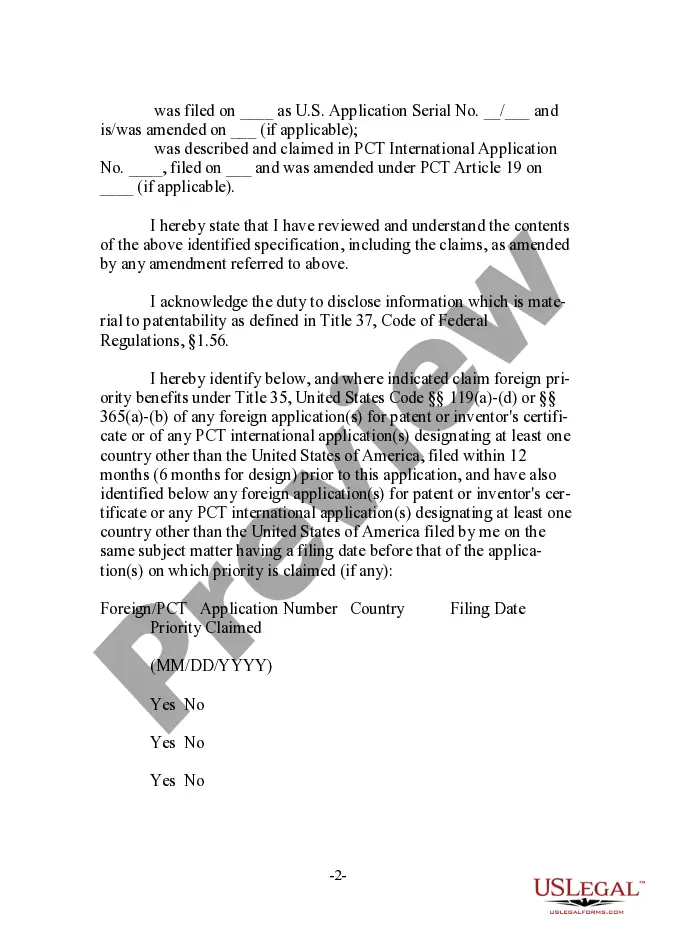

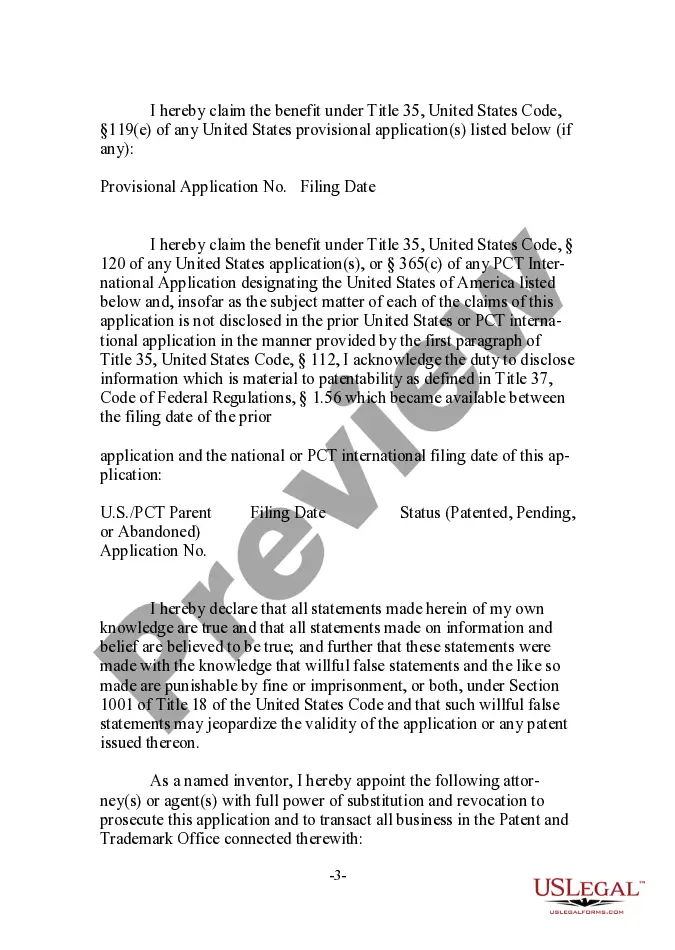

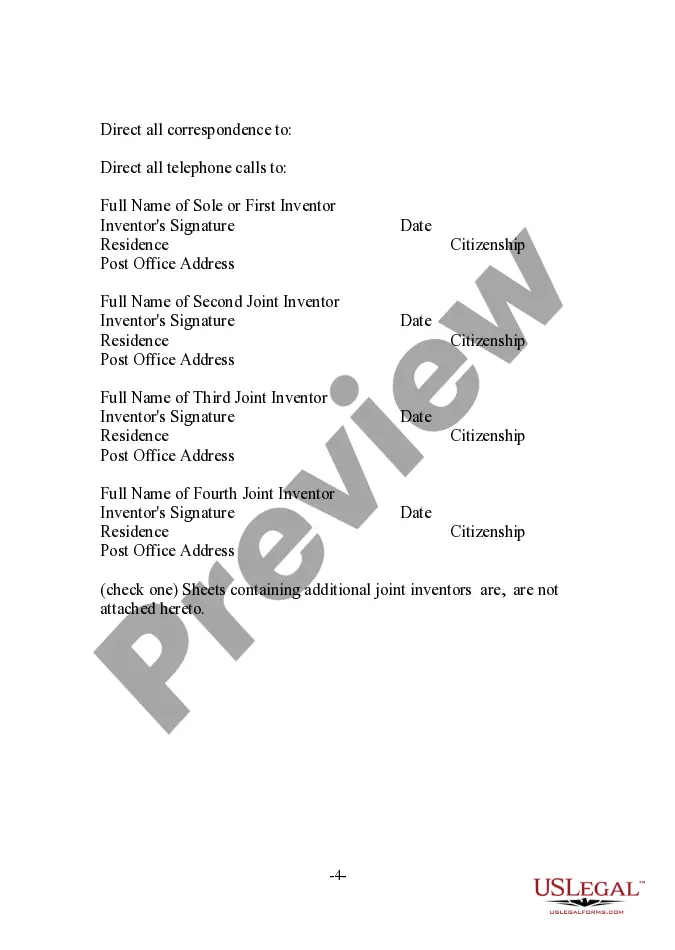

Maine Declaration and Power of Attorney for Patent Application

Description

How to fill out Declaration And Power Of Attorney For Patent Application?

Choosing the best authorized document template might be a have a problem. Needless to say, there are a lot of templates available on the Internet, but how do you obtain the authorized form you need? Use the US Legal Forms web site. The services provides a huge number of templates, including the Maine Declaration and Power of Attorney for Patent Application, that can be used for company and personal requires. Every one of the types are examined by pros and meet state and federal demands.

Should you be presently authorized, log in to the accounts and click on the Obtain key to have the Maine Declaration and Power of Attorney for Patent Application. Make use of accounts to appear with the authorized types you possess purchased formerly. Visit the My Forms tab of your respective accounts and have another backup in the document you need.

Should you be a brand new consumer of US Legal Forms, allow me to share easy guidelines for you to follow:

- First, be sure you have selected the correct form for your personal metropolis/state. You may look over the shape making use of the Review key and read the shape description to make sure it is the right one for you.

- In case the form will not meet your requirements, utilize the Seach area to discover the right form.

- When you are sure that the shape is acceptable, click on the Purchase now key to have the form.

- Opt for the pricing program you would like and enter the necessary information. Build your accounts and pay for your order making use of your PayPal accounts or bank card.

- Opt for the data file format and download the authorized document template to the gadget.

- Full, change and print and indicator the received Maine Declaration and Power of Attorney for Patent Application.

US Legal Forms will be the greatest catalogue of authorized types in which you can find various document templates. Use the company to download appropriately-created documents that follow condition demands.

Form popularity

FAQ

