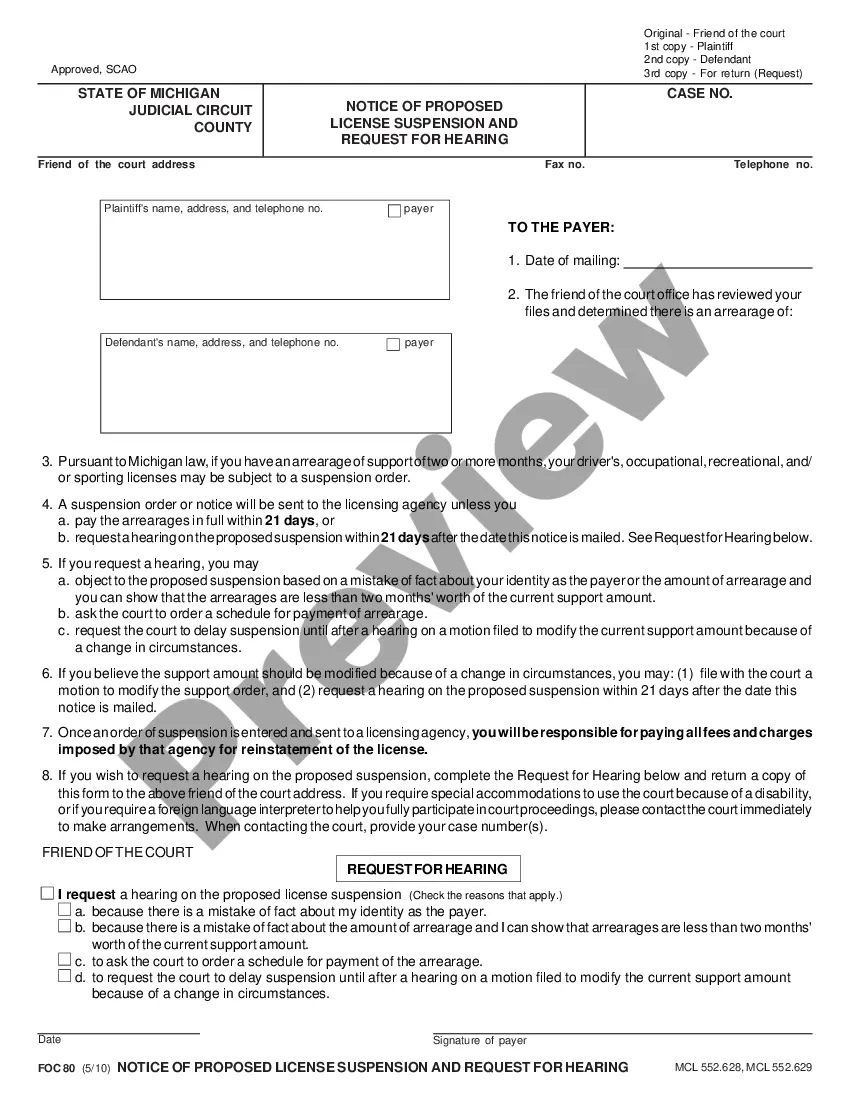

This Notice of Intent to Levy is an official document from the Michigan State Court Administration Office, and it complies with all applicable state and Federal codes and statutes. USLF updates all state and Federal forms as is required by state and Federal statutes and law.

Michigan Notice of Intent To Levy

Description

How to fill out Michigan Notice Of Intent To Levy?

Obtain any template from 85,000 legal documents including the Michigan Notice of Intent to Levy online through US Legal Forms. Every template is crafted and revised by state-certified lawyers.

If you already hold a subscription, Log In. Once you are on the form’s page, click the Download button and navigate to My documents to access it.

If you have not subscribed yet, follow these steps below.

Once your reusable template is downloaded, either print it out or save it to your device. With US Legal Forms, you will consistently have immediate access to the relevant downloadable sample. The platform provides access to forms and categorizes them to make your search easier. Use US Legal Forms to quickly and effortlessly obtain your Michigan Notice of Intent to Levy.

- Verify the state-specific requirements for the Michigan Notice of Intent to Levy that you need to utilize.

- Browse through the description and preview the sample.

- When you’re confident the sample meets your needs, click Buy Now.

- Select a subscription plan that suits your budget.

- Create a personal account.

- Make the payment in one of two acceptable methods: by credit card or through PayPal.

