Maine Heating Contractor Agreement - Self-Employed

Description

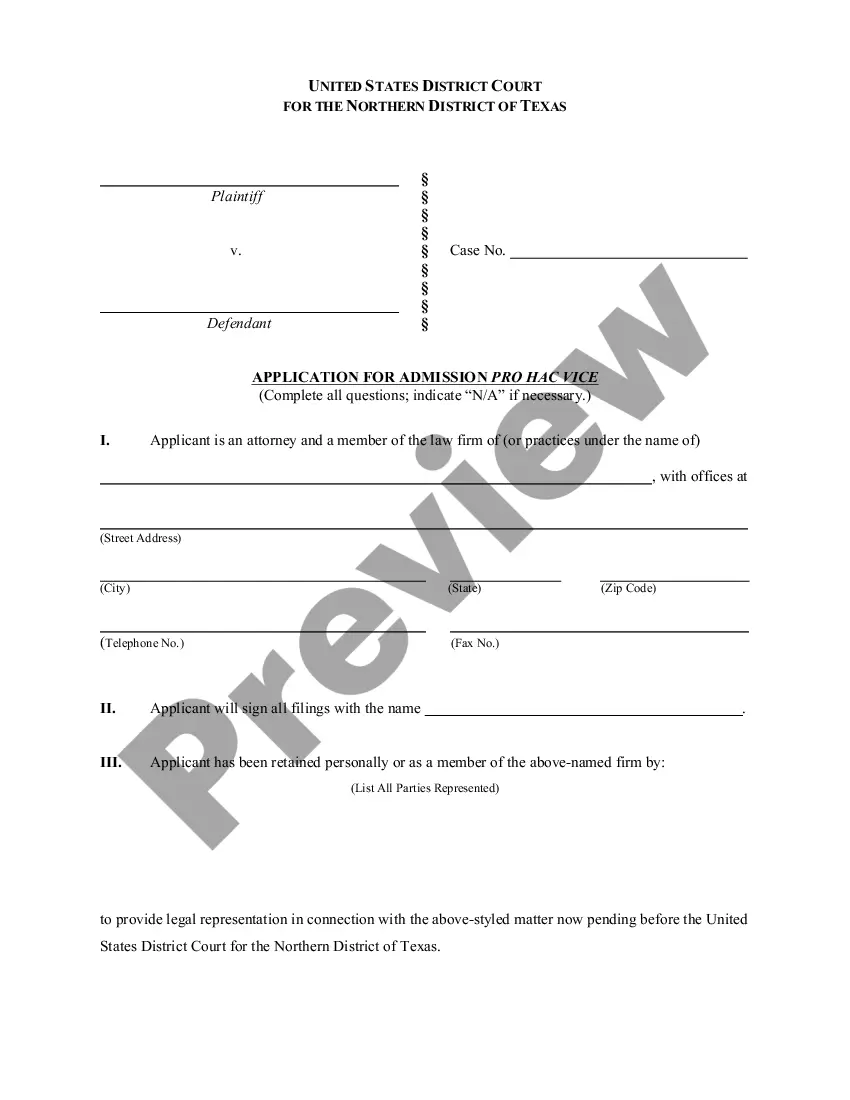

How to fill out Heating Contractor Agreement - Self-Employed?

If you aim to be thorough, obtain, or print legitimate document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site's straightforward and accessible search function to locate the documents you require.

A multitude of templates for businesses and individual purposes are organized by categories and jurisdictions, or keywords.

Each legal document you obtain is yours permanently. You have access to every document you acquired through your account.

Go to the My documents section and select a document to print or download again. Complete and acquire, and print the Maine Heating Contractor Agreement - Self-Employed with US Legal Forms. There are millions of professional and state-specific forms you can use for your business or personal needs.

- Use US Legal Forms to find the Maine Heating Contractor Agreement - Self-Employed with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and then click the Acquire button to find the Maine Heating Contractor Agreement - Self-Employed.

- You can also access forms you previously acquired from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Make sure you have selected the form for the correct area/region.

- Step 2. Use the Preview option to review the form's content. Don't forget to check the summary.

- Step 3. If you are not satisfied with the document, use the Search field at the top of the screen to find other variations of the legal form.

- Step 4. Once you have located the form you need, click on the Acquire now button. Choose your preferred payment plan and provide your details to create an account.

- Step 5. Proceed with the transaction. You can use your credit card or PayPal account to complete the purchase.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Complete, edit, and print or sign the Maine Heating Contractor Agreement - Self-Employed.

Form popularity

FAQ

Filling out an independent contractor agreement involves providing detailed information about the work to be done and the terms of payment. Ensure you specify the project scope, deadlines, and any other critical details. Don't forget to include sections for signatures from both parties. Accessing a Maine Heating Contractor Agreement - Self-Employed template from USLegalForms will streamline this process and ensure you don't miss important elements.

Yes, an independent contractor is classified as self-employed. This means they operate their own business and are responsible for their tax obligations. Understanding this status is crucial for managing finances and potential liabilities. If you're entering this field, a well-drafted Maine Heating Contractor Agreement - Self-Employed helps clarify this relationship.

Filling out an independent contractor form requires accuracy and attention to detail. Begin by entering your personal information and any necessary company details. Next, describe the services you will provide in detail and include payment information. If you use the Maine Heating Contractor Agreement - Self-Employed form from USLegalForms, you'll find prompts to guide you through every step.

To write an independent contractor agreement, start by stating the parties involved and the purpose of the contract. Clearly specify the services to be provided, payment terms, and confidentiality clauses. It’s also useful to include language that defines the relationship, establishing that the contractor is not an employee. Using the Maine Heating Contractor Agreement - Self-Employed template from USLegalForms can simplify this process.

employed contract, like the Maine Heating Contractor Agreement SelfEmployed, should include key elements such as the scope of work, payment terms, and deadlines. It is important to clearly outline both parties' responsibilities to avoid misunderstandings. Additionally, include clauses on termination and dispute resolution. Consider using a platform like USLegalForms to access templates tailored for your needs.

Creating an independent contractor agreement starts with identifying the specific services to be rendered. You should outline payment terms, project timelines, and any relevant legal considerations. Using a Maine Heating Contractor Agreement - Self-Employed can streamline this process, providing you with a solid foundation. By customizing this template, you can ensure the agreement meets the unique needs of your business and your clients.

To prove your independent contractor status, you typically need to demonstrate that you control the work you do and how you perform it. Documenting your work arrangements, including a Maine Heating Contractor Agreement - Self-Employed, can support your claim of independent status. Keep records of your project schedules, correspondence, and any invoices issued. These steps help distinguish you from an employee, clarifying your role.

Yes, a self-employed person can indeed have a contract. In fact, having a contract is essential for establishing clear expectations and responsibilities between parties. The Maine Heating Contractor Agreement - Self-Employed serves as a helpful template to ensure that all terms are transparent and legally binding. This contract protects both you and your clients, providing security in your working relationship.

Filing taxes as a self-employed contractor involves reporting your income and expenses accurately. First, you should keep detailed records of all income earned through your services, as well as any business-related expenses. Using a Maine Heating Contractor Agreement - Self-Employed can help you document your financial transactions effectively. Consider utilizing platforms like uslegalforms to access templates and guidance that simplify tax filing while keeping you compliant with federal and state regulations.

Yes, a 1099 employee can technically operate without a formal contract, but it is not recommended. Working without a contract may lead to misunderstandings about tasks and payment. Using a Maine Heating Contractor Agreement - Self-Employed not only formalizes the relationship but also provides legal clarity, ensuring both parties adhere to agreed-upon terms.