Maine Underwriting Agreement between iPrint, Inc. regarding the Issue and Sale of Shares of Common Stock

Description

How to fill out Underwriting Agreement Between IPrint, Inc. Regarding The Issue And Sale Of Shares Of Common Stock?

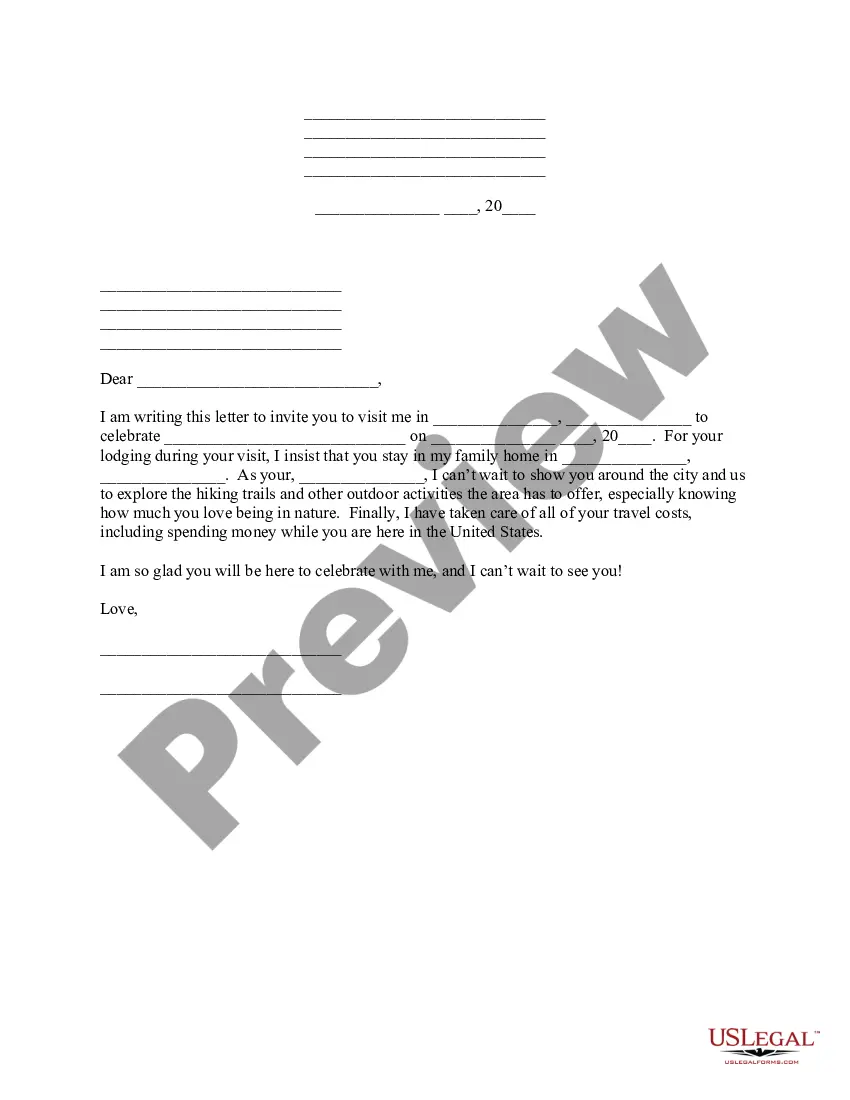

If you have to comprehensive, down load, or print authorized record web templates, use US Legal Forms, the most important collection of authorized varieties, which can be found online. Take advantage of the site`s simple and practical research to find the files you will need. Numerous web templates for enterprise and personal functions are sorted by types and states, or keywords. Use US Legal Forms to find the Maine Underwriting Agreement between iPrint, Inc. regarding the Issue and Sale of Shares of Common Stock within a couple of clicks.

If you are previously a US Legal Forms customer, log in for your accounts and click the Acquire button to get the Maine Underwriting Agreement between iPrint, Inc. regarding the Issue and Sale of Shares of Common Stock. You can also gain access to varieties you earlier acquired inside the My Forms tab of your respective accounts.

If you work with US Legal Forms the first time, refer to the instructions under:

- Step 1. Ensure you have chosen the shape to the correct area/country.

- Step 2. Take advantage of the Preview choice to look over the form`s content material. Never forget about to read through the outline.

- Step 3. If you are unsatisfied together with the form, take advantage of the Research industry near the top of the screen to get other types of the authorized form design.

- Step 4. After you have located the shape you will need, go through the Get now button. Opt for the costs program you choose and put your references to register for the accounts.

- Step 5. Method the transaction. You may use your credit card or PayPal accounts to finish the transaction.

- Step 6. Select the formatting of the authorized form and down load it in your device.

- Step 7. Comprehensive, edit and print or indicator the Maine Underwriting Agreement between iPrint, Inc. regarding the Issue and Sale of Shares of Common Stock.

