Maine Statement to Add to Credit Report

Description

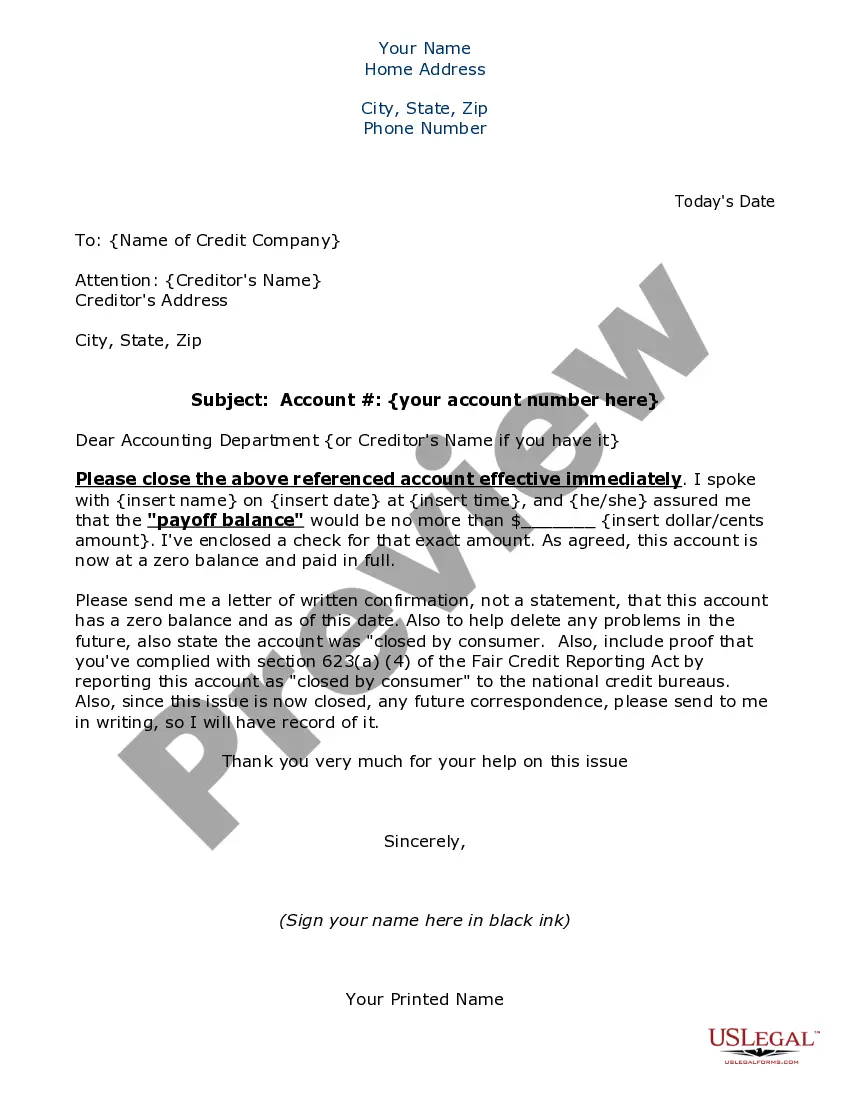

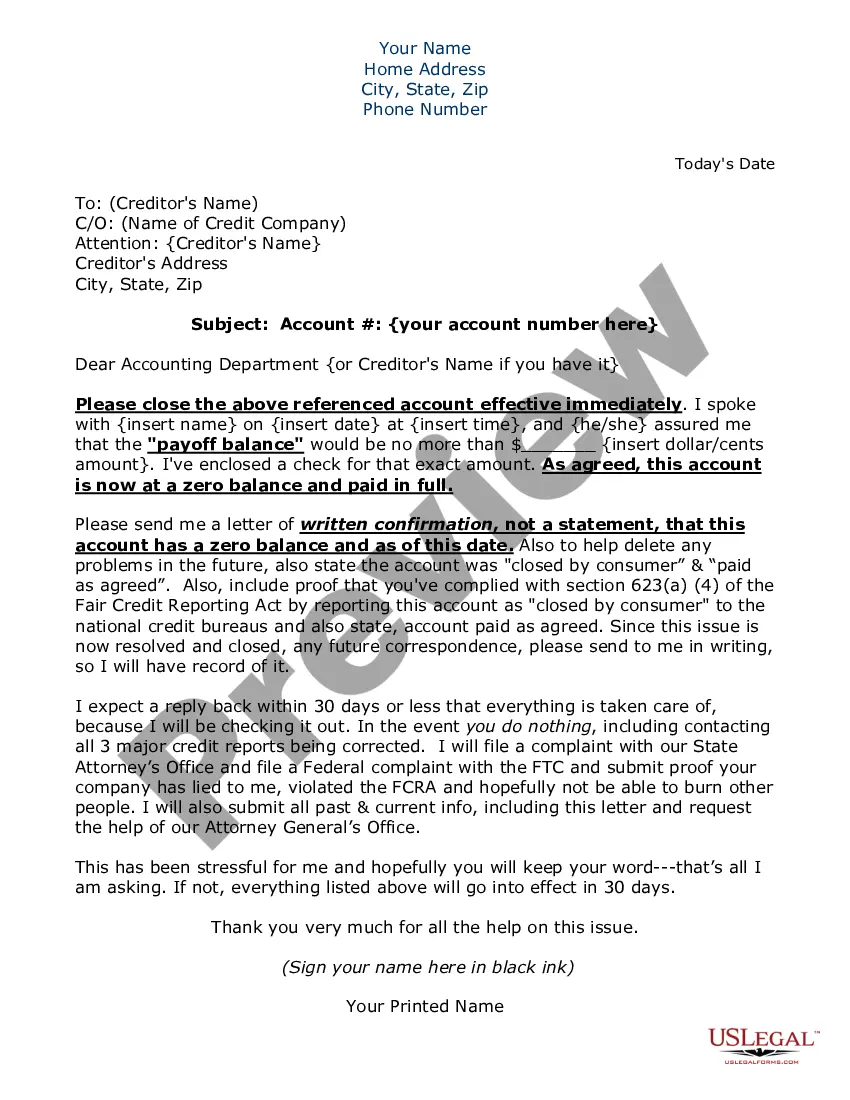

How to fill out Statement To Add To Credit Report?

You might spend several hours online looking for the valid document format that meets the state and federal requirements you need.

US Legal Forms offers a vast array of valid templates that are reviewed by professionals.

You can easily obtain or print the Maine Statement to Add to Credit Report from this service.

If available, use the Review button to look through the format as well. If you want to find another version of the form, use the Search box to locate the format that fits your needs and requirements. Once you have found the format you need, click Get now to proceed. Select the pricing plan you want, enter your details, and create an account on US Legal Forms. Complete the purchase. You can use your Visa or Mastercard or PayPal account to pay for the legal document. Choose the format of the file and download it to your device. Make changes to your document if needed. You can complete, modify, and sign and print the Maine Statement to Add to Credit Report. Download and print thousands of document templates using the US Legal Forms Website, which provides the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already have a US Legal Forms account, you can sign in and click the Download button.

- Then, you can complete, modify, print, or sign the Maine Statement to Add to Credit Report.

- Every legal document you purchase is yours permanently.

- To get another copy of any purchased form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct format for the state/region of your preference.

- Review the form description to make sure you have chosen the right document.

Form popularity

FAQ

A personal financial statement typically includes your assets, liabilities, income, and expenses. This document provides a clear picture of your financial health and is crucial for lenders when considering your application. If you are preparing a Maine Statement to Add to Credit Report, ensure that your financial statement accurately reflects your current situation. This accuracy can improve your chances of securing credit and achieving financial goals.

Yes, Maine has a tax refund offset program that allows the state to apply your tax refund towards certain debts, such as unpaid taxes or child support. This program aims to collect overdue debts efficiently. If you are concerned about how this might affect your refund, consider checking with the Maine Revenue Services or using US Legal Forms for guidance.