- Choose a format to download the document; two options are available (PDF or Word).

- Download the file into the My documents section.

Form popularity

FAQ

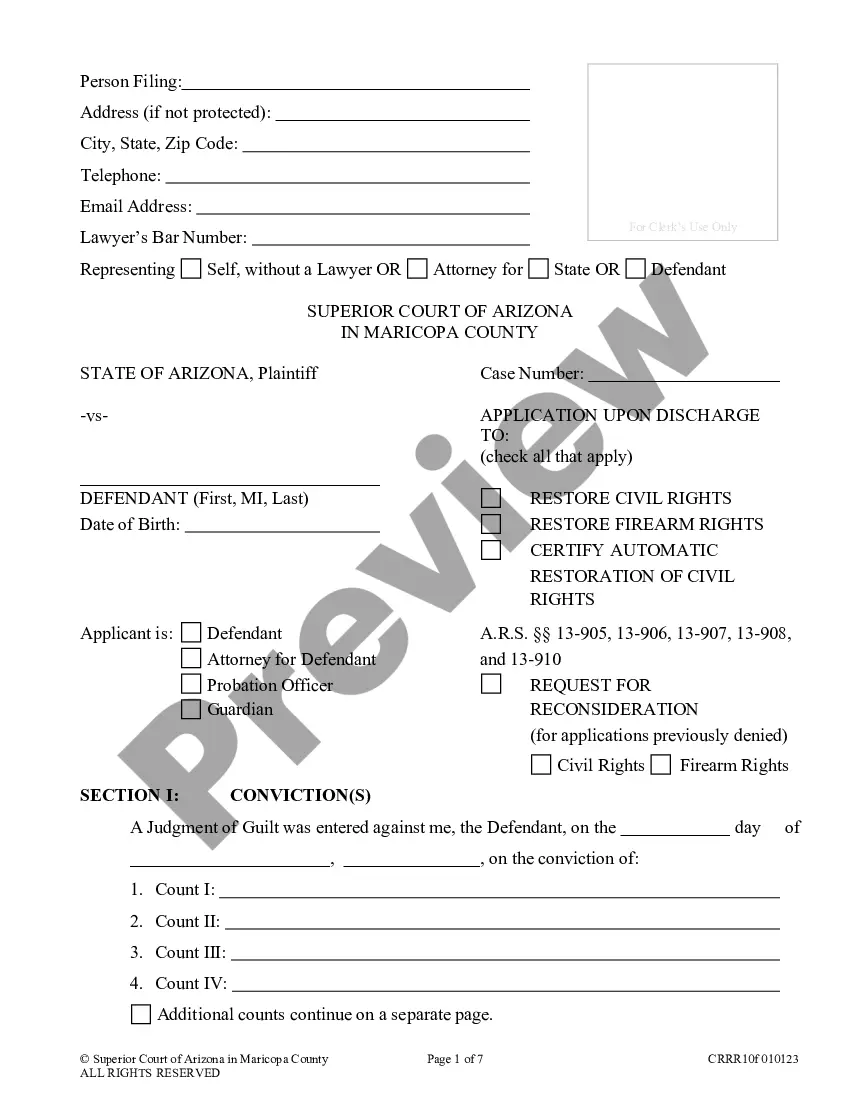

The term 'notice of intent to levy' generally refers to a legal document alerting you that authorities plan to take your property or funds to cover unpaid taxes. In Michigan, this notice outlines your rights and the steps you can take to contest or settle the debt before the levy is enforced. Being informed about this notice empowers you to act swiftly, preventing the loss of your assets. Consider using USLegalForms to navigate this notification efficiently, ensuring you follow the correct procedures.

A Michigan Notice of Intent To Levy is a formal notification issued by the tax authority, indicating their intention to seize your assets to satisfy unpaid tax debts. This document serves as a warning, providing you with an opportunity to address your tax liabilities before the levy occurs. Understanding this notice is crucial for you, as it can help you take timely action to resolve the situation, potentially avoiding further penalties. Utilizing platforms like USLegalForms can simplify the process of responding to such notices.

The timeline following a Michigan Notice of Intent To Levy can vary. Generally, you should expect to receive the actual levy within 30 days from the date of the notice. It’s essential to respond promptly if you wish to contest or negotiate the levy before it becomes final. Using resources from USLegalForms can help you navigate this process effectively and ensure that your rights are protected.