Every authorized record design you buy is yours forever. You have acces to every single form you acquired with your acccount. Select the My Forms section and choose a form to print or down load once more.

Be competitive and down load, and print the Maine Underwriting Agreement between iPrint, Inc. regarding the Issue and Sale of Shares of Common Stock with US Legal Forms. There are thousands of professional and express-certain varieties you can utilize for the enterprise or personal demands.

Form popularity

FAQ

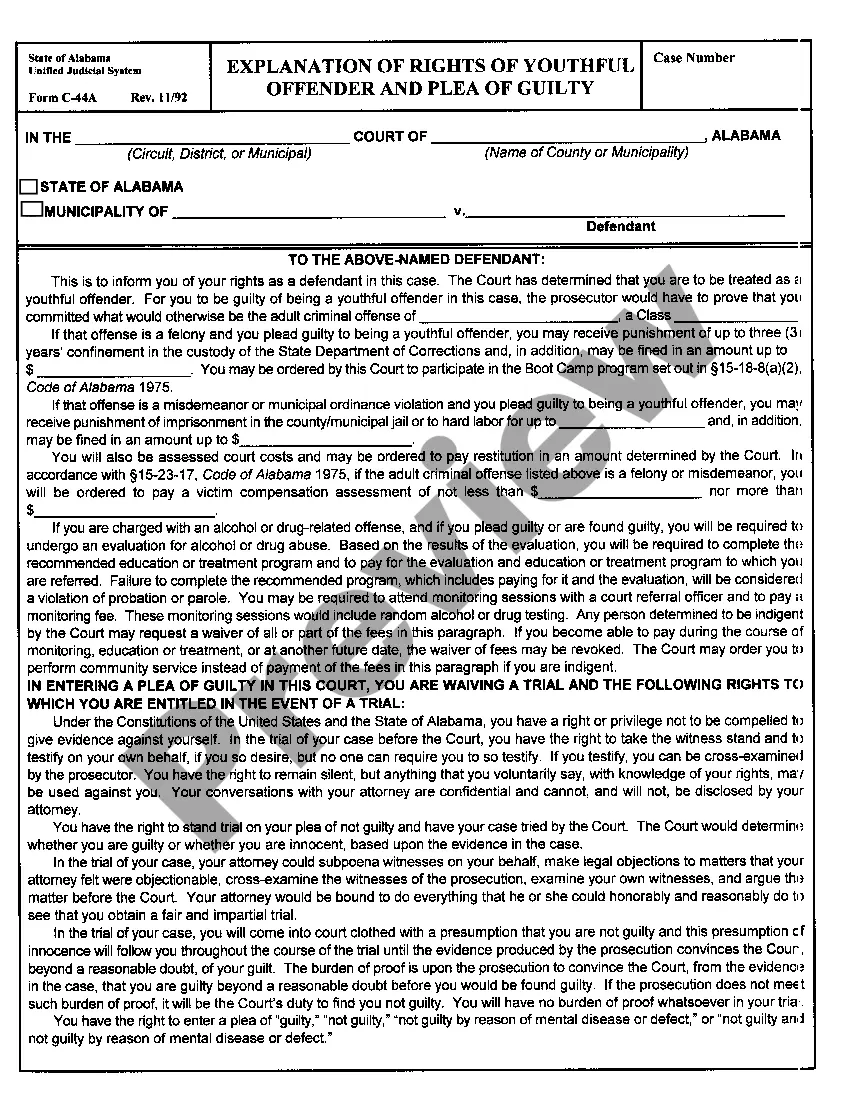

The underwriting agreement contains an agreement by the underwriter(s) to purchase the offered securities from the issuer or other seller and to resell them to the public, the underwriting discount, representations and warranties of the parties, certain covenants, expense allocation and indemnification provisions.

Underwriting of Shares and Debentures. Underwriting is an agreement, with or without conditions, to subscribe to the securities of a body corporate when existing shareholders of the body corporate or the public do not subscribe to the securities offered to them.

Firm Commitment This is the most common underwriting arrangement. Firm commitment IPO deals account for over two-thirds of all equity raised. Most of the largest IPOs in the US are firm commitment deals.

An underwriting agreement is a statutory necessity for Companies who have decided to increase their share capital by the issue of equity share. It is mandatory for the Company to file this agreement with the prospectus of public issue of shares/debentures with the Registrar of Companies.

The underwriting agreement contains the details of the transaction, including the underwriting group's commitment to purchase the new securities issue, the agreed-upon price, the initial resale price, and the settlement date. A best-efforts underwriting agreement is mainly used in the sales of high-risk securities.

Underwriting is the process through which an individual or institution takes on financial risk for a fee. This risk most typically involves loans, insurance, or investments.

There are three different types of underwriting, namely loans, securities, and insurance.

In connection with a registered securities offering, the underwriters of the offering typically enter into an underwriting agreement with the issuer of the securities and any selling stockholders.