Michigan Group Self Insurer Notice of Termination for Workers' Compensation

Description

How to fill out Michigan Group Self Insurer Notice Of Termination For Workers' Compensation?

Access any template from 85,000 legal papers like the Michigan Group Self Insurer Termination Notice for Workers' Compensation online with US Legal Forms. All templates are crafted and revised by state-certified legal experts.

If you already have a membership, Log In. When you reach the form’s webpage, hit the Download button and navigate to My documents to retrieve it.

If you have yet to subscribe, follow the steps outlined below.

After your reusable template is prepared, print it out or store it on your device. With US Legal Forms, you will consistently have immediate access to the appropriate downloadable template. The platform provides you with documents and categorizes them to enhance your search. Utilize US Legal Forms to conveniently and swiftly acquire your Michigan Group Self Insurer Termination Notice for Workers' Compensation.

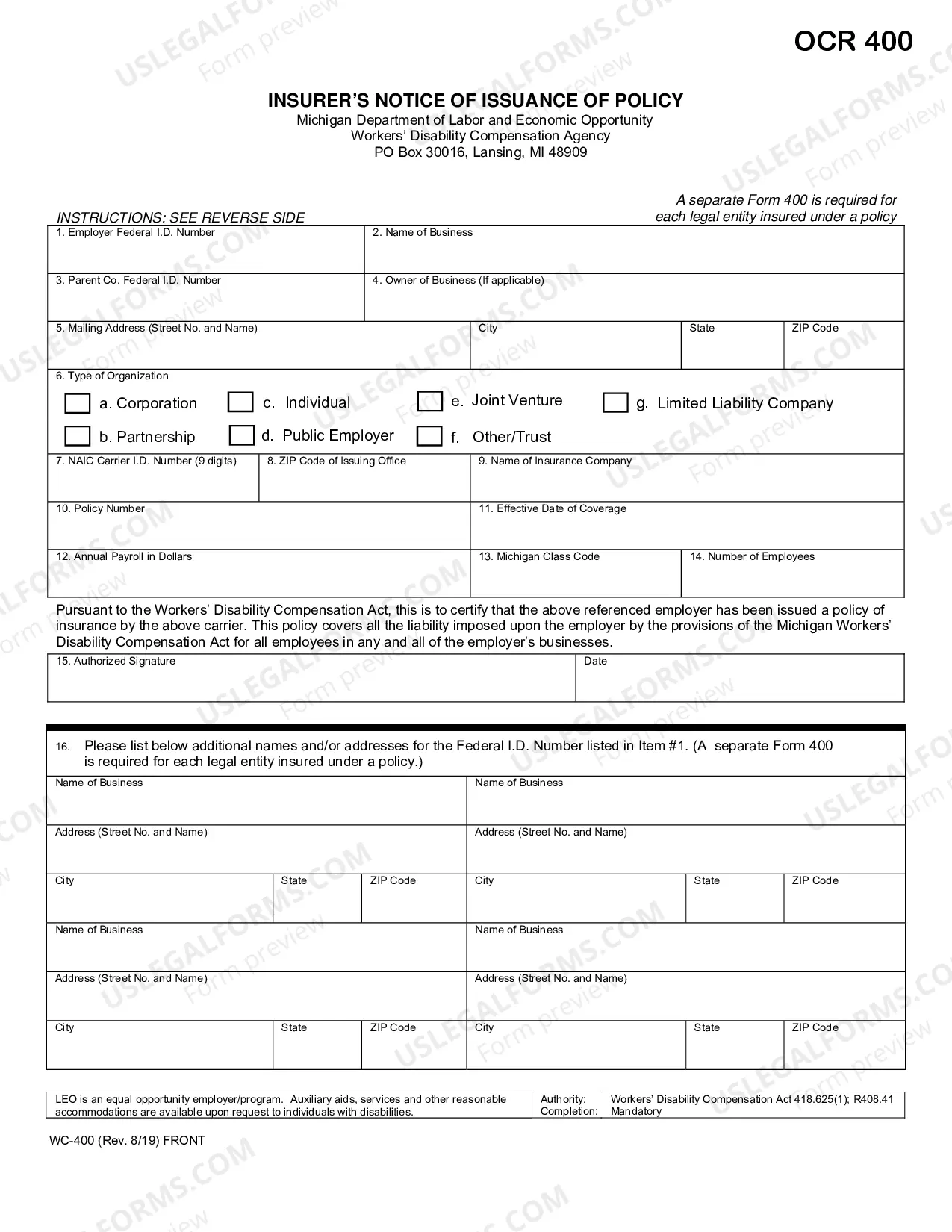

- Verify the state-specific criteria for the Michigan Group Self Insurer Termination Notice for Workers' Compensation you wish to use.

