Michigan Worker Settlement Statement for Workers' Compensation

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Michigan Worker Settlement Statement For Workers' Compensation?

Access a variety of approximately 85,000 lawful documents including the Michigan Worker Settlement Statement for Workers' Compensation online through US Legal Forms. All templates are crafted and regularly updated by licensed lawyers recognized by the state.

If you currently hold a subscription, Log In. Once you reach the form's page, click on the Download button and head over to My documents to retrieve it.

If you have not yet subscribed, please follow these steps.

With US Legal Forms, you will consistently have prompt access to the needed downloadable template. The service offers access to various documents and categorizes them to facilitate your search. Utilize US Legal Forms to quickly and easily obtain your Michigan Worker Settlement Statement for Workers' Compensation.

- Verify the specific state requirements for the Michigan Worker Settlement Statement for Workers' Compensation that you intend to utilize.

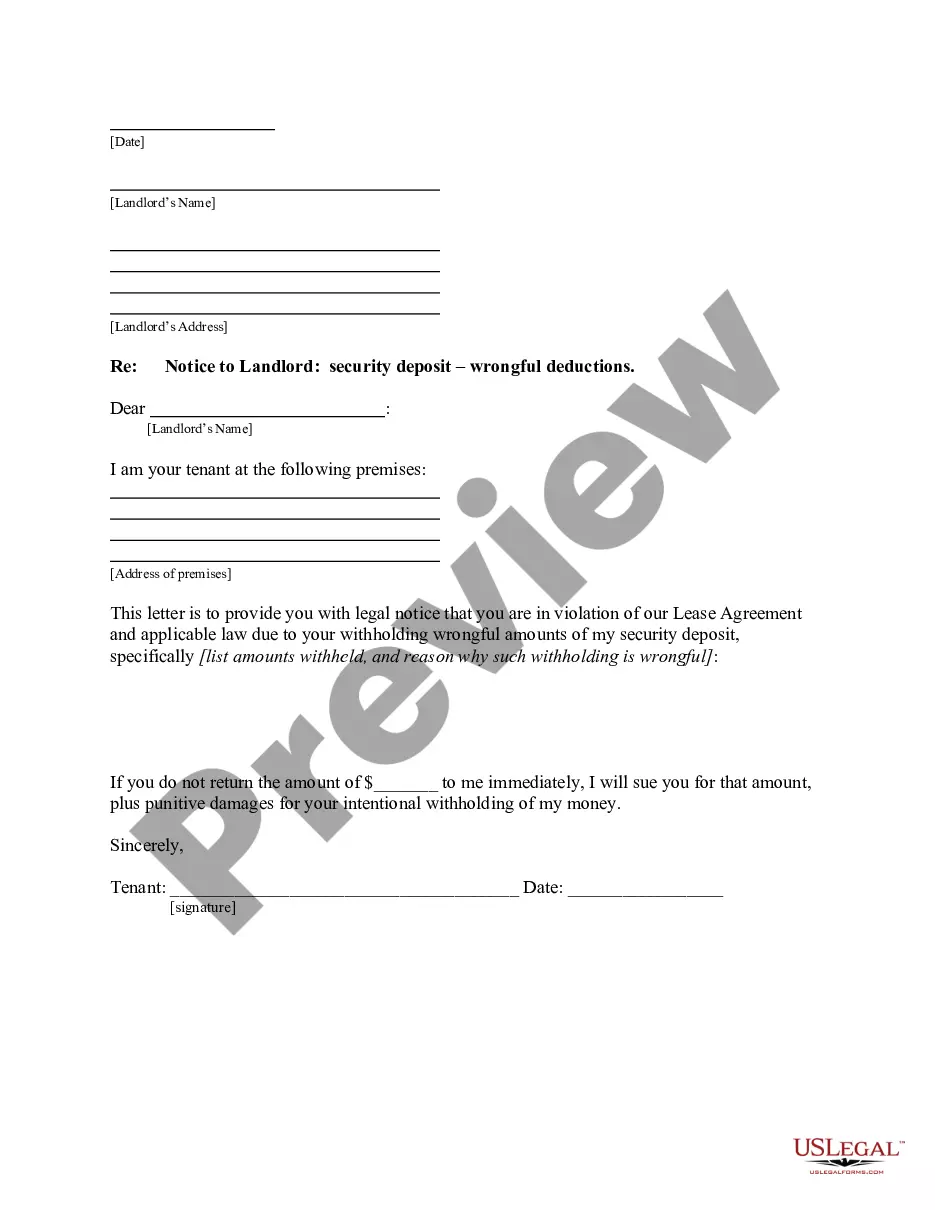

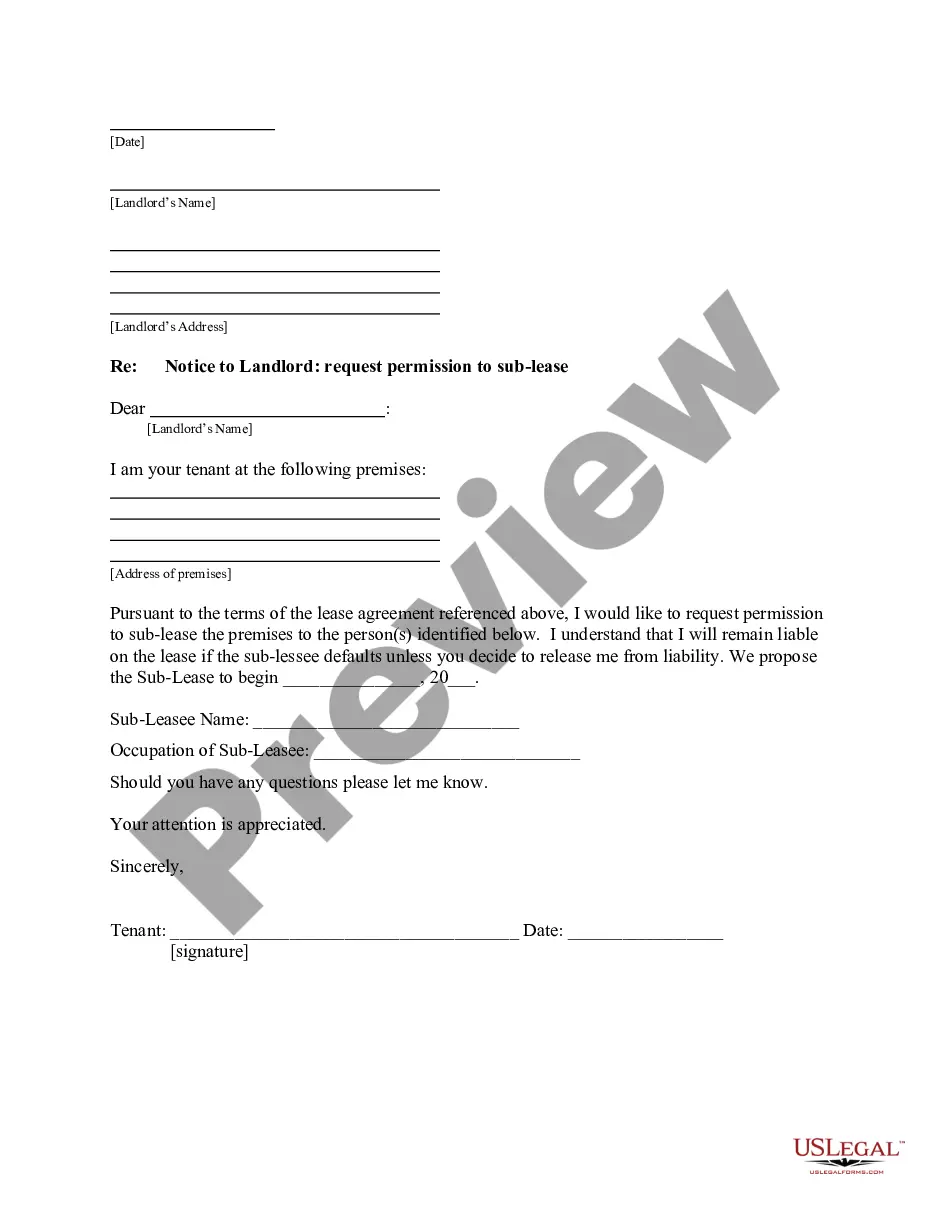

- Browse through the details and examine the sample preview.

- Once you are assured that the sample meets your needs, simply select Buy Now.

- Choose a subscription plan that fits your financial situation.

- Establish a personal account.

- Complete the payment using one of two suitable options: credit card or via PayPal.

- Select a format to download the document in; two choices are available (PDF or Word).

- Save the document in the My documents section.

- After downloading your reusable form, either print it out or store it on your device.

Form popularity

FAQ

Taxability of Workers' Compensation BenefitsWorkers' compensation benefits do not qualify as taxable income at the state or federal level. Lump sum settlements from workers' compensation cases do not count as taxable income either. Usually, workers' compensation benefits will not affect your tax return.