State tax deductions can include personal exemptions, property taxes, and certain education-related expenses. Each state has unique rules, so understanding Maine's specific offerings is essential. You might also find additional deductions based on your income level or filing status. Platforms like US Legal Forms can provide detailed insights into state-specific deductions.

Filing a Maine annual report involves completing the required forms and submitting them to the Secretary of State. You typically need to provide basic information about your business, such as its name and address. It’s important to file on time to avoid penalties. For ease and accuracy, consider using US Legal Forms, which offers templates for filing annual reports.

You can claim a range of deductions on your Maine taxes, including medical expenses, certain business expenses, and educational costs. Additionally, Maine offers specific tax credits that could further reduce your tax burden. To ensure you claim all available deductions, consider consulting resources like US Legal Forms. They provide forms and guidance tailored to Maine tax laws.

In Maine, the penalty for underpayment of taxes can vary based on the amount owed and the duration of the underpayment. Generally, you may face a percentage penalty of your unpaid tax. To avoid penalties, it’s wise to estimate your tax liability accurately and make timely payments. US Legal Forms can help you understand the calculations involved.

You can add various deductions to your tax return, including mortgage interest, property taxes, and charitable contributions. In Maine, specific deductions may also apply to your state return. It's important to review all eligible deductions to optimize your tax benefits. Consider using US Legal Forms to ensure you capture every possible deduction.

Yes, Maine allows itemized deductions on your state tax return. These deductions can help reduce your taxable income, ultimately lowering your tax bill. If you choose to itemize, remember to keep track of all eligible expenses. You can also find useful resources on platforms like US Legal Forms to guide you through the process.

Indeed, medical bills can affect your credit in Maine if they remain unpaid for an extended period. Once reported, these debts can lower your credit score. To counteract this, utilizing a Maine Statement to Add to Credit Report can provide valuable context and improve how lenders view your financial history.

The Maine Opportunity Tax Credit is a program designed to assist low-income residents of Maine. It provides financial relief to eligible individuals and families, potentially easing their financial burden. By improving your financial situation, you may find it easier to manage bills, including medical debt, and maintain a healthier credit report.