Michigan Name Affidavit of Seller

Description

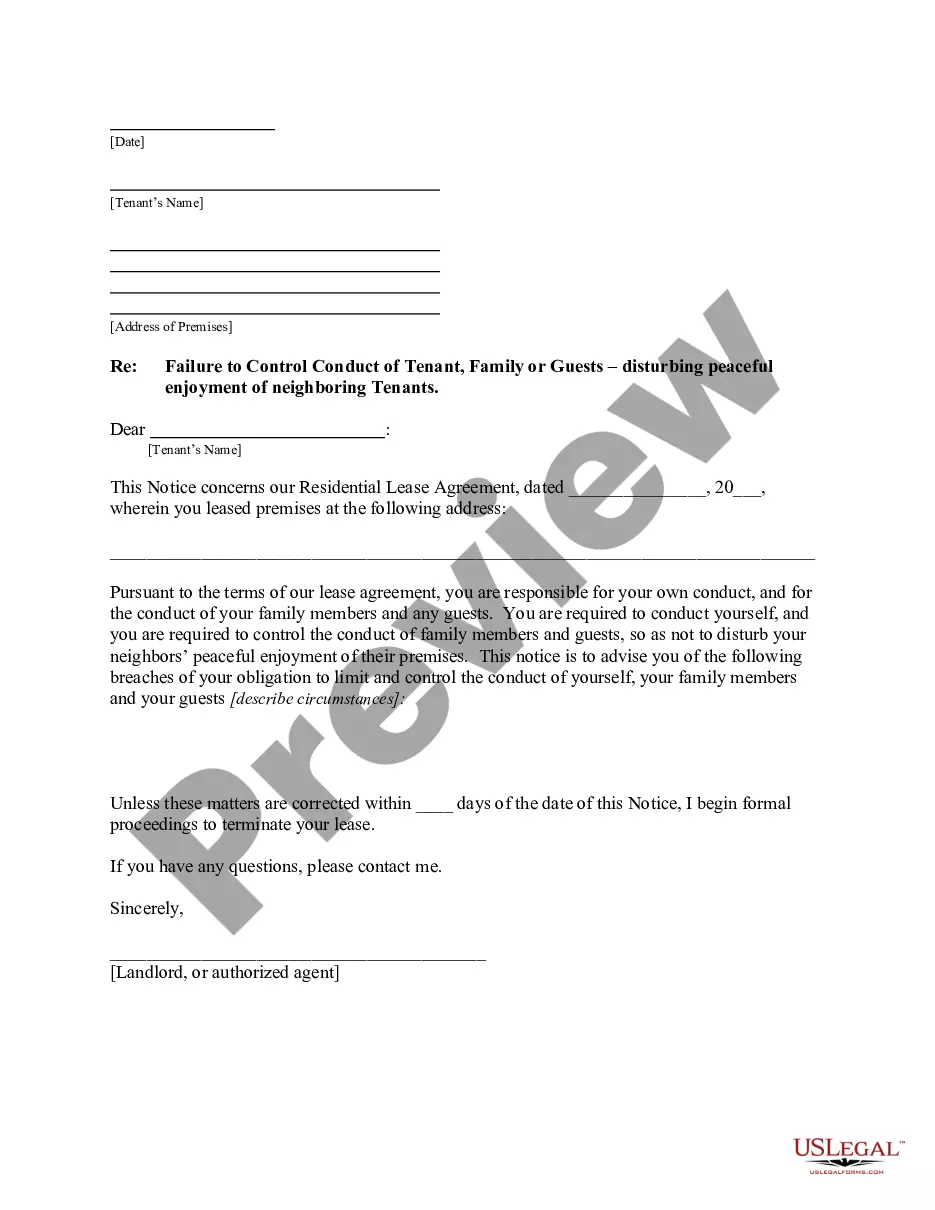

How to fill out Michigan Name Affidavit Of Seller?

Acquire any template from 85,000 legal documents, including the Michigan Name Affidavit of Seller online through US Legal Forms. Each template is crafted and updated by state-certified legal experts.

If you already hold a subscription, sign in. Once you land on the form's page, hit the Download button and navigate to My documents to retrieve it.

If you have not subscribed yet, follow the instructions below.

With US Legal Forms, you will consistently have immediate access to the correct downloadable template. The platform provides you with documents and categorizes them to simplify your search. Utilize US Legal Forms to acquire your Michigan Name Affidavit of Seller quickly and effortlessly.

- Verify the state-specific criteria for the Michigan Name Affidavit of Seller you intend to utilize.

- Examine the description and preview the template.

- Once you are assured that the sample meets your needs, simply click Buy Now.

- Select a subscription plan that fits your financial plan.

- Establish a personal account.

- Make payment in one of two convenient methods: via credit card or through PayPal.

- Choose a format to download the file in; you have two choices (PDF or Word).

- Download the document to the My documents section.

- After your reusable form is set, print it or save it to your device.

