No particular language is necessary for this type of report so long as the report clearly conveys the necessary information.

Maine Report to Creditor by Collection Agency Regarding Judgment Against Debtor

Description

How to fill out Report To Creditor By Collection Agency Regarding Judgment Against Debtor?

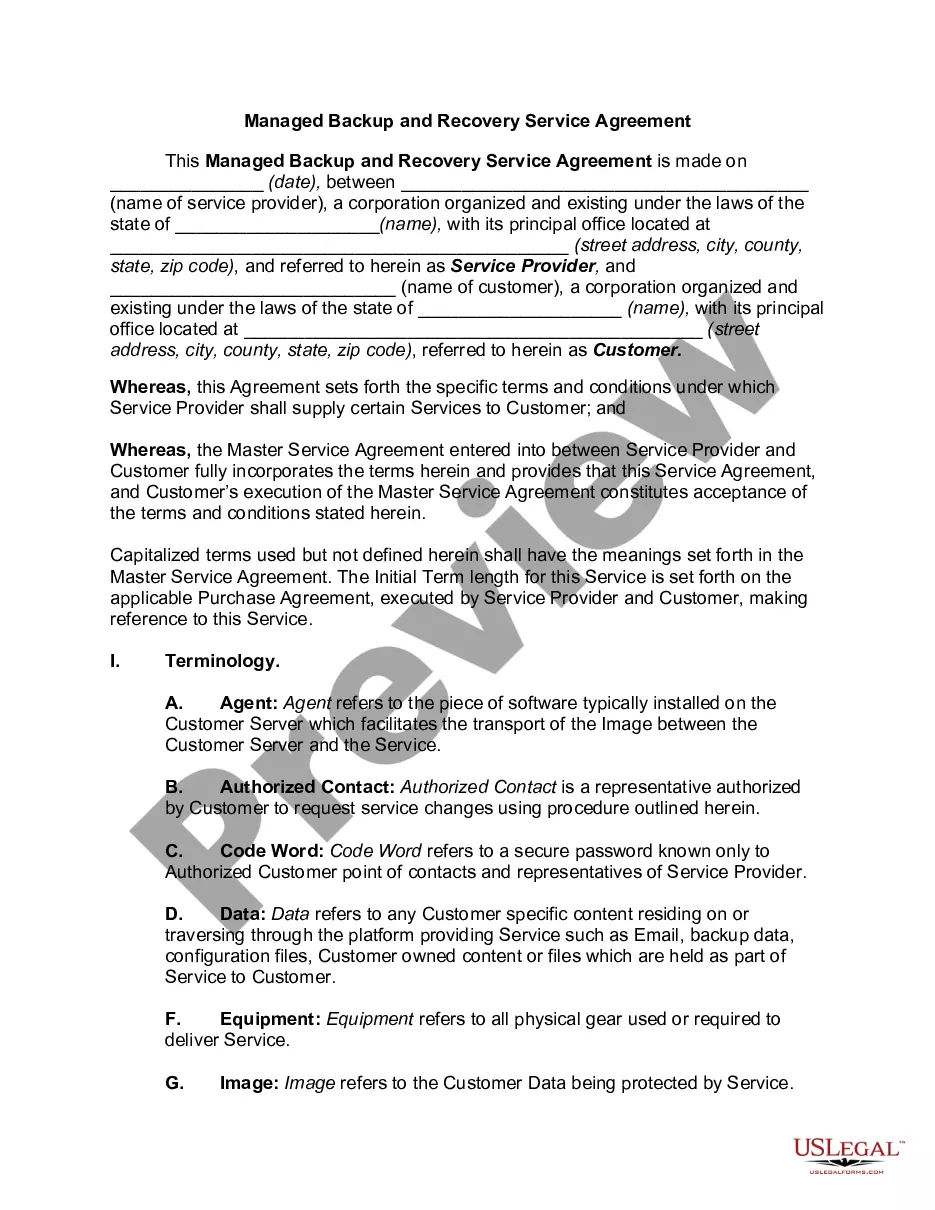

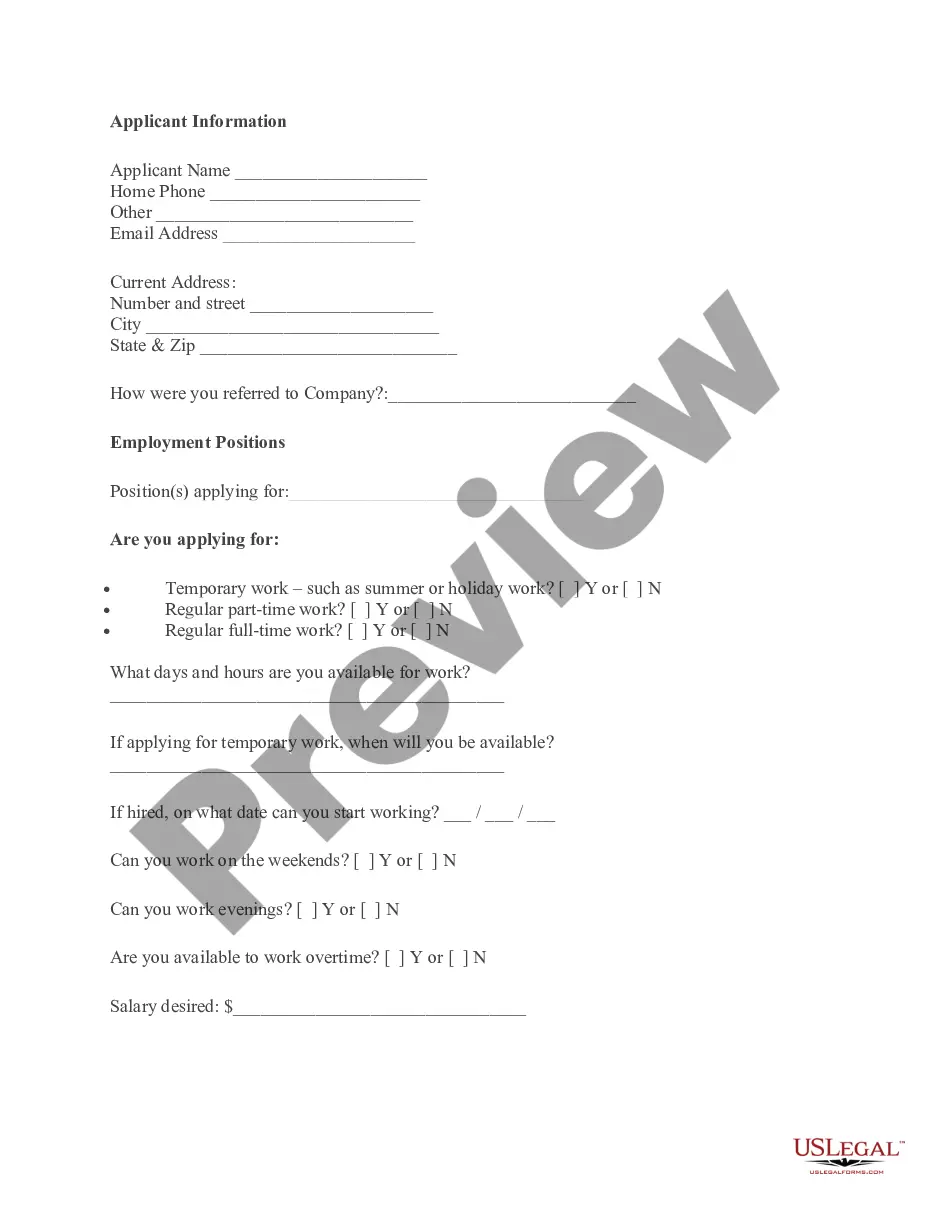

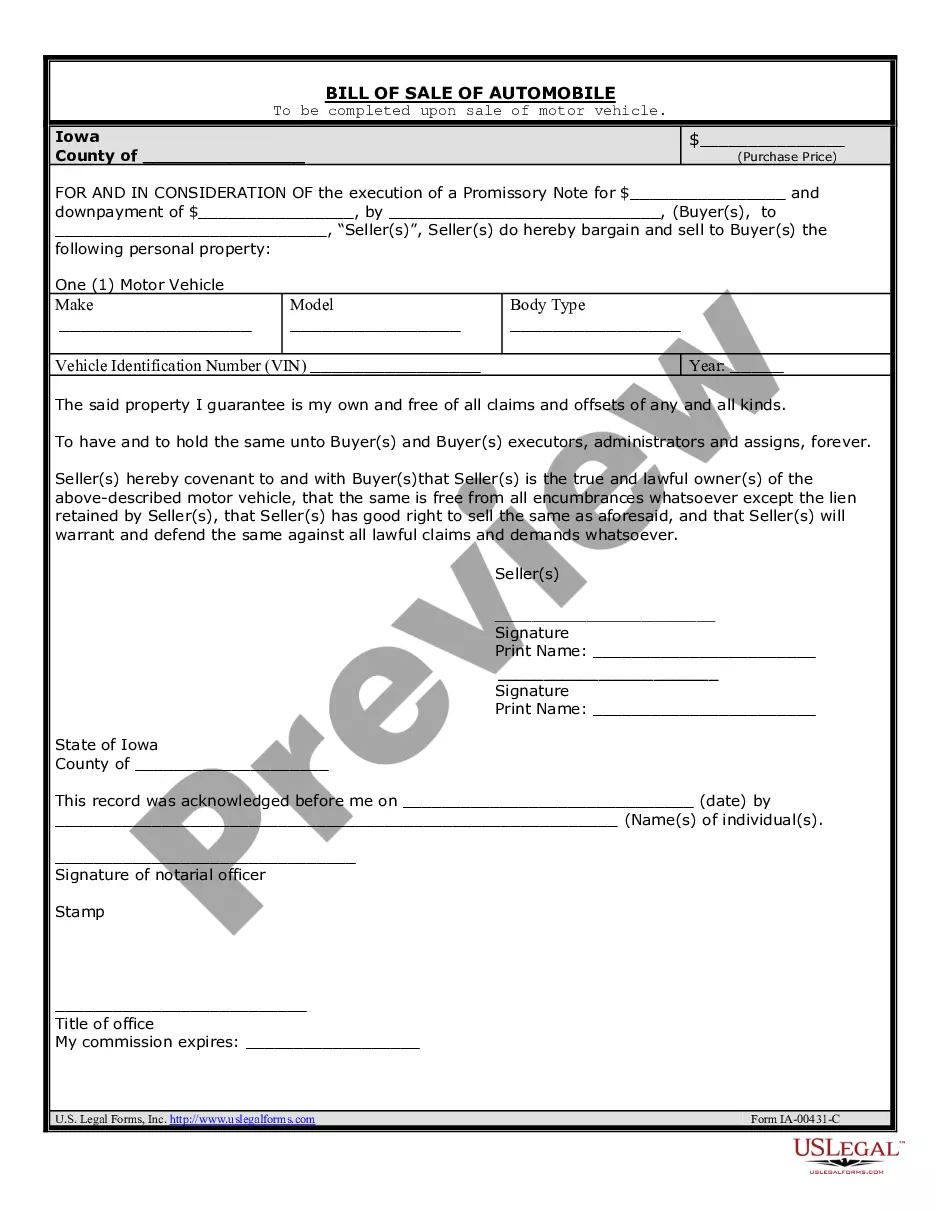

Have you been inside a place that you need documents for both company or person functions nearly every day? There are a lot of lawful file themes available on the net, but discovering versions you can trust is not easy. US Legal Forms delivers a large number of develop themes, much like the Maine Report to Creditor by Collection Agency Regarding Judgment Against Debtor, which can be written to meet state and federal needs.

If you are currently informed about US Legal Forms internet site and get an account, just log in. Afterward, you are able to acquire the Maine Report to Creditor by Collection Agency Regarding Judgment Against Debtor format.

Should you not offer an account and want to start using US Legal Forms, adopt these measures:

- Get the develop you want and make sure it is for your right area/area.

- Make use of the Review option to review the shape.

- Read the outline to ensure that you have selected the right develop.

- In the event the develop is not what you`re trying to find, take advantage of the Research area to discover the develop that fits your needs and needs.

