Maine Self-Employed Lecturer - Speaker - Services Contract

Description

How to fill out Self-Employed Lecturer - Speaker - Services Contract?

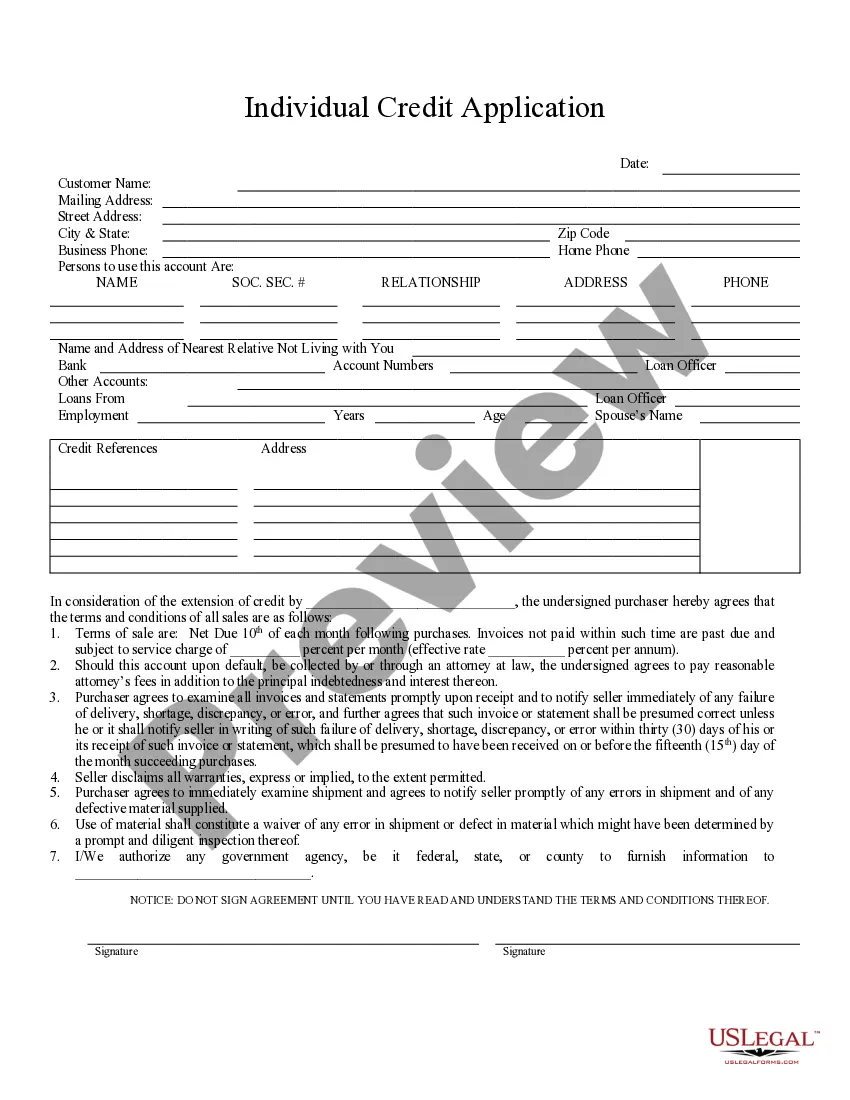

Selecting the optimal authorized document format can be a challenge. Naturally, there is an assortment of web templates accessible online, but how can you obtain the authorized document you need? Utilize the US Legal Forms website. The platform provides a vast array of templates, such as the Maine Self-Employed Lecturer - Speaker - Services Contract, which can be employed for both business and personal purposes. All the forms are vetted by experts and meet federal and state regulations.

If you are already registered, Log In to your account and click the Obtain button to locate the Maine Self-Employed Lecturer - Speaker - Services Contract. Use your account to browse through the authorized forms you may have acquired previously. Visit the My documents section of your account to retrieve an additional copy of the document you need.

