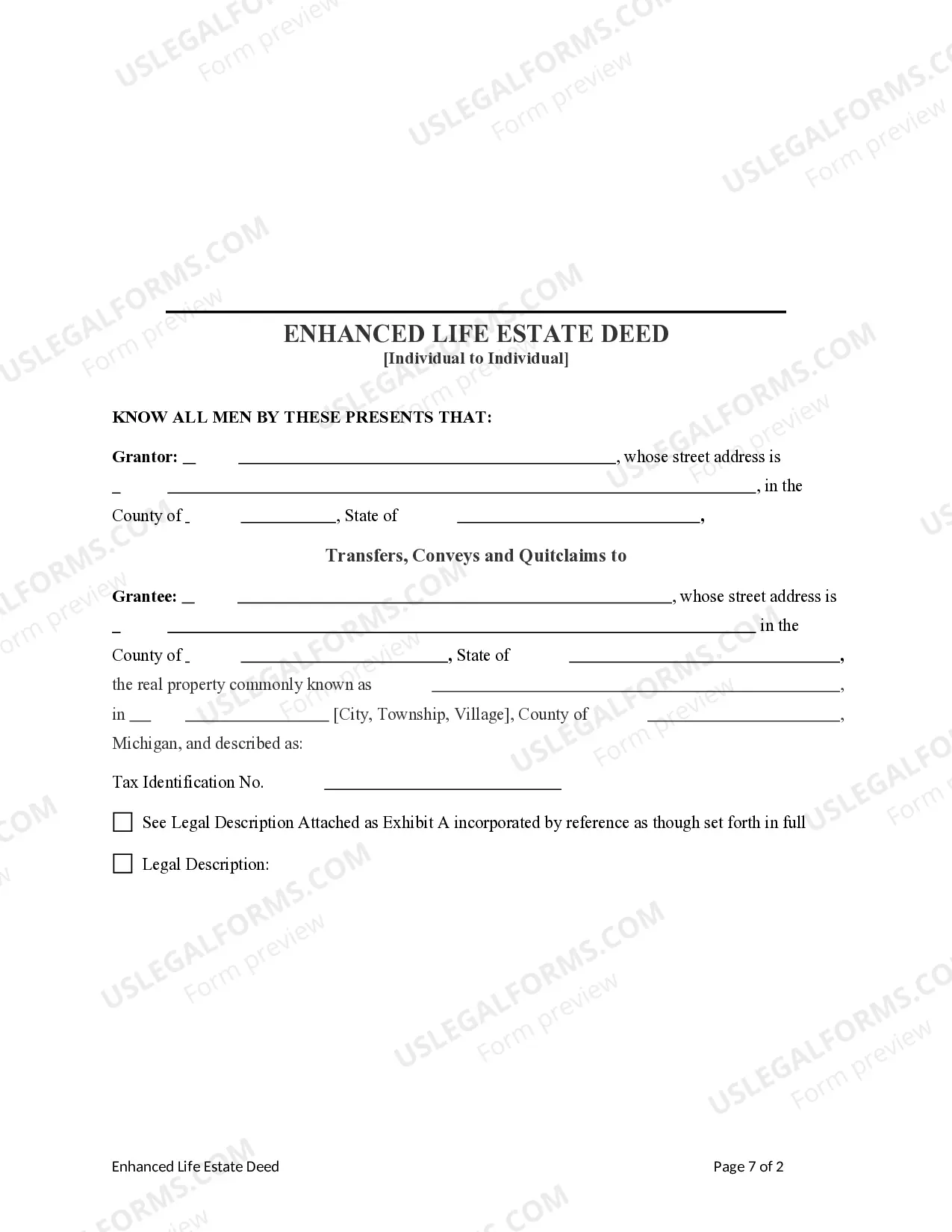

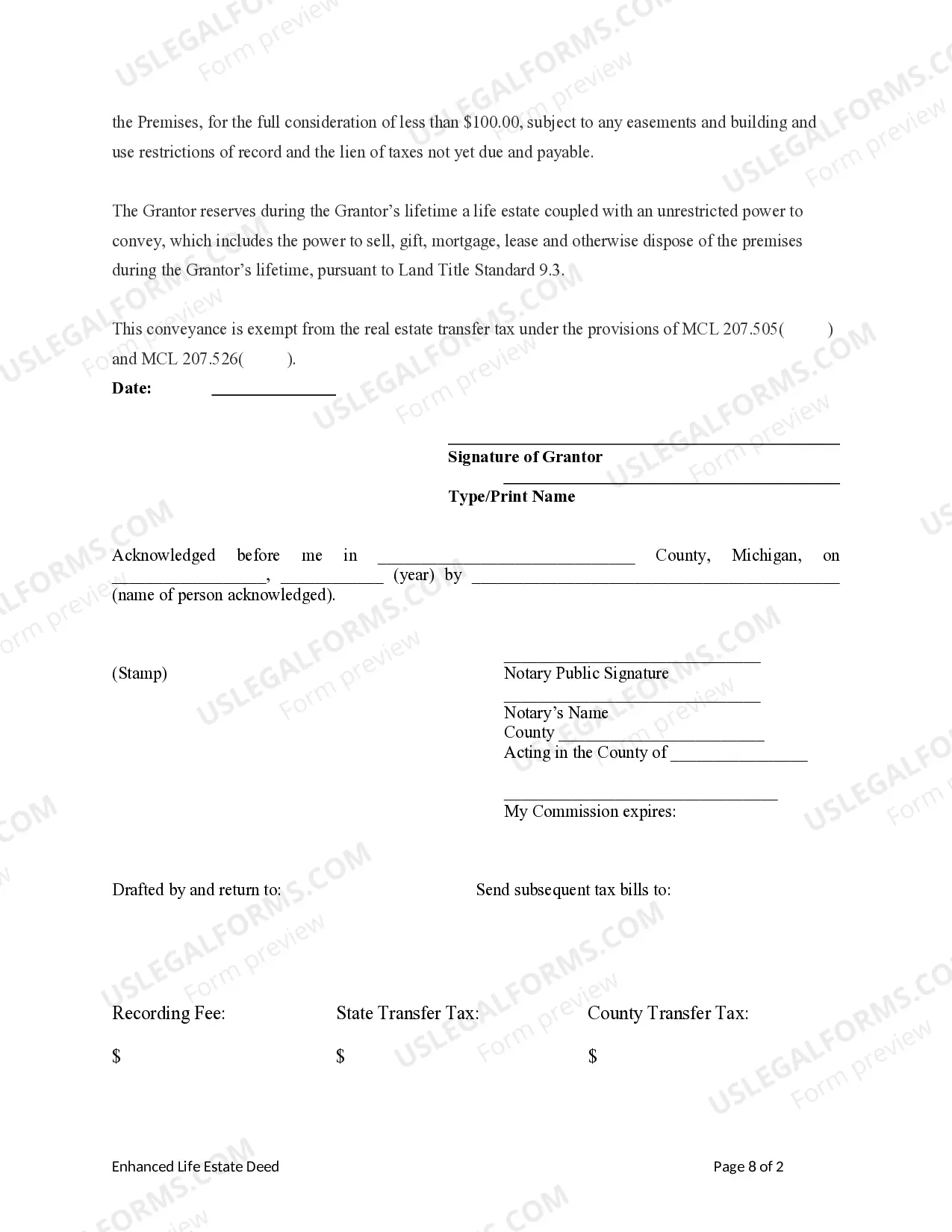

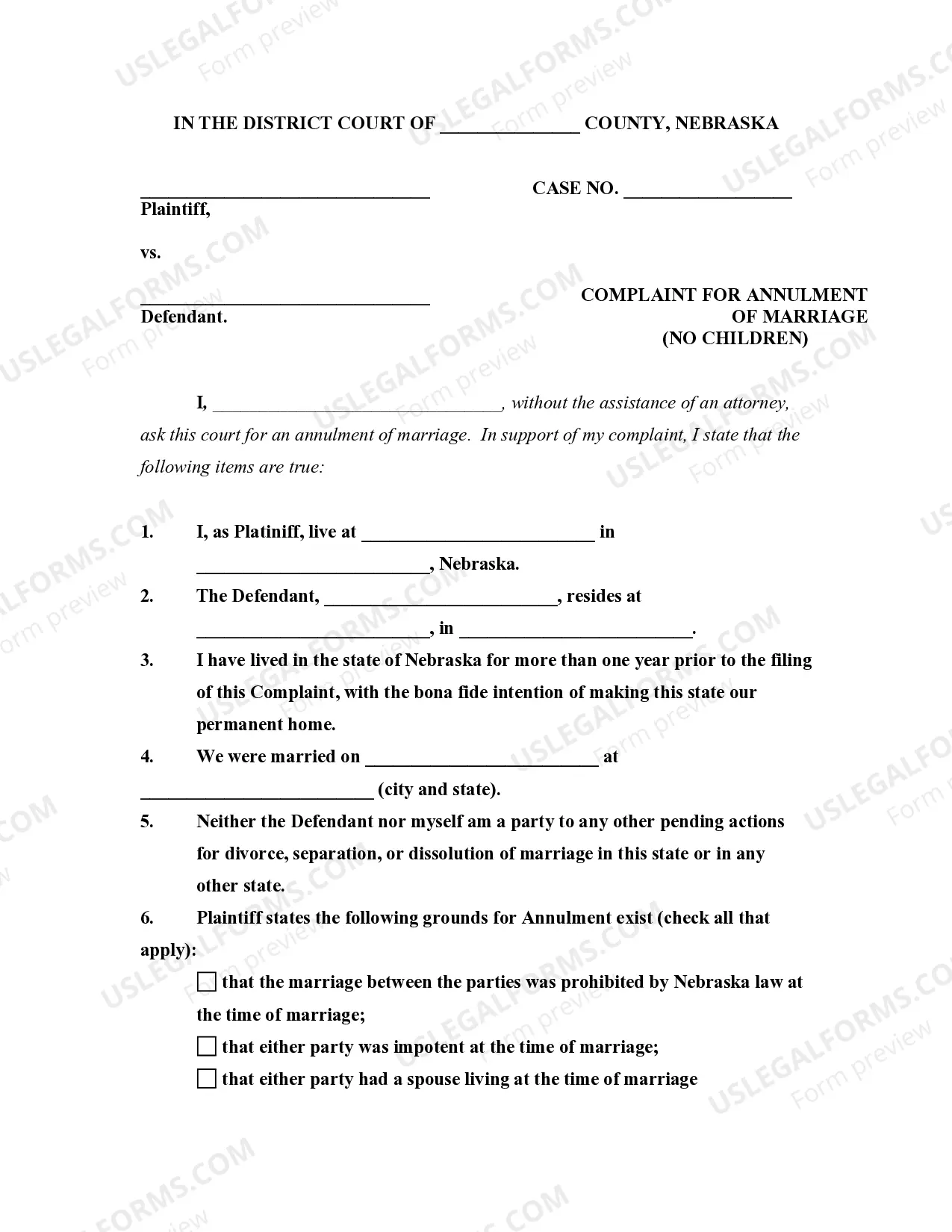

This form is a Quitclaim Deed with a retained Enhanced Life Estate where the Grantor is an individual and the Grantee is an individual. It is also known as a "Lady Bird" Deed. Grantor conveys the property to Grantee subject to an enhanced retained life estate. The Grantor retains the right to sell, encumber, mortgage or otherwise impair the interest Grantee might receive in the future, without joinder or notice to Grantee, with the exception of the right to transfer the property by will. This deed complies with all state statutory laws.

