Maine Design Agreement - Self-Employed Independent Contractor

Description

How to fill out Design Agreement - Self-Employed Independent Contractor?

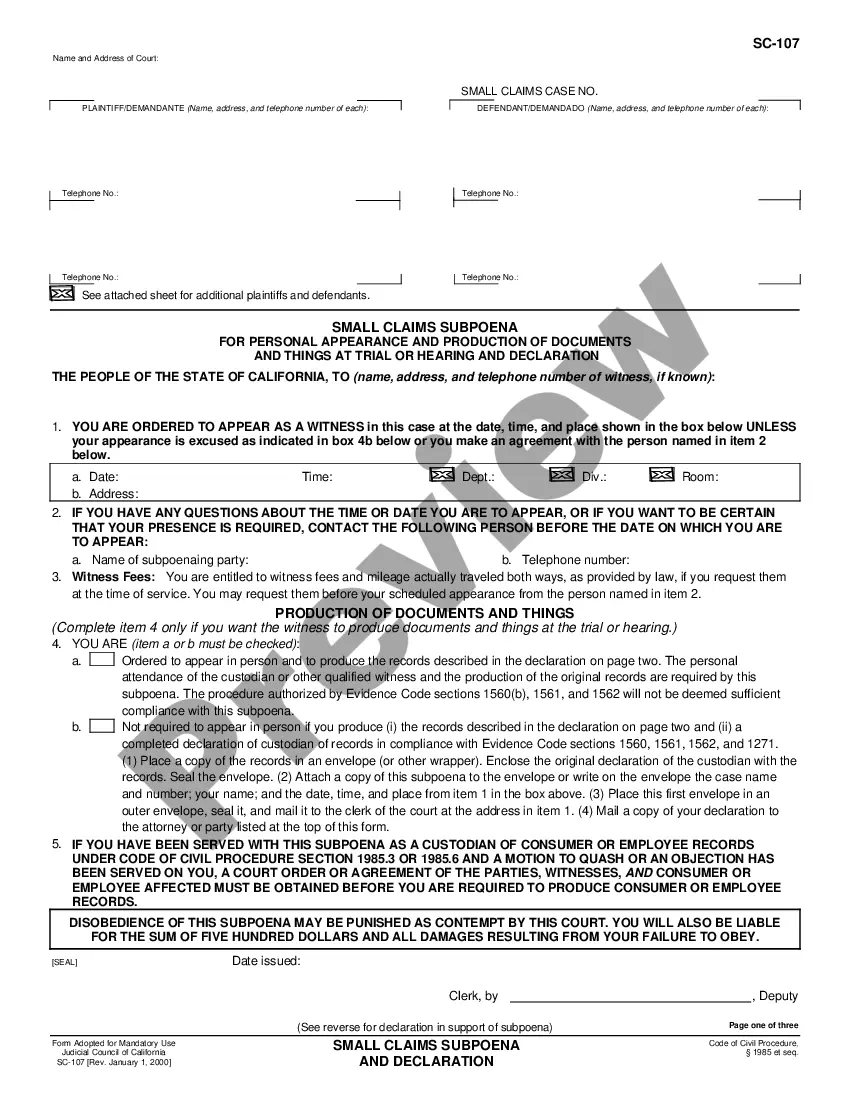

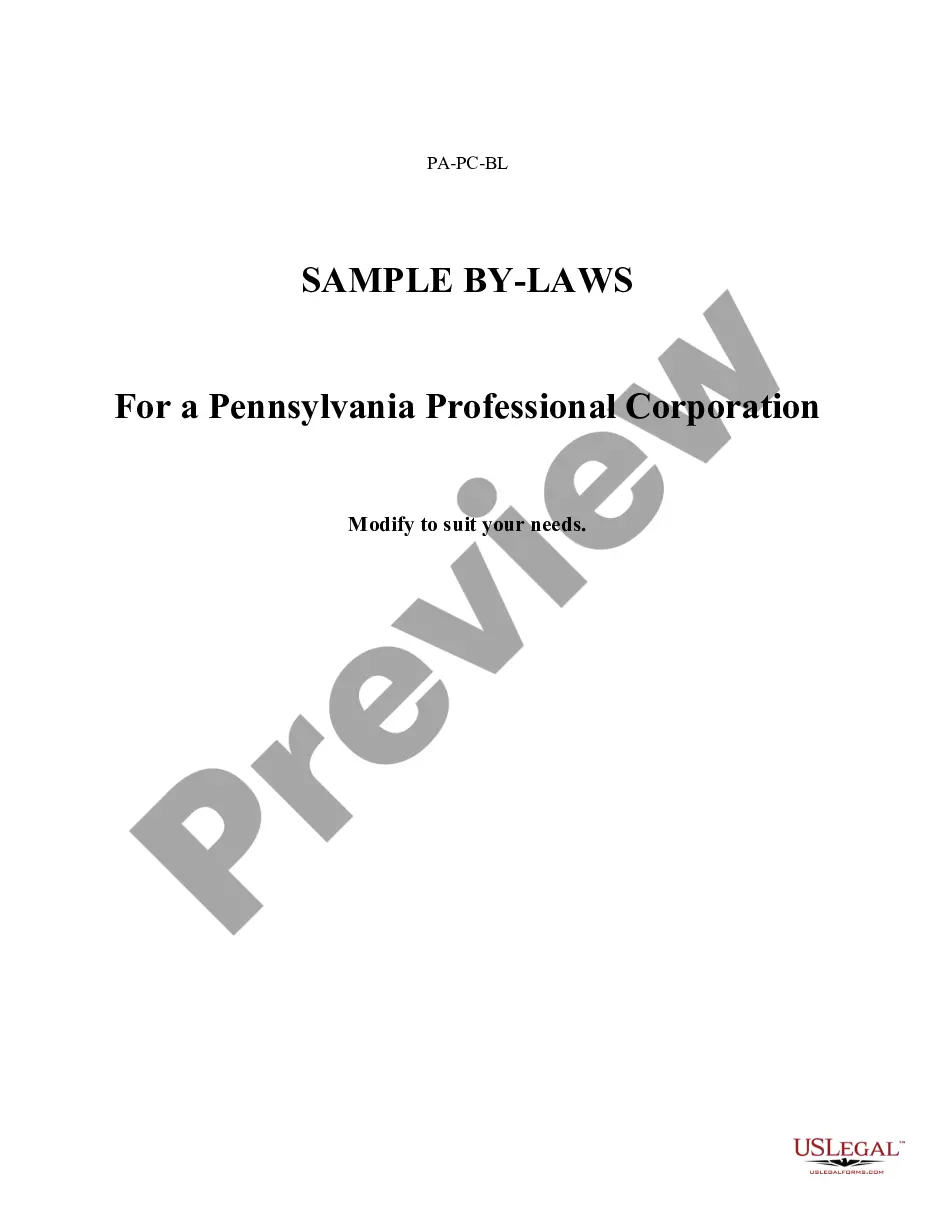

Selecting the appropriate legal document format can be challenging. Clearly, there are plenty of templates available online, but how can you locate the legal form you require? Utilize the US Legal Forms website. This service offers thousands of templates, such as the Maine Design Agreement - Self-Employed Independent Contractor, suitable for both business and personal needs. All forms are reviewed by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click on the Download button to obtain the Maine Design Agreement - Self-Employed Independent Contractor. Use your account to browse through the legal forms you have purchased previously. Visit the My documents section of your account and download another copy of the documents you require.

If you are a new user of US Legal Forms, here are simple instructions you can follow: First, ensure you have selected the correct form for your city/state. You can view the form with the Preview button and check the form outline to confirm this is the right one for you. If the form does not meet your needs, utilize the Search field to find the appropriate form. Once you are certain that the form is suitable, click the Purchase now button to acquire the form. Select the pricing plan you desire and input the necessary information. Create your account and pay for the order using your PayPal account or credit card. Choose the file format and download the legal document format for your device. Complete, modify, and print and sign the downloaded Maine Design Agreement - Self-Employed Independent Contractor. US Legal Forms is the largest collection of legal forms where you can find numerous document templates. Use the service to obtain professionally crafted documents that adhere to state regulations.

US Legal Forms is the largest collection of legal forms where you can find numerous document templates.

- Selecting the appropriate legal document format can be challenging.

- Clearly, there are plenty of templates available online.

- Utilize the US Legal Forms website.

- This service offers thousands of templates.

- All forms are reviewed by experts.

- Comply with state and federal regulations.