By filing this Form 2848-ME, the taxpayer authorizes Maine Revenue Services to send either originals or copies of notices and any other written communications concerning the taxpayer in proceedings involving the above tax matter(s) to the representative first named above.

Due to federal laws, the IRS is required to keep your taxpayer information confidential, so Form 2848 must be filed and approved before anyone else may inquire about your taxes or receive them. For an individual to be granted this authority, they must be an eligible representative. This includes: Attorneys.

A Maine tax power of attorney (Form ME-2848), otherwise known as the Maine Revenue Services Power of Attorney and Declaration of Representative, is a form used when someone wishes to appoint an accountant, tax attorney, or other financial representatives to handle their tax matters such as filings and inquiries.

You may use Form M-2848 to appoint one or more individuals to represent you in tax matters before the DOR. You may use Form M-2848 for any matters affecting any tax imposed by the Commonwealth, and the power granted is limited to these tax matters.

File a Copy With the Land Records Office If you gave your agent the power to conduct real estate transactions, you should also file a copy of your POA in the land records office (in Maine, this office is called the register of deeds) in the county where you own real estate.

In Maine, you can establish a durable power of attorney that gives an agent the power to conduct certain financial transactions on your behalf, including: Selling your property. Withdrawing money from your accounts, cashing your checks, and spending your funds. Entering into contracts on your behalf.

Businesses including partnerships, associations and corporations can file Form 2848 as well if they need a third party to represent them during conversations with the IRS. Trustees and heirs may also need to use Form 2848 if they need help addressing tax issues related to their trusts and their family members' estates.

Do not write ?all years.? Instead, list the current tax year for which you are filing a return or you can list a series of years to cover past and future filings. However, you can only list up to three future years from the year you file the power of attorney form.