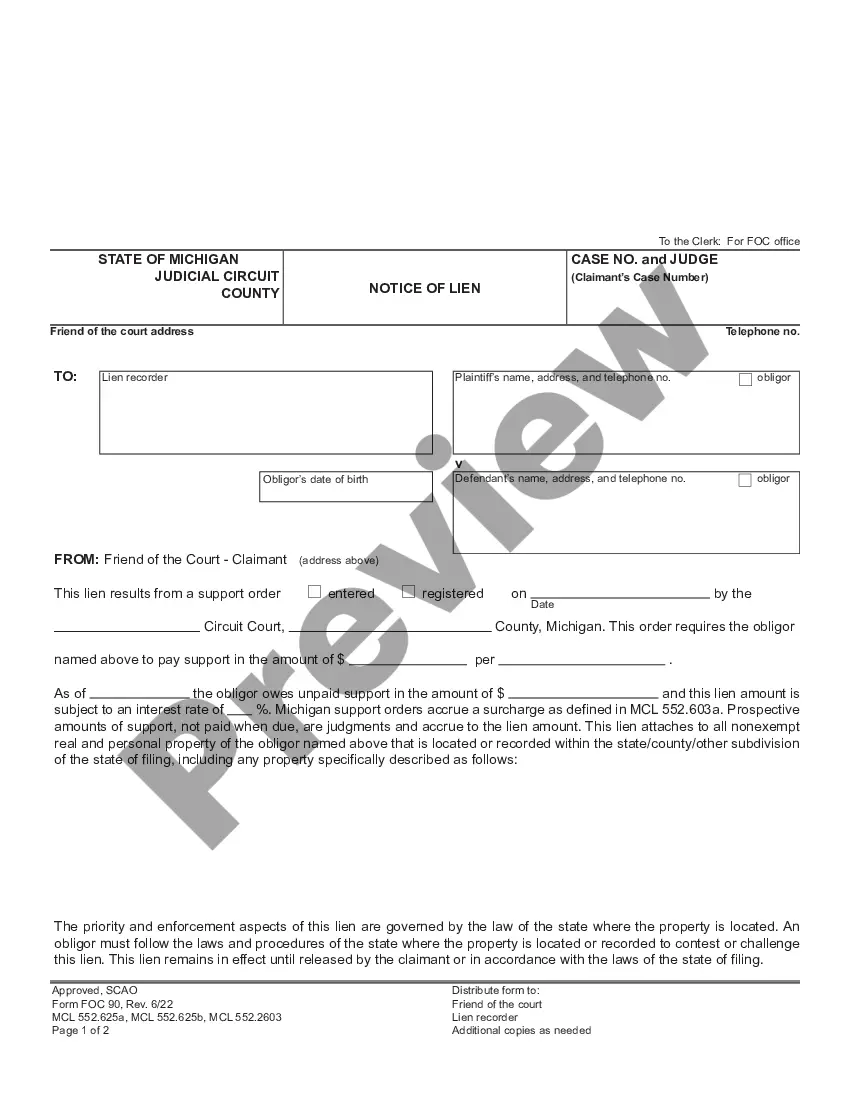

A notice of intent to lien in Michigan is a formal notification that the state plans to place a lien on your property due to unpaid taxes. This notice is often issued after a Michigan Notice of Intent To Levy when no resolution has been made. A lien can affect your credit rating and the sale of your property, so it’s important to address the tax issues indicated. Utilizing resources like USLegalForms can provide the documents and guidance necessary to navigate these situations effectively.