- When you discover the right develop, click Buy now.

- Select the prices program you need, complete the desired details to generate your bank account, and purchase the transaction with your PayPal or Visa or Mastercard.

- Decide on a practical file structure and acquire your copy.

Locate all the file themes you may have bought in the My Forms food list. You can aquire a extra copy of Maine Report to Creditor by Collection Agency Regarding Judgment Against Debtor whenever, if possible. Just click the necessary develop to acquire or printing the file format.

Use US Legal Forms, the most comprehensive assortment of lawful types, to conserve some time and stay away from mistakes. The assistance delivers professionally created lawful file themes that can be used for an array of functions. Generate an account on US Legal Forms and initiate making your way of life easier.

Form popularity

FAQ

A debt collector must stop all collection activity on a debt if you send them a written dispute about the debt, generally within 30 days after your initial communication with them. Collection activities can restart, though, after the debt collector sends verification responding to the dispute.

off is not necessarily the end of the road for a debt, though ? it simply means that it's no longer an active account on the creditor's books. The creditor is still legally allowed to pursue collection, file a lawsuit for the balance due, and report the debt on your credit report.

If you believe you already paid the debt, do not owe the debt, the amount is incorrect, or that it's not even your debt, you may send a written request to the debt collector to dispute the debt or receive more information.

The original creditor can't continue to report a balance due if it has sold the account to a collections agency. However, it can report a charge off, which remains on your credit report for seven years, even if you pay off the debt?with the original creditor or via a collections agency.

Collections accounts will generally stay on your credit report for up to seven years from the date they first became delinquent.

Credit Reporting However, debt collectors cannot report false information about your debt. If you dispute a debt in writing with a debt collector, that debt collector must tell any credit reporting company that it has reported your debt to that you dispute the debt.

A judgment is a court order stating that you owe the debt collector money because of a lawsuit. You may have received a judgment because the court decided in favor of the debt collector in a trial, or because you did not respond to a lawsuit that was filed against you.

The Fair Debt Collection Practices Act (FDCPA) prohibits harassment, abuse, and other behavior intended to bully debtors. If a debt collector is violating the FDCPA in their attempts to collect money from you, you have the right to sue them.