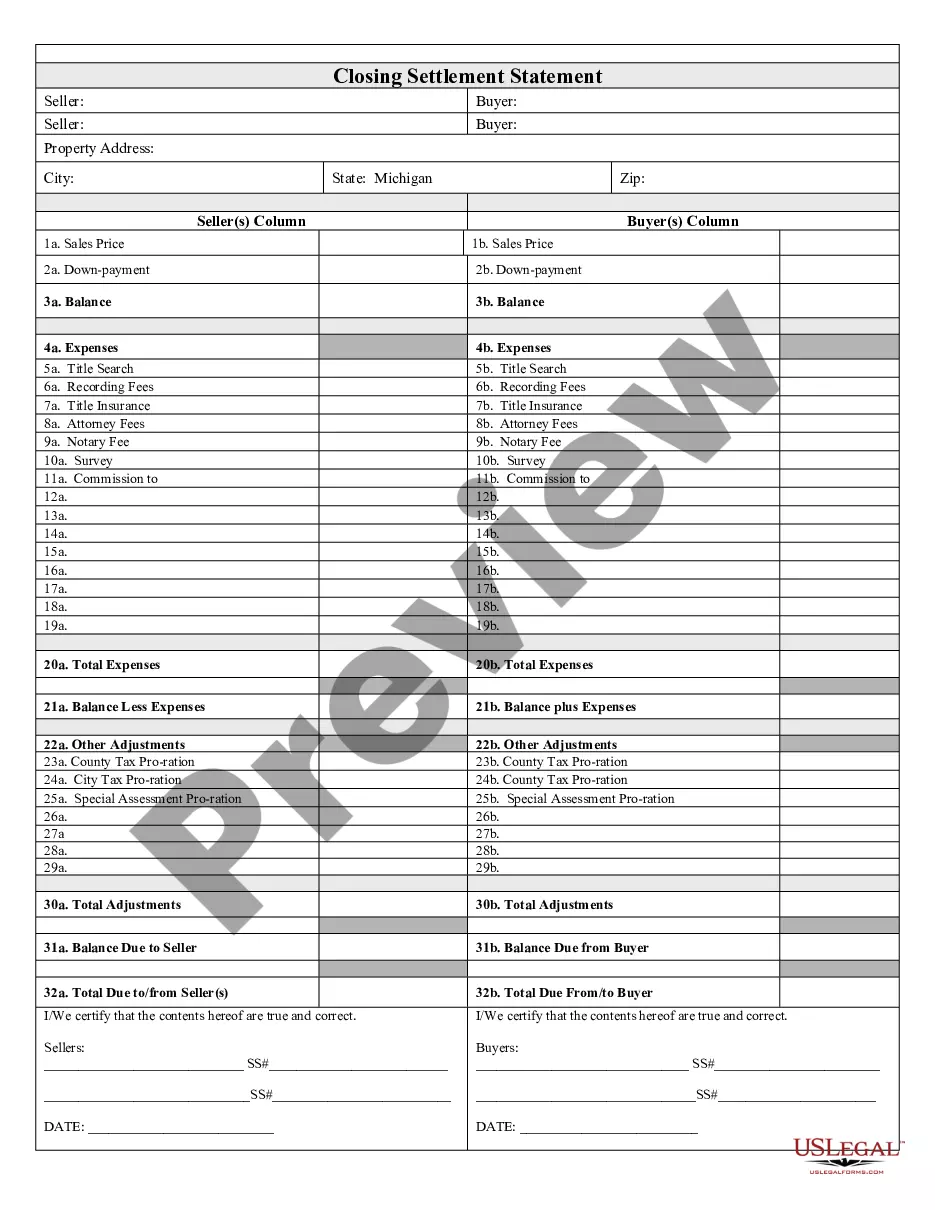

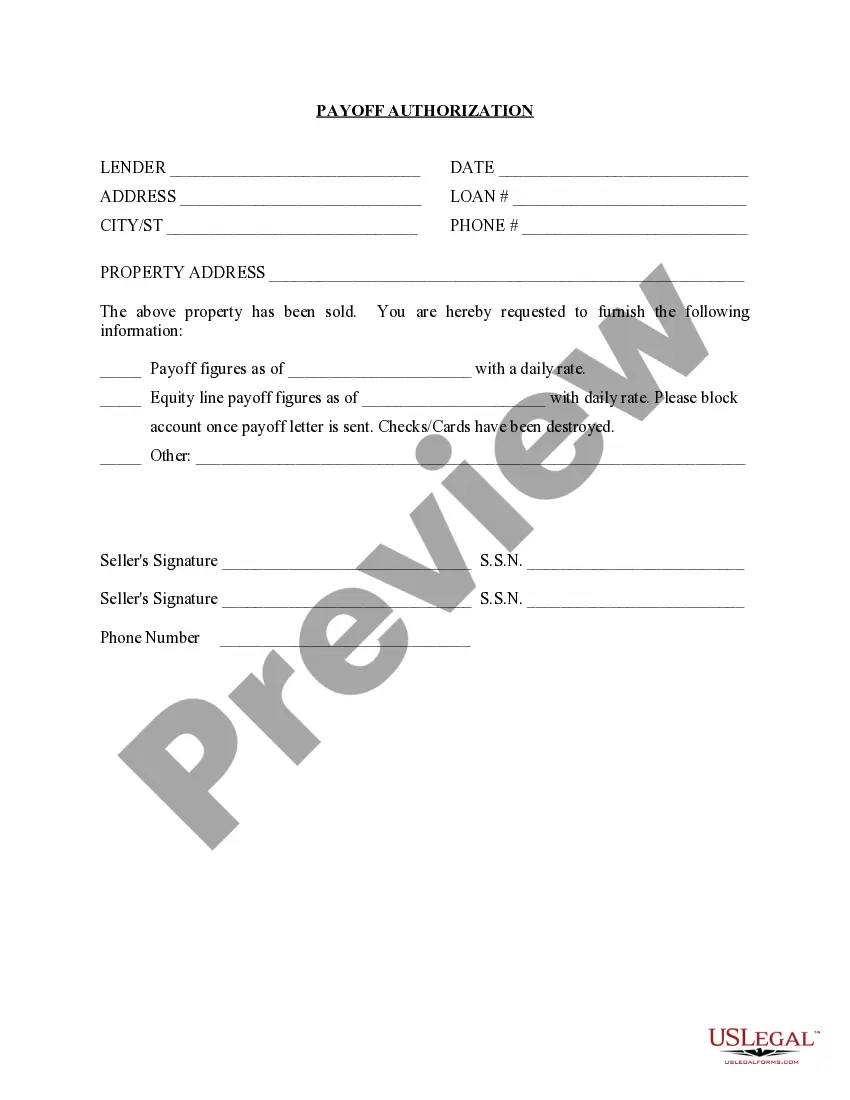

Michigan Payoff Authorization is a legal document used by a lender to transfer a mortgage loan from one party to another. It is commonly used when a borrower refinances their home loan or sells the property. The document authorizes the lender to disburse the remaining balance of the loan to the new lender or to the borrower. It is signed by the borrower, the lender, and the title company. There are two types of Michigan Payoff Authorization: an original Payoff Authorization and a Partial Payoff Authorization. The original Payoff Authorization is used when the borrower pays off the full balance of the loan, while the Partial Payoff Authorization is used when the borrower pays off a portion of the loan balance.

Michigan Payoff Authorization

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Michigan Payoff Authorization?

How much duration and resources do you typically allocate for creating formal documentation.

There’s a superior alternative to obtaining such forms rather than employing legal professionals or consuming hours searching online for an appropriate template.

One more benefit of our library is that you can retrieve previously acquired documents that you securely maintain in your profile under the My documents tab. Access them at any time and re-complete your paperwork as often as necessary.

Conserve time and effort finalizing official documents with US Legal Forms, one of the most reliable online services. Join us now!

- Review the form content to verify it aligns with your state regulations. To accomplish this, examine the form description or utilize the Preview option.

- If your legal template does not fulfill your requirements, search for another one using the search bar positioned at the top of the page.

- If you are already registered with our service, Log In and download the Michigan Payoff Authorization. If you are not, continue to the next steps.

- Click Buy now once you discover the right blank. Select the subscription plan that best fits you to access the entire capabilities of our library.