There are a variety of factors that go into how much an employee gets in a workers comp settlement. Overall, the average employee gets around $20,000 for their payout. The typical range is anywhere from $2,000 to $40,000.

Any change in the amount of these benefits is likely to affect the amount of your Social Security benefits. If you get a lump-sum workers' compensation or other disability payment in addition to, or instead of a monthly benefit, the amount of the Social Security benefits you and your family receive may be affected.

If you've been injured as a result of your work, you should be able to collect workers compensation benefits.Your employer or its workers' comp insurance company does not have to agree to settle your claim, and you do not have to agree with a settlement offer proposed by your employer or its insurance company.

Get your weekly disability check started, if you're not receiving it already. Maximize your weekly benefit check. Report all super-added injuries. Seek psychological care, when appropriate. Seek pain management care, when appropriate. Don't refuse medical procedures. Be very careful what you tell the doctor.

The IRS is authorized to levy, or garnish, a substantial portion of your wages; to seize real and personal property you own, such as your home and your automobiles and even take money that's owed to you. However, the IRS cannot take your workers' compensation settlement for several reasons.

For the most part, the answer is no. Worker's compensation benefits in California are considered non-taxable income.Death benefits paid to survivors in the event of a work-related fatality are also tax-exempt.

Settlements paid in a workers' compensation case are not taxed. If, however, you take a large settlement in a lump sum and invest the money on your own, all of the earnings on the money are taxed.In short, you get a better return on the money because of the tax-free benefit.

Always ask what the net amount will be after deducting lawyers' fees. A good California Workers' Compensation attorney should make sure that all medical expenses for your treatment are taken care of by the insurance company either prior to settlement or included in the settlement. You should not owe anyone.