Form popularity

FAQ

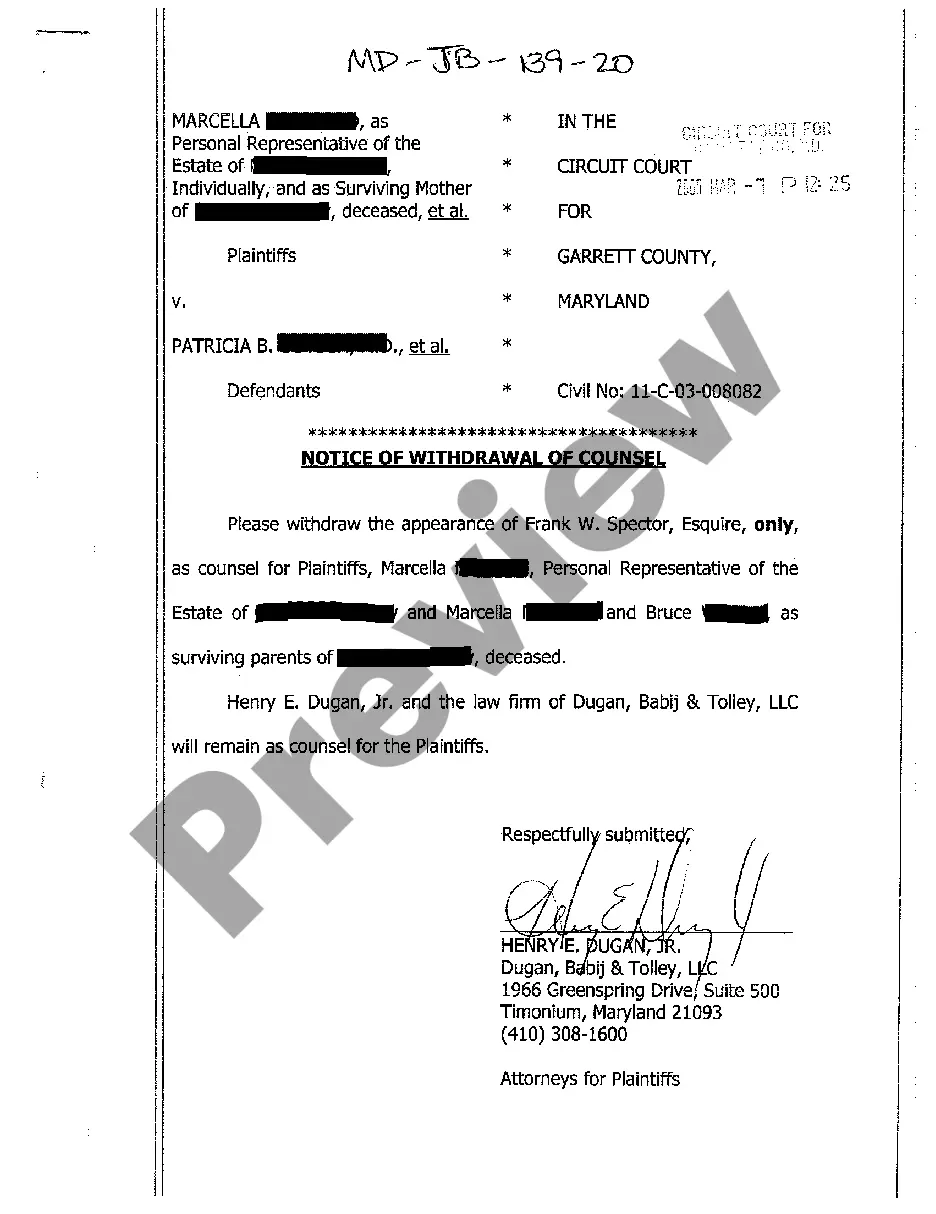

As a self-employed independent contractor in Maine, you need to complete several essential forms to ensure smooth operations. First, you should draft a Maine Design Agreement, which outlines the scope of work, payment terms, and other project specifics. Additionally, you may need to fill out tax forms such as the IRS W-9 to report your income and provide your tax identification number. Using USLegalForms can simplify this process, as it offers templates and resources that help you create comprehensive agreements that meet legal requirements.

Typically, the hiring party drafts the independent contractor agreement to set clear expectations. However, it is beneficial for both parties to contribute to the document, ensuring it reflects their understanding. Using the Maine Design Agreement - Self-Employed Independent Contractor template from USLegalForms can provide a solid starting point, guiding you through essential points to include while simplifying the process.

Creating an independent contractor agreement is straightforward. First, outline the scope of the project, including specific tasks and deadlines. Next, define the payment terms, such as amount and schedule. For a professional touch, consider using the Maine Design Agreement - Self-Employed Independent Contractor template from USLegalForms, which ensures you cover all essential aspects while saving time.

To fill out an independent contractor agreement effectively, gather all the necessary details first. Input your contact information, describe the services, and outline payment and deadlines. Emphasize the Maine Design Agreement - Self-Employed Independent Contractor aspects to ensure compliance with local laws. Using a platform like uslegalforms can simplify this process by providing templates and guidance.

Writing an independent contractor agreement involves outlining the terms of your working relationship. Start with your information and the client's details, followed by the project scope, timelines, and payment structure. Including the Maine Design Agreement - Self-Employed Independent Contractor ensures you cover legal bases while protecting your rights and defining your obligations in the contract.

Yes, independent contractors typically file as self-employed individuals. This means they report their income directly to the IRS using schedules that indicate their self-employment earnings. Including the Maine Design Agreement - Self-Employed Independent Contractor in your initial paperwork ensures all aspects of your work relationship are documented. This can simplify your tax filing and compliance process.

When writing a freelance design contract, start by defining the scope of work clearly. Specify what services you will provide, deadlines, and payment terms. Be sure to incorporate the Maine Design Agreement - Self-Employed Independent Contractor guidelines to ensure that both parties understand their rights and responsibilities. This enhances trust and keeps your project on track.

Filling out an independent contractor form requires specific information to ensure clarity and legality. Begin by providing your name, contact details, and business details. Next, outline the services you will provide and the payment terms. Remember to include the Maine Design Agreement - Self-Employed Independent Contractor details to make the contract fit your state’s requirements.