- Register for an account and pay for your subscription. You can process the payment with your credit card or through PayPal - our service is entirely secure for that.

- Download your Michigan Payoff Authorization onto your device and fill it out on a printed hard copy or digitally.

Form popularity

FAQ

The Michigan State Housing Development Authority (MSHDA) offers Down Payment Assistance (DPA) to specifically help repeat homebuyers purchase a home. The assistance is provided with a zero-interest, non-amortizing loan with no monthly payments.

To qualify, you must meet the following requirements: Complete Homebuyer Education classes. Have a minimum credit score of 640-660 (depending on the type of home). Meet household income limits based on area and household size.

Michigan First Home Down Payment Assistance One of the programs that MSHDA offers is the MI First Home Down Payment Assistance (DPA). The maximum DPA under this program is $7,500. This down payment assistance is a zero-interest, non-amortizing loan with no monthly payments.

MSHDA HHF (StepForward) LOAN SERVICING The balance of the loan may be fully forgiven and lien discharged after five years, if the borrower complies with the terms of the mortgage and note.

The Michigan State Housing Development Authority (MSHDA) offers Down Payment Assistance (DPA) to specifically help repeat homebuyers purchase a home. The assistance is provided with a zero-interest, non-amortizing loan with no monthly payments.

Since people often refer to a MSHDA loan as a first time home buyer grant, it's often mistaken as free money with no pay back requirement. That's not true. You will have to pay it back. For example, if you sell your home or refinance your mortgage, the down payment assistance will need to be paid back.

MSHDA Details: Michigan Down Payment loan: up to $10,000 Cash asset restriction of $20,000. Maximum home purchase price of $224,500. Income limits vary statewide from $64,100 to $123,620, total household income, determined by location and family size.