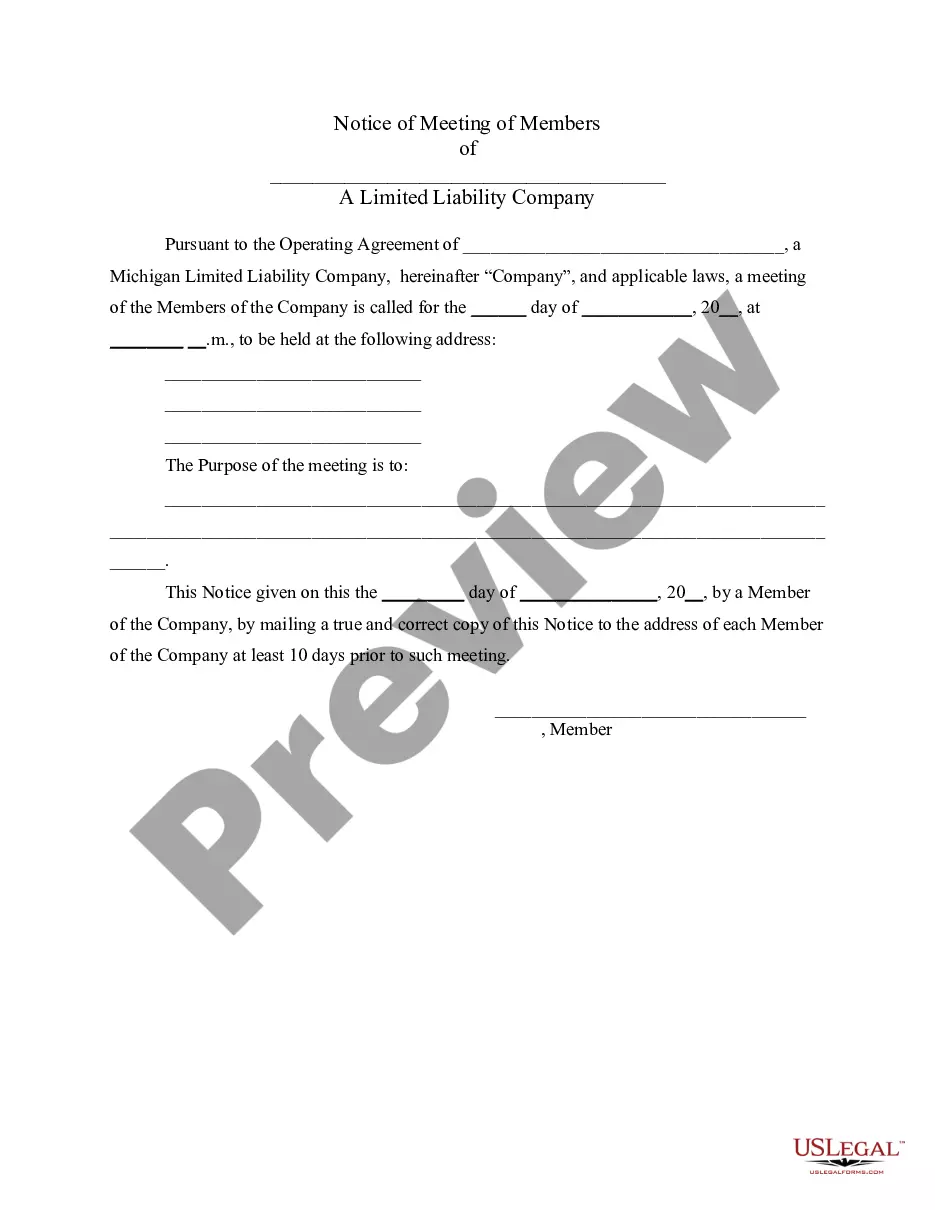

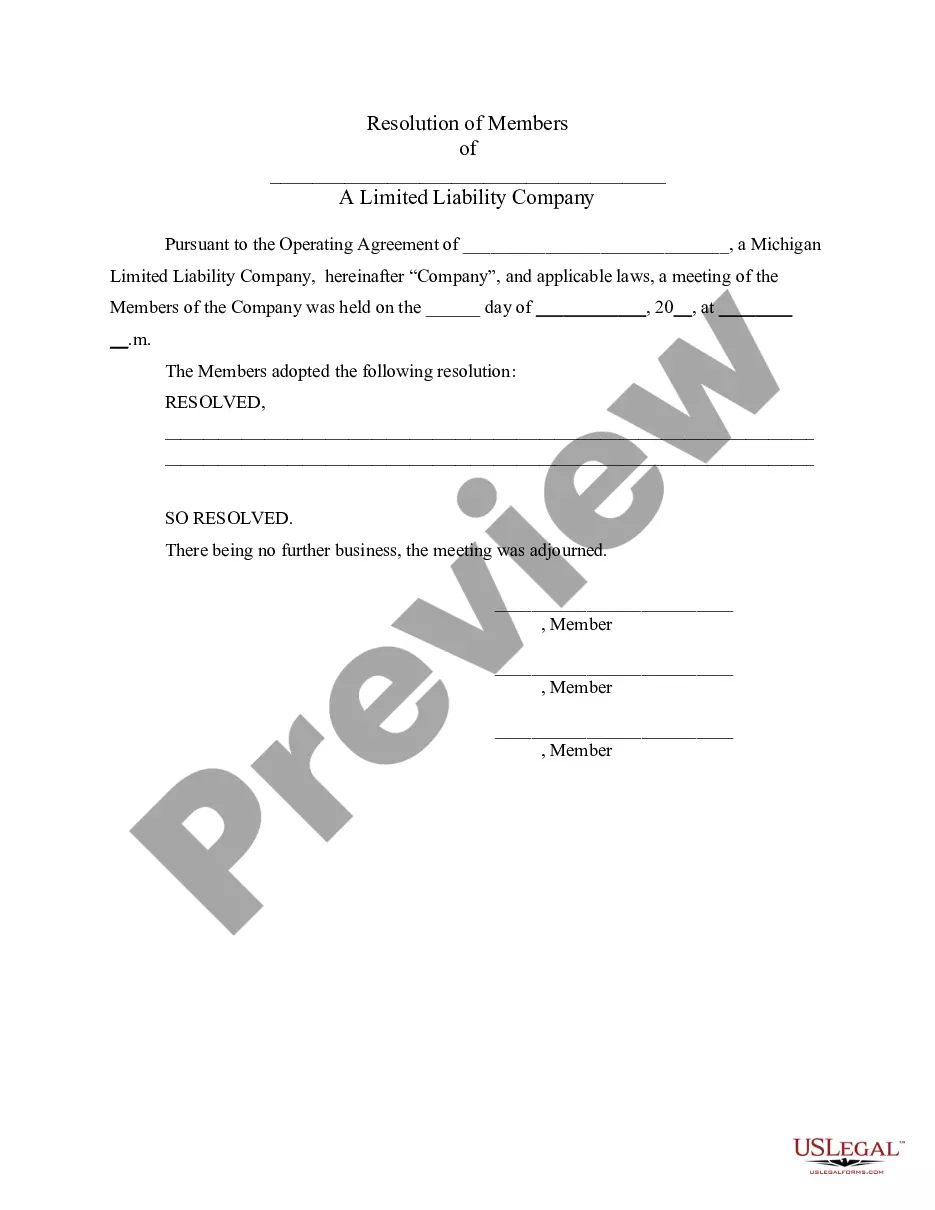

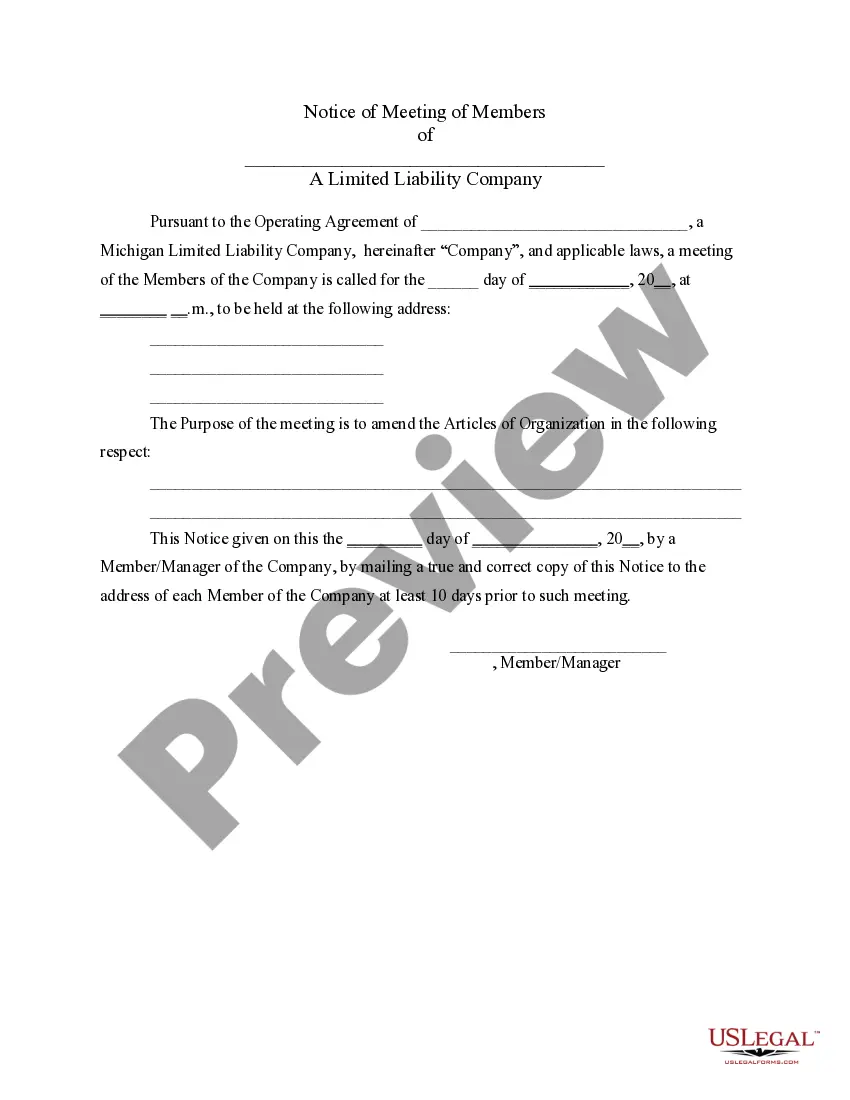

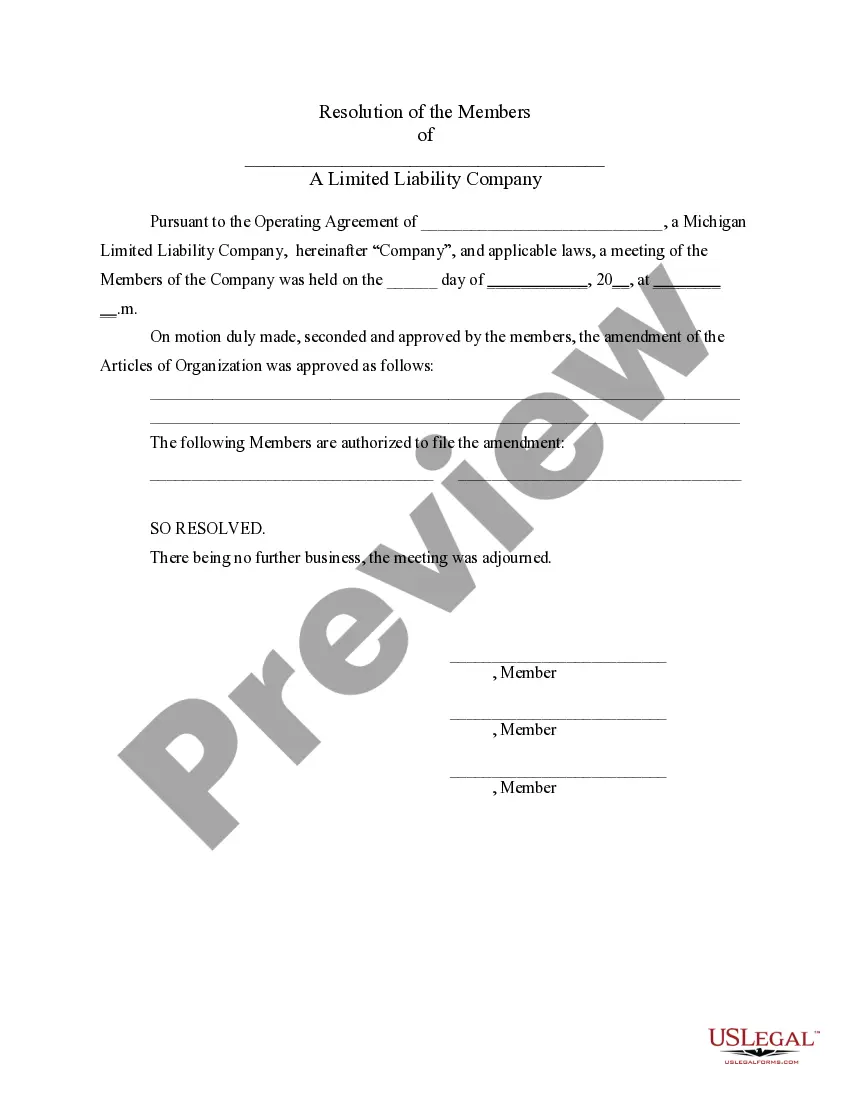

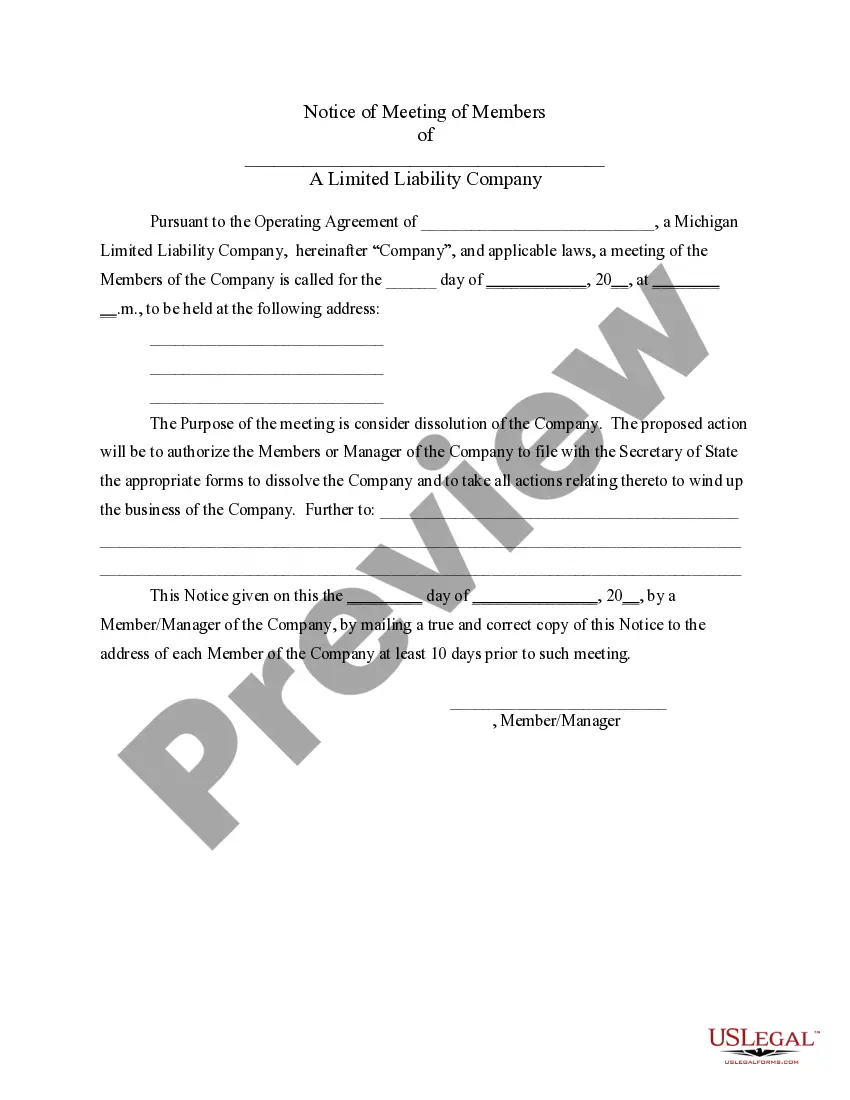

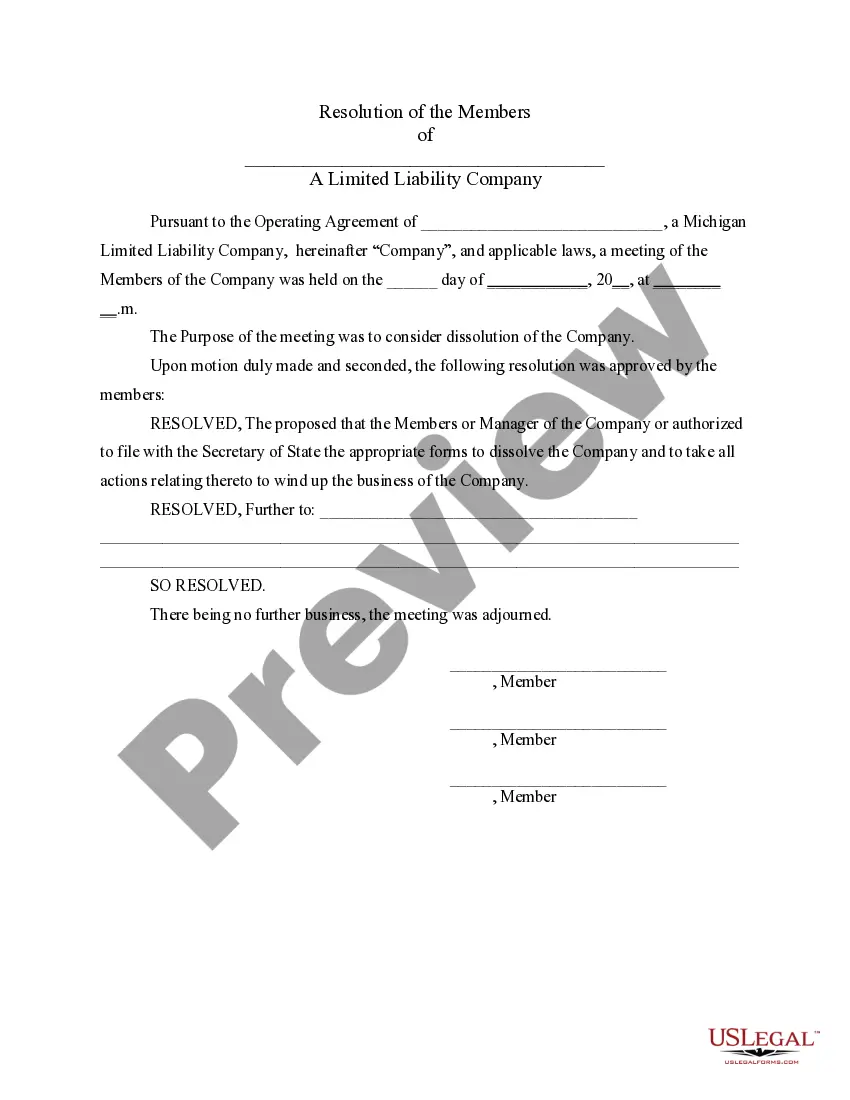

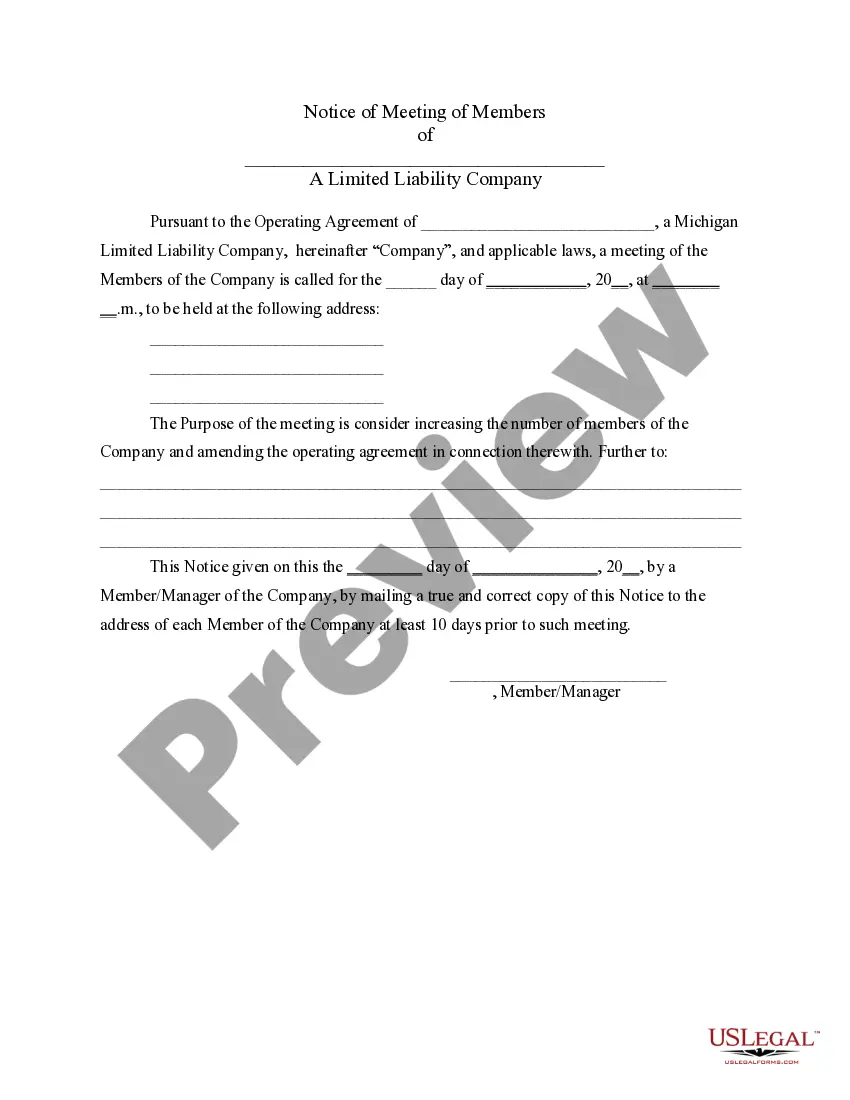

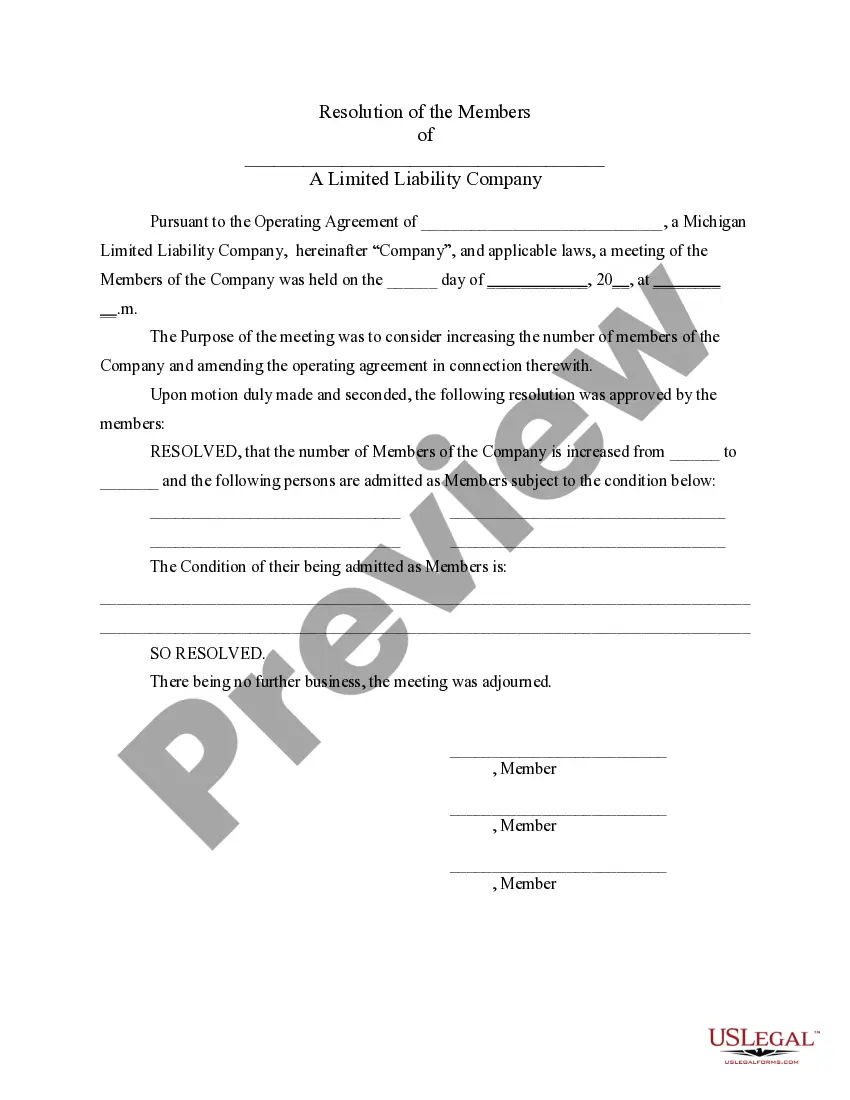

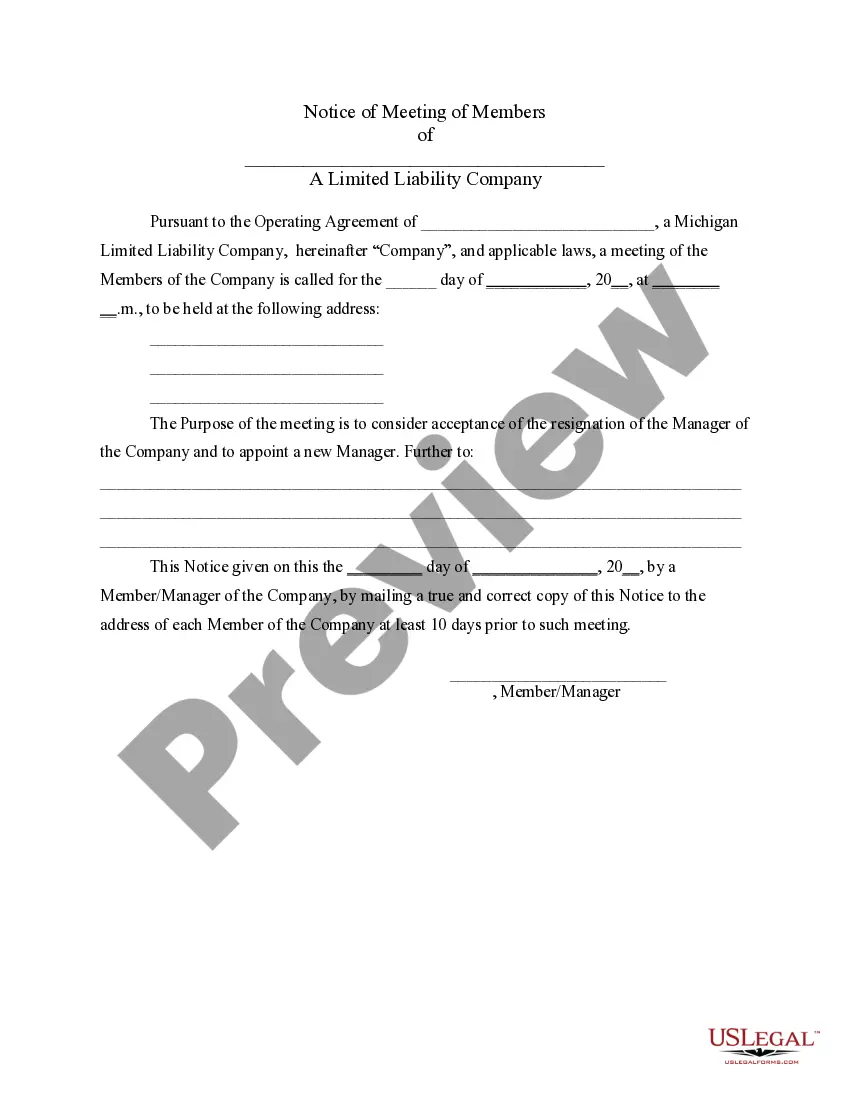