Form popularity

FAQ

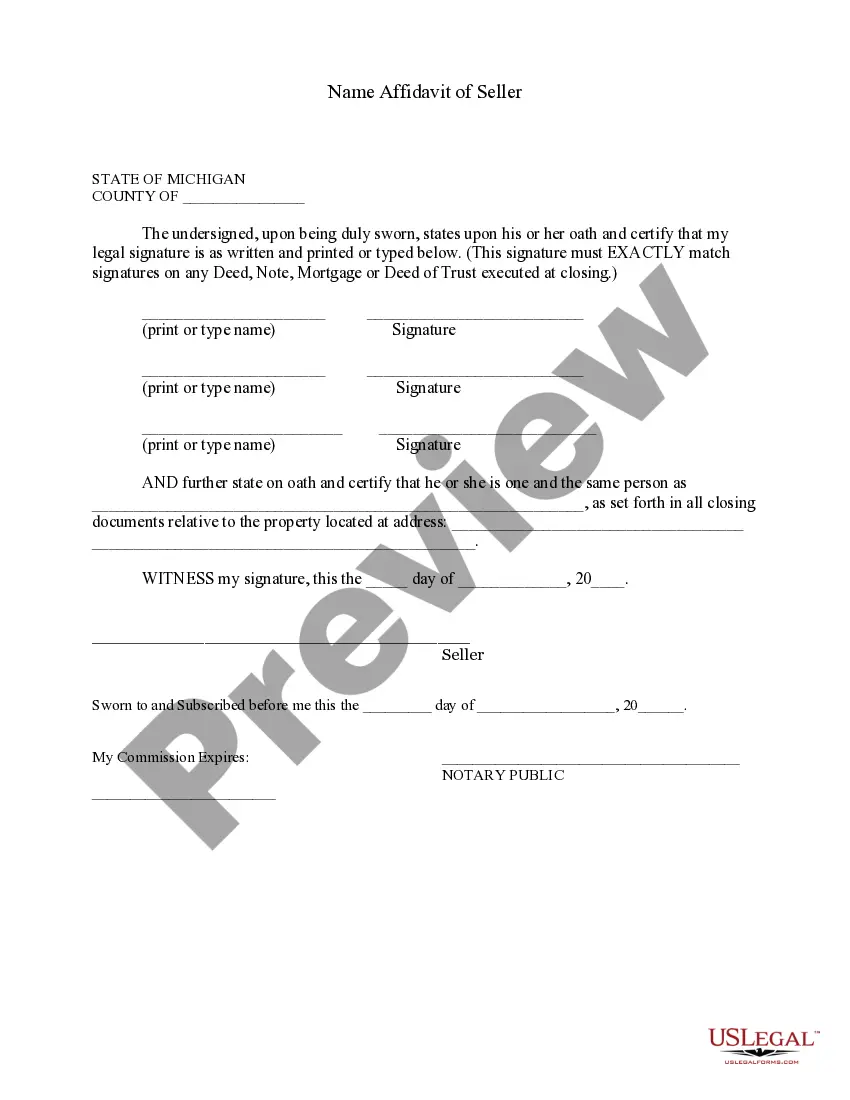

An affidavit of title for an estate is a legal declaration that confirms ownership and the status of the title for a property. It is often used to clear up uncertainties about ownership and potential liens when real estate transfers occur. When filing a Michigan Name Affidavit of Seller, including an affidavit of title can help safeguard the transaction by verifying that there are no hidden claims on the property. For comprehensive templates and guidance, check out US Legal Forms to simplify your process.

The processing time for an affidavit of affixture in Michigan can vary, typically taking around two to four weeks. Factors such as the completeness of your submitted paperwork and the workload of the local register of deeds can influence the timeline. If you use the Michigan Name Affidavit of Seller as part of your paperwork, ensure everything is accurately filled to avoid unnecessary delays. For more timely assistance, explore the resources available on US Legal Forms.

Yes, in Michigan, affidavits generally need to be notarized to ensure their legality. When you complete a Michigan Name Affidavit of Seller, having a notary public sign off on the document can provide an added layer of validity. This requirement helps prevent fraud and assures all parties that the information provided is truthful. Always consult with a legal expert or resource like US Legal Forms to ensure your documents comply with the latest laws.

Under certain circumstances, you can sell your vehicle without replacing a lost title if:there are no liens (bank loans) on the title record, or, if the record shows a lien, the seller brings a lien termination statement, and. a record of the current title is on the Secretary of State's computer system.

A Property Transfer Affidavit is a form that notifies the local taxing authority of a transfer of ownership of real estate.The law requires a new owner to file this within 45 days after a transfer of ownership.

In accordance with Michigan State Law, a Property Transfer Affidavit must be filed with the local assessor's office whenever real estate or some types of personal property transfer ownership (a transfer of ownership is generally defined as: a conveyance of title to, or present interest in, a property, including

Who has to file and/or pay earnings tax? All Kansas City, Missouri residents are required to pay the earnings tax, even if they work outside of the city. Non-residents are required to pay the earnings tax on income earned within Kansas City, Missouri city limits.

Find the most recent deed to the property. Create the new deed. Sign and notarize the deed. File the deed in the county land records.

Identify the donee or recipient. Discuss terms and conditions with that person. Complete a change of ownership form. Change the title on the deed. Hire a real estate attorney to prepare the deed. Notarize and file the deed.

Affidavit must be filed by the new owner with the assessor for the city or township where the property is located within 45 days of the transfer. The information on this form is NOT CONFIDENTIAL.