If you are a new user of US Legal Forms, here are straightforward instructions you should follow: First, ensure you have selected the correct form for your city/region. You can review the form using the Preview option and read the form description to confirm it is suitable for you. If the form does not meet your needs, utilize the Search section to find the appropriate form. Once you are certain that the form is accurate, click the Acquire now button to obtain the form. Choose the pricing plan you desire and enter the necessary information. Create your account and pay for the order using your PayPal account or credit card. Select the submission format and download the authorized document format to your device. Complete, edit, and print out and sign the received Maine Self-Employed Lecturer - Speaker - Services Contract.

US Legal Forms provides an extensive selection of authorized document templates, ensuring you can find the right one for your needs.

- US Legal Forms is the largest collection of authorized forms that you will find various document templates.

- Utilize the service to download professionally crafted papers that comply with state regulations.

- All forms are vetted by professionals to ensure compliance.

- Access a wide range of templates for different needs.

- Easily navigate through your account to manage your documents.

- Follow straightforward steps to acquire and download the forms you require.

Form popularity

FAQ

While both speakers and lecturers present information to an audience, the key difference lies in their approach and context. Speakers often focus on engaging the audience with storytelling or motivational content, whereas lecturers provide structured, educational material. When creating a Maine Self-Employed Lecturer - Speaker - Services Contract, it's essential to specify your role to ensure both you and the event organizer have aligned expectations and responsibilities.

A lecturer is generally someone who educates or informs an audience on a particular subject, often in an academic or professional setting. This role can range from teaching at a university to conducting workshops or seminars. If you identify as a Maine Self-Employed Lecturer - Speaker, it’s vital to have a clear contract that defines your role and the services you provide, ensuring you are compensated fairly for your expertise.

A guest speaker typically presents at an event for a limited time, often sharing expertise or insights on a specific topic. In contrast, a lecturer usually has a more formal role, often associated with teaching or delivering a series of educational presentations. Understanding these distinctions is important for anyone developing a Maine Self-Employed Lecturer - Speaker - Services Contract, as it affects the scope of work and compensation terms.

A speaker agreement is a legally binding document that outlines the terms and conditions between a speaker and an event organizer. This contract typically includes details about the event, compensation, and responsibilities. For individuals seeking to formalize their role as a Maine Self-Employed Lecturer - Speaker, this agreement provides clarity and protects both parties. It ensures that expectations are met and helps avoid misunderstandings.

Maine does not have a specific service provider tax; however, certain services may be subject to sales tax. As a Maine Self-Employed Lecturer - Speaker, understanding the tax framework for your services is essential. Utilizing platforms like uslegalforms can assist you in navigating these regulations and ensuring compliance.

Service contracts can be taxable in Maine, depending on the type of service rendered. If you are entering into a Maine Self-Employed Lecturer - Speaker - Services Contract, it is crucial to understand how sales tax applies to your services. Consulting with a tax advisor can provide specific guidance tailored to your situation.

While Maine does not legally require an operating agreement for LLCs, having one is highly recommended. An operating agreement outlines the management structure and operating procedures for your Maine Self-Employed Lecturer - Speaker business. This document can help prevent misunderstandings and provide clarity among members.

Yes, verbal contracts are generally legal in Maine, but they can be challenging to enforce. For a Maine Self-Employed Lecturer - Speaker - Services Contract, it is advisable to document agreements in writing. This practice not only clarifies expectations but also protects both parties in case of disputes.

In Maine, contract labor can be subject to sales tax depending on the nature of the service provided. When engaging in a Maine Self-Employed Lecturer - Speaker - Services Contract, it is essential to assess the type of service to determine tax implications. This assessment can prevent potential issues with the state and ensure compliance.

Yes, service labor is generally taxable in Maine. However, there are exceptions based on the type of service provided. If you are a Maine Self-Employed Lecturer - Speaker, it is important to determine if your specific services fall under taxable categories. Consulting with a tax professional can help clarify your obligations.