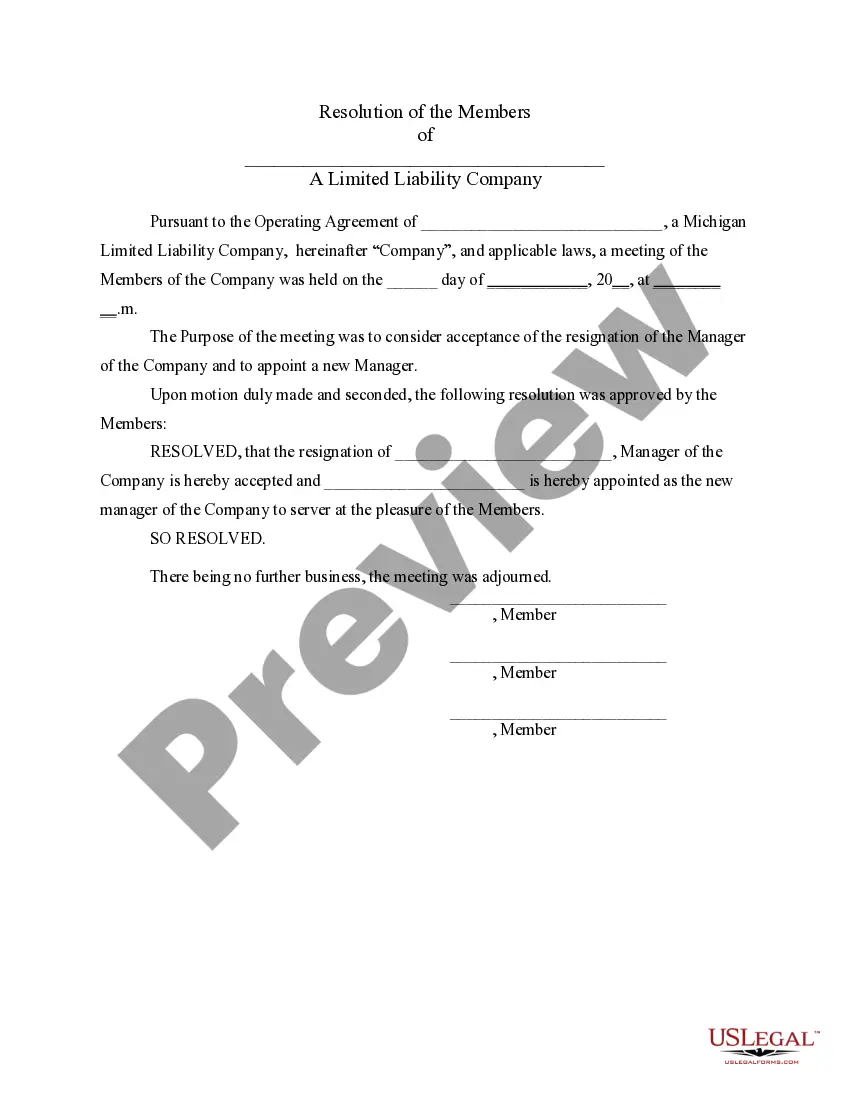

Michigan LLC Notices, Resolutions and other Operations Forms Package

Description

How to fill out Michigan LLC Notices, Resolutions And Other Operations Forms Package?

Access any template from 85,000 legal documents including Michigan LLC Notifications, Resolutions, and other Operations Forms Package online with US Legal Forms. Each template is crafted and revised by state-certified attorneys.

