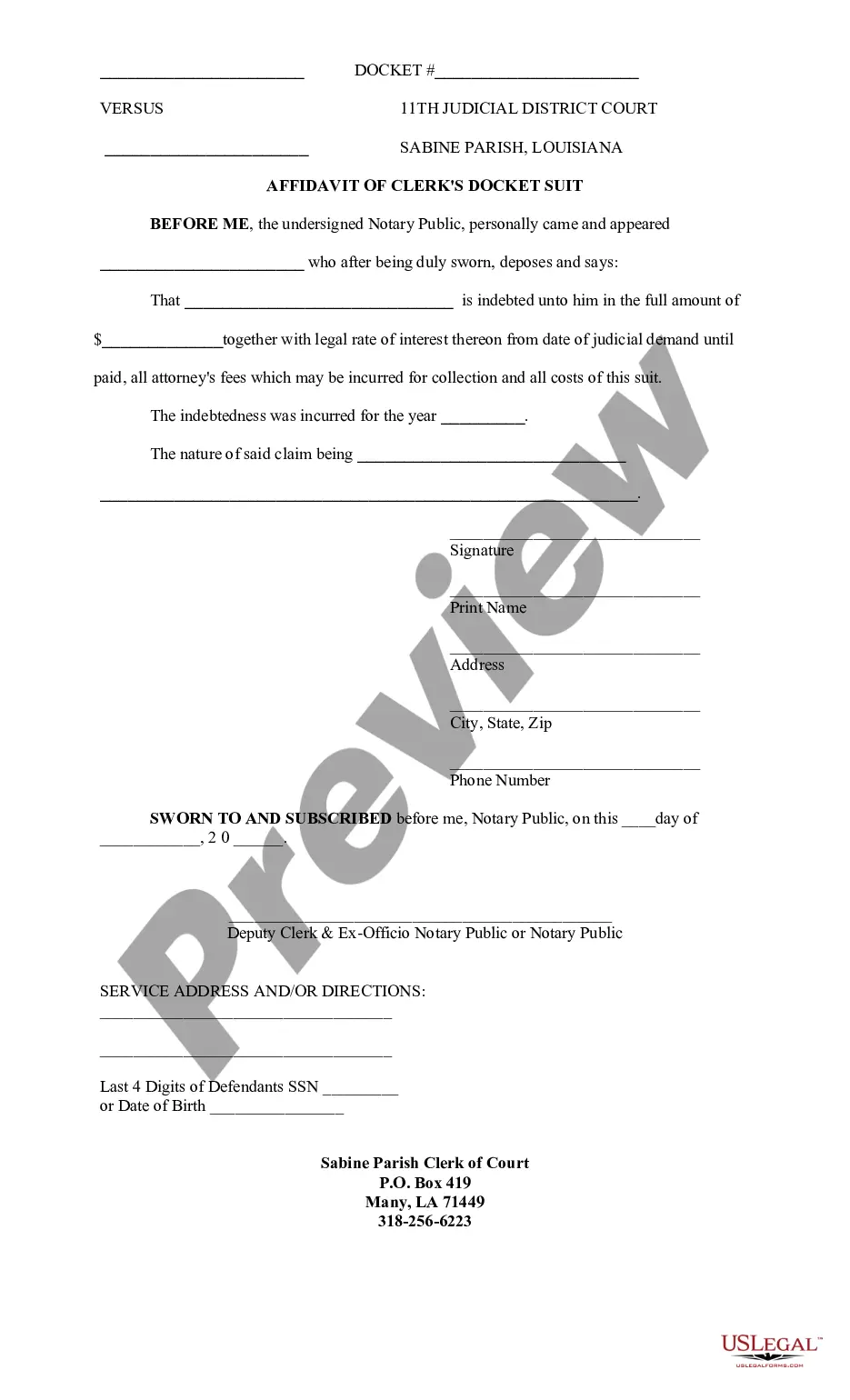

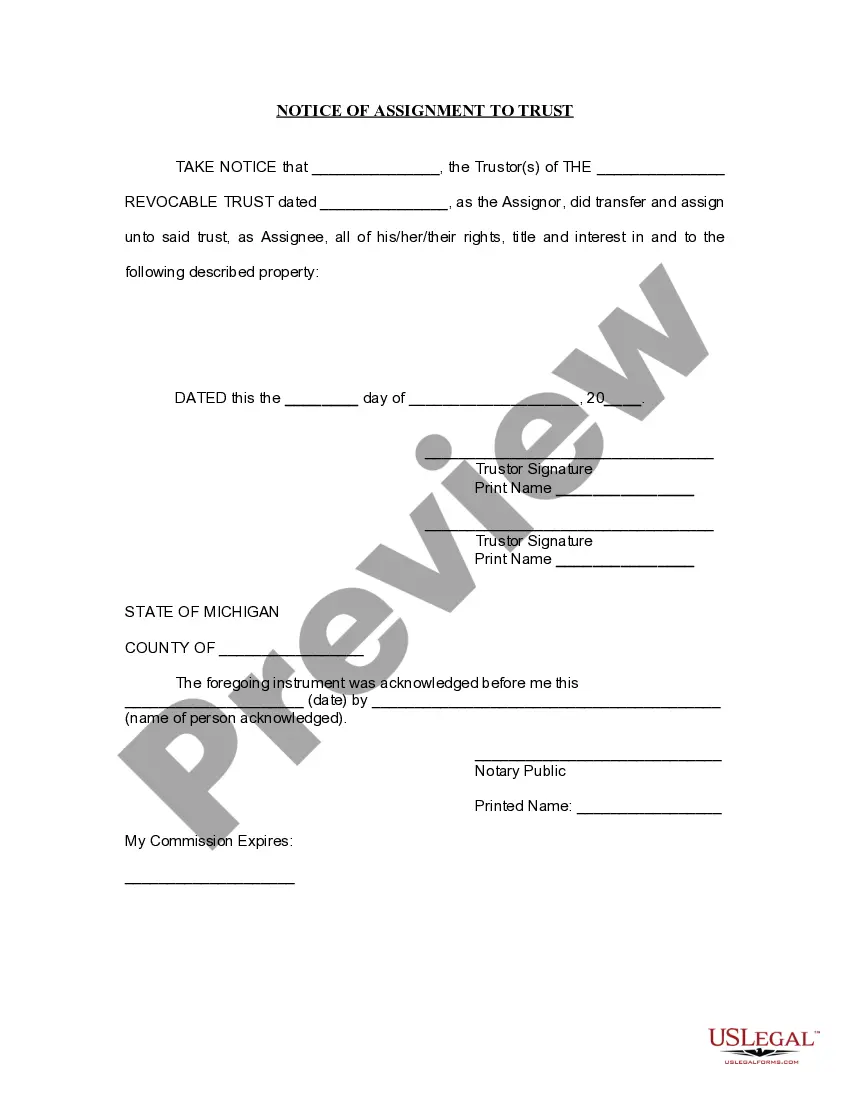

Michigan Notice of Assignment to Living Trust

Description

trustor(s) of the revocable trust transferred and assigned his or her or their rights, title and interest in and to certain described property to the trust.

How to fill out Michigan Notice Of Assignment To Living Trust?

Obtain any template from 85,000 legal documents including the Michigan Notice of Assignment to Living Trust online with US Legal Forms. Each template is created and updated by state-certified legal experts.

If you already hold a subscription, Log In. Once you reach the form’s page, click on the Download button and navigate to My documents to retrieve it.

If you haven't subscribed yet, follow the steps outlined below.

With US Legal Forms, you will always have quick access to the relevant downloadable template. The platform provides access to documents and categorizes them for easier searches. Utilize US Legal Forms to obtain your Michigan Notice of Assignment to Living Trust efficiently and swiftly.

