Maine Domestic Subsidiary Security Agreement regarding ratable benefit of Lenders and Agent

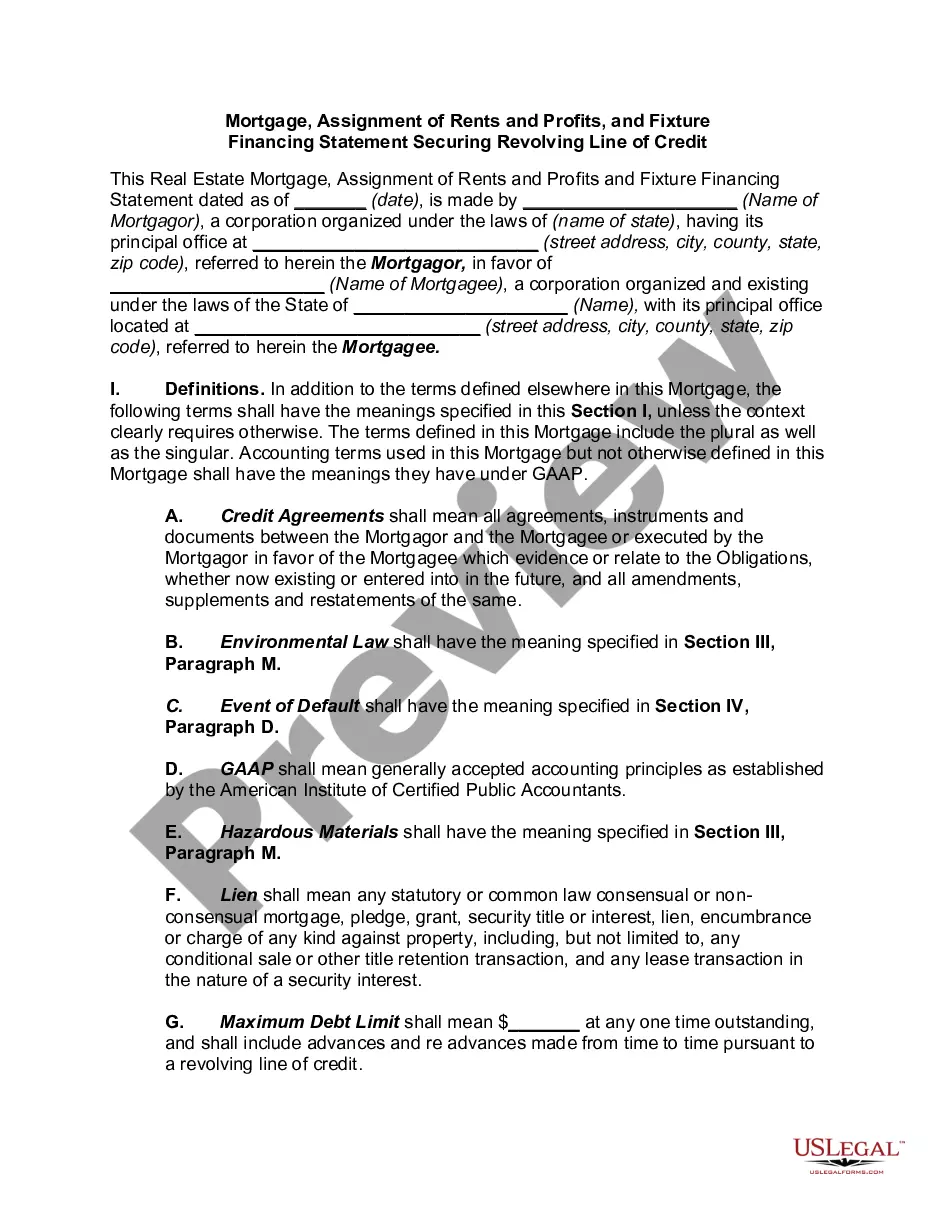

Description

How to fill out Domestic Subsidiary Security Agreement Regarding Ratable Benefit Of Lenders And Agent?

If you want to total, acquire, or print out authorized papers themes, use US Legal Forms, the largest collection of authorized kinds, that can be found on the web. Make use of the site`s basic and practical search to discover the files you require. Numerous themes for business and specific purposes are categorized by classes and claims, or key phrases. Use US Legal Forms to discover the Maine Domestic Subsidiary Security Agreement regarding ratable benefit of Lenders and Agent within a handful of clicks.

Should you be already a US Legal Forms buyer, log in in your profile and click the Down load switch to get the Maine Domestic Subsidiary Security Agreement regarding ratable benefit of Lenders and Agent. Also you can entry kinds you formerly saved from the My Forms tab of your respective profile.

If you work with US Legal Forms the first time, refer to the instructions listed below:

- Step 1. Ensure you have selected the shape for the proper city/land.

- Step 2. Utilize the Preview option to look over the form`s content material. Never neglect to read through the outline.

- Step 3. Should you be unhappy together with the kind, utilize the Lookup discipline at the top of the screen to find other types of your authorized kind template.

- Step 4. After you have located the shape you require, click on the Get now switch. Select the rates plan you prefer and add your credentials to register for an profile.

- Step 5. Method the transaction. You can utilize your credit card or PayPal profile to perform the transaction.

- Step 6. Select the structure of your authorized kind and acquire it on your own device.

- Step 7. Full, modify and print out or indication the Maine Domestic Subsidiary Security Agreement regarding ratable benefit of Lenders and Agent.

Each and every authorized papers template you acquire is your own forever. You might have acces to every single kind you saved with your acccount. Click the My Forms segment and pick a kind to print out or acquire once again.

Remain competitive and acquire, and print out the Maine Domestic Subsidiary Security Agreement regarding ratable benefit of Lenders and Agent with US Legal Forms. There are many professional and express-particular kinds you can utilize for your business or specific demands.

Form popularity

FAQ

Mortgages, charges, pledges and liens are all types of security. The main types of quasi-security are guarantees and indemnities, comfort letters, set-off, netting, standby credits, on demand guarantees and bonds and retention of title (ROT) arrangements.

Several types of collateral can be used for a secured personal loan. Your options may include cash in a savings account, a car or a house. There are two types of loans you can obtain from banks or other financial institutions: secured loans and unsecured loans.

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

The omnibus loan agreement involves a well-defined contract between the debtor and the creditor, which outlines the necessary conditions and terms of accommodation of credit regardless of the type of loan product.

From the lender's point of view, the benefits of securities lending include the ability to earn additional income through the fee charged to the borrower to borrow the security. It could also be viewed as a form of diversification. From the borrower's point of view, it allows them to take positions like short selling.

Collateral. Collateral is an asset you can pledge to the lender as an additional form of security, should you not be able to repay the loan. Collateral can help a borrower secure the financing they need and can help the lender recoup their investment if the borrower defaults on the loan.

This security is called collateral, which minimizes the risk for lenders by ensuring that the borrower keeps up with their financial obligation. The borrower has a compelling reason to repay the loan on time because if they default, they stand to lose their home or other assets pledged as collateral.