If you possess a subscription, Log In. Once you’re on the page of the form, click the Download button and navigate to My documents to retrieve it.

If you haven’t subscribed yet, follow the guidelines below.

After your reusable form is prepared, print it or save it to your device. With US Legal Forms, you will consistently have fast access to the appropriate downloadable template. The platform grants you access to documents and categorizes them to ease your search. Utilize US Legal Forms to acquire your Michigan LLC Notifications, Resolutions, and other Operations Forms Package swiftly and conveniently.

- Verify the state-specific prerequisites for the Michigan LLC Notifications, Resolutions, and other Operations Forms Package you intend to utilize.

- Review the description and preview the template.

- Once you are confident that the sample meets your requirements, click Buy Now.

- Select a subscription plan that aligns with your financial means.

- Establish a personal account.

- Complete payment through one of the two available methods: credit card or PayPal.

- Choose a format to download the document; two options are available (PDF or Word).

- Download the document to the My documents section.

Form popularity

FAQ

The least expensive way to form your LLC is filing the forms yourself, although it will depend on the filing fees in your state. Incorporation statements for LLCs are typically the Articles of Organization.

Choose a Name for Your LLC. Appoint a Registered Agent. File Articles of Organization. Prepare an Operating Agreement. Comply With Other Tax and Regulatory Requirements. File Annual Statements.

How much does it cost to form an LLC in Michigan? The Michigan Department of Licensing and Regulatory Affairs charges $50 for regular service and $100 for priority rush filing. It will cost $25 to file a name reservation application, if you wish to reserve your LLC name prior to filing the Articles of Organization.

