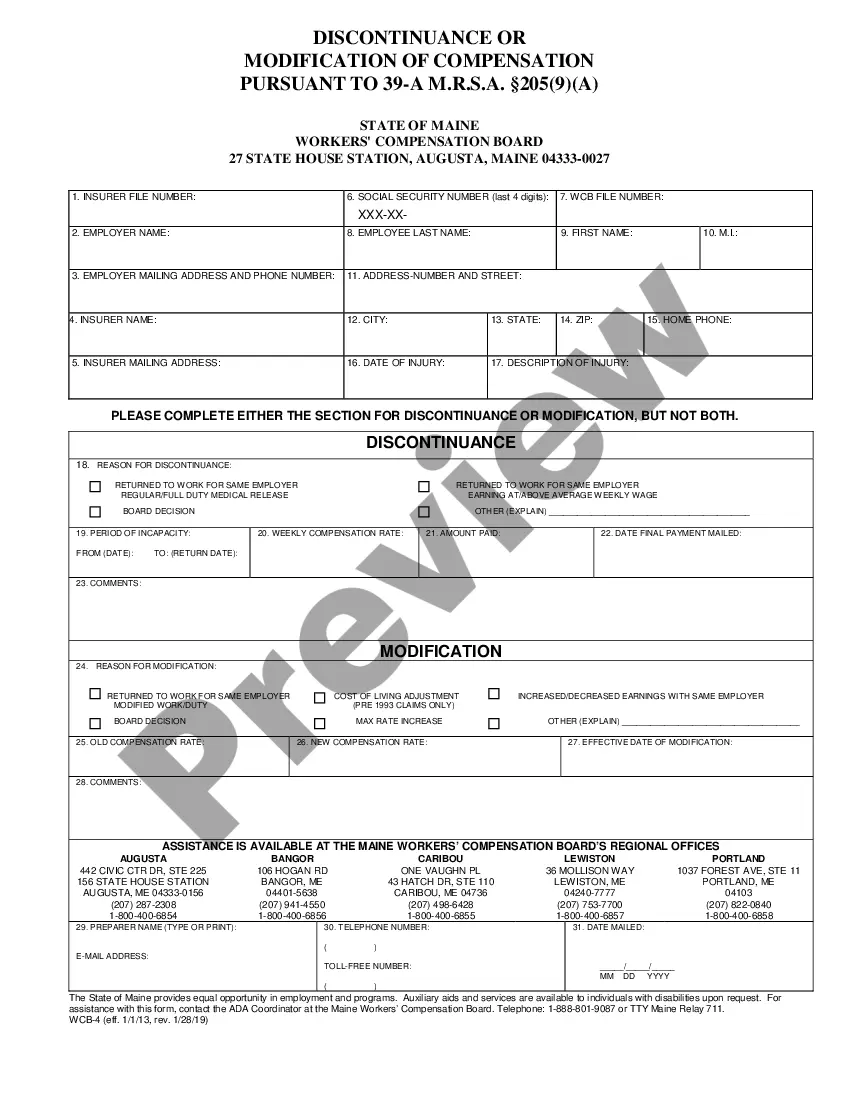

This is one of the official Workers' Compensation forms for the state of Maine.

