Maine Subscription Agreement and Shareholders' Agreement

Description

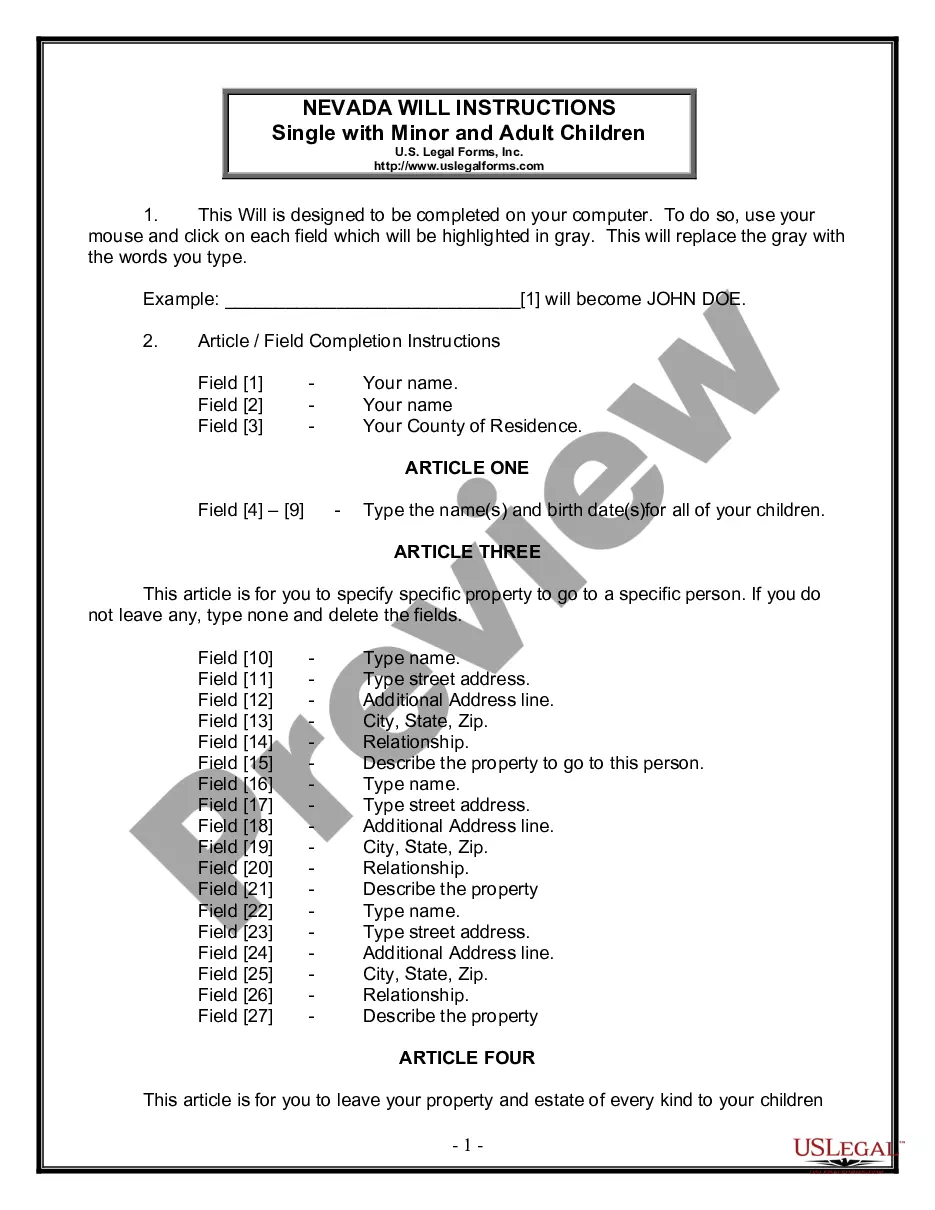

How to fill out Subscription Agreement And Shareholders' Agreement?

Are you currently within a placement where you require documents for both organization or person uses virtually every day? There are a variety of authorized record layouts available online, but finding versions you can trust isn`t easy. US Legal Forms delivers a large number of develop layouts, such as the Maine Subscription Agreement and Shareholders' Agreement, that happen to be published to satisfy state and federal requirements.

When you are previously knowledgeable about US Legal Forms site and possess a merchant account, merely log in. Afterward, you may acquire the Maine Subscription Agreement and Shareholders' Agreement template.

Should you not provide an accounts and want to begin using US Legal Forms, abide by these steps:

- Get the develop you will need and ensure it is to the right area/state.

- Make use of the Review key to review the shape.

- Browse the information to actually have chosen the proper develop.

- If the develop isn`t what you are looking for, make use of the Lookup industry to discover the develop that meets your requirements and requirements.

- Once you find the right develop, click on Acquire now.

- Pick the pricing plan you desire, fill in the desired information to make your money, and purchase the transaction utilizing your PayPal or charge card.

- Pick a practical data file formatting and acquire your copy.

Discover each of the record layouts you have purchased in the My Forms menu. You may get a extra copy of Maine Subscription Agreement and Shareholders' Agreement any time, if possible. Just click the needed develop to acquire or printing the record template.

Use US Legal Forms, probably the most substantial variety of authorized types, in order to save efforts and prevent faults. The service delivers skillfully produced authorized record layouts which you can use for a range of uses. Produce a merchant account on US Legal Forms and initiate making your daily life easier.

Form popularity

FAQ

1.1 The Agreement provides for the sale of ________ [insert number and type of shares] to the Buyer by the Seller at a price of ______ [insert price per share], par value per share (the ?Shares?). 1.2 Purchase and Sale. The Seller agrees to sell and the Buyer agrees to buy the Shares. 1.3 Delivery of Shares.

The subscription agreement refers to the shareholders' agreement and typically they are signed at the same time. Sometimes, these documents are merged to one big document (often called investment agreement) but for clarity they are usually separated.

Summary. A subscription agreement is a formal agreement between a company and an investor to buy shares of a company at an agreed-upon price. It contains all the details of such an agreement, including Outstanding Shares, Shares Ownership, and Payouts.

What to Think about When You Begin Writing a Shareholder Agreement. ... Name Your Shareholders. ... Specify the Responsibilities of Shareholders. ... The Voting Rights of Your Shareholders. ... Decisions Your Corporation Might Face. ... Changing the Original Shareholder Agreement. ... Determine How Stock can be Sold or Transferred.

Subscription agreement vs shareholders agreement? A share subscription agreement is essentially an agreement for the purchase of shares from a company. In contrast, a shareholders agreement contains terms that govern the ongoing relationship between shareholders.

What is a Shareholders' Agreement? A shareholders' agreement is an arrangement among the shareholders of a company. It contains provisions regarding the operation of the company and the relationship between its shareholders. A shareholders' agreement is also known as a stockholders' agreement.

A share purchase agreement differs from a share subscription agreement because a share purchase agreement has a seller that is not the business itself. In a subscription agreement, the business agrees to sell shares to a subscriber.