Option 1: File your Articles of Organization on the Michigan Department of Licensing and Regulatory Affairs website. Select 700 - Articles of Organization under Domestic Limited Liability Company and fill out the required fields.

State LLC taxes and feeMichigan taxes LLC profits the same way as the IRS: the LLC's owners pay taxes to the state on their personal tax returns. The LLC itself does not pay a state tax, but Michigan does require LLCs to file an annual report, due February 15 each year, with a filing fee of $25.

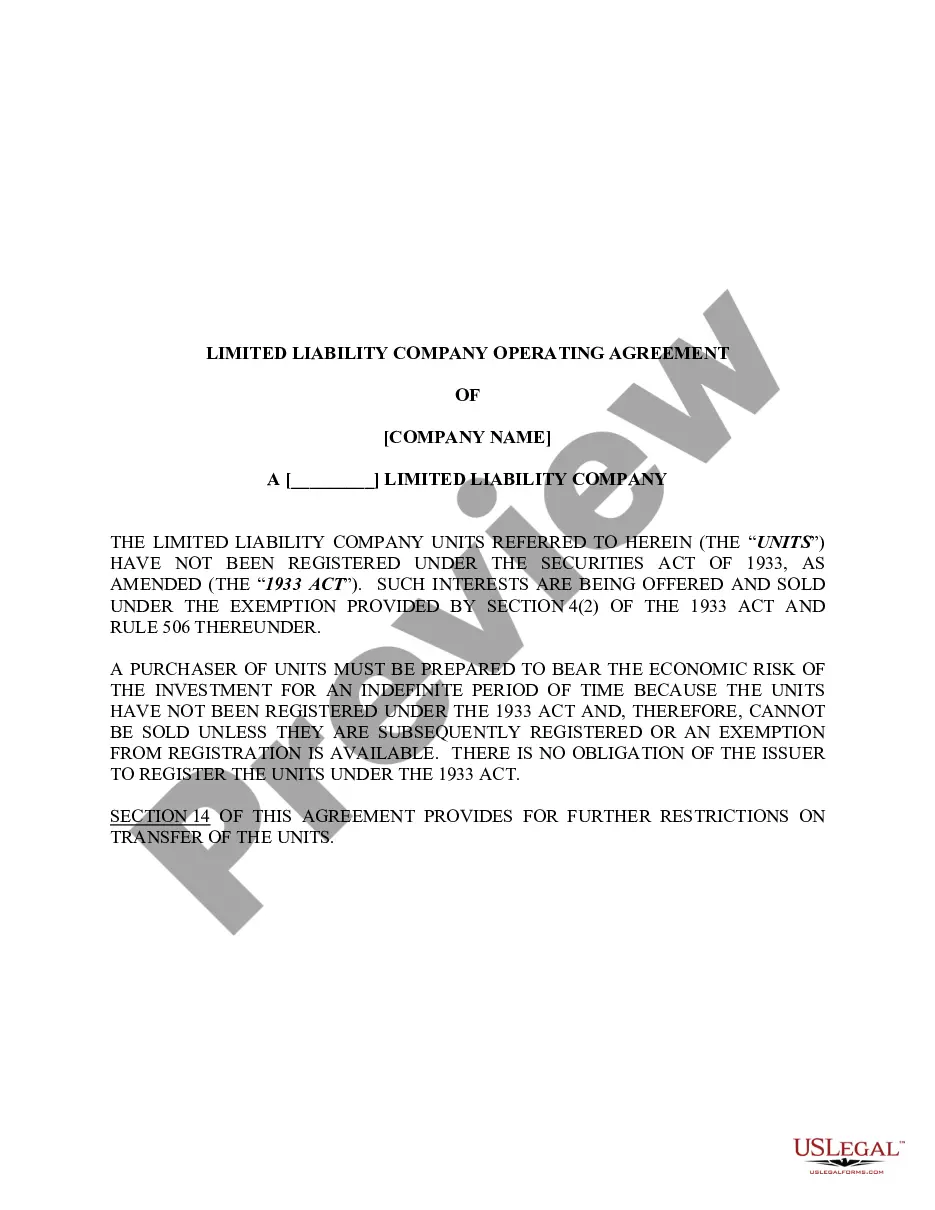

Michigan does not require an operating agreement in order to form an LLC, but executing one is highly advisable.The operating agreement does not need to be filed with the state. Please see the Operating Agreement page for details.

When you form a corporation or LLC, you need to pay a one-time filing fee to the state's secretary of state office. Arkansas, Colorado, Hawaii, Iowa, Oklahoma and Mississippi all boast the lowest corporation formation fee at $50. It costs $310 to incorporate in Texas.

The usual processing time for LLC documents and filings is between three to five working days. Expedited services are available.

Filing the LLC Renewal Form You can file by mail if you include a check or money order, or you can file in person using a check, money order, or credit card featuring either the VISA or MasterCard logo. If you file by mail, be sure to add your corporation name and ID number and make it out to the State of Michigan.