Maine Self-Employed Ceiling Installation Contract

Description

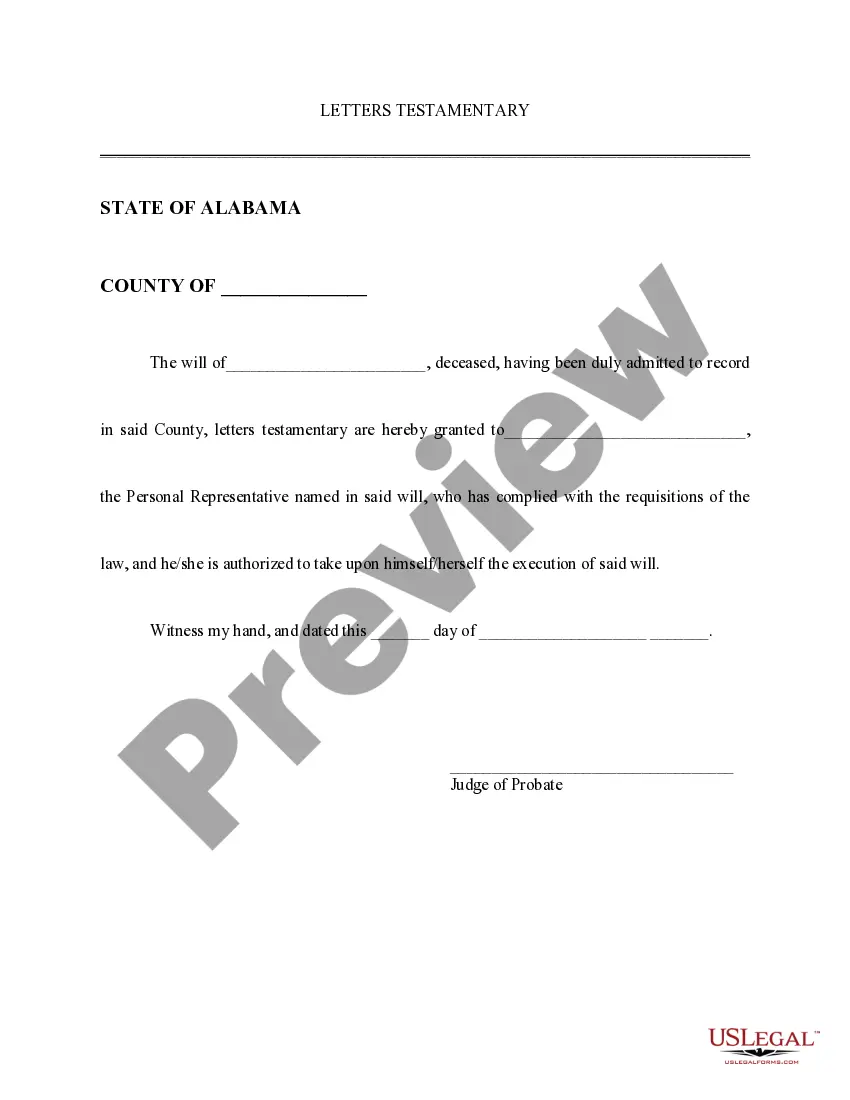

How to fill out Self-Employed Ceiling Installation Contract?

If you intend to finalize, obtain, or create sanctioned document templates, utilize US Legal Forms, the largest selection of legal forms available online. Take advantage of the site’s straightforward and user-friendly search to find the files you require. Various templates for business and personal purposes are categorized by types and states, or keywords. Use US Legal Forms to locate the Maine Self-Employed Ceiling Installation Contract with just a few clicks.

If you are currently a US Legal Forms user, Log In to your account and click the Download button to obtain the Maine Self-Employed Ceiling Installation Contract. You can also access forms you previously downloaded from the My documents tab in your account.