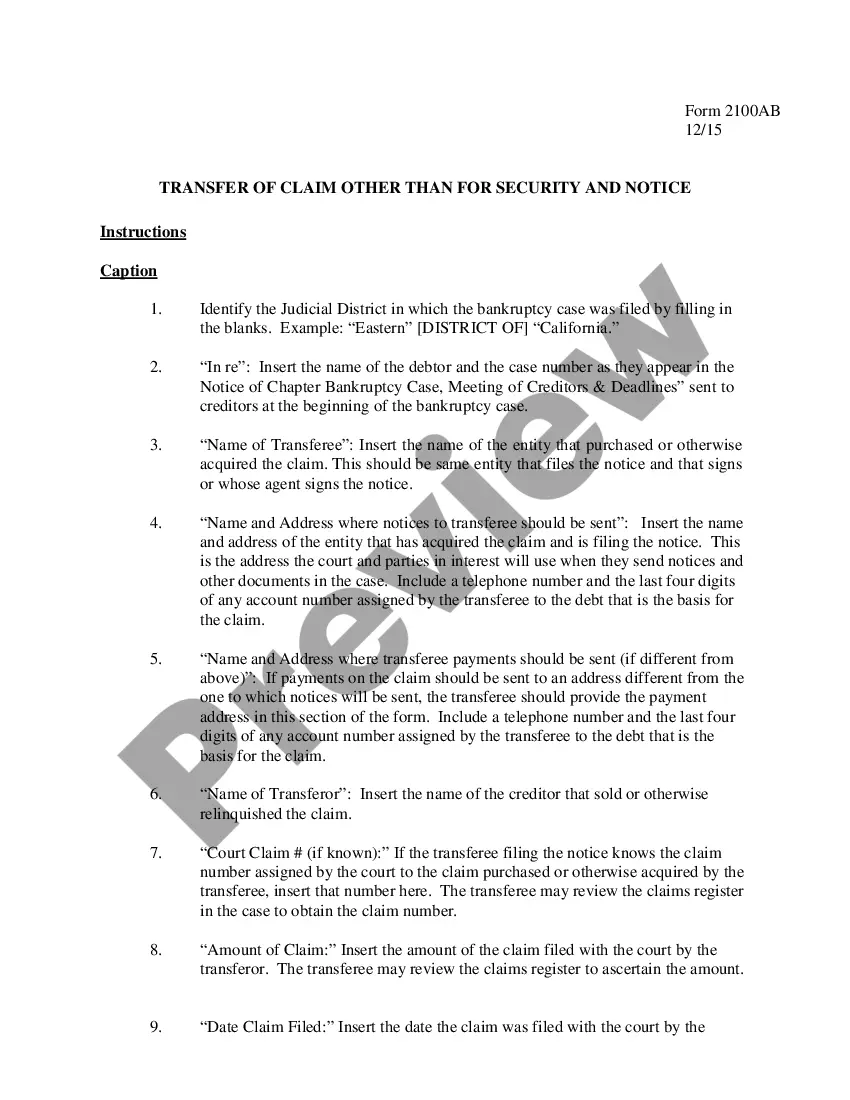

Maine Certificate Discontinuance or Reduction for Workers' Compensation

Description

How to fill out Maine Certificate Discontinuance Or Reduction For Workers' Compensation?

Obtain any type of form from 85,000 legal documents, including the Maine Certificate Discontinuance or Reduction for Workers' Compensation, online through US Legal Forms.

Each template is created and revised by attorneys certified by the state.

If you have an active subscription, Log In. Once on the form’s page, click the Download button and navigate to My documents for access.

Once your reusable template is prepared, you can either print it or store it on your device. With US Legal Forms, you will always enjoy prompt access to the necessary downloadable template. The platform provides access to documents and categorizes them to enhance your search experience. Utilize US Legal Forms to swiftly and conveniently obtain your Maine Certificate Discontinuance or Reduction for Workers' Compensation.

- Review the state-specific requirements for the Maine Certificate Discontinuance or Reduction for Workers' Compensation you intend to use.

- Browse through the description and view the sample.

- When you are convinced that the template meets your needs, click on Buy Now.

- Select a subscription plan that fits your financial situation.

- Set up a personal account.

- Make a payment using either of the two accepted methods: by credit card or through PayPal.

- Choose a file format for downloading the document; two options are available (PDF or Word).

- Download the document to the My documents section.

Form popularity

FAQ

Typically, the workers' comp system in most states offers 66% of your wages. Depending on the state, you may receive your salary benefits weekly, bi-weekly, or once a month. Do your research to find out if your workers' compensation coverage will also include health care benefits.

Because workers' compensation programs are run by each state, state law ultimately determines the time frame of claims processing. As a general rule, you can expect a response within 2 or 3 weeks after you've given notice of an injury or filed a claim.

With a compromise and release, you are agreeing to close out your workers' comp case for good in exchange for a lump sum payment.A compromise and release is final. As long as you signed the agreement voluntarily, workers' comp judges usually won't let you take it backeven if you end up needing more money later.

Workers Compensation Calculator Most often, benefits are calculated and paid based on the average weekly wage. This is calculated by multiplying the employee's daily wage by the number of days worked in a full year. That number is then divided by 52 weeks to get the average weekly wage.

Settlements are calculated based on a combination of lost wages, medical expenses, future medical expenses, specific loss, scarring, and more. Because factors vary so widely from case to case, it's nearly impossible to provide an average workers' comp settlement amount.

A workers' compensation rate is represented as the cost per $100 in payroll. For example: A rate of $1.68 means that a business with $100,000 in payroll would pay $1,680 annually in work comp premiums. A rate of $0.35 means that a business with $100,000 in payroll would pay $350 annually in work comp premiums.

Maine's workers' compensation system is a no-fault system that compensates injured workers for medical bills, lost wages, and permanent impairments resulting from their injuries. To take advantage of these benefits, injured workers must take certain steps required by Maine law.

When Does Workers' Compensation Start Paying? You are supposed to receive your first Workers' Compensation check within 21 days of telling your employer about your work-related injury.

Regarding your question: do you claim workers comp on taxes, the answer is no. You are not subject to claiming workers comp on taxes because you need not pay tax on income from a workers compensation act or statute for an occupational injury or sickness.

Workers' comp laws change constantly. Therefore, it can be difficult for the company to track what needs to be done. As laws change, the company must make adjustments to many facets of a claim, from the application process to the confirmation that you are eligible for compensation.