- Review the description and preview the sample.

- Once you’re confident the sample meets your needs, simply click Buy Now.

- Choose a subscription plan that suits your finances.

- Establish a personal account.

- Make a payment via either credit card or through PayPal.

- Choose a format to download the document in; two options are available (PDF or Word).

- Download the document to the My documents section.

Form popularity

FAQ

Workers' compensation statute of limitations in MichiganMichigan requires that a claim is made within two years of the date of injury.

Workers' compensation insurance gives your employees benefits if they get a work-related injury or illness. This type of insurance is required in most states, and employers are responsible for buying and providing it to their employees.

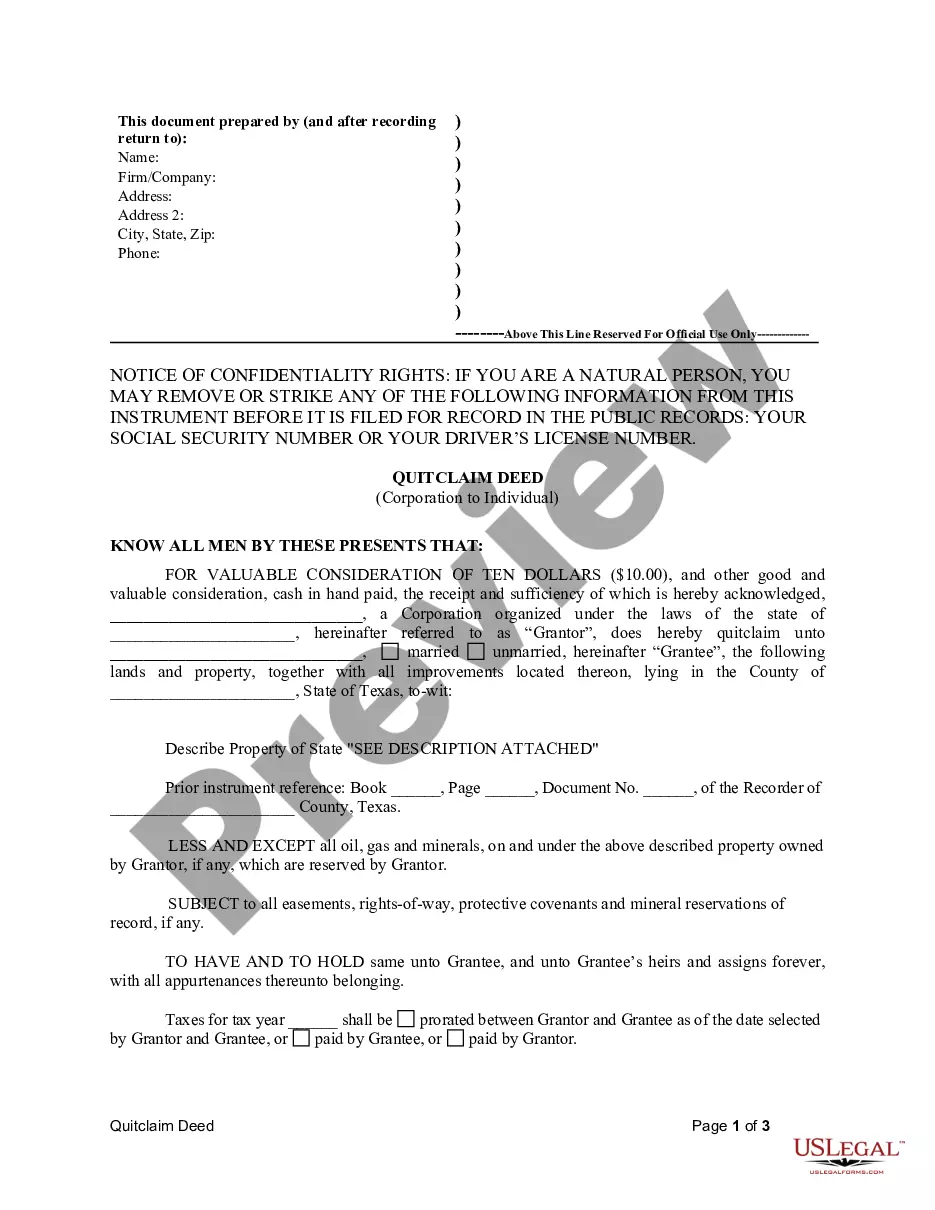

California is just one of many states which allow employers to self-insure workers compensation as long as the employer supports that self-insurance with a surety bond or other form of security.

