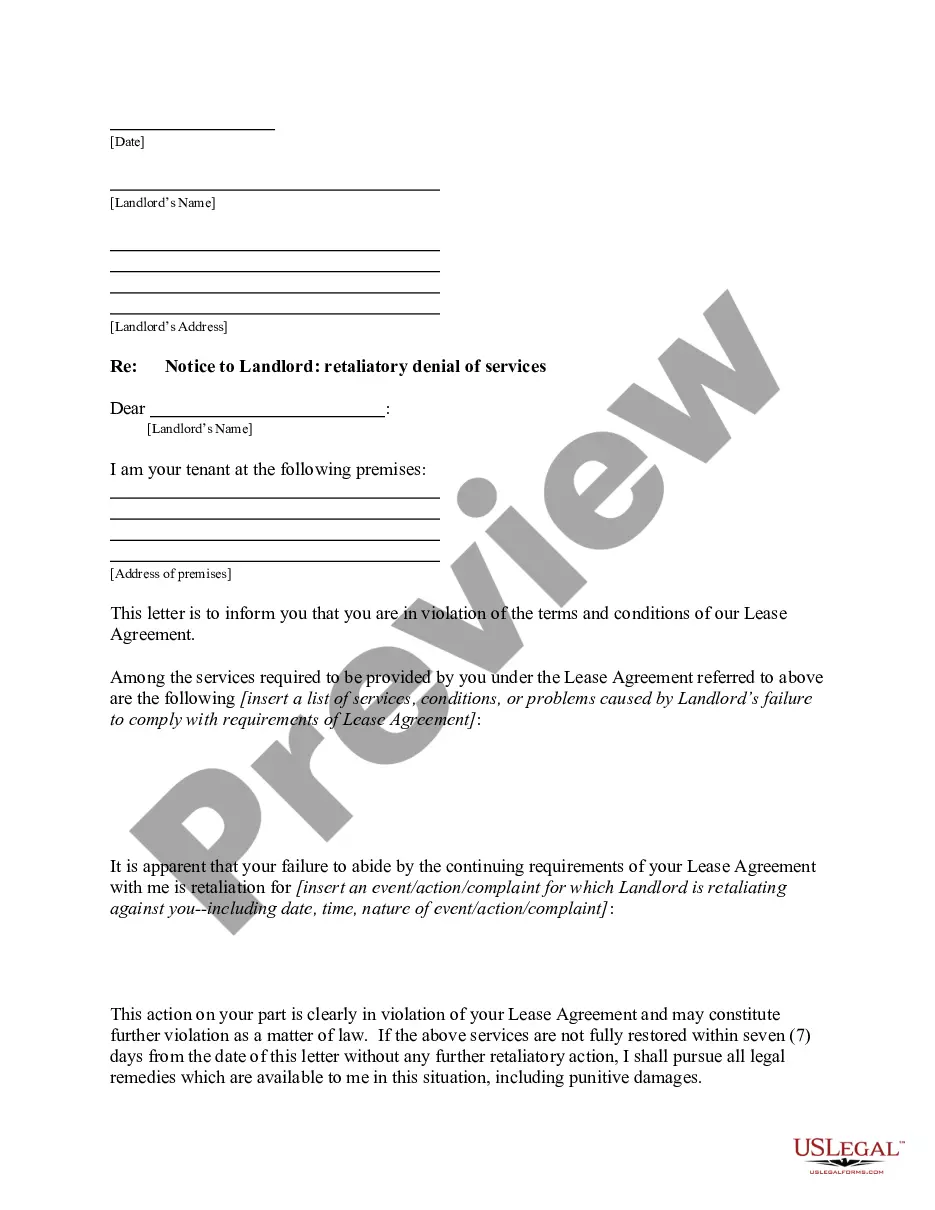

- Take advantage of the Preview key to check the form.

- See the information to actually have selected the right form.

- In the event the form is not what you`re trying to find, make use of the Look for field to find the form that fits your needs and requirements.

- When you obtain the appropriate form, just click Buy now.

- Choose the pricing strategy you desire, fill out the specified info to make your account, and purchase the order utilizing your PayPal or credit card.

- Select a handy document format and down load your copy.

Get all the record web templates you possess purchased in the My Forms food list. You can obtain a more copy of Michigan Assumption Agreement of Loan Payments anytime, if needed. Just click on the necessary form to down load or produce the record design.

Use US Legal Forms, probably the most substantial selection of authorized forms, to save lots of time as well as avoid faults. The service gives appropriately created authorized record web templates that you can use for a variety of uses. Produce your account on US Legal Forms and begin generating your way of life easier.

Form popularity

FAQ

Buying ?Subject to? the Mortgage While the deed is transferred to your name and you agree to make the mortgage payments, the person selling you the house is still responsible for paying the loan.

A seller is still responsible for any debt payments if the mortgage is assumed by a third party unless the lender approves a release request releasing the seller of all liabilities from the loan. If approved, the title of the property is transferred to the buyer who makes the required monthly repayments to the bank.

An assumable mortgage clause allows a buyer to take over mortgage payments for an existing loan on behalf of a seller. The original homeowner is released from any liability toward the loan, while the buyer assumes responsibility for the mortgage payments and ownership of the property.

Updated March 7, 2022. In real estate transactions, an assumption agreement allows a third party to ?assume? or take over the loan of the property's seller. Mortgages may be assumed when the house is sold, a divorcing spouse is awarded the property in a settlement or when someone inherits property.

If the mortgage loan is assumable, a seller can sell their home to a qualified buyer, allowing the buyer to purchase the home by way of assuming responsibility for the seller's loan terms and remaining balance.

When a buyer buys property and assumes a mortgage, the buyer becomes primarily liable for the debt and the seller becomes secondarily liable for the debt. "Assume" means the buyer takes on liability, and the seller is no longer primarily liable. "Subject to" means the seller is not released from responsibility.

An assumable mortgage works much the same as a traditional home loan, except the buyer is limited to financing through the seller's lender. Lenders must typically approve an assumable mortgage. If done without approval, sellers run the risk of having to pay the full remaining balance upfront.

How does the loan assumption process work? Getting approved to assume a loan is similar to getting approved for a new mortgage. You will need to complete an application, provide documents, and meet the lender's credit, income, and financial requirements to get the loan assumption approved.