If you are using US Legal Forms for the first time, refer to the steps below: Step 1. Ensure you have selected the form for the correct city/state. Step 2. Use the Preview option to view the content of the form. Remember to read the details. Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other versions of the legal form template. Step 4. Once you have found the form you need, click the Get now button. Choose the pricing plan you prefer and enter your information to register for the account. Step 5. Process the transaction. You can use your credit card or PayPal account to complete the purchase. Step 6. Select the format of the legal form and download it to your device. Step 7. Fill out, modify, and print or sign the Maine Self-Employed Ceiling Installation Contract.

Avoid altering or deleting any HTML tags. Only synonymize plain text outside of the HTML tags.

- Every legal document template you obtain is yours indefinitely.

- You have access to all forms you downloaded within your account.

- Visit the My documents section and choose a form to print or download again.

- Complete and obtain, and print the Maine Self-Employed Ceiling Installation Contract with US Legal Forms.

- There are countless professional and state-specific forms you can use for your business or personal needs.

Form popularity

FAQ

In Maine, construction services are generally subject to sales tax, which includes ceiling installation services. When you engage in a Maine Self-Employed Ceiling Installation Contract, it is important to understand your tax obligations. You may need to collect sales tax from your clients and remit it to the state. To navigate these regulations effectively, consider using resources from US Legal Forms to stay compliant and informed.

Filing a 1099 in Maine is a straightforward process that involves reporting payments made to independent contractors. If you have entered into a Maine Self-Employed Ceiling Installation Contract, you will likely need to file a 1099 form for services rendered. To file, you must gather the necessary information from your contractor, complete the form, and submit it to both the IRS and the contractor. Utilizing platforms like US Legal Forms can simplify this process and ensure you meet all regulatory requirements.

In Maine, you generally do not need a specific license for ceiling installation as a self-employed contractor under a Maine Self-Employed Ceiling Installation Contract. However, certain municipalities may require permits or registrations, especially for larger projects. It's crucial to check local regulations to ensure compliance. US Legal Forms can assist you in finding the necessary documentation and guidance to navigate these requirements effectively.

To prove your independent contractor status when working under a Maine Self-Employed Ceiling Installation Contract, you must demonstrate that you control your work and manage your own schedule. Gather documents such as contracts, invoices, and tax forms that show your business relationship with clients. Additionally, maintaining a separate business account and offering services to multiple clients can further confirm your status. Using platforms like US Legal Forms can help you create contracts that clearly outline your independent contractor status.

Independent contractors typically receive a 1099-NEC form, which reports non-employee compensation. This form is issued when you earn $600 or more from a single client during the tax year. It's important to ensure that you have a Maine Self-Employed Ceiling Installation Contract in place, as it can help clarify payment terms and protect your interests.

An independent contractor needs to fill out various paperwork, including a W-9, invoices for clients, and potentially a Maine Self-Employed Ceiling Installation Contract. These documents help establish your business relationship and ensure you receive proper payment. Keeping thorough records of all paperwork will simplify your tax filing and promote professional interactions.

9 form is used to provide your taxpayer identification information to clients, while a 1099 form reports your income to the IRS. As an independent contractor, you will typically complete a W9 for each client, and they will issue you a 1099 at the end of the year if you earn more than $600. Therefore, both forms are essential, but they serve different purposes in the context of a Maine SelfEmployed Ceiling Installation Contract.

In Maine, a home improvement contract must include specific elements such as the contractor's name, address, and license number, if applicable. It should detail the scope of work, payment terms, and project timeline. Utilizing a Maine Self-Employed Ceiling Installation Contract helps ensure all necessary information is included, protecting both you and your client.

An independent contractor in Maine needs to complete several forms, including the IRS Form W-9 for tax identification purposes. If you earn $600 or more from a client, they will likely issue you a Form 1099. For compliance with state laws, having a Maine Self-Employed Ceiling Installation Contract is also advisable to protect your rights and outline project details.

Independent contractors in Maine should fill out the appropriate tax forms to report their income. If you are self-employed, you typically need to fill out a Schedule C along with your 1040 tax return. Additionally, if you hire subcontractors, you may need to provide them with a Maine Self-Employed Ceiling Installation Contract to ensure compliance and clarity.