In NSW, a worker for workers compensation purposes is 'a person who has entered into or works under a contract of service or a training contract with an employer2026'.If you are a small employer, your premium will not be impacted by the costs of your workers compensation claims.

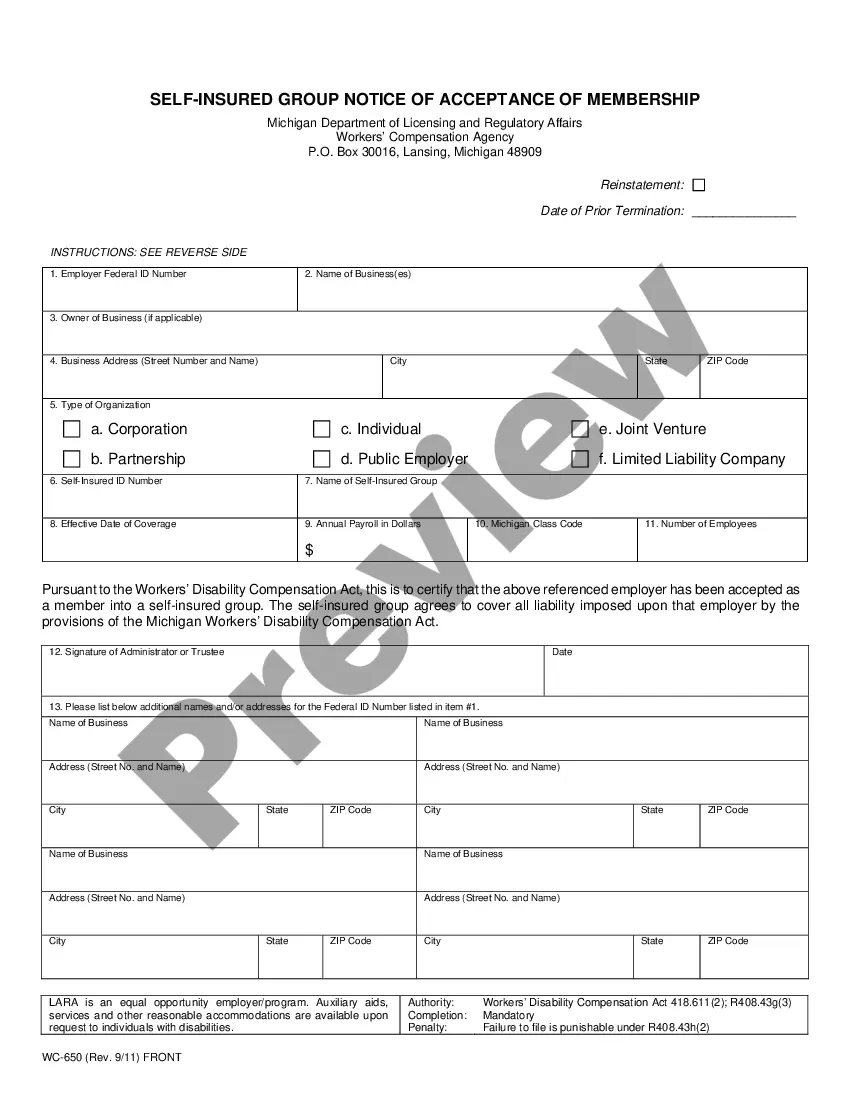

A self-insured Workers' Compensation plan (or a self-funded plan as it is also called) is one in which the employer assumes the financial risk for providing Workers' Compensation benefits to its employees.

Self-Insurer Licence - New South Wales This licence will allow you to manage your own workers' compensation claims instead of paying workers compensation premiums to a licensed insurer.Self-Insurance can provide: better work health and safety conditions. fair and equitable treatment.

Being self-insured means that rather than paying an insurance company to pay medical, dental and vision claims, we pay the claims ourselves, using a third-party administrator to process the claims on our behalf.The insurance coverage itself does not change.

No, you should not be using your personal health insurance to cover costs for injuries that should be covered under workers' compensation insurance. Unfortunately, some companies do not have your best interests at heart when you suffer from a workplace injury.

After you report your injury or illness, you'll usually have to file a workers' comp claim with the state workers' comp agency (although your employer may take care of this step in some states). The deadlines for filing claims are typically in the range of one to three years after the injury.