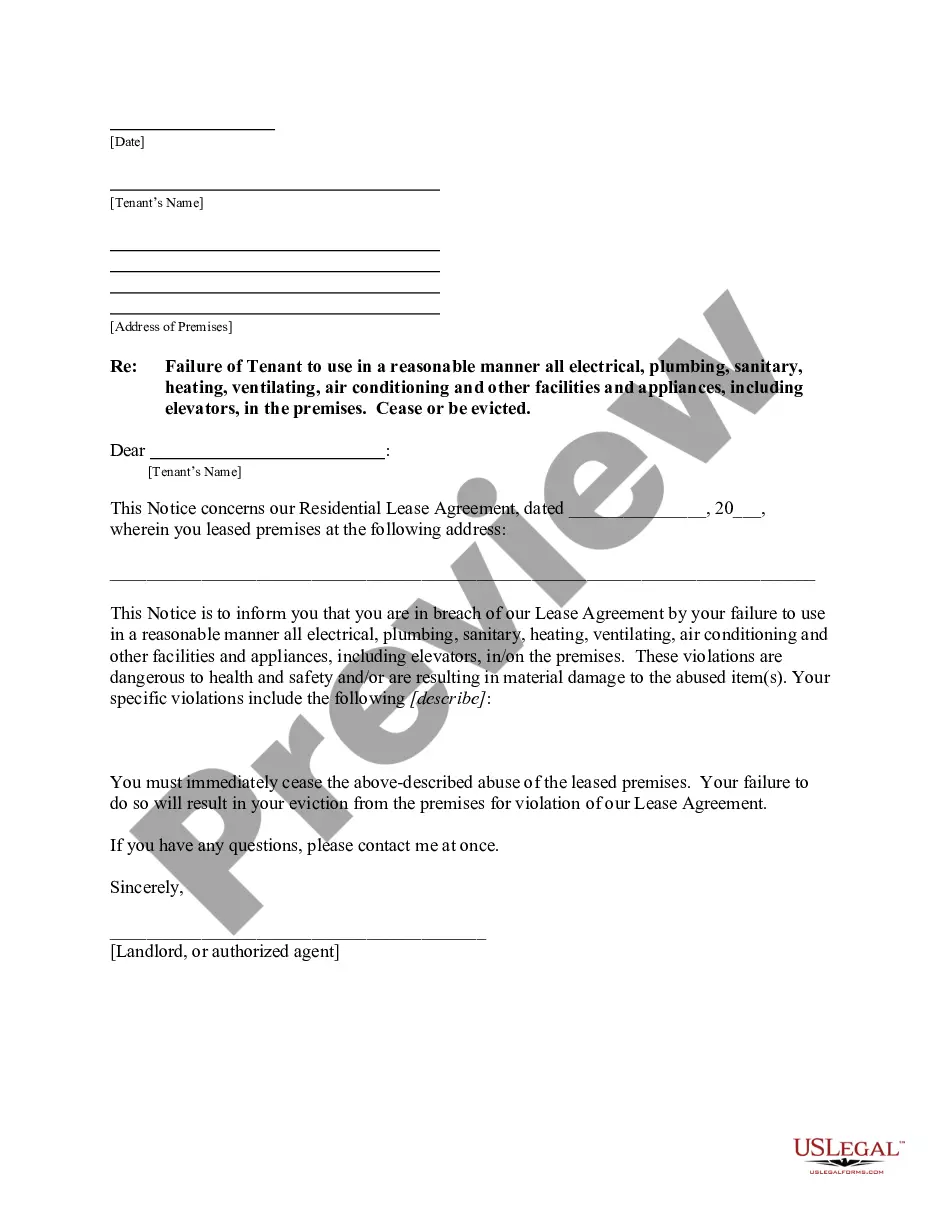

In Michigan, a levy allows the state to legally seize your property or funds to satisfy your tax debts. When you receive a Michigan Notice of Intent To Levy, it indicates that the state is preparing to take your assets if you do not address your tax obligations. This action can include garnishing wages or freezing bank accounts, so it is vital to act quickly. Settling your tax liabilities can help you avoid the consequences of a levy.

A Michigan Notice of Intent To Levy is a legal document issued by the state to inform you of the government's plan to seize your assets due to unpaid taxes. This document serves as an advance warning, giving you a chance to resolve your tax issues before the government takes action. It is crucial to respond promptly to this notice to avoid further actions that may affect your financial standing. Understanding this process is essential to effectively manage your tax responsibilities.

Contrary to popular belief, the IRS does not have to record an NFTL before it can levy bank accounts or receivables. Once the Final Notice has been issued and 30 days have passed, the IRS can levy bank accounts and/or accounts receivable. The IRS does not perform a lien search prior to issuing a levy.

Here is a link to the IRS website that explains what notice the IRS must give before levying. The good news is that normally the IRS sends you five letters (five for individuals and four for businesses) before actually seizing your assets.

You can change your tax withholding through your MIWAM Account. Once you access your account, select the Claim ID. Under the Claimant Services Tab, click on the link Update Withholding.

The IRS can take some of your paycheck The IRS determines your exempt amount using your filing status, pay period and number of dependents. For example, if you're single with no dependents and make $1,000 every two weeks, the IRS can take up to $538 of your check each pay period.