Maine Interest Verification

Description

How to fill out Interest Verification?

Discovering the right legitimate document web template might be a struggle. Of course, there are plenty of layouts accessible on the Internet, but how do you get the legitimate form you require? Utilize the US Legal Forms internet site. The support gives a large number of layouts, including the Maine Interest Verification, which can be used for organization and personal requirements. All the forms are inspected by experts and satisfy state and federal needs.

When you are already registered, log in to your bank account and then click the Obtain key to find the Maine Interest Verification. Utilize your bank account to appear through the legitimate forms you may have bought in the past. Go to the My Forms tab of your respective bank account and obtain one more duplicate in the document you require.

When you are a fresh user of US Legal Forms, allow me to share simple directions that you should comply with:

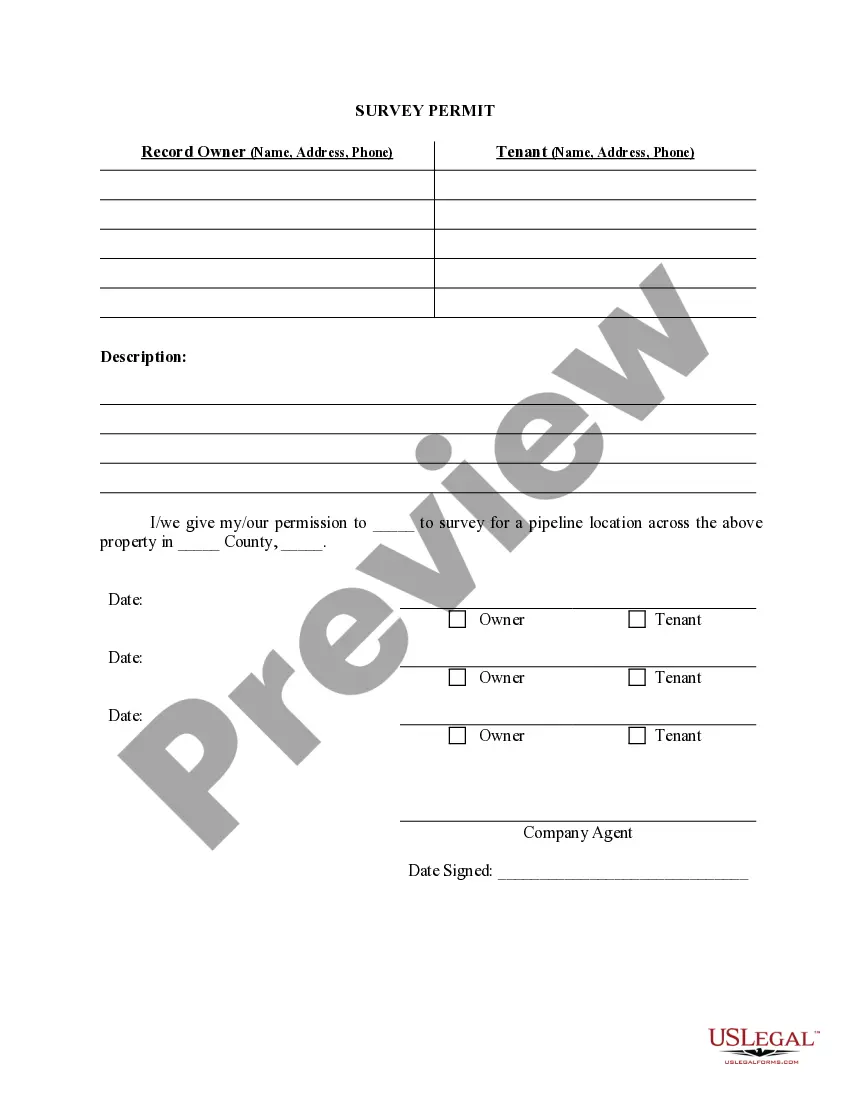

- Very first, make sure you have selected the proper form for your personal city/county. You are able to check out the shape while using Review key and study the shape description to ensure this is basically the best for you.

- In the event the form does not satisfy your needs, make use of the Seach area to get the proper form.

- Once you are sure that the shape is proper, go through the Buy now key to find the form.

- Choose the prices prepare you desire and type in the essential info. Create your bank account and pay for an order using your PayPal bank account or charge card.

- Select the document file format and acquire the legitimate document web template to your system.

- Complete, modify and produce and signal the acquired Maine Interest Verification.

US Legal Forms will be the largest catalogue of legitimate forms for which you can discover different document layouts. Utilize the company to acquire professionally-produced papers that comply with express needs.

Form popularity

FAQ

Generally, nonresidents , part-year residents , and ?safe harbor? residents who have Maine taxable income must file a Maine personal income tax return.

Wages, business income, and capital gains from sources within Maine are Maine income even if you received the income as a nonresident. All part-year residents, nonresidents and safe harbor residents must send a copy of their federal return with their Maine return.

The Property Tax Fairness Credit Program: Who can get help? You must own your own home or pay rent. You were a Maine resident during any part of the tax year. Your household ?adjusted gross income? is not more than: $33,333 a year for a household of 1 (filing as single individual),

Single or married filing separately: $12,950.

National per capita general revenues were $12,277. Maine uses all major state and local taxes. After federal transfers, Maine's largest sources of per capita revenue were property taxes ($2,835) and individual income taxes ($1,507).

All income derived from or connected with the carrying on of a trade or business within Maine is Maine-source income.

Three of the main types of income are earned, passive and portfolio. Earned income includes wages, salary, tips and commissions. Passive or unearned income could come from rental properties, royalties and limited partnerships. Portfolio or investment income includes interest, dividends and capital gains on investments.

Maine resale certificates are only to be used when a purchaser intends to resell tangible property. A valid certificate must include the name and address of the purchaser. It should also include the purchaser's account ID or federal employer identification number (EIN).