Maine Qualified Investor Certification Application

Description

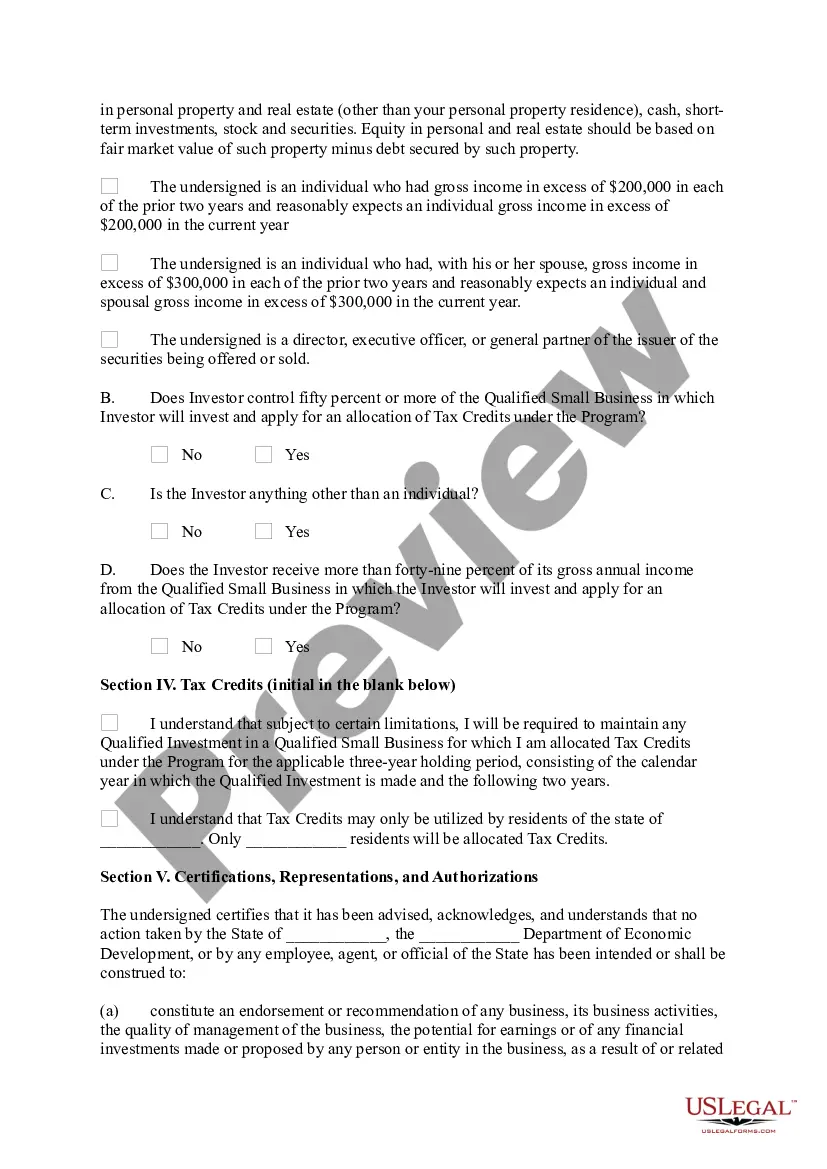

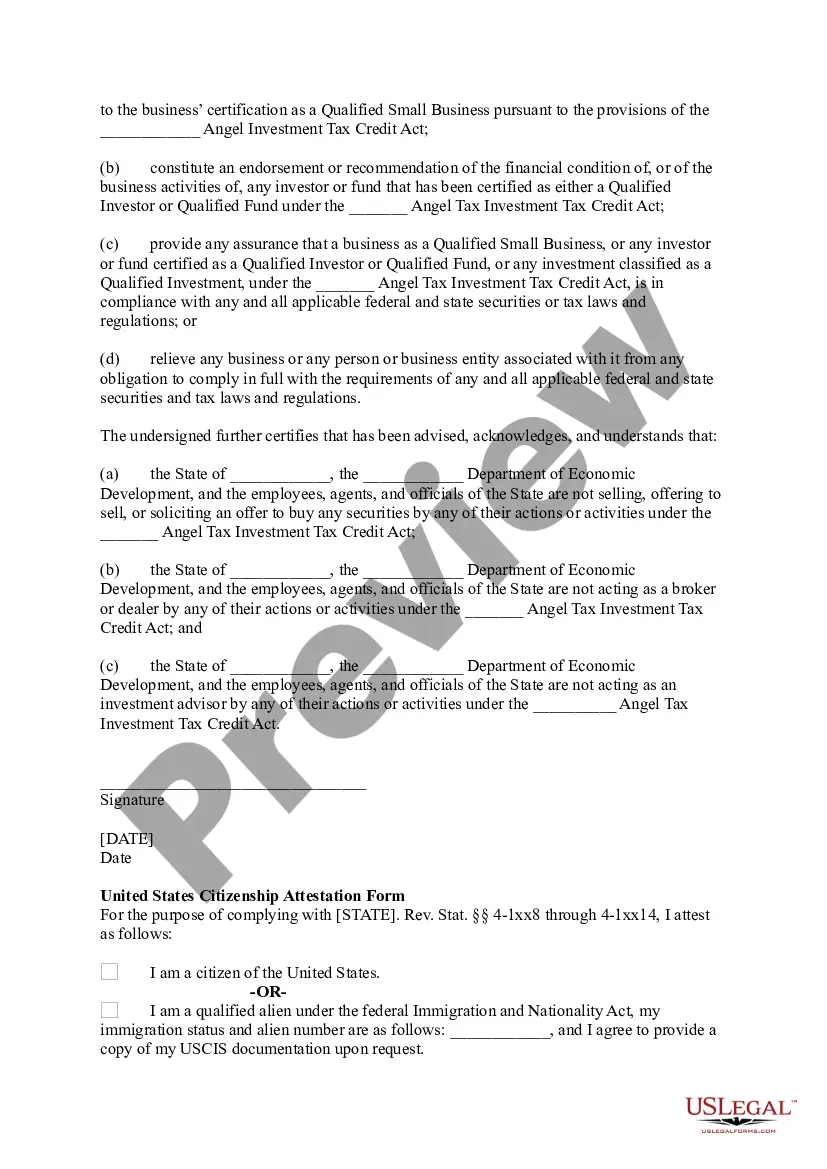

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status, take Investor statements regarding information, and waiver of claims."

How to fill out Qualified Investor Certification Application?

US Legal Forms - among the biggest libraries of legitimate kinds in America - gives a variety of legitimate document themes it is possible to download or produce. Making use of the web site, you will get thousands of kinds for enterprise and personal uses, categorized by categories, suggests, or search phrases.You will discover the latest models of kinds such as the Maine Qualified Investor Certification Application in seconds.

If you have a membership, log in and download Maine Qualified Investor Certification Application from the US Legal Forms library. The Down load button will appear on every type you look at. You have accessibility to all earlier acquired kinds within the My Forms tab of your respective accounts.

If you would like use US Legal Forms the very first time, allow me to share simple instructions to help you get started:

- Be sure to have picked out the best type for your personal city/state. Go through the Review button to check the form`s information. Read the type explanation to ensure that you have chosen the correct type.

- In the event the type does not satisfy your specifications, make use of the Search industry towards the top of the screen to obtain the the one that does.

- In case you are content with the shape, verify your selection by clicking the Purchase now button. Then, select the prices plan you want and supply your qualifications to register for an accounts.

- Process the financial transaction. Utilize your bank card or PayPal accounts to complete the financial transaction.

- Find the structure and download the shape on your system.

- Make modifications. Fill up, change and produce and signal the acquired Maine Qualified Investor Certification Application.