Michigan Enhanced Life Estate or Lady Bird Deed - Individual to Individual

Description

Key Concepts & Definitions

Enhanced life estate deed, often called Lady Bird Deed, is a legal document that modifies a life estate to give the life tenant—often the property owner—enhanced controls. Unlike a regular life estate, the enhanced version allows the property owner to retain the right to sell or mortgage the property without beneficiary consent. This tool is crucial for estate planning and can help in safeguarding assets, particularly in regard to Medicaid benefits and nursing home cost planning.

Step-by-Step Guide

- Consult with an estate planning attorney to discuss your situation and whether an enhanced life estate deed is suitable.

- Identify the beneficiary who will receive the property upon your passing.

- Have your attorney draft the Lady Bird Deed including all necessary legalese to ensure legality and effectiveness.

- Execute the deed in the presence of necessary parties, such as a notary.

- Record the deed at your local county recorder's office to make it official.

Risk Analysis

Using an enhanced life estate or Lady Bird deed carries certain risks:

- Medicaid Lookback: Although generally exempt, improper timing or execution could affect Medicaid eligibility.

- Property Claims: Future creditors of the life tenant may place claims on the property.

- Market Limitations: Some buyers and lenders are wary of properties transferred under Lady Bird deeds due to their complexity and uncommon nature.

Key Takeaways

Considerations: An enhanced life estate deed is a powerful tool for estate planning, offering flexibility and protection.

Benefits: It allows the property owner increased control over their property versus traditional life estates and helps in asset protection pertaining to Medicaid planning.

Consultation Needed: Always consult with a qualified attorney to ensure compliance with state laws and personal needs.

How to fill out Michigan Enhanced Life Estate Or Lady Bird Deed - Individual To Individual?

Obtain any template from 85,000 legal documents like Michigan Enhanced Life Estate or Lady Bird Deed - Individual to Individual online with US Legal Forms. Each template is prepared and revised by state-certified attorneys.

If you already possess a subscription, Log In. Once you're on the form's page, hit the Download button and navigate to My documents to gain access to it.

If you have not subscribed yet, follow the guidance provided below.

Once your reusable form is ready, print it out or save it to your device. With US Legal Forms, you will always have immediate access to the suitable downloadable template. The platform will provide you with access to forms and categorize them to simplify your search. Utilize US Legal Forms to obtain your Michigan Enhanced Life Estate or Lady Bird Deed - Individual to Individual quickly and effortlessly.

- Verify the state-specific prerequisites for the Michigan Enhanced Life Estate or Lady Bird Deed - Individual to Individual that you wish to employ.

- Examine the description and view the template.

- When you're certain the example is what you require, simply click Buy Now.

- Choose a subscription plan that aligns with your budget.

- Establish a personal account.

- Make payment using one of two convenient methods: by credit card or through PayPal.

- Select a format to download the document in; two options are available (PDF or Word).

- Download the document to the My documents section.

Form popularity

FAQ

Avoid probate of the property. keep the right to use and profit from the property for your lifetime. keep the right to sell the property at any time. avoid making a gift that might be subject to federal gift tax. avoid jeopardizing your eligibility for Medicaid.

This right to rescind is what distinguishes a Lady Bird Deed from a standard Life Estate Deed.A properly written, signed and filed Enhanced Life Estate Deed does supersede the terms of the owner's Will, so long as the grantor has not exercised the retained right to reclaim ownership while living.

A Lady Bird deed avoids probate, so the home is not part of the probate estate and Medicaid cannot go after it.

Using a Lady Bird Deed in Michigan allows you to retain control of your property during your lifetime, meaning that you can still sell or mortgage your property at any time if you want.Once you pass, your tax basis in the property will step up to its value at death.

It only applies to residential properties and must be promptly recorded after it is notarized. This document is exempt from documentary transfer tax under Rev. & Tax. Code §11930.

While you can draft a Ladybird Deed on your own, it is always best to have something like this done by an experienced attorney. These are documents that need to be done correctly, or it can create additional issues for your loved ones.

The answer is yes. Parties to a transaction are always free to prepare their own deeds. If you do so, be sure your deed measures up to your state's legal regulations, to help avert any legal challenge to the deed later. Some deeds require more expertise than others.