Maine Educator Agreement - Self-Employed Independent Contractor

Description

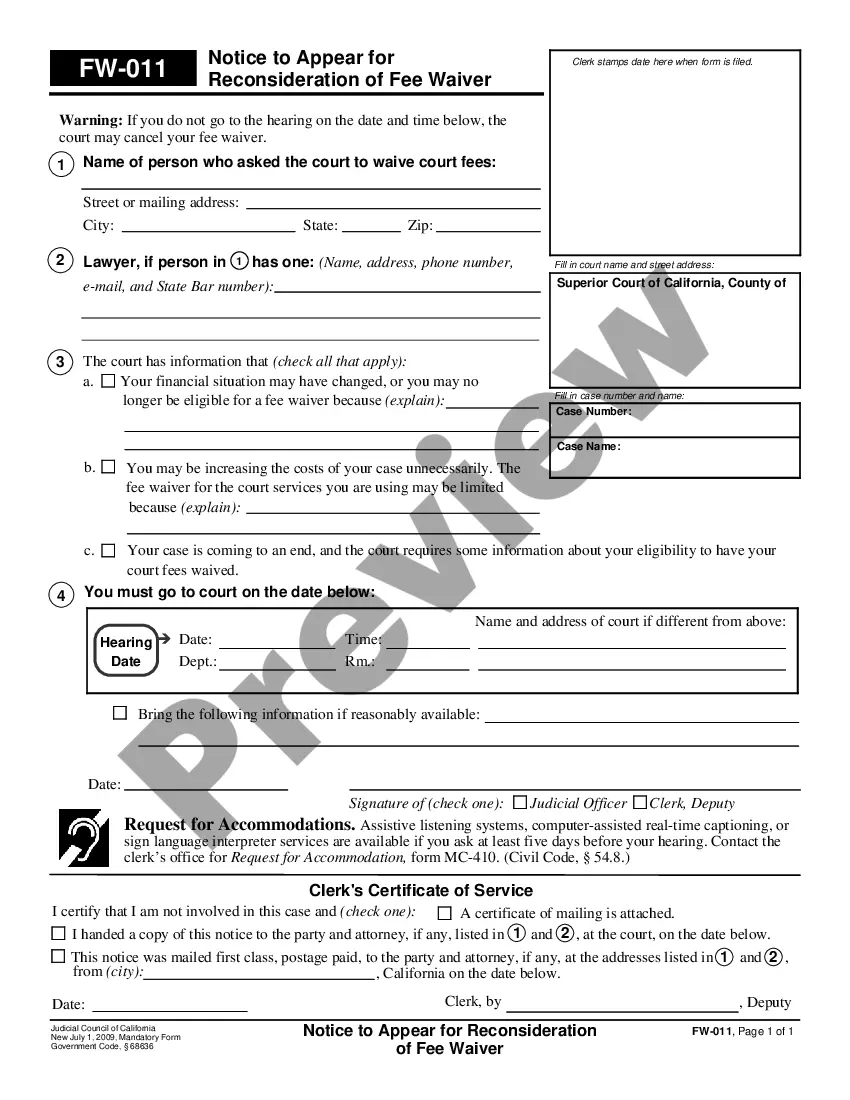

How to fill out Educator Agreement - Self-Employed Independent Contractor?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a variety of legal document templates that you can download or print. By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can obtain the latest forms such as the Maine Educator Agreement - Self-Employed Independent Contractor in moments.

If you hold a subscription, Log In and download the Maine Educator Agreement - Self-Employed Independent Contractor from your US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms in the My documents section of your account.

To use US Legal Forms for the first time, here are some straightforward instructions to get you started: Ensure you have selected the correct form for your city/state. Click the Preview button to review the content of the form. Check the form summary to confirm that you have chosen the right form. If the form does not meet your needs, utilize the Search field at the top of the screen to find one that does. If you are satisfied with the form, confirm your choice by clicking on the Purchase now button. Next, select the pricing plan you prefer and provide your details to register for an account. Process the payment. Use a credit card or PayPal account to complete the transaction. Choose the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the downloaded Maine Educator Agreement - Self-Employed Independent Contractor. Each template you add to your account does not have an expiration date and belongs to you indefinitely. Therefore, in order to download or print another copy, just navigate to the My documents section and click on the form you need.

- Access the Maine Educator Agreement - Self-Employed Independent Contractor through US Legal Forms, one of the most extensive collections of legal document templates.

- Utilize a vast array of professional and state-specific templates that meet your business or personal needs and requirements.

Form popularity

FAQ

Yes, independent contractors are classified as self-employed. They have their own business, accept contracts, and manage their operations. A Maine Educator Agreement - Self-Employed Independent Contractor exemplifies this relationship, establishing clear terms between the contractor and the hiring entity.

Yes, receiving a 1099 form typically indicates you are self-employed. This form is issued to freelancers and independent contractors, confirming that you earned income without being an employee. Thus, in a Maine Educator Agreement - Self-Employed Independent Contractor scenario, it's common to receive a 1099 for your services.

Both terms are used interchangeably, but saying independent contractor can emphasize the contractual relationship. It often clarifies the nature of the work arrangement. In the context of the Maine Educator Agreement - Self-Employed Independent Contractor, it details the professional framework that both parties operate within.

Writing an independent contractor agreement involves specifying the scope of work, payment terms, and duration of the contract. It's crucial to include clauses related to confidentiality and dispute resolution. Using our platform, you can easily create a tailored Maine Educator Agreement - Self-Employed Independent Contractor that meets your unique needs.

To qualify as self-employed, an individual must work for themselves rather than for an employer. They should be responsible for their own business, including managing clients and finances. A Maine Educator Agreement - Self-Employed Independent Contractor typically outlines these responsibilities and clarifies the contractor's status.

Yes, an independent contractor is considered self-employed. This means they operate their own business and provide services to clients. In a Maine Educator Agreement - Self-Employed Independent Contractor context, this arrangement allows educators to manage their work independently, maintaining flexibility and autonomy.

Typically, the agreement can be drafted by either party involved in the Maine Educator Agreement - Self-Employed Independent Contractor. However, it is often beneficial for the hiring party to draft it to ensure it meets their specific needs. Using uslegalforms can assist in creating a legally sound document that reflects both parties' interests. Collaboration on the details is critical, so both parties feel comfortable and protected.

Creating an independent contractor agreement is straightforward. First, outline the roles, duties, and payment structure for the Maine Educator Agreement - Self-Employed Independent Contractor. You can use templates available on platforms like uslegalforms to simplify the process. Remember, it is important to ensure that the agreement complies with your specific state laws and regulations.

Yes, having a contract is essential for independent contractors. It formalizes the terms of the working relationship and helps protect both parties involved. In the context of the Maine Educator Agreement - Self-Employed Independent Contractor, a contract clarifies payment terms, responsibilities, and deadlines. This clarity reduces misunderstandings and establishes professional expectations.

Filling out an independent contractor agreement involves several key steps. Start by including the title, which should reflect the nature of the work, such as the Maine Educator Agreement - Self-Employed Independent Contractor. Clearly define the services, payment structure, and timelines to avoid misunderstandings. Finally, both parties should sign and date the agreement to confirm their acceptance of the terms.