Every design you added to your account does not have an expiration date and is also yours forever. So, if you would like download or produce an additional duplicate, just go to the My Forms portion and click on in the type you need.

Get access to the Maine Qualified Investor Certification Application with US Legal Forms, the most considerable library of legitimate document themes. Use thousands of specialist and status-specific themes that meet your small business or personal requires and specifications.

Form popularity

FAQ

In Maine, you will need to register with the Maine Revenue Services to get your Withholding Account Number (also known as a state EIN or employer account number) and with the Maine Department of Labor to get the tax ID numbers you'll need to pay employees.

You can apply for a Maine Sales Tax Exemption in the Maine Tax Portal by clicking here, navigate to the Business panel, and selecting the Exemptions link. If you are unable to apply using the Maine Tax Portal, you can click on the application number next to the type of organization to download an application form.

To qualify for a resale certificate, a retailer must have an active account and report gross sales of $3,000 or more per year. MRS reviews all active sales tax accounts that do not have an active resale certificate each year. Resale certificates are automatically issued to retailers that qualify.

Maine resale certificates are only to be used when a purchaser intends to resell tangible property. A valid certificate must include the name and address of the purchaser. It should also include the purchaser's account ID or federal employer identification number (EIN).

Resale Certificates expire on December 31st. A Resale Certificate issued before October 1st is valid for the remainder of that calendar year and the following three calendar years. A Resale Certicate issued after October 1st is valid for the remainder of that calendar year and the following four calendar years.

Fortunately, collecting sales tax in Maine is fairly simple. The state sales tax rate is 5.5% and Maine doesn't have local sales tax rates. So whether you live in Maine or outside Maine but have nexus and sell to a customer there, you would charge your customer the 5.5% sales tax rate on most transactions.