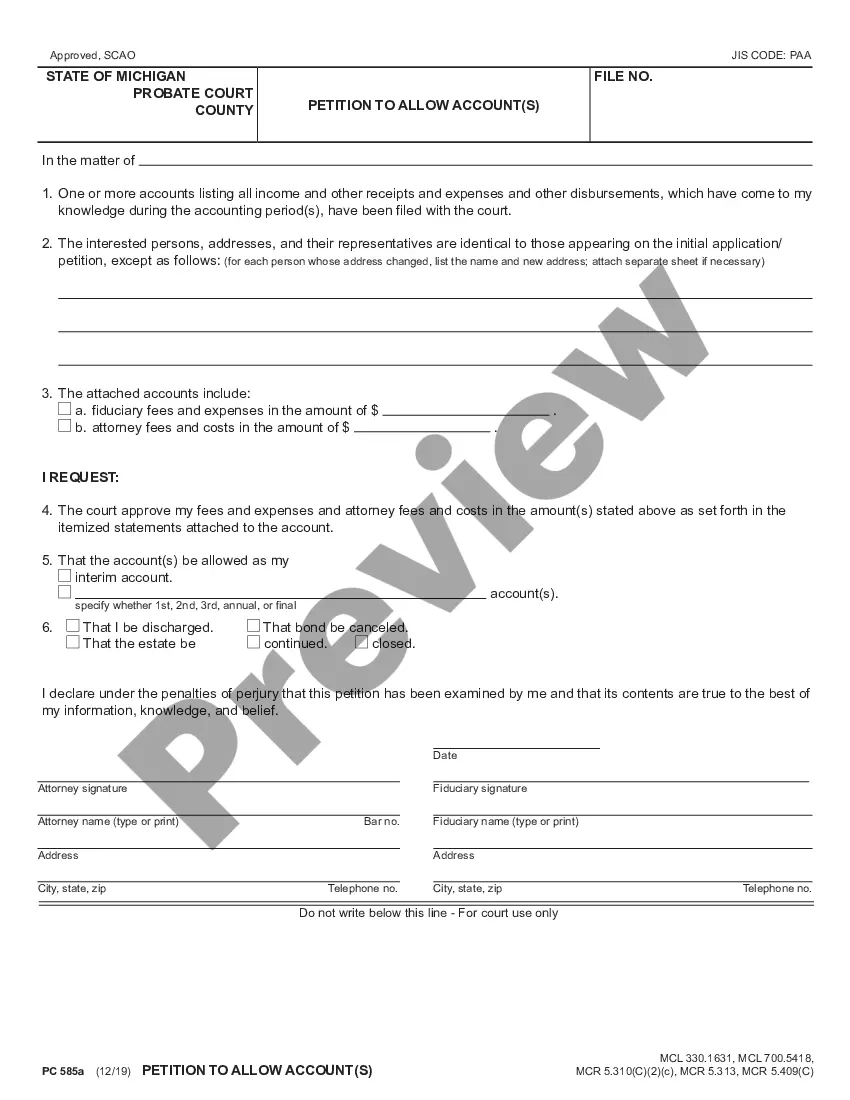

The Michigan Petition to Allow Account(s) is a legal document filed with the Michigan Department of Treasury to ask permission to open a bank account, mutual fund, or other financial account in the name of an individual or entity. This petition is typically used when an account holder is unable to open the account themselves due to age, disability, or other reasons. The petition must be signed by an authorized representative of the individual or entity and must be accompanied by supporting documentation. There are three main types of Michigan Petition to Allow Account(s): 1) Petition to Allow Minor Account, 2) Petition to Allow Account for Disabled Person, and 3) Petition to Allow Account for Elderly Person. Each type of petition provides unique details regarding the individual or entity requesting the account, as well as the account type and owner.

Michigan Petition to Allow Account(s)

Description

How to fill out Michigan Petition To Allow Account(s)?

How much time and resources do you frequently expend on creating official documentation.

There’s a better alternative to obtaining such forms than employing legal experts or squandering hours searching online for a suitable template. US Legal Forms is the premier online repository that provides professionally crafted and validated state-specific legal documents for any reason, such as the Michigan Petition to Allow Account(s).

Another advantage of our service is that you can retrieve previously downloaded documents that you securely keep in your profile in the My documents section. Access them anytime and re-complete your paperwork as often as you need.

Conserve time and effort completing legal documents with US Legal Forms, one of the most dependable online services. Register with us now!

- Review the form content to confirm it adheres to your state regulations. To do so, verify the form description or utilize the Preview option.

- If your legal document doesn’t meet your requirements, find another one using the search bar at the top of the page.

- If you already possess an account with us, Log In and download the Michigan Petition to Allow Account(s). Otherwise, continue to the next steps.

- Click Buy now once you locate the correct template. Choose the subscription plan that best fits your needs to access our library’s complete services.

- Create an account and pay for your subscription. You can make a payment with your credit card or through PayPal - our service is completely secure for that.

- Download your Michigan Petition to Allow Account(s) onto your device and fill it out on a printed hard copy or digitally.

Form popularity

FAQ

In Michigan, you typically have one year to transfer property after death. However, this can vary based on the type of assets involved and the specific circumstances of the estate. The Michigan Petition to Allow Account(s) can help streamline this process by providing a structured way to manage estate assets. Utilizing platforms like US Legal Forms can ensure you complete the necessary paperwork efficiently, allowing for smoother transitions during a challenging time.

Filing a petition in Michigan involves completing the appropriate forms, which vary based on the type of petition you are submitting. After gathering your information and necessary documentation, you must file the petition with the correct court. It is essential to ensure that you understand the local rules and procedures, as these can affect your submission. For additional support, USLegalForms offers comprehensive solutions, including detailed templates for the Michigan Petition to Allow Account(s), making the filing process simpler.

To petition for guardianship in Michigan, you will need to prepare a petition that outlines your reasons for seeking guardianship, along with pertinent information about the individual who requires assistance. Assemble necessary documentation, including medical assessments, and file the petition with the probate court. It is vital to comply with all legal requirements to ensure a smooth process. Using resources like USLegalForms can help you navigate the complexities of the Michigan Petition to Allow Account(s) more effectively.

To fill out a petition for letters of administration form in Michigan, start by gathering all relevant information, such as the decedent's details and your relationship to them. Next, complete the form accurately, ensuring you include any required information about assets and debts. After reviewing your completion, submit the petition to the probate court in your county. For added guidance, consider using USLegalForms, which provides templates specifically tailored for the Michigan Petition to Allow Account(s).

Michigan Probate Laws require a decedent's assets go through Probate if the assets were held solely in their name. Assets usually don't need to go through Probate if the assets that are jointly owned, the assets have a beneficiary designation, or the assets are held in a Living Trust.

Non-Probate Assets If the deceased designated a beneficiary to receive an asset upon the deceased's death, it is known as a non-probate asset. It may not require any type of estate administration or court filings. These assets pay directly to the named beneficiary and are not transferred under the deceased's will.

Probate is required in Michigan when the assets are solely owned. For example if someone passes away and they are the only owner on the property title of their home, then the home would need to pass through probate.

In Michigan, you can make a living trust to avoid probate for virtually any asset you own?real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

Michigan Probate Laws require a decedent's assets go through Probate if the assets were held solely in their name. Assets usually don't need to go through Probate if the assets that are jointly owned, the assets have a beneficiary designation, or the assets are held in a Living Trust.

In Michigan, you can make a living trust to avoid probate for virtually any asset you own?real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).