- Verify the state-specific requirements for the Michigan Notice of Assignment to Living Trust that you wish to use.

- Browse the description and preview the sample.

- Once you confirm that the template meets your needs, click Buy Now.

- Select a subscription plan that fits your financial situation.

- Create a personalized account.

- Complete payment in one of two convenient methods: by credit card or via PayPal.

- Choose a format to download the file in; two options are available (PDF or Word).

- Download the document to the My documents section.

- When your reusable form is prepared, print it out or save it to your device.

Form popularity

FAQ

To assign assets to a living trust, begin by identifying all the assets you wish to include. Next, prepare the necessary legal documents to transfer ownership, which may involve deeds for real property or account change forms for financial accounts. Be sure to follow up with the Michigan Notice of Assignment to Living Trust to confirm the assignment is properly documented. Resources like uslegalforms can streamline this process, helping you navigate the required steps seamlessly.

Form PC 598 is a Michigan form used for the assignment of property into a living trust. This form acts as a record that indicates the transfer of assets into the trust, ensuring that your intentions are documented and legally binding. Using this form correctly will support your estate planning efforts. When completing it, reference the Michigan Notice of Assignment to Living Trust for accuracy.

In Michigan, a trustee is required to notify beneficiaries within 63 days after accepting the role. This notification includes providing copies of the trust document and any relevant information about the trust’s assets. Timely communication is vital for maintaining transparency and trust. Additionally, understanding the implications of the Michigan Notice of Assignment to Living Trust can be beneficial in this context.

In Michigan, a trust does not need to be filed with the court. However, certain situations, such as probate, might require a court to review the trust. It is essential to keep your trust documents safe and accessible, as they outline the terms and intentions behind your estate plan. Understanding the Michigan Notice of Assignment to Living Trust helps clarify these procedures.

To put your assets in a living trust, first, you need to create the trust document. After that, you transfer your assets into the trust by changing the title of the assets, such as property or bank accounts, to the name of the trust. Ensure you update all appropriate estate planning documents. Using the Michigan Notice of Assignment to Living Trust can help facilitate this transfer effectively.

In Michigan, the property transfer affidavit is typically completed by the seller of the property. This document is crucial for accurately reporting any transfer of ownership. It is essential to include accurate information, as it is tied to property assessments and taxes. To simplify the process, you can use resources from US Legal Forms, which provides specific guidelines relating to the Michigan Notice of Assignment to Living Trust.

To write an addendum to a living trust, first, clearly identify and state the specific changes or additions you want to incorporate. Make sure to reference the original trust document, using its official name and date. After drafting the addendum, ensure you sign it in accordance with Michigan's legal requirements to validate it. If you seek assistance, consider using the US Legal Forms platform, which offers templates tailored for a Michigan Notice of Assignment to Living Trust.

The 2 year rule for trusts in Michigan pertains to the timeframe in which a trust can distribute assets without incurring additional taxes. Essentially, this rule states that if the trust distributes assets within two years of its creation, those transfers are generally not subject to certain tax obligations. Understanding this rule is essential to effectively manage your estate and stay informed about your Michigan Notice of Assignment to Living Trust. Platforms like US Legal Forms provide valuable insights and resources to follow these guidelines accurately.

For a trust to be valid in Michigan, it must have a lawful purpose, be created voluntarily, and must have an identifiable trust property. Also, the trustor must have legal capacity, which means they should be of sound mind when creating the trust. Additionally, under the Michigan Notice of Assignment to Living Trust, the trust must be in writing to be enforceable. If you're unsure about the requirements, consulting US Legal Forms can guide you through the legal nuances.

Transferring property to a trust in Michigan requires you to execute a deed that conveys your property to the trust. You must complete the deed with accurate details, sign it, and ensure it is recorded with the county register of deeds. This process formalizes the transfer and protects your asset within the framework of your Michigan Notice of Assignment to Living Trust. Utilizing services like US Legal Forms simplifies this process, ensuring compliance with state requirements.