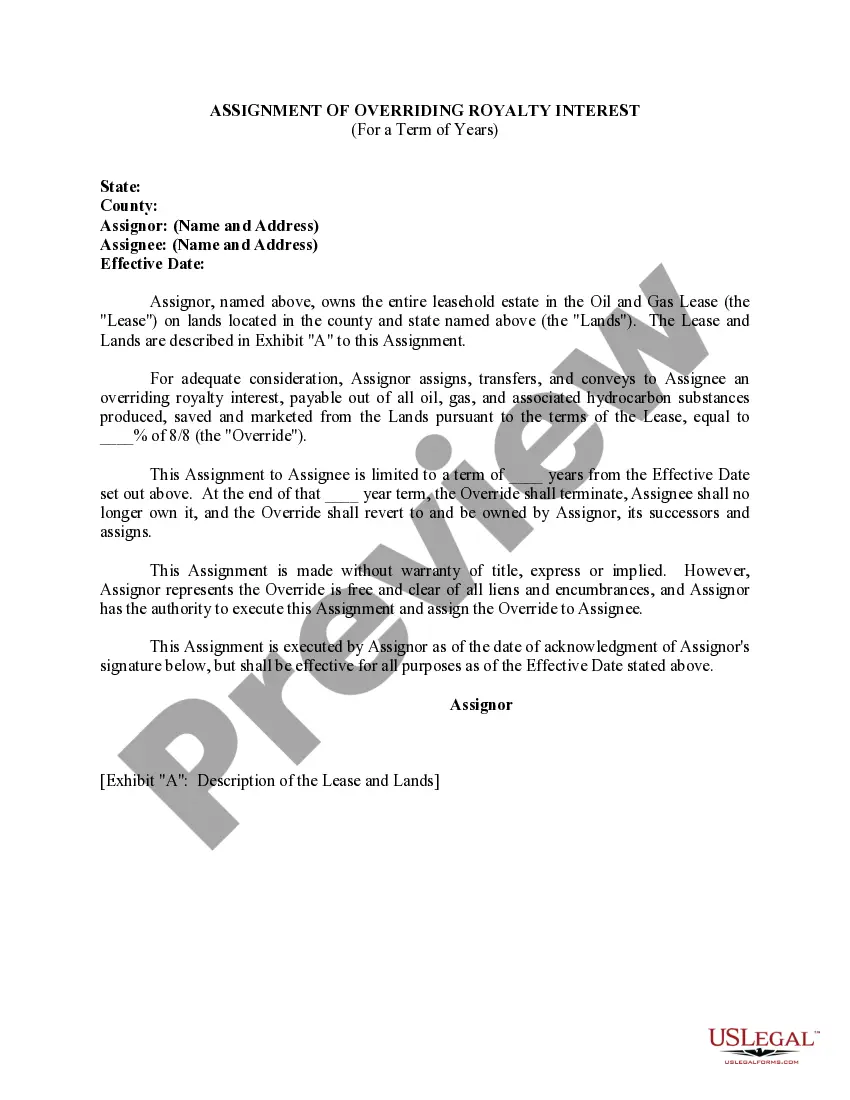

Maine Assignment of Overriding Royalty Interest For A Term of Years

Description

How to fill out Assignment Of Overriding Royalty Interest For A Term Of Years?

Finding the right authorized document design could be a have difficulties. Naturally, there are a lot of themes available on the Internet, but how do you obtain the authorized develop you need? Make use of the US Legal Forms site. The assistance delivers a huge number of themes, for example the Maine Assignment of Overriding Royalty Interest For A Term of Years, that you can use for company and private demands. All of the kinds are checked by pros and meet up with federal and state demands.

In case you are presently registered, log in to the account and then click the Obtain option to find the Maine Assignment of Overriding Royalty Interest For A Term of Years. Make use of account to check with the authorized kinds you possess purchased formerly. Visit the My Forms tab of your own account and acquire one more duplicate of your document you need.

In case you are a new customer of US Legal Forms, listed below are straightforward directions so that you can comply with:

- First, be sure you have selected the appropriate develop for your personal area/region. You can look through the shape utilizing the Review option and look at the shape information to make certain it is the right one for you.

- When the develop fails to meet up with your preferences, use the Seach discipline to find the proper develop.

- When you are certain the shape is proper, click the Acquire now option to find the develop.

- Opt for the pricing plan you desire and type in the essential info. Build your account and pay money for the transaction with your PayPal account or credit card.

- Select the submit structure and download the authorized document design to the product.

- Comprehensive, revise and print and indicator the attained Maine Assignment of Overriding Royalty Interest For A Term of Years.

US Legal Forms will be the greatest catalogue of authorized kinds for which you will find a variety of document themes. Make use of the company to download professionally-created papers that comply with express demands.

Form popularity

FAQ

How to calculate the overriding royalty interest? ORRI = NRI * 5 percent. $750,000 * 0.005 = $3,750.

Overriding Royalty Interest: A given interest severed out of the record title interest or lessee's share of the oil, and not charged with any of the cost or expense of developing or operation. The interest provides no control over the operations of the lease, only revenue from lease production.

Essentially, NPRI is the royalty severed from minerals just as minerals are severed from the surface interest. Unlike mineral owners, non-participating royalties do not have executive rights in lease negotiations, leasing incentives, or rental payments. They just receive the actual production proceeds.

Overriding royalty interest: Unlike mineral and royalty interests, an overriding royalty interest runs with a lease and not with the land. Therefore, they only remain in effect for as long as a lease is in effect and they expire when a lease expires.

If at any time Assignee desires to transfer or dispose of all or any portion of the Overriding Royalty Interest, Assignee must first give to Assignor written notice thereof stating: (a) the amount of the Overriding Royalty Interest offered by Assignee; (b) the form of consideration (which shall be either cash or a ...

However, unlike royalty and working interests, an overriding royalty interest cannot be fractionalized unlike royalty and working interests. The ORRI is a non-possessory, undivided right to a share of the oil and gas production, but it excludes the production costs of the mineral lease.

Royalty interest in the oil and gas industry refers to ownership of a portion of a resource or the revenue it produces. A company or person that owns a royalty interest does not bear any operational costs needed to produce the resource, yet they still own a portion of the resource or revenue it produces.

The value of an overriding royalty interest is simple to calculate since it is a percent of the working interest lease. The ORRI value is based on production on the acreage leased by the working interest.