Maine Masonry Services Contract - Self-Employed

Description

How to fill out Masonry Services Contract - Self-Employed?

You can spend considerable time online searching for the legal form template that satisfies the local and national regulations you require.

US Legal Forms offers a wide variety of legal documents that have been reviewed by experts.

You can easily download or print the Maine Masonry Services Agreement - Self-Employed from our service.

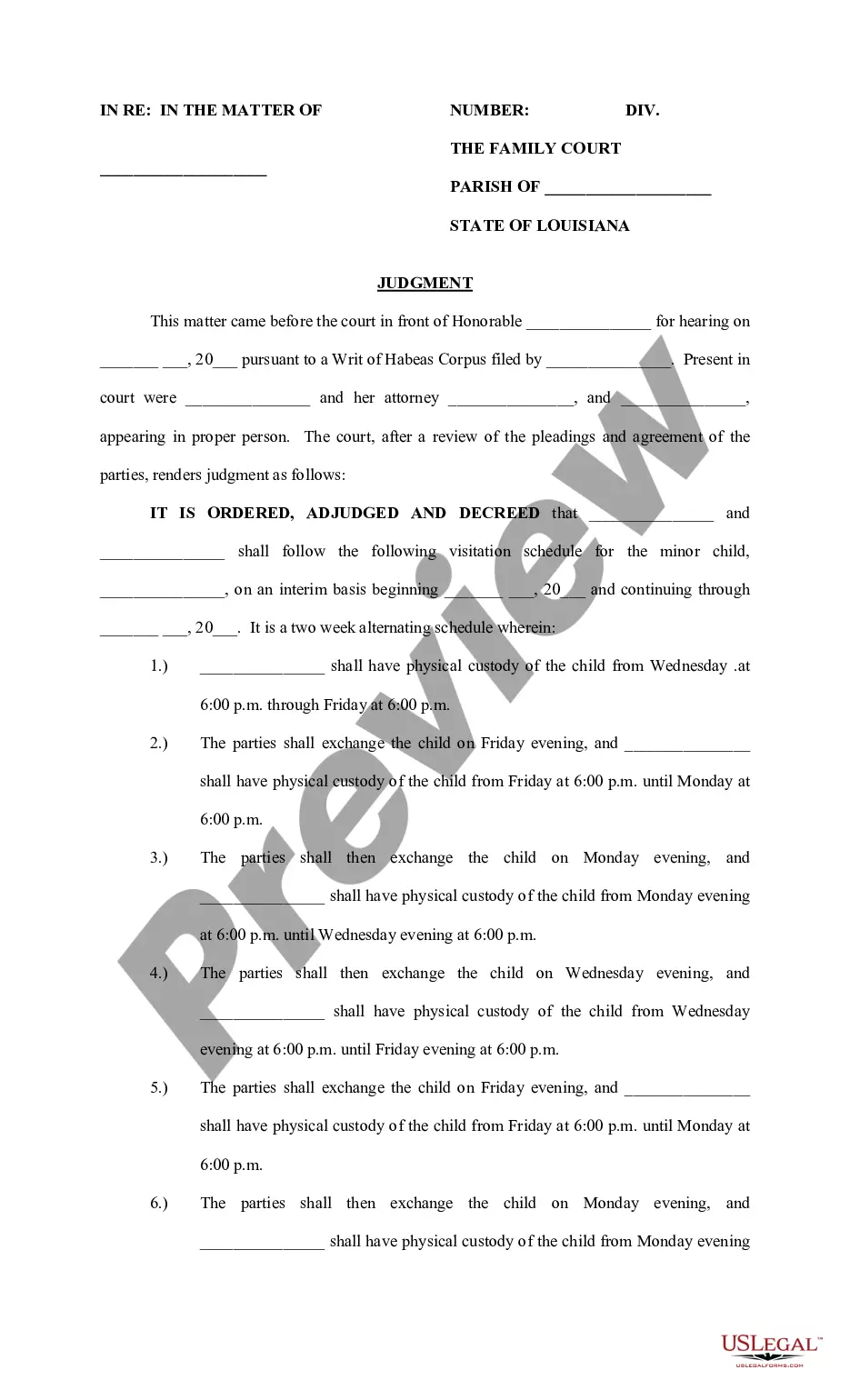

If available, use the Review option to examine the form template as well.

- If you possess a US Legal Forms account, you can Log In and select the Download option.

- Subsequently, you can complete, modify, print, or sign the Maine Masonry Services Agreement - Self-Employed.

- Every legal form template you obtain is yours forever.

- To acquire another copy of any purchased form, visit the My documents tab and click on the respective option.

- If you are accessing the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct form template for your region/locality.

- Examine the form description to confirm you have chosen the correct document.

Form popularity

FAQ

To become a subcontractor in Maine, begin by registering your business and outlining your services. You should actively network with general contractors and construction firms needing your expertise. Furthermore, utilizing a Maine Masonry Services Contract - Self-Employed can help you establish professional agreements that enhance your credibility and define your role.

To be a subcontractor, you need to have your business registered and acquire any necessary insurance. It is essential to build a solid network with general contractors who may need your services. Moreover, having a solid understanding of a Maine Masonry Services Contract - Self-Employed ensures you can deliver your work effectively and fulfill contract requirements.

A contractor license is not universally required in Maine; various professions have different regulations. For masonry services, it often depends on the scope of your work and local ordinances. It is wise to check local regulations and consider a Maine Masonry Services Contract - Self-Employed to clarify your obligations.

In Maine, not all contractors are required to have a state-issued license, but it depends on your specific services. If your work involves certain specialized trades, like plumbing or electrical work, you may need a license. However, understanding the requirements for a Maine Masonry Services Contract - Self-Employed can guide you in determining if a license is necessary for your masonry services.

An independent contractor in Maine is a person who provides services under their own business name and works without being an employee of another company. This role allows for more flexibility in work choices and contracts, including those related to masonry. Utilizing a Maine Masonry Services Contract - Self-Employed can help you outline your terms clearly and protect your interests.

To become a 1099 subcontractor in Maine, start by registering your business and obtaining any necessary permits. Next, you should establish a clear agreement outlining your services and payment terms with the contractor. Familiarizing yourself with Maine Masonry Services Contract - Self-Employed guidelines will help ensure that you understand your rights and responsibilities.

A 1099 contract, used for independent contractors, should specify the nature of the work, payment terms, and tax responsibilities. It usually includes details such as deadlines, project milestones, and the payment method. The Maine Masonry Services Contract - Self-Employed can serve as a useful guide for structuring these elements correctly. To ensure compliance and clarity, using uslegalforms can help you draft an effective 1099 contract.

An employment contract should include job details, salary or payment terms, work hours, and responsibilities. It should also cover confidentiality clauses, termination conditions, and any benefits provided. The Maine Masonry Services Contract - Self-Employed may serve as a reference point for independent work agreements, but it differs from traditional employment contracts in terms of flexibility and responsibilities. Resources available through uslegalforms simplify the creation of comprehensive employment contracts.

employed individual typically uses an independent contractor agreement. This contract defines the working relationship without creating an employeremployee dynamic. For those in masonry, a Maine Masonry Services Contract SelfEmployed encapsulates all crucial elements, including project specifics and payment terms. By opting for uslegalforms, you can find tailored contracts that fit your unique selfemployment situation.

employed contract should include your name, the client’s name, project details, payment structure, and timeline. The Maine Masonry Services Contract SelfEmployed should also address the scope of work and any materials or services provided. Including terms for revisions and the process for dispute resolution is essential. Utilizing uslegalforms can streamline the creation of this contract to ensure it meets all necessary requirements.